ID: PMRREP35942| 184 Pages | 10 Dec 2025 | Format: PDF, Excel, PPT* | Packaging

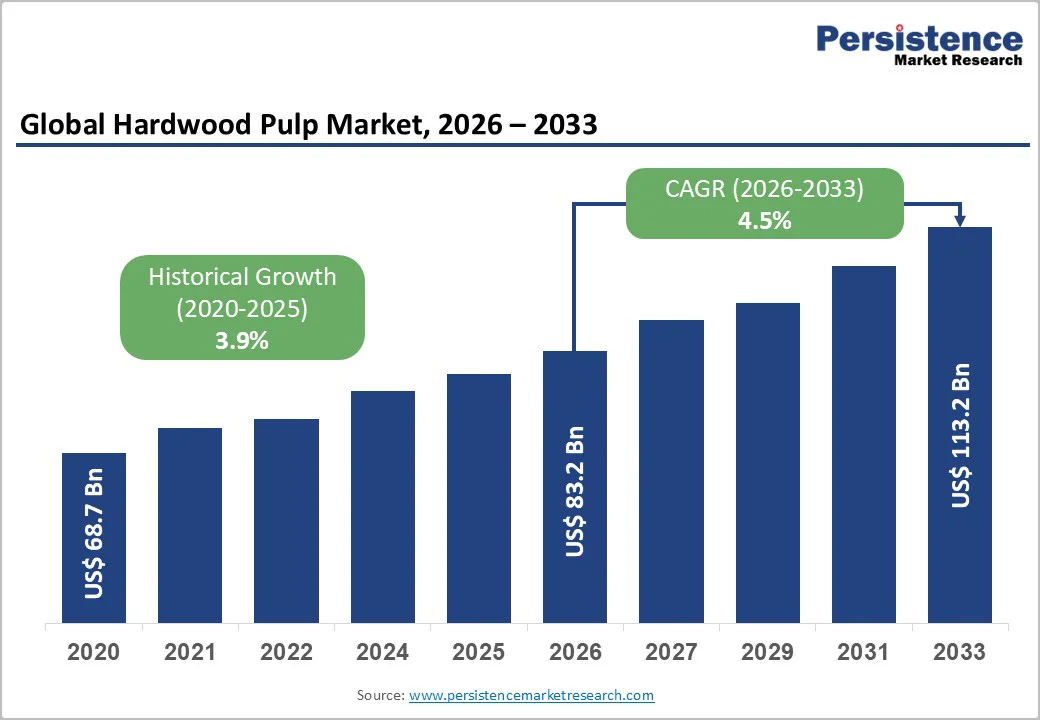

The global hardwood pulp market size is likely to be valued at US$83.2 billion in 2026 and is expected to reach US$113.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period from 2026 to 2033.

Demand growth is supported by rising consumption of tissue and hygiene products, increased use of bleached hardwood kraft pulp (BHKP) in sustainable packaging, and productivity improvements in high-yield eucalyptus plantations. Regulatory shifts such as the EU Deforestation Regulation and tightening effluent controls in North America will influence cost structures and sourcing models.

| Key Insights | Details |

|---|---|

| Hardwood Pulp Market Size (2026E) | US$83.2 Bn |

| Market Value Forecast (2033F) | US$113.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.9% |

Global tissue and hygiene demand continues to increase due to population growth, urbanization, and rising per-capita usage in emerging markets. Consumers in Asia, Latin America, and parts of the Middle East are shifting toward premium and soft-grade tissue products, which rely heavily on bleached hardwood kraft pulp (BHKP) for softness, bulk, and absorbency.

BHKP holds a significant share of hardwood pulp consumption and remains the preferred fiber for modern tissue furnish optimization. Rapid capacity additions in developing regions and steady penetration in mature markets sustain incremental pulp absorption. Market implications point toward structurally rising demand for high-brightness hardwood grades and a stronger competitive position for producers with secure eucalyptus-based BEKP and BHKP platforms.

Packaging and specialty paper converters are increasingly shifting away from multi-material laminates and plastic-based structures toward recyclable, fiber-based alternatives. New grades of bleached hardwood pulp support high-brightness packaging, barrier-coated formats, and mono-material fiber solutions aligned with regulatory and brand sustainability commitments.

