ID: PMRREP35446| 145 Pages | 20 Jun 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

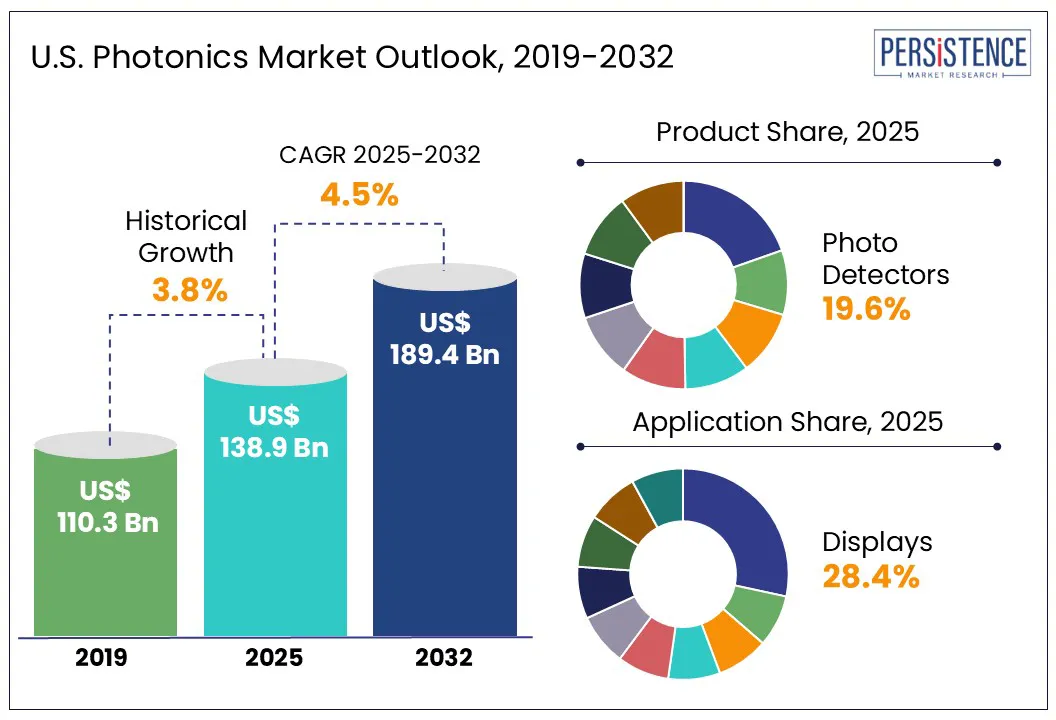

The U.S. photonics market size is predicted to reach US$ 189.4 Bn in 2032 from US$ 138.9 Bn in 2025. It will likely witness a CAGR of around 4.5% in the forecast period between 2025 and 2032.

Photonics has rapidly become one of the most strategically significant technology sectors in the U.S. In recent years, the country has witnessed a surge of investment and innovation in this field, pushed by rising demand for fast internet, secure communications, biomedical breakthroughs, and national defense modernization. Federal initiatives, including CHIPS and Science Act, have begun funneling billions into domestic photonics IC infrastructure. Leading players such as Rockley Photonics and Intel are pushing boundaries in silicon integration and on-chip light transmission.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. Photonics Market Size (2025E) |

US$ 138.9 Bn |

|

Market Value Forecast (2032F) |

US$ 189.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.8% |

The boom of consumer electronics is propelling the U.S. photonics market growth by bolstering innovations in optical sensing, high-speed data transmission, and display technologies. One of the most impactful trends is the integration of LiDAR and 3D sensing modules in smartphones, tablets, and wearables. For example, Apple's adoption of LiDAR in its iPhone Pro and iPad Pro models since 2020 has catalyzed a wave of photonics research and development across the U.S. Apple sourced components from U.S.-based companies, including Lumentum, which reported double-digit growth in 3D sensing revenue backed by demand from consumer tech giants.

