ID: PMRREP23839| 178 Pages | 20 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

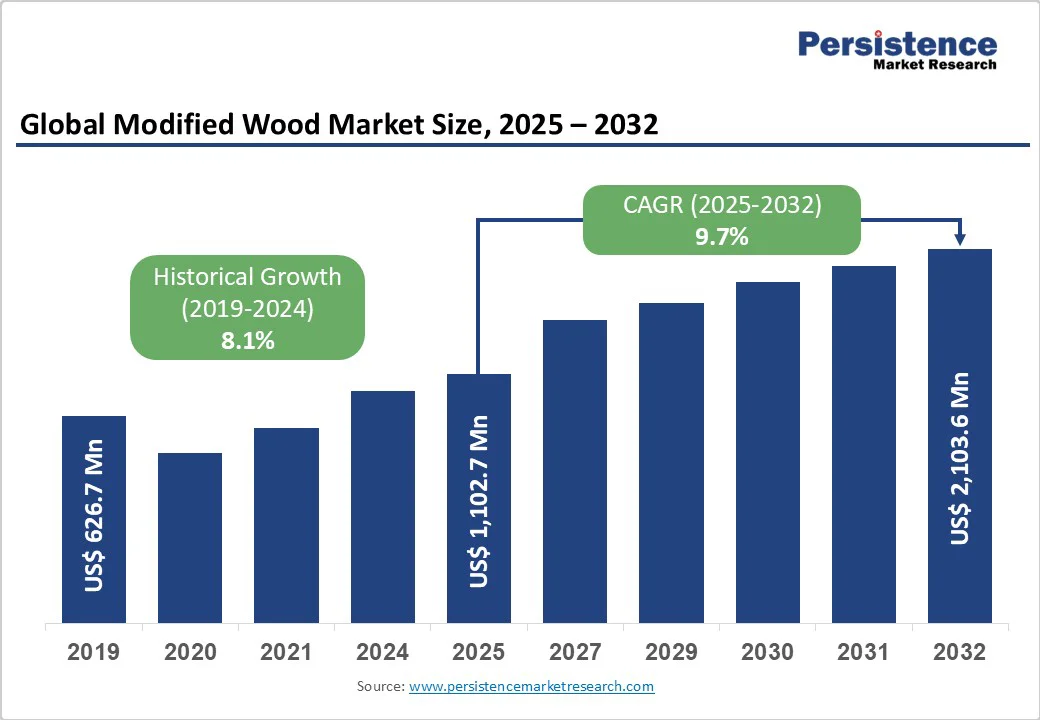

The global modified wood market size is likely to be valued at US$626.7 million in 2025. It is projected to reach US$ 2,103.6 million by 2032, growing at a CAGR of 9.7% during 2025 - 2032, driven by the increasing demand for eco-friendly and durable wood alternatives amid growing environmental awareness and restrictions on deforestation.

| Key Insights | Details |

|---|---|

| Modified Wood Market Size (2025E) | US$ 1,102.7 Mn |

| Market Value Forecast (2032F) | US$ 2,103.6 Mn |

| Projected Growth (CAGR 2025 to 2032) | 9.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.1% |

The global push toward sustainable building practices has become a primary catalyst for the modified wood market. Government regulations promoting green construction and the European Union's Timber Regulation (EUTR) have significantly impacted demand for treated wood meeting environmental criteria.

The U.S. Environmental Protection Agency (EPA)'s advocacy for low-emission building materials has further accelerated adoption in North America. Modified wood offers enhanced durability, extending product lifespan while reducing replacement frequency, directly supporting circular economy principles and reducing environmental impact.

90% of timber produced in North America is expected to be certified by sustainable forestry programs by 2030, creating substantial tailwinds for modified wood adoption

Rapid global urbanization and continuous innovation in wood modification technologies are key catalysts driving the modified wood market. With nearly 70% of the global population expected to reside in urban areas by 2050, construction demand for durable, sustainable, and low-maintenance materials is accelerating.

Modified wood’s superior stability, weather resistance, and premium aesthetics make it ideal for modern infrastructure and high-density developments. Concurrently, advancements in thermal modification, acetylation, and furfurylation are enhancing product performance, reducing production costs, and broadening the range of applicable wood species.