This substitution trend is reinforced by consumer preference for recyclable materials and by tightening environmental standards for plastics.

Hardwood pulp’s printability, uniformity, and brightness make it highly suitable for next-generation packaging papers, especially for foodservice and e-commerce applications. Market effects include steady volume expansion, improved grade premiums for well-specified hardwood pulp, and growing demand for mills that can deliver consistent performance for converters seeking reliable raw material quality.

Eucalyptus-based bleached eucalyptus kraft pulp (BEKP) has become a cornerstone of global hardwood pulp supply due to its high fiber yield, rapid growth cycles, and efficient bleaching characteristics. Large plantation-held producers, especially in Latin America, operate some of the lowest-cost pulp mills globally.

New investments, including greenfield mills, debottlenecking programs, and conversion projects, are expanding available BEKP capacity and strengthening the export position of plantation-based suppliers. This structural advantage supports consistent supply reliability and competitive delivered costs, especially to Asia and Europe.

Market implications include shifting pricing power toward integrated producers with plantation ownership, increased competition for mid-cost regional producers, and rising supply chain efficiency driven by modern large-scale operations.

Compliance with emerging environmental and traceability regulations introduces new structural costs for hardwood pulp producers and exporters. The EU Deforestation Regulation requires detailed origin verification for wood-derived products, elevating the administrative burden and creating trade frictions for suppliers lacking robust certification or digital traceability.

In North America, tightened effluent and PFAS-related discharge rules require technology upgrades and higher operating costs. These requirements can raise supply-chain expenses by mid-single-digit percentages and emphasize certified, traceable fiber. Suppliers with unclear sourcing documentation face higher risks of market exclusion or cost penalties.

Hardwood pulp production is sensitive to fluctuations in woodchip prices, energy costs, and freight rates. Weather disruptions, labor shortages, shipping delays, and energy market volatility can rapidly increase operating costs, especially for standalone producers without plantation integration.

Sustained increases of 10-15% in delivered chip costs can materially erode EBITDA margins for both integrated and merchant mills. Volatile freight markets also influence delivered pulp pricing and trade flows. Market implications include heightened emphasis on feedstock management, hedging strategies, and investments in energy-efficient mill designs.

Dissolving hardwood pulp is gaining traction as global textile chains diversify away from fossil-based fibers and seek sustainable alternatives such as viscose and lyocell. Hardwood-derived dissolving pulp offers high purity and reactivity necessary for these applications. Even modest penetration into the expanding textile fiber market represents a significant multi-hundred-million-dollar opportunity by the next decade.

Converting existing kraft pulp lines or building specialized dissolving pulp capacity allows producers to access premium price segments. Market implications include the chance for higher margins and long-term offtake arrangements with textile manufacturers aiming to diversify sourcing.

Growth in inkjet papers, barrier-coated substrates, filtration media, and technical papers creates opportunities for hardwood pulp suppliers to differentiate through quality, brightness control, and consistency. Specialty-grade development requires targeted investments in bleaching, refining, and fiber modification, enabling suppliers to secure long-term contracts with converters.

Demand for sustainable food packaging, premium printing, and functional papers is rising across Asia and Europe. The incremental addressable market for specialty hardwood pulp grades is expected to reach tens to hundreds of millions of dollars annually as high-performance substrates replace non-recyclable materials.

Bleached Hardwood Kraft Pulp (BHKP) remains the dominant product type, anticipated to represent approximately 50.6% of all hardwood pulp consumption. The segment’s leadership is due to its versatility across tissue, printing and writing, specialty papers, and an increasing number of fiber-based packaging formats. Its uniform fiber characteristics, brightness, and bulk performance make it a preferred choice for converters seeking high-consistency raw materials.

Producers with eucalyptus-based BEKP platforms command additional advantages due to the fiber’s high uniformity, high yield, and strong performance in both tissue and coated packaging grades. BHKP maintains a large share of global trade flows and is widely used in North America, Europe, and Asia for premium tissue and board applications.