High-speed data transmission within and between consumer devices is another significant area of photonics growth. With the shift toward 8K streaming, cloud gaming, and AI-enhanced mobile apps, devices require quick interconnects and low latency. A few companies are hence developing optical I/O solutions to replace conventional copper interconnects in edge devices and gaming consoles. In 2024, for instance, Ayar Labs secured additional contracts to deliver chip-to-chip optical communication solutions for consumer-grade AI processors, targeting brands focused on gaming laptops and smart home hubs.

Integration challenges and material limitations are emerging as key bottlenecks in scaling photonics sensors and detectors across computing and telecommunications industries. A significant issue is the complexity of co-packaging photonic and electronic components on a single chip. While companies are developing optical I/O systems, widespread adoption is hindered by the difficulty of integrating photonic components with CMOS processes used in conventional chip fabrication.

Material limitations also present significant barriers. Silicon, while foundational to the semiconductor industry, has inherent limitations in light generation due to its indirect bandgap. Hence, several photonic devices rely on materials such as lithium niobate or gallium arsenide. These materials are not natively compatible with silicon and often require costly and delicate bonding or hybrid integration techniques.

The surge in space exploration activities in the U.S. is creating exponential demand for photonics technologies, reveals Persistence Market Research. It is particularly evident in the areas of high-speed communication, remote sensing, and in-orbit processing. One of the most transformative shifts has been the move from conventional radio-frequency systems to laser-based communication. For example, NASA's Psyche mission successfully demonstrated Deep Space Optical Communications (DSOC). It transmitted ultra-high-definition video across a distance of 140 Mn miles at speeds reaching 267 Mbps.

NASA’s Laser Communications Relay Demonstration (LCRD) and the TeraByte InfraRed Delivery (TBIRD) system have further achieved in-orbit communication speeds up to 200 Gbps by using energy-efficient and compact photonics payloads. These capabilities are important for missions involving Earth observation, the Moon, and Mars, where rapid and secure data transfer is essential. Photonics are also being deployed onboard spacecraft for innovative data processing and control. Adaptive optics and fast-steering mirrors are now allowing spacecraft to maintain stable, narrow laser beams across millions of kilometers.

Based on product, the market is divided into waveguides, optical modulators, optical interconnectors, LED, WDM filters, photo detectors, lasers, and amplifiers. Out of these, photo detectors are expected to hold nearly 19.6% of the U.S. photonics market share in 2025 with their important role in applications, including quantum information science, optical communication, automotive safety systems, and biomedical diagnostics. Their ability to convert light into electrical signals with high precision and speed makes them ideal for novel optical networks. Their integration into LiDAR systems, which are significant for autonomous vehicles and industrial automation, is also predicted to drive demand.

Amplifiers, on the other hand, are poised to witness steady growth through 2032 due to their key role in extending the capacity and reach of fiber-optic communication systems. The boom of internet traffic propelled by 5G, AI workloads, and data center interconnects has raised the demand for high-performance optical amplifiers. These are also enabling long-haul and submarine cable networks, where signal loss over hundreds or thousands of kilometers necessitates the use of low-noise amplification.