Established construction methods and resistance to adopting new technologies present substantial market challenges. Many local manufacturers remain unaware of advanced modification technologies, preferring familiar treatment methods despite inferior performance. This technological inertia is particularly pronounced in developing markets where traditional construction practices dominate and educational resources about modern wood modification techniques are limited.

The most significant challenge facing modified wood manufacturers is insufficient consumer and intermediate awareness of product benefits. A sizeable portion of potential customers in large economies lack a clear understanding of modified wood characteristics and applications, significantly impacting sales volumes.

Additionally, the perception of high costs compared to traditional wood alternatives creates adoption barriers, particularly among small-scale builders and cost-sensitive market segments. This awareness gap limits market penetration despite superior performance characteristics and long-term cost benefits.

Modified wood is experiencing application diversification beyond conventional decking and cladding into specialized sectors, including marine environments, industrial infrastructure, and high-performance architectural elements. The material's enhanced properties make it suitable for demanding applications previously dominated by synthetic materials or exotic hardwoods. Market expansion into interior applications, furniture manufacturing, and specialized industrial uses represents significant growth potential.

Advancing research in bio-based chemicals and more efficient thermal treatment processes promises to reduce production costs while maintaining performance advantages. These innovations address primary market restraints related to cost competitiveness, potentially expanding addressable markets, and accelerating adoption rates across price-sensitive segments.

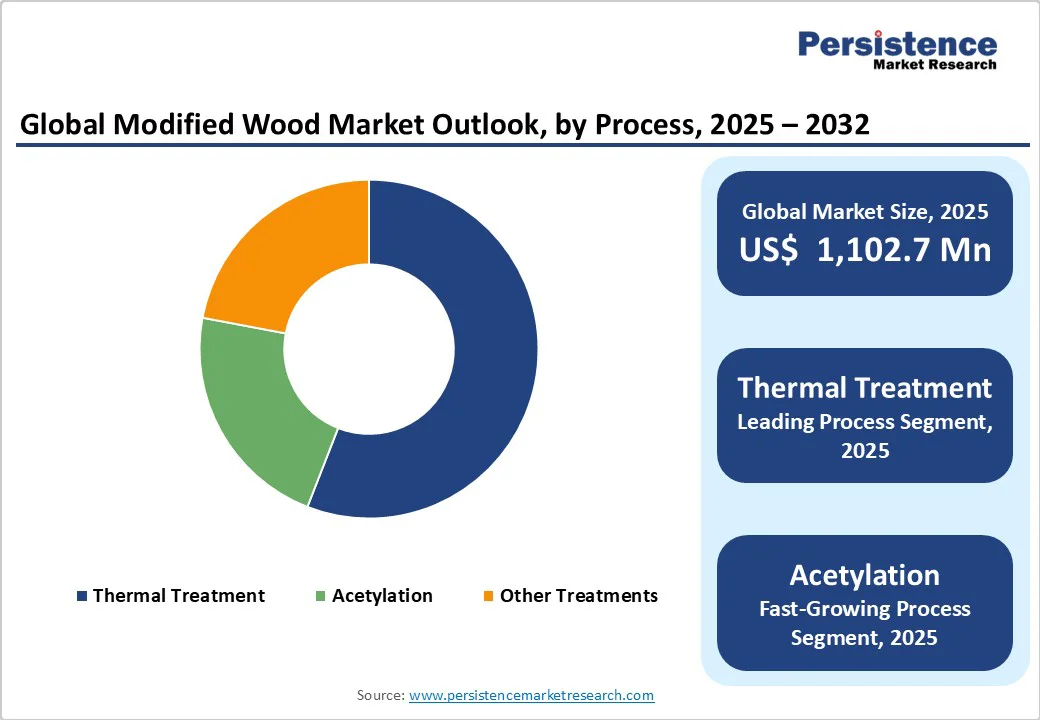

Thermal treatment is anticipated to remain the leading process in the modified wood market in 2025, accounting for over 48% share due to its established technology base and proven performance in 2025. The process involves heating wood at 180-220°C under controlled conditions to remove organic molecules, thereby enhancing dimensional stability, moisture resistance, and protection against decay and insects.