Dissolving pulp is expanding faster than all other hardwood pulp types, supported by long-term shifts in the textile sector. Regenerated cellulose fibers such as viscose and lyocell are gaining acceptance as lower-impact alternatives to polyester and other synthetic fibers.

Producers investing in dissolving pulp technologies, such as enhanced purification, higher alpha-cellulose content, and ECF/TCF bleaching processes, are increasingly capturing demand from textile firms seeking traceable fiber inputs.

Growth rates for dissolving pulp exceed the standard kraft pulp market trajectory, and ongoing projects across Asia and Latin America point to continued investment. This segment will gain relevance as sustainability pressures intensify across global apparel value chains.

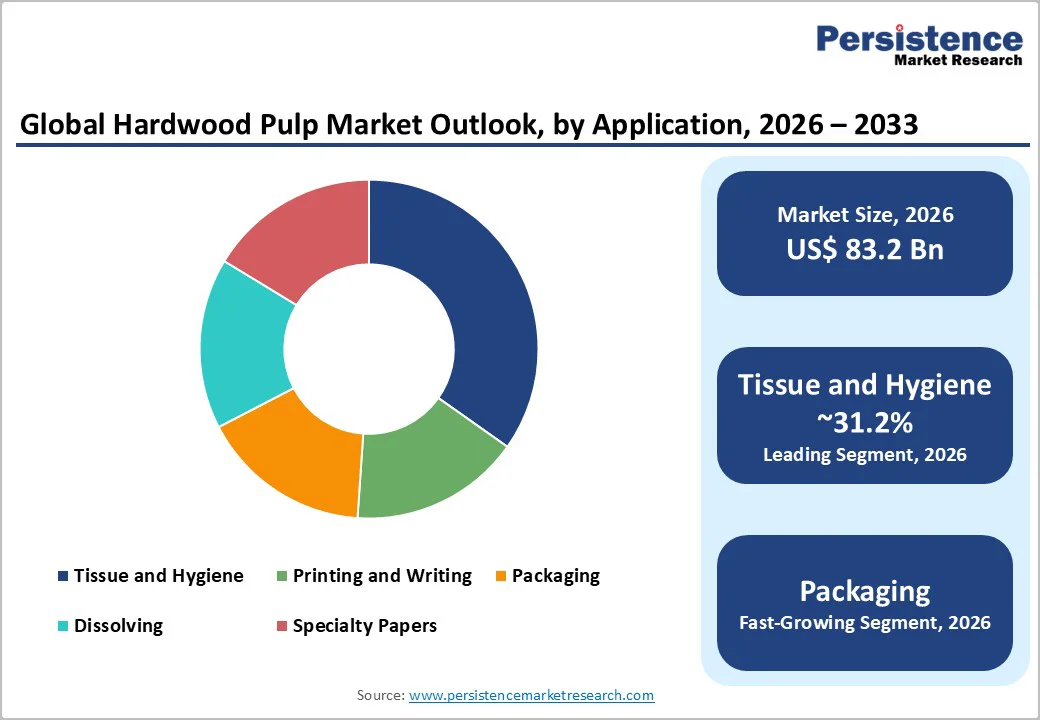

Tissue and hygiene applications represent the largest share of hardwood pulp usage, estimated to account for roughly 31.2% of the total demand. Hardwood fibers provide softness, absorbency, and formation benefits that are essential for consumer tissue products, including bath tissue, facial tissue, and paper towels.

Rising urbanization, higher per-capita usage in emerging markets, and steady preferences for premium softness in developed regions reinforce the dominance of this segment. Converters are also increasingly optimizing furnish compositions to leverage hardwood pulp’s uniformity and to meet product performance specifications.

As major producers expand tissue-machine capacity across Asia and Latin America, hardwood pulp demand for this segment remains structurally strong.

Packaging applications are expanding the fastest due to regulatory and consumer shifts toward recyclable fiber-based solutions. High-brightness hardwood pulp supports barrier-coated papers, folding boxboard, specialty flexible packaging, and mono-material solutions that replace plastic laminates. E-commerce growth, foodservice packaging needs, and corporate sustainability commitments accelerate the adoption of fiber-based materials.

