ID: PMRREP35700| 198 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

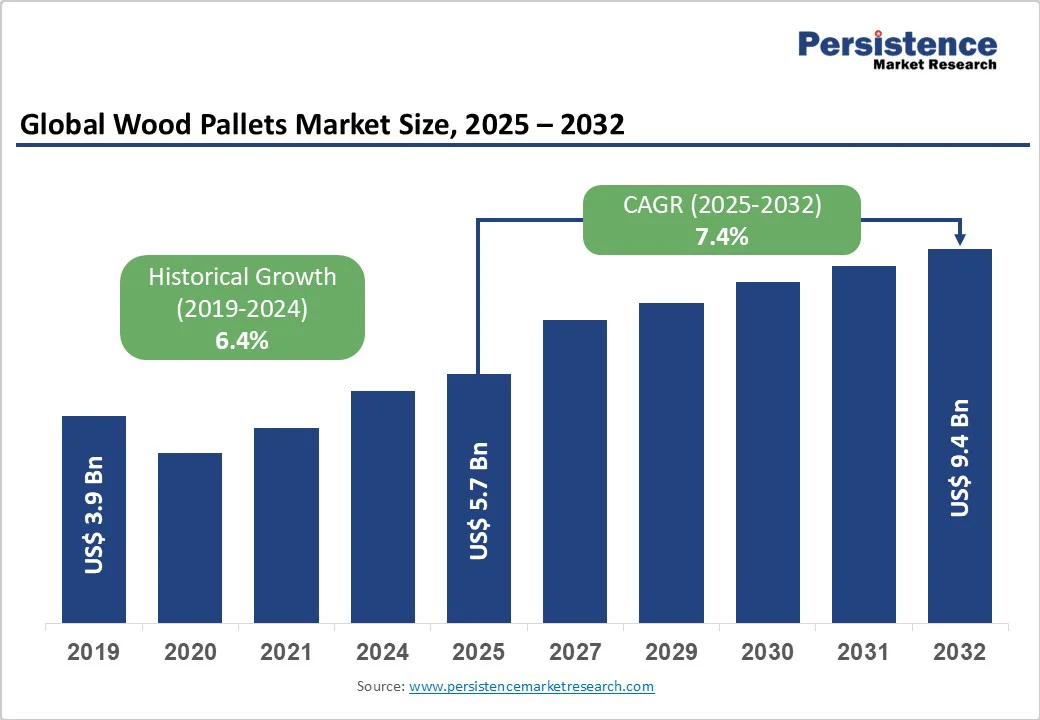

The global wood pallets market size is likely to be valued at US$5.7 billion in 2025 and is projected to reach US$9.4 billion by 2032, growing at a CAGR of 7.4% between 2025 and 2032.

The market expansion is primarily driven by the exponential growth of e-commerce activities and global trade volumes, which necessitate efficient material handling solutions.

The increasing focus on sustainable packaging alternatives and circular economy principles has positioned wood pallets as environmentally preferable options compared to plastic alternatives. Additionally, the standardization initiatives by international organizations and regulatory compliance requirements for safe goods transportation contribute significantly to market growth momentum.

| Key Insights | Details |

|---|---|

| Wood Pallets Market Size (2025E) | US$5.7 Bn |

| Market Value Forecast (2032F) | US$9.4 Bn |

| Projected Growth CAGR (2025-2032) | 7.4% |

| Historical Market Growth (2019-2024) | 6.4% |

The surge in global e-commerce is fueling strong demand for wood pallets as critical components in logistics and warehousing. Online retail sales reached US$5.8 trillion in 2023, reflecting the scale of digital trade that requires standardized pallet systems for streamlined inventory handling and order fulfillment. Major players, such as Amazon, alone consume millions of pallets annually across their fulfillment centers, highlighting the reliance of e-commerce networks on palletized solutions.

The rise of automated warehouses and robotic material handling systems has created demand for precision-engineered pallets that meet strict dimensional and durability standards. High-quality wood pallets ensure compatibility with advanced technologies while supporting faster throughput, optimized space utilization, and reduced operational downtime. This convergence of automation and logistics expansion positions wood pallets as essential enablers of global e-commerce supply chains.

