ID: PMRREP28528| 435 Pages | 6 May 2025 | Format: PDF, Excel, PPT* | Food and Beverages

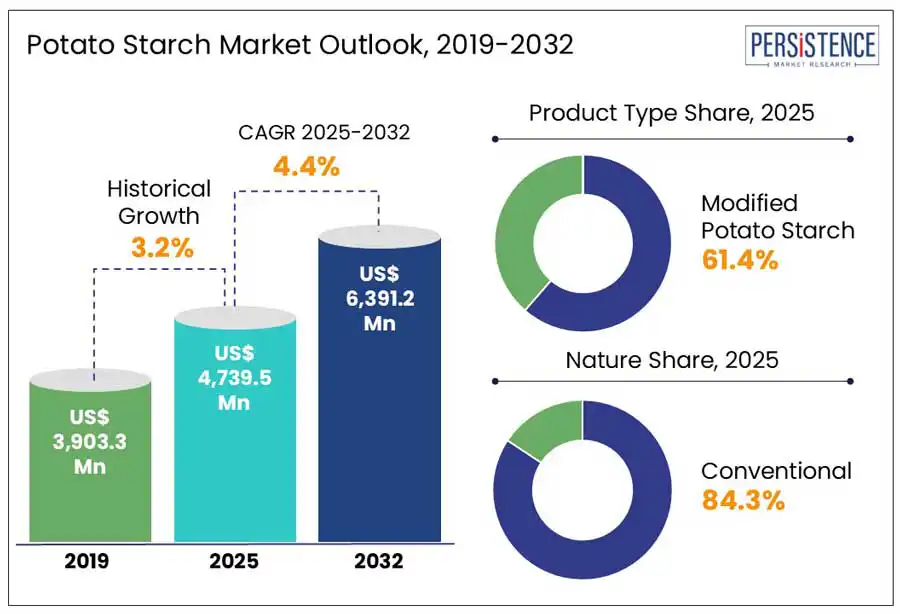

The global potato starch market size is estimated to grow from US$ 4,739.5 million in 2025 to US$ 6,391.2 million by 2032. The market is projected to record a CAGR of 4.4% during the forecast period from 2025 to 2032. According to the Persistence Market Research report, the gradual growth driven by the increasing consumption of processed and convenience foods propels industry growth. Potato starch is highly valued for its thickening, binding, and stabilizing properties, making it essential in the food, pharmaceutical, and paper industries. The demand for clean-label and functional ingredients further supports market expansion.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Potato Starch Market Size (2025E) |

US$ 4,739.5 Mn |

|

Market Value Forecast (2032F) |

US$ 6,391.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.2% |

The rising global demand for processed and convenience foods is driving significant interest in potato starch, valued for its excellent thickening, binding, and stabilizing properties. As busy lifestyles and urbanization lead consumers to seek out ready-to-eat meals and snacks, the preference for clean labels and functional ingredients becomes crucial. Potato starch, which is gluten-free and neutral in flavor, is widely utilized to improve texture and shelf life in processed meats, soups, sauces, bakery items, and quick foods. Its ability to improve mouthfeel and retain moisture makes it a popular food additive.

According to the USDA, U.S. processed food product exports in 2024 were valued at US$38.8 billion, reflecting the rising global appetite for processed and convenience products. The rise in processed food demand is a strong growth driver for the global potato starch market, creating significant development potential for ingredient manufacturers focusing on clean-label, plant-based, and functional food solutions.

The global potato starch market is facing significant challenges due to intense competition from various substitute starches, such as corn starch, wheat flour, arrowroot powder, rice flour, and tapioca starch. These alternatives are commonly used in food applications like thickening, baking, and frying, which reduces the reliance on potato starch.

Substitutes often offer benefits like better heat stability and perceived health advantages, particularly in gluten-free products. For example, corn starch is popular for frying, while arrowroot and sweet rice flour are preferred in gluten-free baking. Furthermore, in the industrial sector, modified corn starch is favored for high-temperature processing, as potato starch may crack or degrade. This shift toward alternative starches is limiting the market potential of potato starch in high-growth application areas.

The paper and packaging sector offers a lucrative opportunity for developing specialized modified potato starch variants tailored specifically for industrial applications. Potato starch, known for its superior binding and film-forming properties, is increasingly being used in paper sizing, coating, and adhesive applications. By enhancing the starch’s viscosity, water retention, and temperature resistance, manufacturers can craft superior variants that not only meets but exceed the rising demands for sustainable packaging options.

