ID: PMRREP35615| 189 Pages | 15 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

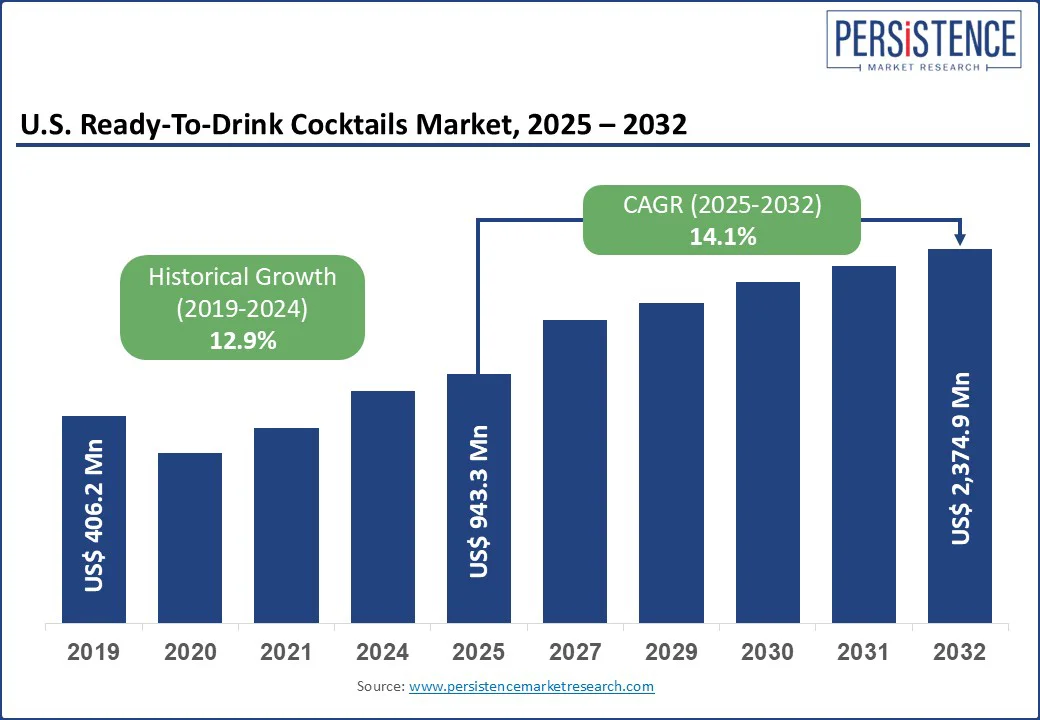

The U.S. ready-to-drink cocktails market size is likely to be valued at US$ 943.3 Mn in 2025 and is expected to reach US$ 2,374.9 Mn by 2032 growing at a CAGR of 14.1% during the forecast period from 2025 to 2032.

Key Industry Highlights

| U.S. Ready-To-Drink Cocktails Market Attribute | Key Insights |

|---|---|

| U.S. Ready-To-Drink Cocktails Market Size (2025E) | US$ 943.3 Mn |

| Market Value Forecast (2032F) | US$ 2,374.9 Mn |

| Projected Growth (CAGR 2025 to 2032) | 14.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 12.9% |

The U.S. ready-to-drink (RTD) cocktails market is witnessing robust growth, driven by rising consumer demand for convenient, premium-quality alcoholic beverages. Shifts in lifestyle, preference for low-alcohol content, and the popularity of flavored, spirit-based cocktails are fueling adoption.

Convenience and on-the-go consumption is a major growth driver for the market. Gallup’s 2025 survey shows that only 54% of U.S. adults report drinking alcohol, the lowest level in nearly 90 years, highlighting a decline in overall alcohol consumption. Despite this, RTDs are gaining popularity because they offer a controlled, easy-to-consume alternative that fits modern lifestyles.

Young adults aged 18-34 are at the forefront of this trend, with just 50% reporting alcohol consumption, lower than older age groups, yet showing a preference for convenient, portable options. At the same time, the proportion of adults who view moderate drinking as potentially harmful has risen, reflecting growing health consciousness.

RTD cocktails cater directly to these preferences: they are single-serve, require no preparation, and are packaged for mobility. Consumers can easily grab them from convenience stores, liquor outlets, or order online, making RTDs an ideal solution for safe, moderate, and on-the-move drinking experiences.

Regulatory restrictions on alcohol sales significantly constrain the growth of the market. Alcohol distribution in the U.S. is highly fragmented, with rules varying by state and local jurisdictions. For example, in Pennsylvania, only certain retail licensees are allowed to sell spirits-based RTDs in specific alcohol ranges and container sizes, limiting product availability to selected stores. In South Carolina, RTDs with alcohol content above certain thresholds must be sold exclusively in licensed liquor stores or establishments.

Additionally, federal requirements mandate that all alcoholic beverages obtain label approval before marketing. These state-specific and federal regulations create a complex compliance landscape, increasing costs for producers, limiting market access, and slowing product rollout.

As a result, companies seeking to expand RTD cocktails nationwide face challenges in navigating varying rules, ensuring compliance, and reaching consumers across different regions. Regulatory hurdles remain a key restraint despite strong consumer demand and the growing popularity of convenient, ready-to-drink beverages.

Premiumization and craft-style innovation offer a strong growth opportunity for the market. Consumers are increasingly seeking high-quality, artisanal beverages with unique flavors, natural ingredients, and authentic taste experiences. The rise of craft cocktail culture in the U.S. has fueled interest in products that replicate bar-quality drinks at home, particularly among Millennials and Gen Z. Spirit-based RTDs, such as vodka, gin, and tequila cocktails, are benefiting from this trend, as consumers are willing to pay a premium for superior ingredients and innovative flavor profiles.