Environmental concerns and regulatory frameworks are also driving the adoption of wood pallets across various industries. Unlike plastic alternatives, wooden pallets offer superior recyclability, repairability, and renewability, making them a natural fit within sustainability-focused policies such as the EU’s Circular Economy Action Plan. Corporates like Unilever and Nestlé are prioritizing sustainable logistics solutions, creating significant opportunities for wood-based pallets.

Responsible sourcing through Forest Stewardship Council (FSC) certifications has gained traction, with FSC-certified pallets recording 15-20% higher demand growth compared to non-certified variants. This aligns with global ESG commitments and demonstrates a growing preference for eco-friendly logistics solutions. By balancing cost efficiency with environmental stewardship, wood pallets are increasingly favored in supply chains seeking long-term sustainable practices.

The wood pallets market faces significant challenges from fluctuating raw material prices and unstable supply chains. Softwood lumber prices witnessed 40-60% volatility between 2022 and 2024 (Random Lengths), creating unpredictability in production costs. Climate-related events, including wildfires and pest infestations, have further reduced timber availability and impacted quality, adding to raw material uncertainties for manufacturers.

Escalating logistics costs have intensified the pressure on pallet producers. Freight rates rose 25-30% compared to pre-pandemic levels, directly influencing raw material procurement and overall manufacturing economics. These rising input costs limit pricing flexibility for manufacturers while straining margins, compelling many producers to adopt short-term sourcing strategies that can compromise long-term stability.

Rising competition from alternative pallet materials also restricts wood pallet demand, especially in industries with strict hygiene standards. Plastic and metal pallets are increasingly favored in food and pharmaceutical supply chains due to their resistance to contamination and ease of sterilization, displacing wood in certain applications.

Pallet pooling and rental models are reshaping buyer preferences. CHEP’s rental network, for example, has gained market traction by enabling companies to adopt asset-light logistics strategies with 20-30% cost savings for fluctuating demand. This shift reduces direct pallet purchases, constrains growth opportunities for wood pallet suppliers, and signals a long-term movement toward service-driven business models rather than traditional sales.

Rapid industrialization in emerging economies offers significant opportunities for wood pallet adoption. Countries such as India and Vietnam are witnessing 8-12% annual growth in manufacturing, driving demand for efficient logistics and material handling systems.

In India, the Make in India initiative, coupled with strong growth in automotive and pharmaceutical sectors, is spurring wider palletization adoption. Similarly, Vietnam’s rise as a regional manufacturing hub has accelerated the need for standardized pallet systems to support growing exports.

Regional growth trends are equally influential. The ASEAN region is investing over US$ 200 billion annually in infrastructure projects, positioning itself as a vital link in global supply chains. Expanding trade volumes and integration into international logistics frameworks require reliable, cost-effective, and scalable material handling solutions. Wood pallets, being versatile and widely available, are well placed to capture this demand, serving as critical enablers of modern distribution networks in emerging markets.

The adoption of advanced technologies is creating new growth avenues for wood pallet manufacturers. The integration of Internet of Things (IoT) sensors and RFID systems is transforming pallets into intelligent assets that enhance supply chain visibility and efficiency.

Companies like Brambles are pioneering smart pallet solutions that offer real-time tracking and predictive analytics, enabling businesses to monitor product flows with greater accuracy. These solutions are also commanding 15-25% price premiums compared to traditional pallets, opening higher-value revenue streams.

Hybrid designs combining traditional wood strength with embedded smart technology are gaining traction. Sensor-integrated pallets not only support automated storage and retrieval systems but also align with the ongoing evolution of industrial racking and warehouse automation markets. As transparency, traceability, and sustainability become critical requirements for global supply chains, smart wood pallets are emerging as strategic assets, driving differentiation for manufacturers and enhancing efficiency for end-users.

The softwood segment leads the wood pallets market, holding about 65% market share, largely due to its cost-effectiveness, strength-to-weight balance, and wide availability. Softwood species such as pine, fir, and spruce are highly preferred in pallet manufacturing for their easy workability and consistent quality, making them suitable for mass production in logistics applications. According to the U.S. Forest Service, softwood species account for 75% of industrial wood consumption, underlining their dominance in structural applications across industries.

