ID: PMRREP35790| 196 Pages | 29 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

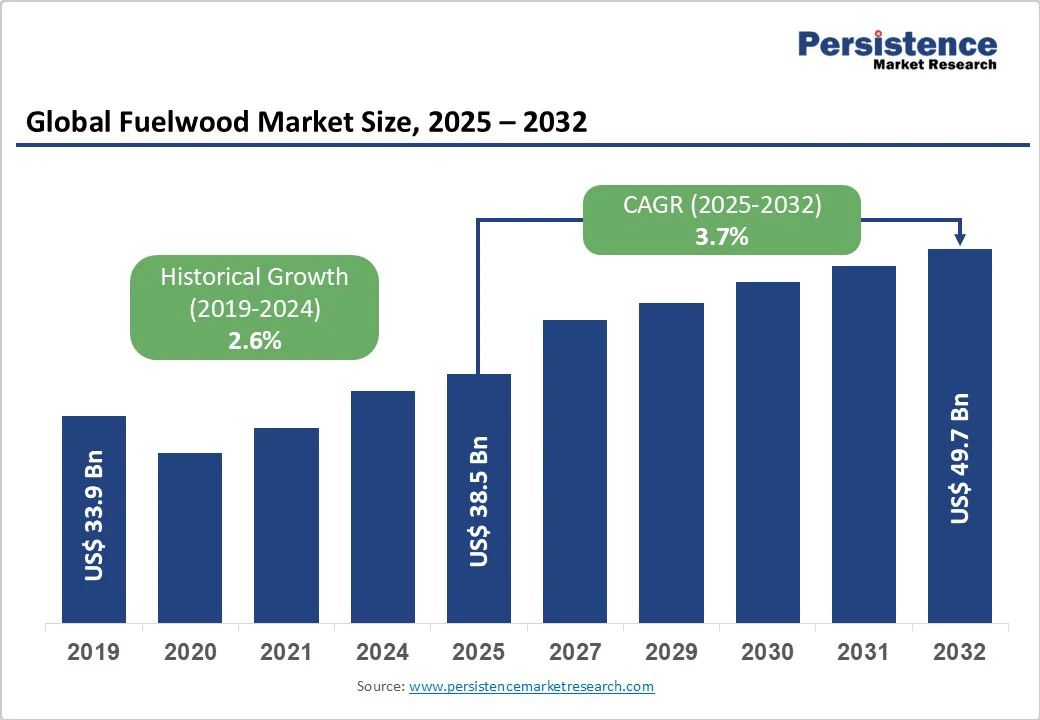

The global fuelwood market size is likely to be valued at US$38.5 billion in 2025. It is expected to reach US$49.7 billion by 2032, growing at a CAGR of 3.7% during the forecast period from 2025 to 2032, driven by increasing rural energy dependence, renewable energy mandates, and the growing adoption of wood pellets for heating.

Fuelwood serves a dual role in the global energy mix, providing primary household energy in developing regions and renewable industrial fuel in advanced markets. Rural energy needs, renewable mandates, and rising pellet-based heating drive demand.

| Key Insights | Details |

|---|---|

| Fuelwood Market Size (2025E) | US$38.5 Bn |

| Market Value Forecast (2032F) | US$49.7 Bn |

| Projected Growth (CAGR 2025 to 2032) | 3.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.6% |

The largest share of global fuelwood demand originates from low- and middle-income countries, where wood remains the most affordable and accessible energy source. In 2019, global wood-fuel removals exceeded 2.5 billion cubic meters, illustrating the immense scale of household dependence.

Rural communities across Sub-Saharan Africa, South Asia, and Southeast Asia continue to rely on firewood and charcoal for cooking and heating. This sustained baseline consumption ensures market stability and supports large informal economies. As energy-access programs evolve, gradual formalization of these markets offers long-term potential for standardized, cleaner fuel products such as briquettes and pellets.

Across North America and Europe, renewable-energy policies encourage the substitution of fossil fuels with certified woody biomass. The European Union’s Renewable Energy Directive and national heat-incentive programs promote sustainable biomass for combined heat and power (CHP) and district heating.

These policies have strengthened demand for certified, traceable pellets and chips, while restricting non-compliant biomass sources. In response, producers are investing in traceability systems and third-party certifications to maintain export access. The growing convergence between environmental policy and industrial energy transition continues to fuel the steady expansion of the processed fuelwood segment.

Periodic surges in natural gas and electricity prices have driven residential and municipal consumers toward alternative heating solutions. Households and communities in colder regions of Europe and North America increasingly adopt pellet stoves and small-scale boilers, valuing affordability and independence.

District-heating networks powered by wood pellets have also gained traction in urban areas. Technological advancements in combustion efficiency and emissions control further enhance the appeal of wood-based heating systems. These dynamics sustain a rising premium market for processed biomass products.

