ID: PMRREP34522| 220 Pages | 24 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

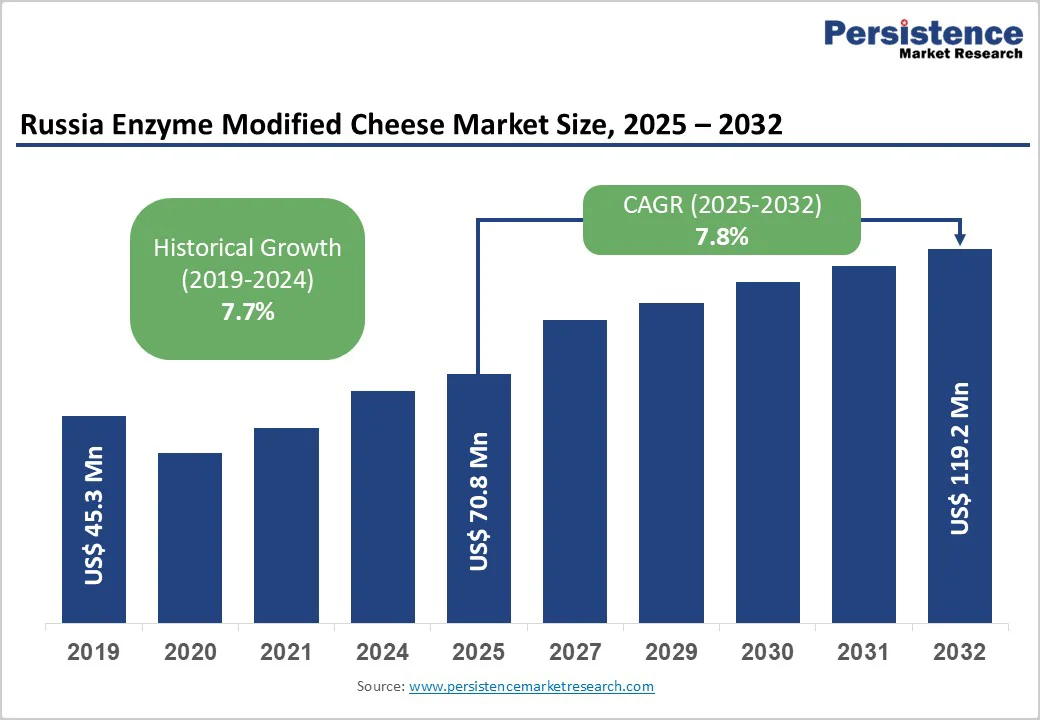

The Russia enzyme modified cheese market size is likely to be valued at US$70.8 Million in 2025, and is estimated to reach US$119.2 Million by 2032, growing at a CAGR of 7.8% during the forecast period 2025 - 2032, driven by accelerating urbanization, evolving consumer preferences toward convenience-oriented food solutions, and the modernization of the domestic processed food industry.

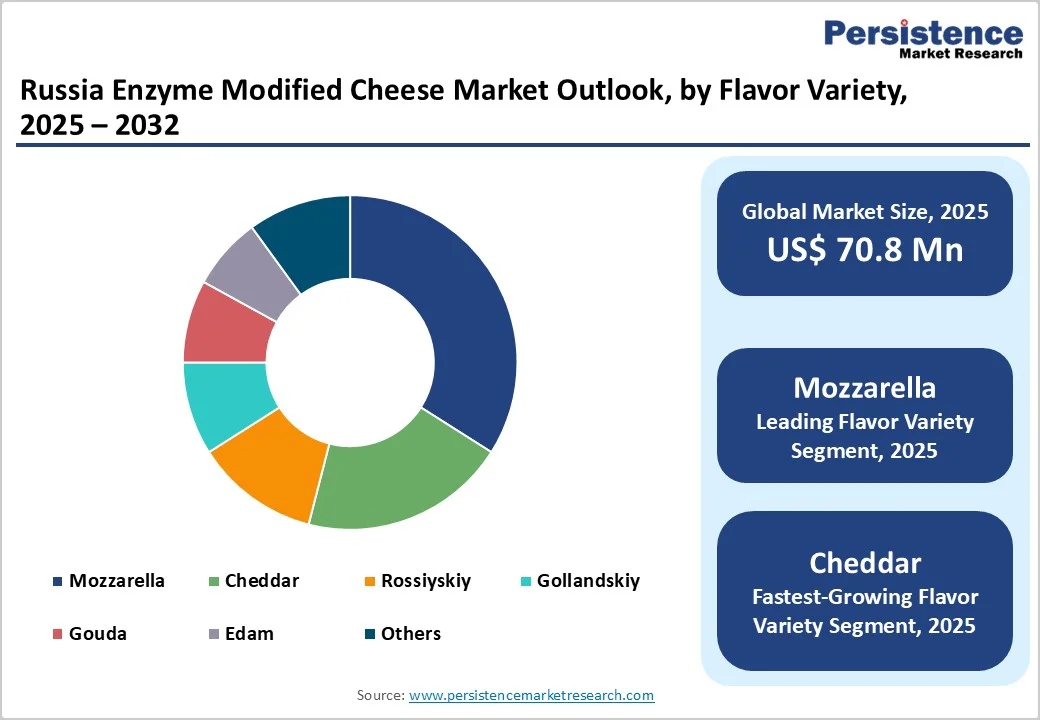

Rising ready-to-eat meal sales, a concentrated dairy sector dominated by large producers, and strong demand for Western-style cheese flavors, especially Mozzarella and Cheddar, are shaping Russia enzyme modified cheese market. These trends create attractive opportunities for suppliers while heightening competition within an increasingly consolidated dairy ingredients landscape.