Softwood’s rapid growth cycles, typically 20-30 years compared to 50-100 years for hardwoods, ensure a sustainable and affordable raw material supply for pallet manufacturers. These shorter growth cycles also translate into lower production costs, making softwood pallets an economical option for businesses seeking high-volume solutions. At the same time, they provide sufficient load-bearing capacity for standard shipping requirements, reinforcing their market leadership over hardwood alternatives.

Block wooden pallets dominate global market share at around 55%, primarily because of their durability and superior load-handling characteristics. Their design enables four-way forklift access, which increases handling efficiency in high-traffic warehouses.

Block pallets distribute loads evenly, ensuring higher stability for stacking and long-haul shipping, particularly in automated warehouses where precision is critical. The ISO standards also favor block pallet designs for international shipping due to their reduced damage rates and structural resilience.

Another advantage of block pallets is their 20-30% longer service life compared to stringer pallets, offering better value and reduced replacement costs for end users. Their modular construction allows damaged parts to be replaced, extending product lifecycles and aligning with circular economy practices. This recyclability and repairability, combined with operational benefits, make block pallets the preferred design configuration for industries prioritizing cost savings and sustainability.

Four-way entry pallets dominate the market with approximately 70% share, owing to their unmatched flexibility and efficiency in material handling operations. They allow forklifts and pallet jacks to approach from all sides, minimizing handling time and improving workflow efficiency in busy warehouses. According to Toyota Material Handling studies, four-way entry designs improve warehouse throughput by 15-20% compared to two-way entry alternatives, underscoring their productivity benefits.

The design also supports compatibility with automated guided vehicles (AGVs) and robotic systems, making them ideal for warehouses shifting toward automation and advanced storage solutions. Leading retailers like Walmart and Target standardize four-way entry pallets across distribution networks to optimize supply chain performance and reduce operational costs. This widespread adoption highlights their role as the backbone of modern logistics infrastructure and warehouse automation strategies.