Stringent sustainability regulations, particularly within the EU, have introduced no-go zones for biomass sourcing and require extensive documentation of carbon and biodiversity impacts. Producers must now maintain detailed chain-of-custody records and independent certification to qualify for subsidies or export contracts.

These requirements raise operational costs, increase competition for feedstock, and limit eligible supply areas. For smaller producers, compliance costs can account for a significant share of delivered fuel prices, reducing competitiveness with fossil alternatives.

In many developing regions, fuelwood trade operates informally, with limited oversight and high environmental pressure on local forests. This informality results in inconsistent product quality, unreliable supply, and reputational risk for downstream buyers.

Deforestation and unsustainable charcoal production have drawn scrutiny from governments and international organizations. As a result, large institutional buyers and importers demand verifiable sourcing data, thereby excluding unverified suppliers and reducing the export potential of informal producers. This structural barrier continues to constrain modernization and large-scale investment.

The modernization of household biomass use represents one of the most promising areas for inclusive growth. Replacing traditional firewood with standardized briquettes or pellets, combined with efficient cookstoves, significantly reduces indoor air pollution, fuel costs, and deforestation rates.

Capturing even a modest fraction of current household fuelwood demand could represent billions in new market value globally. Public-private partnerships and carbon-credit mechanisms create attractive conditions for investors focused on social impact and clean-energy access.

Growing commitments to industrial decarbonization and renewable heat targets have expanded opportunities for wood pellets and chips as substitutes for coal in district heating, manufacturing, and power generation. Long-term supply contracts between pellet producers and utilities or industrial users secure stable revenue streams.

Merging biofuel and sustainable aviation fuel (SAF) initiatives may also integrate wood-derived feedstock, opening premium markets for certified suppliers. Companies that meet strict carbon-accounting standards are best positioned to capture this demand.

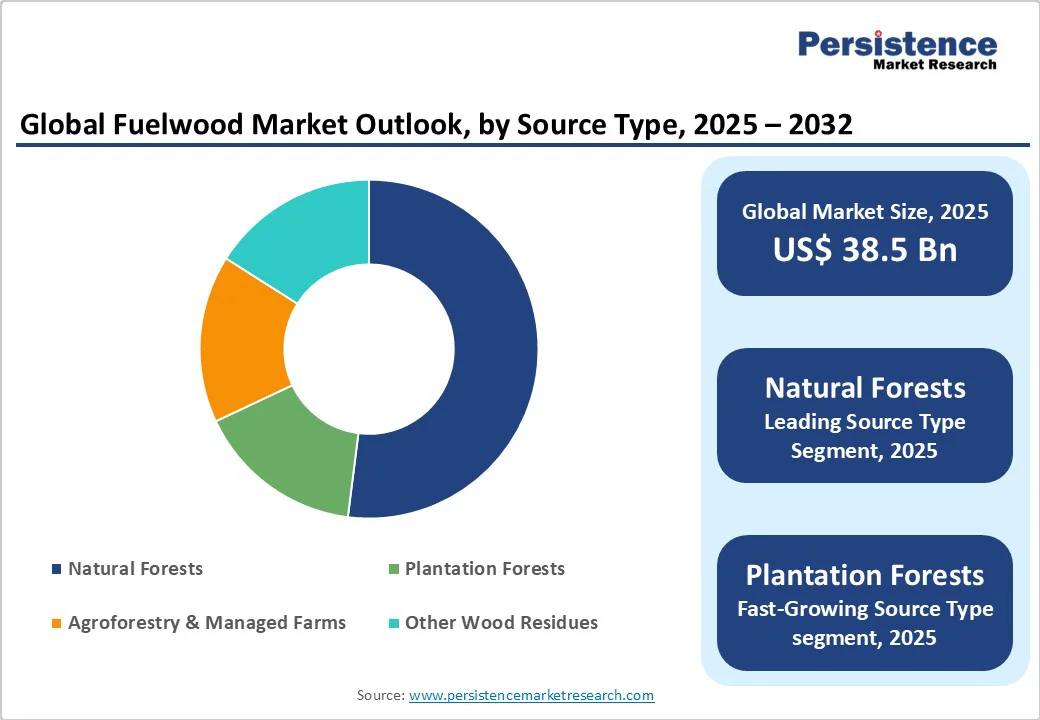

Natural forests currently supply over half of global fuelwood volume, accounting for approximately 51.2% of total market revenue. Their dominance stems from widespread availability and traditional harvesting practices, especially across Sub-Saharan Africa, South Asia, and Latin America, where rural populations depend heavily on naturally grown wood for cooking and heating.