| Key Insights | Details |

|---|---|

| Russia Enzyme Modified Cheese Market Size (2025E) | US$70.8 Mn |

| Market Value Forecast (2032F) | US$119.2 Mn |

| Projected Growth (CAGR 2025 to 2032) | 7.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.7% |

The Russia enzyme-modified cheese market growth is benefiting substantially from the federal government's comprehensive Food Security Doctrine, which subsidizes the dairy sector and provides extensive financial support.

This strategic policy framework, implemented under the Ministry of Agriculture's domestic production enhancement mandate following import substitution priorities, is directly catalyzing investments in specialized dairy processing infrastructure while incentivizing technological upgrading across Russia's cheese manufacturing base.

The subsidy architecture specifically targets production capacity expansion, quality enhancement protocols, and technological modernization of existing facilities, creating favorable conditions for enzyme-modified cheese adoption as domestic manufacturers seek cost-effective pathways to replicate premium Western-style cheese flavor profiles previously dominated by imported products.

The Russia enzyme-modified cheese market expansion is confronting significant supply-side constraints stemming from the strategic withdrawal of Chr. Hansen from Russian operations following shareholder decisions finalized in May 2024.

Chr. Hansen historically commanded approximately 45% market share in Russia's dairy culture and enzyme ingredients sector, establishing the company as the dominant supplier of specialized proteolytic and lipolytic enzyme systems essential for enzyme-modified cheese production.

The company's exit has created immediate supply chain disruptions affecting the ability of Russian food manufacturers to source consistent-quality enzyme preparations, particularly those proprietary enzyme blends optimized for specific cheese flavor profile development that domestic suppliers have limited capability to replicate with equivalent functional performance characteristics.

This supply chain fragmentation is exacerbated by the broader geopolitical context affecting biotechnology ingredient imports into Russia, where Western enzyme manufacturers face logistical complexities, payment mechanism constraints, and regulatory compliance uncertainties that collectively elevate procurement costs and extend lead times.

Russian dairy processors historically relied on imported enzyme systems from European suppliers for their superior consistency, standardized specifications, and technical support resources. The withdrawal of these established suppliers has forced domestic manufacturers to either develop in-house enzyme production capabilities or source alternatives from geographically dispersed suppliers, including Turkish, Chinese, and Indian enzyme manufacturers.

Substantial growth opportunities are emerging in Russia from the explosive expansion of convenience store prepared food segments. This segment evolution represents a fundamental transformation in Russian food retail dynamics, as convenience-focused formats, historically underdeveloped compared to Western European markets, are rapidly adopting fresh prepared food offerings including packaged salads, hot dishes, sandwiches, and frozen meal solutions.

This structural shift is being driven primarily by urban consumers in Moscow, St. Petersburg, and regional metropolitan centers who are increasingly prioritizing time-saving meal solutions compatible with fast-paced professional lifestyles, generating unprecedented demand for cheese-enhanced ready-to-eat products that leverage enzyme-modified cheese as a cost-effective flavor intensifier.

Major Russian retail chains, including Pyaterochka (X5 Retail Group), VkusVill, and Lenta, have expanded their prepared food assortments considerably, dedicating increased shelf space and refrigerated storage capacity to fresh prepared items, creating direct procurement demand for ingredient suppliers capable of providing cost-effective, stable cheese flavor systems.

Enzyme-modified cheese offers distinct competitive advantages for prepared food manufacturers serving this expanding market segment. The ingredient's concentrated flavor profile enables manufacturers to achieve robust cheese taste characteristics at substantially lower dosage rates compared to natural cheese inclusion.

For high-volume prepared food applications, including pasta dishes, pizza products, and cheese-enhanced sauces, the cost differential between enzyme-modified cheese and natural cheese can represent a significant ingredient cost reduction while maintaining consumer-acceptable flavor profiles, creating compelling economic incentives for food manufacturers to incorporate EMC in formulation optimization efforts.

Mozzarella is commanding market leadership, capturing an estimated 34% of the Russia enzyme modified cheese market revenue share in 2025. This dominance is fundamentally driven by Mozzarella's position as Russia's leading cheese variety in the broader cheese market, propelled by the explosive growth of pizza consumption and Italian-cuisine-inspired prepared foods across urban markets.

The rapid expansion of both domestic and international pizza chains operating in Russia, including Domino's Pizza, Dodo Pizza, and Papa John's local franchises, has created sustained industrial demand for cost-effective Mozzarella flavor solutions, positioning enzyme-modified cheese as an economically advantageous alternative to expensive fresh or processed Mozzarella in high-volume pizza production applications.