With an estimated 8.7% year-over-year revenue growth, thermal modification continues to gain traction as a chemical-free and environmentally friendly solution. Its ability to improve wood durability without introducing harmful additives makes it a preferred substitute for pressure-treated lumber in decking, cladding, and outdoor structures.

In contrast, acetylation is the fastest-growing process segment, recognized for delivering exceptional stability and longevity. This technique transforms the free hydroxyl groups in wood into acetyl groups, significantly reducing water absorption and improving dimensional stability.

Since acetyl groups naturally exist in all wood species, the process adds nothing unnatural to the material, ensuring sustainability and safety. Treated with acetic anhydride, acetylated wood achieves premium moisture resistance and structural integrity, making it ideal for high-performance applications in challenging environments.

Decking applications are estimated to account for approximately 46.1% of the modified wood market revenue share in 2025, underscoring a strong consumer demand for durable, sustainable outdoor flooring materials. This leadership is driven by modified wood’s superior resistance to moisture, UV radiation, and temperature fluctuations, challenges that often limit traditional materials.

Growth is further reinforced by the rising popularity of outdoor living spaces, expanding residential construction, and increasing awareness of the product’s longevity and aesthetic appeal, particularly in high-growth housing markets.

Meanwhile, siding is expected to emerge as the fastest-growing application segment during the 2025 - 2032 forecast period, fueled by robust adoption in residential and commercial construction. Its appeal stems from modified wood’s exceptional weather resistance, dimensional stability, and minimal maintenance needs.

As architects and builders increasingly favor natural materials that meet modern performance standards, modified wood siding is gaining traction in premium projects for its combination of natural elegance, enhanced durability, and lower lifecycle costs.

The residential segment is likely to account for 44.6% of the global demand for modified wood, driven by strong adoption in home construction and renovation projects, including decking, siding, windows, doors, and interior furnishings. Growth is fueled by rising housing demand, increasing disposable incomes, and heightened environmental awareness, with homeowners valuing modified wood’s durability, aesthetic appeal, and chemical-free treatment.

The commercial segment is slated to be the fastest-growing end-use from 2025 to 2032, supported by architects and developers specifying sustainable, high-performance materials for office buildings, retail spaces, hospitality facilities, and institutional construction. Modified wood’s durability, low maintenance, and consistent appearance make it ideal for demanding commercial environments.

Expansion is further accelerated by green building certifications such as LEED and BREEAM, along with corporate sustainability initiatives that prioritize eco-friendly, long-lasting materials, enhancing the segment’s premium value and adoption worldwide.