Recent innovations in coating technologies, lightweighting, and print performance drive a strong preference toward hardwood fiber grades that balance brightness, bulk, and surface properties. As packaging converters accelerate transitions toward more recyclable materials, hardwood pulp’s role in packaging-grade furnish will continue strengthening throughout the forecast period.

North America remains a key market for pulp, paper, and fiber-based packaging, characterized by high consumption levels and technological sophistication.

While the region maintains extensive integrated pulp and paper assets, it continues to import select high-brightness hardwood grades used in tissue, specialty paper, and advanced packaging applications. The U.S. drives regional demand with strong per-capita tissue use and an expanding packaging sector increasingly incorporating fiber-based and sustainable materials.

Mills across the region benefit from advanced digitalization, automation, and energy-efficiency frameworks. However, regulatory pressures from the U.S. Environmental Protection Agency significantly shape investment priorities. Stricter rules on effluent discharge, air emissions, and PFAS management are prompting continuous process upgrades and modernization.

Compliance with the EPA’s Pulp and Paper Production MACT I & III, covering emissions from pulping vents, bleaching operations, and condensate streams, requires mills to deploy incineration, scrubbing, and treatment technologies to mitigate hazardous air pollutants.

Investment trends focus on recovery boiler modernization, digital process control, and adoption of advanced wastewater treatment systems to meet evolving environmental standards. As demand shifts toward packaging and specialty grades, North American producers continue portfolio realignment and plant upgrades.

Strategically, the region’s mills must balance regulatory compliance with cost control while leveraging strong converter networks and premium pulp production capabilities to serve sustainability-focused markets.

Europe is driven by demand in printing and writing papers, specialty applications, and fast-growing packaging segments. Consumption growth remains moderate, but buyers prioritize certified, sustainably sourced pulp, favoring producers with strong traceability and compliance systems.

Regulation is a defining market force. The EU Deforestation Regulation mandates strict documentation of origin for wood-based imports, reshaping procurement and raising barriers for uncertified suppliers.

Complementary initiatives under the EU Green Deal, such as the Circular Economy Action Plan (CEAP 2.0) and Fit for 55 target, intensify the focus on circularity, low-carbon production, and sustainable sourcing. The forthcoming Corporate Sustainability Due Diligence Directive (CSDDD) extends ESG requirements across supply chains, reinforcing strict certification and transparency expectations.

Germany, the U.K., France, and Spain act as key operational hubs. Germany and the U.K. specialize in high-value printing and specialty grades, while France and Spain lead in tissue and packaging. Converters across Europe emphasize fiber uniformity, brightness, and verified environmental credentials.

Recent developments center on EUDR compliance timelines, procurement realignment, and heightened due diligence systems. Overall, Europe remains a high-value market for certified suppliers of premium hardwood pulp, particularly in packaging and specialty papers where sustainable alternatives are limited.