For instance, in countries such as Nigeria, India, and Brazil, community-managed forests remain the backbone of rural energy systems. Low harvesting costs and minimal infrastructure requirements sustain their prominence.

However, this dependence on unmanaged forests raises environmental concerns, particularly over deforestation and biodiversity loss, prompting governments to encourage regulated and sustainable extraction through national forest management programs.

Plantation-based are emerging as the fastest-growing segment, driven by global demand for traceable and certified biomass. Managed plantations enable predictable yields, carbon accounting, and compliance with international sustainability standards such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification).

Countries, including Vietnam and Indonesia, have rapidly expanded acacia and eucalyptus plantations for pellet exports to Japan and South Korea, meeting their renewable energy procurement policies. Similarly, in India, social forestry programs are promoting short-rotation species such as Prosopis juliflora and Casuarina for local biomass supply.

Unprocessed firewood continues to dominate the market with a share of 57.8%, representing the primary energy source for over 2.5 billion people worldwide. Its accessibility, low cost, and ease of collection make it indispensable in rural Africa, South Asia, and parts of Latin America, where modern fuels remain unaffordable or inaccessible.

For example, in Ethiopia and Nepal, over 80% of households still depend on traditional firewood for daily cooking. Despite its vital role, this segment generates limited economic value due to informal trading and low unit margins. Global energy initiatives, such as the United Nations’ Clean Cooking Alliance, are gradually promoting the replacement of raw firewood with cleaner and more efficient biomass fuels.

Processed fuels such as wood pellets and briquettes are expanding at a remarkable pace, supported by renewable heat policies in Europe, Japan, and North America. These products offer higher calorific value, cleaner combustion, and compatibility with modern heating appliances. In 2024, European pellet consumption surpassed 24 million tonnes, led by countries like Germany, Sweden, and the U.K., where government incentives promote bioheat adoption.

In Japan, the Feed-in Tariff (FiT) system has encouraged rapid expansion of wood-pellet power plants, sourced primarily from Southeast Asia and Canada. Manufacturers such as Enviva (U.S.) and Drax Biomass (U.K.) continue to scale production to meet this global surge in demand.

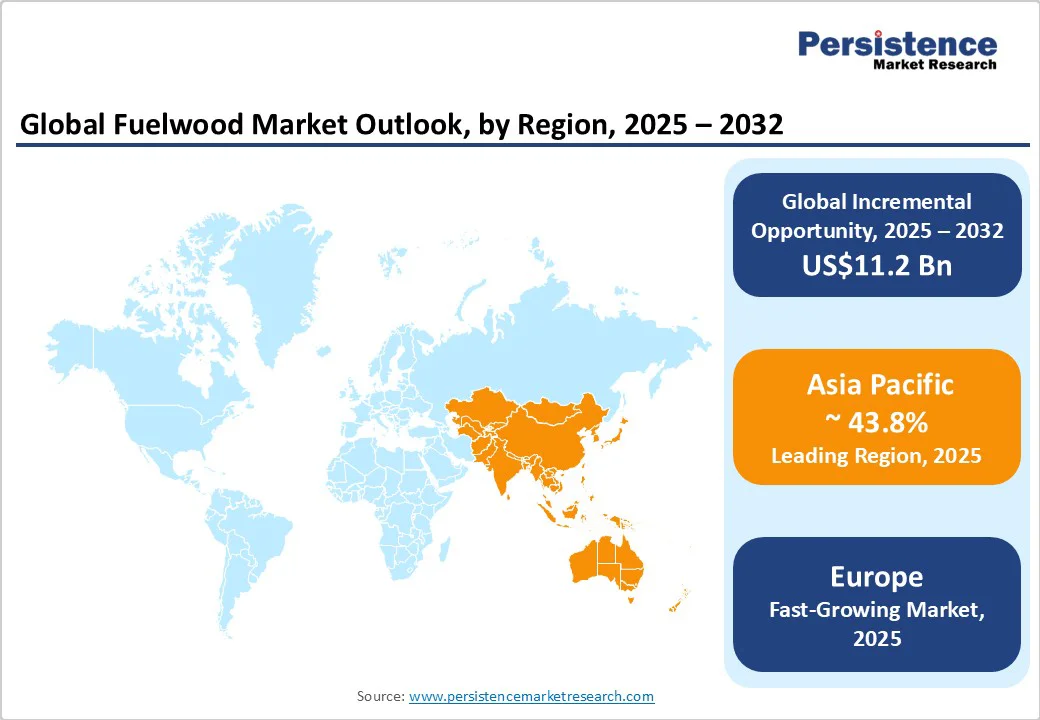

Asia Pacific accounts for 43.8% of global fuelwood consumption, primarily for household use in India, China, and Southeast Asia. Despite initiatives promoting LPG and electricity, wood remains a key energy source for millions of rural households.

