ID: PMRREP35674| 199 Pages | 3 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

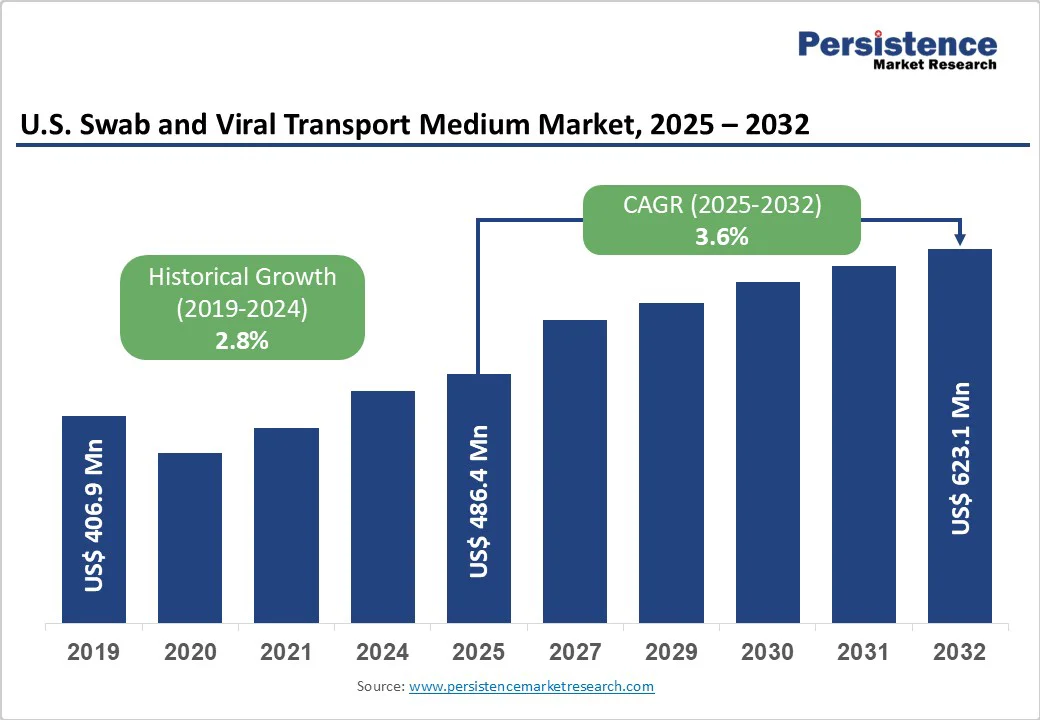

The U.S. swab and viral transport medium market size is likely to be valued at US$486.4 Mn in 2025 and is projected to reach US$623.1 Mn by 2032, growing at a CAGR of 3.6% during the forecast period from 2025 to 2032.

The U.S. swab and viral transport medium market is driven by the rising prevalence of respiratory infections, the expansion of molecular diagnostics, and stricter FDA quality regulations. Trends include the adoption of flocked nylon swabs, the growing demand for molecular transport media, domestic manufacturing expansion, and digital-enabled supply chain solutions ensuring reliable specimen handling and testing efficiency.

| Key Insights | Details |

|---|---|

| U.S. Swab and Viral Transport Medium Market Size (2025E) | US$486.4 Mn |

| Market Value Forecast (2032F) | US$623.1 Mn |

| Projected Growth (CAGR 2025 to 2032) | 3.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.8% |

Advances in molecular diagnostics, particularly multiplex PCR and syndromic panels, are increasingly critical in U.S. public health and clinical settings. For example, the Centers for Disease Control and Prevention’s (CDC) Community-Based Testing Sites conducted over 11.66 million SARS-CoV-2 tests between March 2020 and November 2021, reflecting both capacity expansion and high baseline demand for molecular testing. Companies are developing multiplex panels to detect several respiratory pathogens (SARS-CoV-2, influenza A/B, RSV, rhinovirus) from a single swab sample.

One such product, the BIOFIRE SPOTFIRE R Panel Mini, cleared in 2023, detects five common viruses in about 15 minutes, combining speed and breadth of detection. Also, the BD Respiratory Viral Panel for the BD MAX System was cleared (in 2023) to run SARS-CoV-2, flu, and RSV from a single swab specimen.

Such tests emphasize the importance of the swab (collection) and transport media (sample integrity), as one specimen must reliably preserve multiple pathogens to ensure accurate molecular amplification. These diagnostic innovations thus elevate demand for high-quality swabs and VTMs capable of maintaining nucleic acid stability, supporting the growth of multiplex testing.

Regulatory and quality compliance challenges have a significant impact. The U.S. Food and Drug Administration (FDA) mandates that all viral transport media undergo rigorous testing to ensure they maintain viral stability during transport. This includes demonstrating the medium's ability to preserve the integrity of viral RNA for accurate molecular diagnostics.

For instance, the FDA requires manufacturers to submit performance data supporting the stability and recovery of target viruses from the transport medium. This process involves extensive validation studies, which can be resource-intensive and time-consuming.

Additionally, the FDA's enforcement policies, such as the Enforcement Policy for Viral Transport Media During the COVID-19 Public Health Emergency, have undergone revisions, reflecting the evolving regulatory landscape and the need for manufacturers to stay abreast of policy changes. These regulatory complexities can delay product development and market entry, posing challenges for manufacturers in the competitive diagnostic market.