Additionally, the U.S. alcohol industry reports that sales of higher-ABV and craft spirits grew in recent times, reflecting a willingness to spend on premium options. Distillers and RTD brands are leveraging this by introducing limited-edition flavors, small-batch production, and natural ingredients, creating differentiation in a crowded market. This premiumization strategy helps attract discerning consumers and encourages repeat purchases, strengthening brand loyalty.

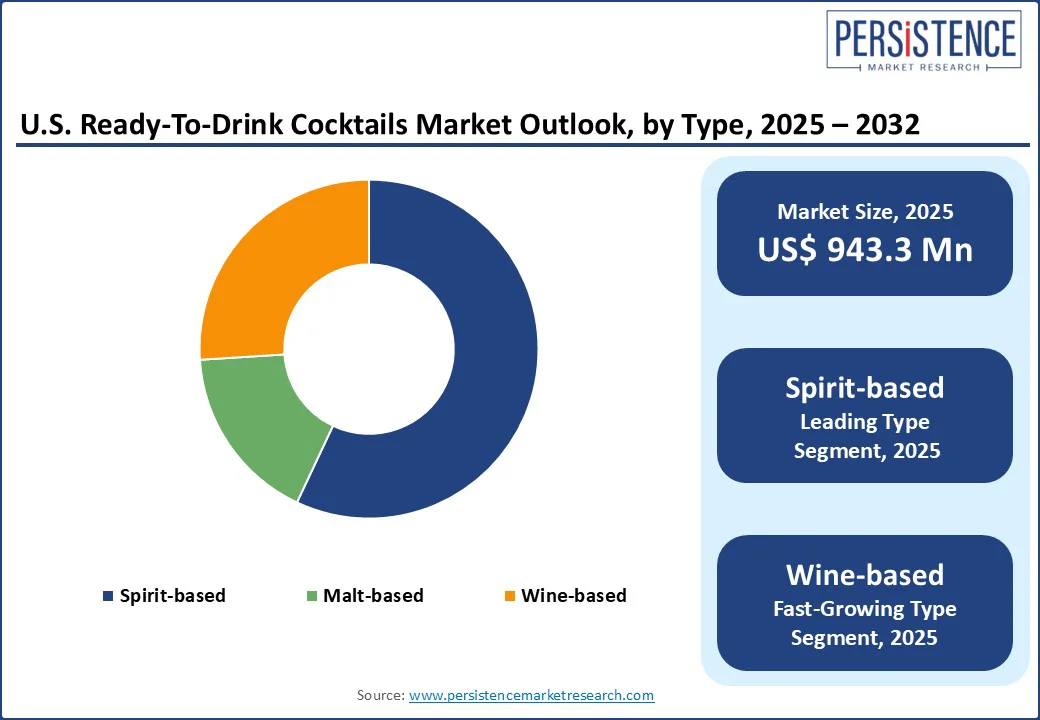

Spirit-based RTD cocktails are leading the U.S. market with 56.8% share in 2025 because they deliver a more authentic cocktail experience compared to malt- or wine-based alternatives. Consumers recognize vodka, tequila, rum, and whiskey as classic bases for popular mixed drinks, making spirit-based RTDs feel closer to traditional bar offerings.

This authenticity resonates strongly with younger drinkers, particularly Millennials and Gen Z, who seek both convenience and premium taste in a ready-made format. The ability to replicate familiar cocktails such as margaritas, mojitos, or vodka sodas in a portable and consistent way has given spirit-based RTDs a clear edge. Their positioning as a high-quality option that combines taste, branding, and convenience makes them the preferred category in the U.S. RTD cocktail market.

Cans packaging is leading the market with 77.6% share in 2025, because it combines portability, durability, and convenience qualities that align perfectly with modern consumer lifestyles. Unlike glass bottles or cartons, cans are lightweight, unbreakable, and easy to transport, making them ideal for outdoor activities, travel, and on-the-go consumption.

They also chill quickly and are more sustainable, as aluminum is widely recyclable and has a strong recovery rate in the U.S. For producers, cans offer flexibility in portion sizing and branding, allowing eye-catching designs that appeal to younger demographics. This combination of practicality, eco-friendliness, and consumer preference for grab-and-go formats has made cans the dominant packaging choice in the market.

The U.S. RTD cocktails sector is fast-growing and fiercely competitive, featuring both legacy global beverage companies and dynamic craft players. Prominent spirits conglomerates Diageo, Bacardi, Pernod Ricard, Brown-Forman, Anheuser-Busch InBev, and Suntory are increasingly leveraging their brand strength to launch RTD offerings. They often introduce premium innovations such as gluten-free options or eco-conscious packaging to appeal to health-conscious and sustainability-minded consumers.

The U.S. Ready-To-Drink Cocktails Market is projected to be valued at US$ 943.3 Mn in 2025.

Convenience, premium flavors, health trends, on-the-go lifestyles, and growing e-commerce drive the U.S. RTD market.

The U.S. market is poised to witness a CAGR of 14.1% between 2025 and 2032.

Premiumization, craft-style innovation, low-alcohol options, sustainable packaging, and regional or seasonal flavor expansions offer opportunities.

Major players in the U.S. are Ranch Rider Spirits Co., House of Delola, LLC, Diageo plc, Brown-Forman, Bacardi Limited, Pernod Ricard and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Type

By Packaging

By Distribution Channel

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author