The technical characteristics of Mozzarella-style EMC also align exceptionally well with Russian food manufacturers' operational requirements.

Cheddar-style enzyme modified cheese represents the fastest-expanding flavor variety segment throughout the 2025 - 2032 forecast period. This strong growth momentum is driven by evolving Russian consumer preferences toward sharper, more pronounced cheese flavor profiles characteristic of Western-style snack foods, particularly cheese-flavored potato chips, crackers, and extruded snack products, where Cheddar represents the archetypal flavor benchmark.

The expansion of the snacks market in Russia is producing incremental demand for Cheddar-style EMC as flavor coating applications and seasoning blend formulations, where the ingredient's intense flavor delivery at low dosage rates provides significant cost advantages compared to natural aged Cheddar cheese powder alternatives.

The exceptional growth of the segment is further amplified by the versatility of Cheddar across diverse food processing applications beyond traditional snack categories.

B2B commercial food manufacturers constitute the dominant end-users, commanding an estimated 68% of the Russia enzyme modified cheese market in 2025. This overwhelming dominance reflects the fundamental nature of enzyme-modified cheese as an industrial ingredient rather than a consumer-facing product, with procurement concentrated among large-scale food processors operating in prepared meals manufacturing, snack food production, processed cheese manufacturing, and bakery product categories.

Russia's highly consolidated dairy processing sector creates concentrated purchasing power among major industrial accounts. The B2B segment's market leadership is reinforced by the production economics of enzyme-modified cheese applications, where industrial-scale food manufacturers achieve optimal cost efficiency through bulk procurement contracts, standardized formulation protocols, and integrated supply chain relationships with ingredient suppliers.

Foodservice operators represent the fastest-expanding end-users through 2032, aided by the robust expansion of Russia's foodservice sector, with quick-service restaurants (QSRs) and casual dining establishments leading the expansion trajectory.

Pizza chains represent particularly high-value customers for enzyme-modified cheese suppliers, as these operators require standardized, cost-effective Mozzarella and Mozzarella-Cheddar blend flavor solutions that deliver consistent taste profiles across multiple outlet locations while maintaining acceptable food cost percentages in competitive pricing environments.

The growth momentum of the Russia foodservice industry also reflects several structural market dynamics favoring increased enzyme-modified cheese adoption, such as the proliferation of pizza restaurants in the country.

Ready-to-eat and prepared meals constitute the largest application segment, capturing an estimated 42% of the Russia enzyme modified cheese market share in 2025. This leadership position is bolstered by the explosive growth trajectory of Russia's convenience food sector, where ready-to-eat meals have already generated billions in revenue.

As a result, there is now a sustained demand for cost-effective cheese flavor solutions that enable manufacturers to deliver consumer-acceptable taste profiles at competitive production costs.

Frozen pizzas represent the single largest sub-application within this segment, leveraging enzyme-modified cheese in sauce formulations, cheese topping blends, and stuffed crust applications, where the ingredient's thermal stability during baking processes and authentic Mozzarella flavor replication capabilities provide distinct technical advantages over alternative flavoring systems.

Snacks and convenience foods applications represent the fastest-expanding segment within the Russia enzyme modified cheese market from 2025 to 2032. This exceptional growth trajectory is being driven by Russia's thriving snack food sector, with cheese-flavored variants representing one of the fastest-growing taste profiles within the category.

Domestic snack manufacturers have aggressively expanded production capacity following reduced availability of international brands, with companies including Chernogolovka (Chels brand), Russkaya Kartoshka, and other regional producers investing in modern processing facilities and flavor innovation capabilities that position them to capitalize on growing consumer demand for diverse, premium snack offerings.

The Russia enzyme-modified cheese market landscape exhibits a moderately consolidated competitive structure characterized by the presence of both international ingredient suppliers maintaining limited operations and an emerging base of domestic and regional players positioned to capitalize on supply chain disruptions affecting Western multinationals.

Market concentration analysis indicates that the top five suppliers collectively command approximately 55-60% market revenue share, with the remaining distributed among smaller regional distributors, specialty ingredient suppliers, and direct importers serving niche customer segments.

This concentration level is indicative of the technical expertise, regulatory compliance capabilities, and established customer relationships required to successfully compete in the enzyme-modified cheese ingredients space.

The Russia enzyme modified cheese market is projected to reach US$70.8 Million in 2025.

Accelerating urbanization, evolving consumer preferences toward convenience-oriented food solutions, and the modernization of the domestic processed food industry are driving the Russia enzyme modified cheese (EMC) market.

The Russia enzyme modified cheese market is poised to witness a CAGR of 7.8% from 2025 to 2032.

Sales surge of ready-to-eat meals, concentrated market structure dominated by large-scale dairy producers, and the strategic prioritization of Western-style cheese flavor profiles, particularly Mozzarella and Cheddar, are key market opportunities.

Kerry Group plc, Aromsa A.Ş., Jeneil Biotech, and Maysa Gıda are some of the key players in the Russia enzyme modified cheese market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Flavor Variety

By End-User

By Application

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author