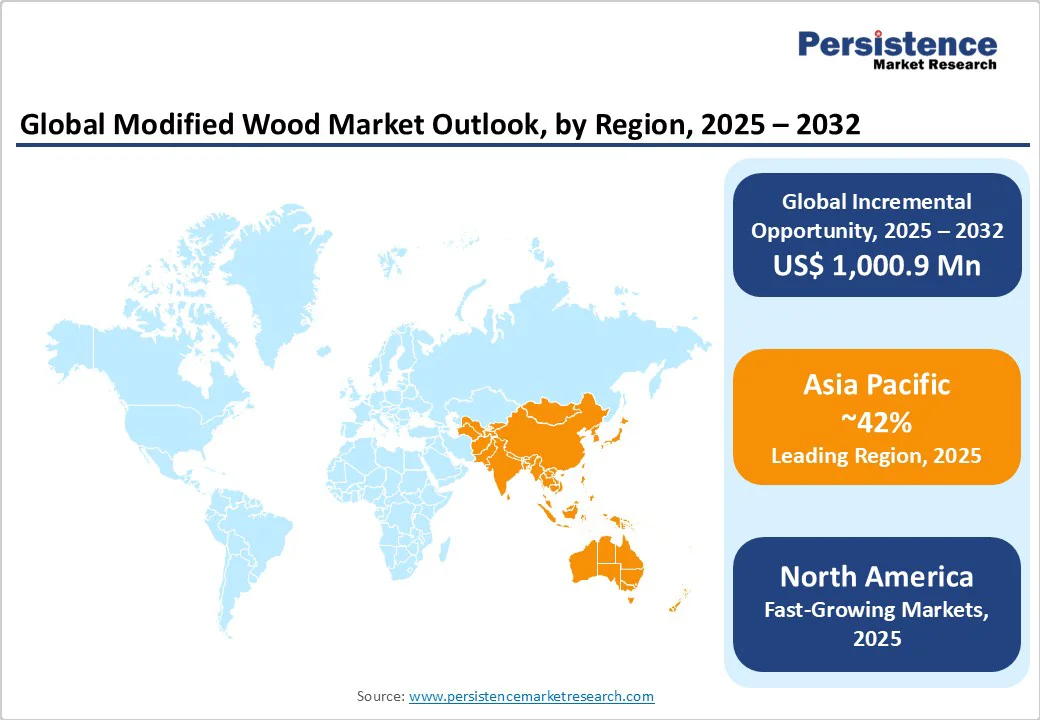

Asia Pacific is poised to capture around 42% of the modified wood market share in 2025. The regional market growth is fueled by rapid urbanization, large-scale infrastructure projects, and expanding industrial activities. China leads the market, serving as both a major consumption hub and a manufacturing powerhouse. Its strong construction sector, high domestic demand, and robust manufacturing ecosystem have made it the center for production and export of mini cranes, attracting both local and international players.

Japan and South Korea contribute modestly but benefit from technological adoption and modernization of urban infrastructure, while India is emerging as a high-potential market due to rapid urban expansion, rising disposable incomes, and significant government investment in industrial and urban projects.

The region’s dominance is further strengthened by cost-competitive manufacturing, proximity to raw materials, and established supply chains, allowing manufacturers to serve both domestic and global markets effectively. Competitive dynamics are driven by a mix of established international players and emerging regional manufacturers focusing on innovation, operational efficiency, and cost leadership, positioning the Asia Pacific as the primary growth engine.

Europe is anticipated to be the fastest-growing regional market for modified wood through 2032, with Germany, France, and the U.K. leading adoption. Germany drives regional growth, reflecting market resilience despite pandemic challenges.

Stringent environmental regulations, high consumer sustainability awareness, and well-established distribution networks support the robust regional demand. Germany’s construction sector, encompassing residential, industrial, and commercial projects, is the largest in Europe. High per capita income supports premium material adoption, while robust residential and infrastructure development fuels decking and other modified wood consumption.

EU regulations promoting sustainable construction practices and regulatory harmonization have created favorable conditions for cross-border trade and standardized product specifications, boosting market expansion. Investment trends focus on technological innovation, capacity enhancement, and strategic acquisitions. Manufacturers prioritize R&D to maintain technological leadership, develop new applications, and improve sustainable production processes, including lifecycle assessments.

The global modified wood market structure is moderately concentrated, with established players such as Accsys Technologies, Kebony, Thermory, Stora Enso, and Arbor Wood Co. driving innovation and ruling the market. Competitive differentiation is largely based on process expertise, with acetylation dominated by European firms and thermal modification led by North American and Nordic companies. Market strategies focus on innovation leadership, vertical integration, and geographic expansion, while sustainability credentials and premium positioning strengthen customer appeal.

Recent strategic developments highlight trends in consolidation and value chain integration. R&D collaborations focus on energy-efficient, bio-based, and automated processes, thereby enhancing operational efficiency and performance. Emerging business models emphasize direct-to-consumer channels, digital marketing, and value-added services, positioning companies as solution providers rather than commodity suppliers.

The global modified wood market is projected to reach US$ 1,102.7 million in 2025.

The key demand driver for the modified wood market is the growing need for sustainable, durable, and high-performance wood products, particularly in construction, decking, and infrastructure applications.

The modified wood market is poised to witness a CAGR of 9.7% from 2025 to 2032.

The increasing demand for eco-friendly and durable wood alternatives amid growing environmental awareness and restrictions on deforestation and the urgency to transition from traditional chromated copper arsenate treatments to eco-friendly alternatives such as thermal modification are key market opportunities.

Accsys Technologies, Kebony, Thermory AS, and Stora Enso are some key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author