Industrialized economies such as Japan and South Korea are major importers of wood pellets for renewable power generation. China’s efforts to diversify biomass energy and reduce coal dependence further contribute to demand. The region’s dual structure —massive traditional use alongside industrial modernization —creates distinct investment pathways.

Recent developments reflect this diversity. In January 2025, Sumitomo Forestry Co. announced a 100,000 tonne/year pellet joint venture in Vietnam, aimed at supplying Japanese utilities under long-term contracts. In June 2024, the China National Energy Administration (NEA) launched a new Biomass Energy Transition Program supporting regional pellet and briquette production hubs in Anhui and Shandong.

In November 2024, Malaysia’s Bioeconomy Corporation partnered with private investors to develop three decentralized pellet production clusters totaling 180,000 tonnes annual capacity for exports to South Korea.

Rural markets are also witnessing innovation: India’s Ministry of New and Renewable Energy (MNRE) launched a pilot program in March 2024 to support the installation of 2 million improved biomass stoves under the National Clean Cooking Scheme. Export-oriented producers across Vietnam, Indonesia, and Thailand are scaling operations to capture growing overseas pellet demand.

North America represents a key production and export hub for processed biomass fuels, notably wood pellets. The U.S. market benefits from abundant forest resources, developed logistics, and established certification systems.

Residential pellet stove adoption and community heating projects contribute to stable domestic demand, while large export contracts with European and Asian buyers drive industrial scale. State-level renewable heat incentives and sustainability mandates continue to shape investment decisions.

Recent developments underscore growing industrial and policy momentum. In March 2025, Drax Group announced a US$300 million expansion of its pellet production capacity in Louisiana, aimed at supplying both domestic and European utilities under long-term offtake agreements.

In July 2024, Enviva Inc. completed the expansion of its Lucedale, Mississippi, facility, increasing output to 750,000 tonnes/year, making it one of the largest pellet plants in North America. In September 2024, the U.S. Department of Energy (DOE) launched a new Bioenergy Technology Program providing US$118 million in grants to accelerate biomass-to-energy conversion research.

Despite recent financial challenges among major producers such as Enviva, long-term fundamentals remain sound, supported by strong policy alignment and energy diversification goals.

Europe remains the largest regional market for certified fuelwood products, particularly pellets and wood chips. Countries such as Germany, France, the U.K., and Spain maintain extensive district-heating networks and renewable-energy targets that prioritize biomass use.

The European Union’s Renewable Energy Directive (RED III), revised in 2023, tightened sustainability standards, limiting eligible feedstock and driving demand for traceable plantation-based supply. High compliance costs have consolidated the industry around certified suppliers, enhancing market transparency. Europe’s import dependency on North America and the Baltics supports a vibrant trade ecosystem.

Several new investments are strengthening Europe’s biomass infrastructure. In February 2025, Graanul Invest launched a €45 million (US$48.4 million) modernization of its pellet terminal in Riga, Latvia, improving export capacity and reducing emissions. In October 2024, ENGIE France inaugurated a 40 MW biomass CHP plant in Alsace, projected to generate renewable heat for 15,000 households.

In May 2024, U.K.-based Highland Pellets secured government approval for its £80 million (US$106.6 million) facility upgrade to meet new EU sustainability requirements. Investment opportunities are increasingly focused on port logistics, sustainable sourcing networks, and advanced combustion systems, while ongoing EU carbon accounting debates continue to influence project viability and investor sentiment.

The global fuelwood market is moderately fragmented, with household fuelwood and charcoal supply chains remaining informal and dominated by small traders. In contrast, the industrial pellet segment is dominated by a few vertically integrated players that oversee forestry, processing, and exports.

Europe leads certified consumption, while North America dominates production. Market power lies with producer,s ensuring traceability and certification. Leading firms focus on vertical integration, product diversification into premium pellets and bio-carbon, and innovative energy-service models combining fuel supply with heating systems and maintenance for sustained growth.

The fuelwood market size is estimated at US$38.5 Billion in 2025.

By 2032, the fuelwood market is projected to reach US$49.7 Billion.

Key trends include a shift toward sustainable forest management, rise in biomass energy initiatives, and growing use of processed wood fuels such as pellets and briquettes.

The traditional firewood segment dominates the market, accounting for around 57.8% of the total share, driven by extensive use in rural cooking and heating applications. The processed fuelwood category is, however, expanding rapidly due to efficiency and environmental benefits.

The fuelwood market is anticipated to grow at a CAGR of 3.7% from 2025 to 2032.

Major players include Enviva Inc., Pinnacle Renewable Energy Inc., Drax Group plc, Ecostan India Pvt. Ltd., and Land Energy Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source Type

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author