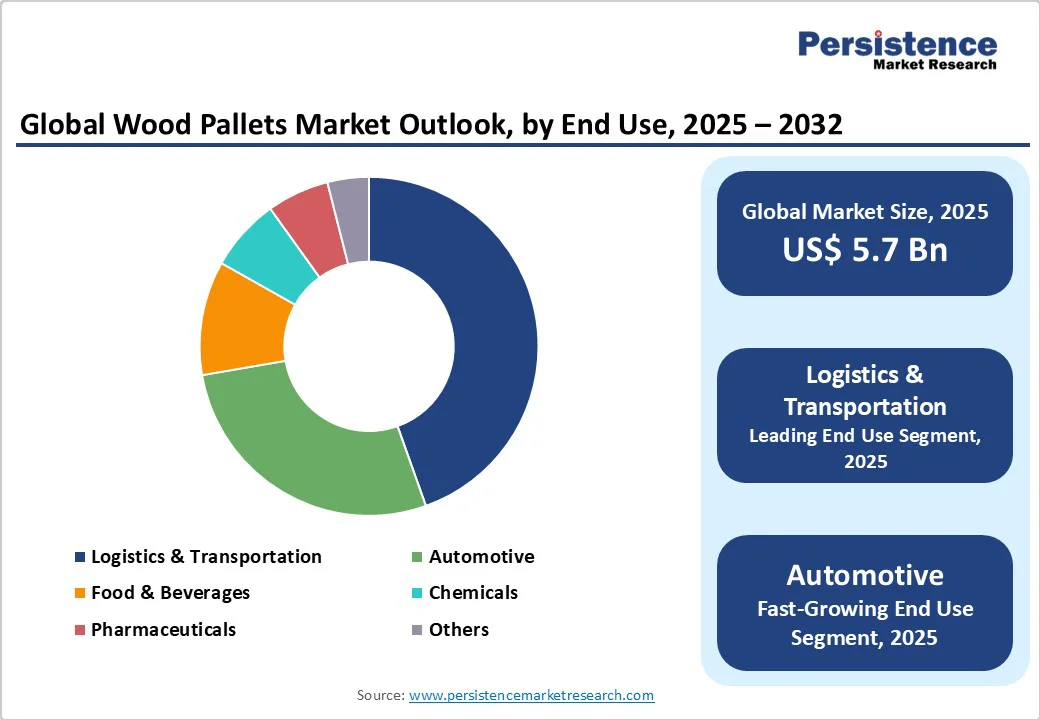

The logistics and transportation sector is the largest end-use segment, commanding roughly 45% of the global wood pallets market. This dominance is driven by rising international trade volumes, containerized shipping, and the explosive growth of e-commerce logistics networks.

Standardized wood pallets are vital for freight forwarding, 3PL operations, and cargo handling efficiency. Major global logistics providers such as DHL and FedEx consume millions of pallets annually, underscoring the segment’s sheer scale.

The sector benefits from the rapid containerization of global trade, with the World Shipping Council reporting a 6% annual increase in container traffic volumes. This growth drives consistent demand for ISO-compliant pallets that meet international shipping standards.

As global supply chains become increasingly multimodal, wood pallets remain essential for cost-effective, reliable, and standardized cargo movement, reinforcing their role as indispensable assets in global trade and transportation systems.

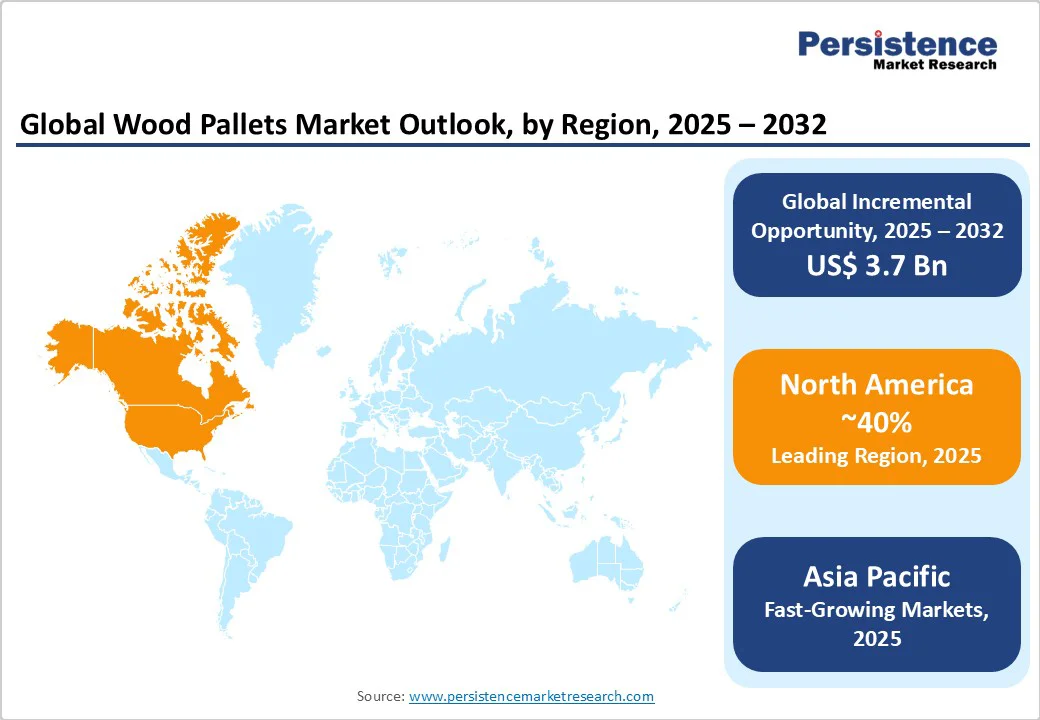

North America maintains its position as the leading regional market, driven by robust e-commerce growth and advanced logistics infrastructure, with the United States accounting for approximately 80% of regional demand.

The U.S. Census Bureau reports that e-commerce sales reached US$ 1.1 trillion in 2023, necessitating sophisticated warehousing and distribution systems that rely heavily on standardized pallet solutions. Major retailers including Amazon, Walmart, and Home Depot operate extensive distribution networks requiring millions of pallets annually for efficient inventory management and order fulfillment processes.