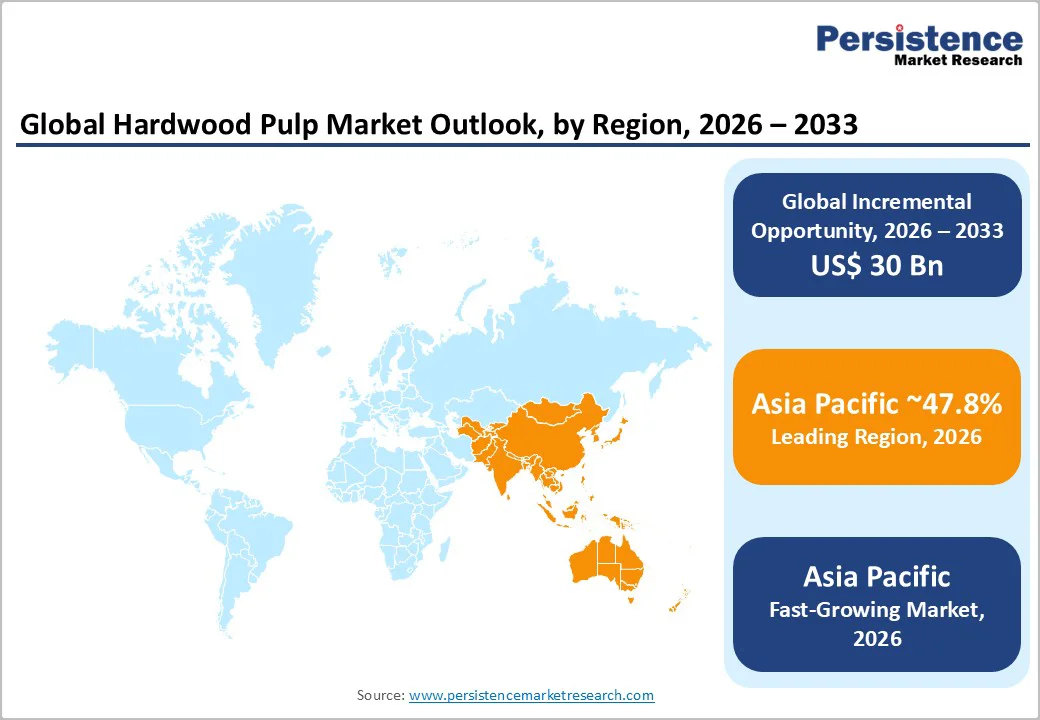

Asia Pacific is the largest and fastest-growing market for hardwood pulp, expected to account for about 47.8% of global demand. Growth stems from strong consumption in tissue, packaging, and printing applications, supported by rising incomes and expanding middle-class populations.

China dominates regional demand with its extensive converting base and reliance on imported hardwood pulp for tissue, coated paper, and specialty packaging. Japan sustains high-value demand through advanced printing and office paper markets, while India and ASEAN countries post rapid growth from lower starting levels.

Regulatory frameworks are strengthening across the region. China’s amended 2020 Forest Law and the China Forest Certification Scheme (aligned with PEFC) enhance traceability, while Japan’s Green Purchasing Law mandates sourcing from certified or verified fibers. Broader regional sustainability guidelines are emerging under international buyer influence.

E-commerce expansion, foodservice packaging growth, and the shift toward fiber-based formats reinforce demand fundamentals. Converters in China and Southeast Asia are investing in modern, high-capacity facilities that require high-quality hardwood pulp with consistent brightness and strength.

Exporters must meet global brand sustainability standards and compete through cost efficiency, supply reliability, and technical support. Long-term demand remains robust, driven by structural economic growth, rising consumption, and Asia Pacific’s transition toward sustainable, fiber-based materials.

The global hardwood pulp market is moderately concentrated, with a small number of large, plantation-integrated producers shaping global supply and price dynamics. These players dominate BEKP production and export volumes, particularly from Latin America.

Other regions contribute through specialized or regionally focused mills. Market characteristics display oligopolistic tendencies in traded pulp, while local markets retain diverse competitive conditions. Key producers include Suzano, UPM, Sappi, Stora Enso, International Paper (historic fibers footprint), Oji, APP, CMPC, and Klabin. Integration into plantations and large-scale production provides significant cost advantages and pricing stability.

Leading producers prioritize scale, plantation integration, traceability, product innovation, and regulatory compliance. They employ long-term supply agreements, invest in energy-efficient and low-impact technologies, and develop specialty and dissolving grades to differentiate. Business models increasingly emphasize sustainability, operational efficiency, and strategic partnerships with converters.

The hardwood pulp market size is estimated to reach US$83.2 billion in 2026.

By 2033, the hardwood pulp market value is projected to reach US$113.2 billion.

Key trends shaping the market include rising demand for eucalyptus-based BEKP, expansion of premium tissue and hygiene applications, increasing penetration of fiber-based packaging replacing plastics, and investments in high-yield, energy-efficient pulping technologies to reduce operating costs and emissions.

Bleached hardwood kraft pulp (BHKP) stands as the leading pulp type, accounting for around 50.6% of the total hardwood pulp consumption.

The hardwood pulp market is projected to grow at a CAGR of 4.5% from 2026 to 2033.

Major companies include Suzano S.A., International Paper, UPM-Kymmene Corporation, Mondi Group, and Asia Pulp & Paper (APP).

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Pulp Type

By Application

By Source

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author