As the global market shifts towards biodegradable and eco-friendly materials, the demand for natural adhesives and coatings is soaring, positioning modified potato starch as an unparalleled solution. With innovation in this field, key players can harness the growing industrial demand while championing circular economy initiatives and advancing sustainable packaging trends.

Modified starch is becoming the preferred choice across industries due to its exceptional functionality and versatility. In the food sector, it serves as a highly effective thickener, stabilizer, and emulsifier in sauces, soups, baked goods, and ready-to-eat meals, excelling in frozen and processed applications due to its resistance to freezing-thawing cycles. In pharmaceuticals, modified starch functions as a binder and disintegrant in tablet formulations, ensuring reliable drug delivery. Its adaptability makes modified starch an essential ingredient in food and pharmaceutical production. The textile industry relies on this ingredient for warp sizing and fabric finishing, as its film-forming properties enhance fabric smoothness and strength. In the paper industry, it is crucial to improve paper strength, printability, and surface quality, making it essential for high-performance applications. In contrast, the native potato starch is valued for its natural origins and clean label appeal. It is ideal for minimally processed products, offering superior thickening and water-binding capabilities, making it a top choice for clean-label and organic food formulations.

The rising consumer demand for clean eating and natural food options drives organic potato starch market. Health-conscious individuals are increasingly seeking chemical-free and non-GMO ingredients in processed foods, baked goods, snacks, and ready-to-eat products. Organic potato starch is a standout choice, as it is free from synthetic additives, pesticides, and genetic modifications. As a thickener, stabilizer, and moisture retainer its effectiveness meets the growing need for transparency and sustainability. As manufacturers adapt to these evolving preferences, organic starches are becoming essential. Meanwhile, conventional potato starch faces scrutiny due to pesticide residues and GMO concerns, pushing more consumers toward the clear advantages of organic alternatives.

The Europe potato starch market is experiencing incremental growth, backed by a strong agricultural foundation and advanced processing infrastructure. Germany, France, and the Netherlands provide a steady supply of raw materials and are home to leading producers such as Royal Avebe, Roquette, and Emsland Group, investing in innovative and sustainable practices.

According to the European Starch Industry Association, the industry produces about 9.2 million tons of starch and starch derivatives annually, underscoring its global significance. Rising demand in food, paper, and biodegradable packaging sectors, along with a growing focus on clean-label and organic products, is further propelling the market forward.

The North American potato starch market is growing rapidly, fueled by rising demand from the food processing and paper industries. The U.S., a global leader in food processing, increasingly uses potato starch as a clean-label thickening and texturizing agent in ready-to-eat meals, snacks, and baked goods. It also leads in potato starch imports, supported by its strong packaged food and paper sectors. Meanwhile, Canada is seeing a significant increase in imports, driven by the demand for gluten-free and plant-based food options. This trend highlights North America's crucial role as a key hub for global starch consumption.

The potato starch market in the Asia Pacific is set for impressive growth, driven by expanding industries and rising demand for processed foods. China leads as the largest exporter, benefiting from its strong industrial base and status as the top textile producer, where modified starch plays a vital role. In India, the rapidly growing paper industry and increasing foreign direct investment (FDI) are creating significant demand for starch-based adhesives and binders. With a rising population and changing consumption trends, India offers exciting opportunities for starch manufacturers. Overall, the Asia Pacific is key contributor to the global potato starch market expansion, presenting exceptional growth potential.

The global potato starch market is vibrant and competitive, featuring numerous regional and international players focused on innovation, quality, and cost efficiency. Industry leaders are investing in expanded production capacities and enhanced processing technologies to meet increasing demand across various sectors. A rising trend of collaborations with food technologists is driving the creation of specialized potato starch variants that offer improved functionality and stability. Additionally, strategic mergers and acquisitions are strengthening global supply chains and diversifying product offerings. Investments in research and development for modified and organic potato starch are fueling innovation, while advancements in extraction and drying technologies are optimizing output and reducing costs. This dynamic market presents significant opportunities for stakeholders to leverage the growing potential of potato starch.

The Global Potato Starch market is projected to be valued at US$ 4,739.5 Mn in 2025.

Growing consumption of processed and convenience foods is driving demand for potato starch as a natural thickener and binder.

The Global Potato Starch market is expected to witness a CAGR of 4.4% between 2025 and 2032.

Companies can develop modified potato starch variants specific to the Paper & Packaging industry is the key market opportunity.

Key players in the Global Potato Starch market include Ingredion, Cargill, Incorporated, Emsland-Stärke GmbH, Avebe, KMC, AKV AmbA, Duynie, and others.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Nature

By End-use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author