The regulatory framework established by the U.S. Department of Agriculture through ISPM-15 standards ensures phytosanitary compliance for international trade, driving demand for heat-treated and certified wood pallets.

The North American Free Trade Agreement (USMCA) provisions facilitate cross-border commerce, increasing demand for standardized pallet solutions across Canada, United States, and Mexico. Innovation ecosystems centered around logistics technology hubs in California, Texas, and Illinois drives the adoption of smart pallet solutions and automated material handling systems.

European markets demonstrate strong growth momentum driven by European Union sustainability initiatives and circular economy regulations, with Germany, United Kingdom, France, and Spain leading regional demand.

The European Commission's Green Deal emphasizes sustainable packaging solutions, positioning wood pallets favorably against plastic alternatives due to their renewable material base and recyclability characteristics. Germany's robust manufacturing sector, particularly automotive and industrial equipment, generates substantial demand for heavy-duty pallet solutions capable of handling precision components and machinery.

Regulatory harmonization across EU member states through standardized pallet specifications and EPAL certification systems ensures interoperability and quality consistency across regional supply chains.

The European Pallet Association reported 15% growth in certified pallet volumes during 2023, reflecting increased adoption of standardized solutions. France's agricultural exports and Spain's fresh produce distribution networks require specialized pallet designs for temperature-controlled logistics, driving innovation in ventilated and moisture-resistant wood pallet solutions.

Asia Pacific emerges as the fastest-growing regional market, with China, Japan, India, and ASEAN countries driving expansion through rapid industrialization and export-oriented manufacturing growth.

China's position as the world's largest manufacturing hub generates enormous demand for logistics solutions, with the National Development and Reform Commission reporting US$ 500 billion in annual logistics expenditures. The India Pallets Market demonstrates exceptional potential, supported by the government's Make in India initiative and expanding automotive, pharmaceutical, and textile manufacturing sectors.

Japan's advanced automation in manufacturing and logistics drives demand for precision-engineered pallets compatible with robotic systems and automated guided vehicles. The ASEAN region's integration into global supply chains, particularly in electronics and automotive components, necessitates standardized pallet solutions for efficient international trade.

Manufacturing advantages including lower labor costs and proximity to raw material sources position Asia Pacific producers competitively in global markets, with countries like Vietnam and Thailand emerging as significant pallet manufacturing hubs for regional and export markets.

The wood pallets market exhibits a moderately fragmented structure characterized by numerous regional players alongside several global market leaders, creating diverse competitive dynamics across geographical markets. Market concentration remains relatively low, with the top five players accounting for approximately 25-30% of global market share, indicating significant opportunities for consolidation and strategic acquisitions.

Leading companies pursue horizontal integration strategies through acquisitions of regional manufacturers to expand geographical presence and increase operational scale. Vertical integration initiatives focus on securing raw material supplies and developing captive lumber sources to mitigate price volatility and ensure consistent quality standards.

Research and development investments concentrate on sustainable manufacturing processes, smart pallet technologies, and enhanced durability solutions to differentiate offerings in competitive markets.

The global wood pallets market is projected to reach US$ 9.4 billion by 2032, growing at a CAGR of 7.4% from 2025 to 2032, driven by increasing e-commerce activities and sustainable packaging initiatives.

The wood pallets market is primarily driven by exponential e-commerce growth, supply chain optimization needs, sustainability initiatives favoring renewable materials, and increasing global trade volumes requiring standardized logistics solutions.

Softwood pallets lead the market with approximately 65% market share due to their optimal balance of strength, weight, and cost-effectiveness, making them suitable for standard logistics applications.

Asia Pacific represents the fastest-growing regional market.

Smart pallet technologies and IoT integration presents the most significant opportunity, potentially commanding 15-25% price premiums while enabling real-time supply chain visibility and optimization.

Key market players include CHEP, UFP Industries Inc., Kamps Inc., Kronus LTD, and PECO Pallet, with CHEP maintaining market leadership through its global pallet pooling system and extensive international network.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Wood Type

Design

Entry Points

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author