The integration of digital health platforms presents significant opportunities for the market. As telemedicine adoption continues to rise, the demand for reliable sample collection and transport solutions grows. In 2021, 37.0% of adults used telemedicine, with growing usage with age and education level.

This shift towards remote healthcare necessitates the development of VTMs that are compatible with at-home or point-of-care testing, ensuring sample integrity during transport. Moreover, the integration of VTMs with digital health platforms enables real-time monitoring and data collection, thereby enhancing patient care and expanding the reach of diagnostic services. The convergence of digital health technologies and diagnostic solutions offers a promising avenue for innovation and growth in the VTM market.

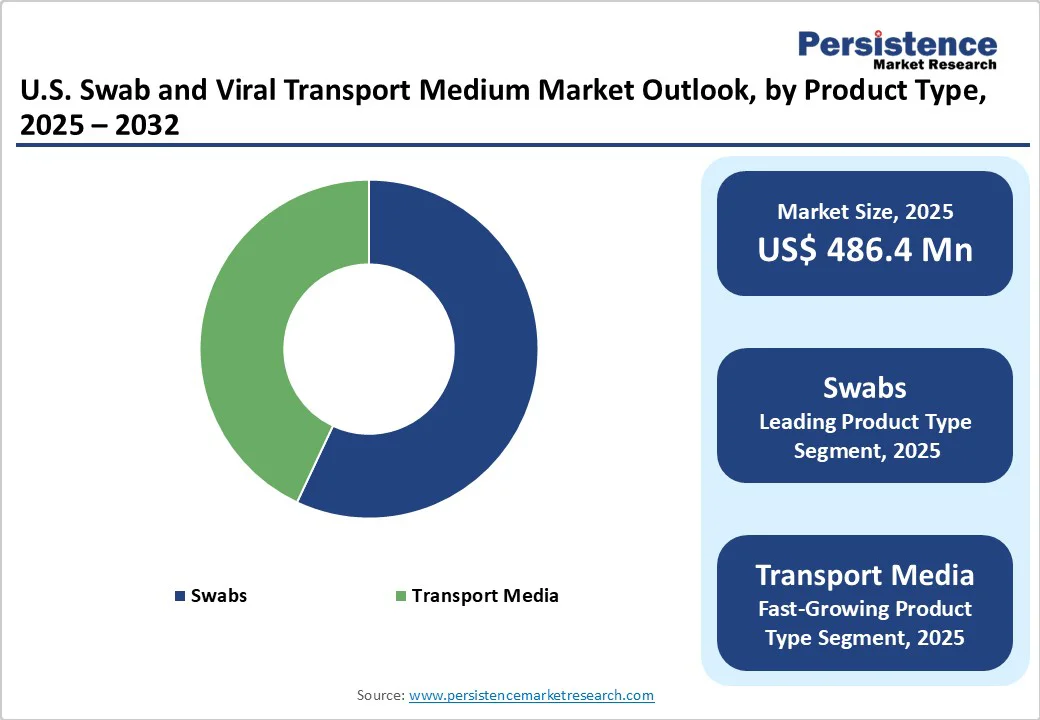

Swabs dominate the market, accounting for approximately 56.7% of the market share in 2025. This dominance is attributed to their essential role in collecting viral specimens for diagnostic testing, particularly for respiratory infections such as COVID-19, influenza, and respiratory syncytial virus (RSV).

The Centers for Disease Control and Prevention (CDC) recommends using synthetic fiber swabs with thin plastic or wire shafts for sampling the nasopharyngeal mucosa, as these are designed to preserve viral integrity and are compatible with molecular diagnostic tests.

The widespread adoption of molecular diagnostics, such as reverse transcription polymerase chain reaction (RT-PCR), further underscores the critical role of swabs in ensuring accurate and reliable test results. As diagnostic testing continues to evolve, the demand for high-quality swabs remains a cornerstone of effective viral surveillance and disease management.

Flocked nylon swabs are leading in performance and adoption, especially for molecular diagnostics. Their design, featuring perpendicular synthetic fibers, increases surface area, enhancing sample collection and release efficiency. Studies have shown that flocked nylon swabs can collect significantly more respiratory epithelial cells compared to traditional rayon swabs, leading to improved diagnostic sensitivity.

While polyester and rayon swabs are still used, particularly in DNA collection due to their minimal interference with sample integrity, they are less favored for viral diagnostics. For instance, the CDC recommends avoiding cotton-tipped or calcium alginate swabs for PCR assays, as residues from these swabs can inhibit amplification. Given the growing demand for accurate and rapid diagnostics, flocked nylon swabs are increasingly preferred, aligning with the market's shift towards advanced molecular testing.

The U.S. swab and viral transport medium market is highly competitive, led by prominent companies such as Copan Diagnostics, Puritan Medical Products, and Thermo Fisher Scientific, which focus on quality, regulatory compliance, and large-scale clinical supply. Emerging players offer affordable, user-friendly swabs and VTMs for home testing and point-of-care diagnostics, emphasizing innovation in materials, transport media, and compatibility with multiplex molecular testing.

The U.S. Market is projected to be valued at US$ 486.4 Mn in 2025.

Rising infectious disease prevalence, increased molecular testing, home diagnostics adoption, government surveillance programs, and robust U.S. healthcare infrastructure drive market growth.

The U.S. market is poised to witness a CAGR of 3.6% between 2025 and 2032.

Opportunities include multiplex diagnostics, digital health integration, eco-friendly VTMs, point-of-care testing expansion, and growing global health initiatives.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Swab Material

By End User

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author