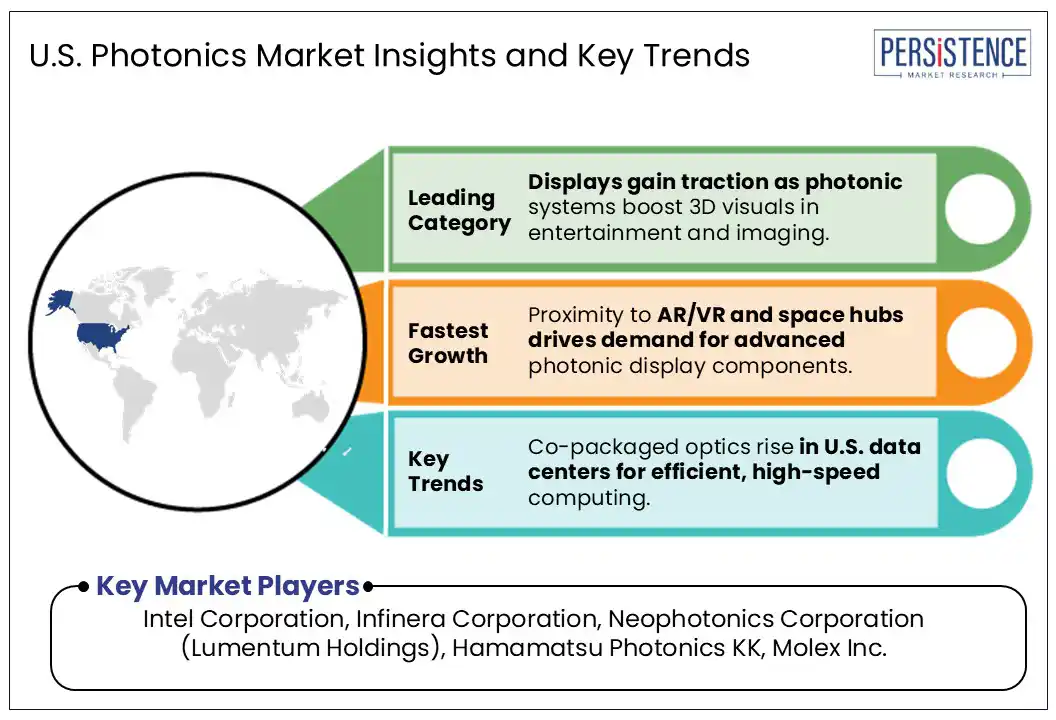

In terms of application, the market is segregated into displays, information, photovoltaics, measure and machine vision, medical technology, production technology, lighting, communication, defense and security, and optical component. Among these, displays are projected to account for approximately 28.4% of share in 2025 due to their key role in high-growth consumer electronics, augmented and virtual reality (AR/VR), and defense visualization systems. The shift toward microLED and OLED displays, which rely heavily on novel photonic fabrication techniques, is also considered a significant driver.

Medical technology has become a key application area for photonics due to its integral role in bolstering innovation in diagnostic imaging, minimally invasive surgeries, and real-time biosensing. One of the most impactful use cases is in Optical Coherence Tomography (OCT). Companies, including Optovue and Carl Zeiss, are developing OCT systems that leverage broadband light sources and photo detectors to generate high-resolution cross-sectional images of tissue. Photonics is also foundational in minimally invasive and robotic-assisted surgeries.

In the West, California is serving as the main hub of innovation due to its concentration of tech giants, elite research universities, and government-backed research initiatives. Silicon Valley-based companies are heavily investing in silicon photonics to support the rising demand for AI and high-performance computing infrastructure. Such innovations are enabled by ongoing developments in integrated photonic circuits emerging from the region’s strong semiconductor-photonics ecosystem.

Southern California, specifically San Diego and Los Angeles, is a hub for defense and aerospace photonics. Key players such as Raytheon and Northrop Grumman are leveraging photonics for directed energy weapons and satellite-based optical communication. Of late, the U.S. Space Force contracted multiple California-based companies to deliver free-space optical communication payloads for next-gen satellites. The presence of institutions, including UC Santa Barbara and Caltech, also reinforces the innovation pipeline, mainly in quantum photonics.

Southeast U.S. is gaining strategic importance, primarily in defense, manufacturing, and medical applications. Florida stands out as a key contributor, not just because of its aerospace legacy but also due to the significant role of Orlando in fostering optics and photonics innovation. The area is anchored by the University of Central Florida’s College of Optics and Photonics (CREOL), which has become a national center for photonics research and talent development. In the recent past, CREOL collaborated with L3Harris Technologies and Lockheed Martin to develop high-power laser systems for missile defense and counter-drone applications.

Georgia and North Carolina are emerging as competitive markets through their focus on reflective photoelectric sensor development and telecom infrastructure. Georgia Tech is spearheading research in integrated photonic sensors for industrial monitoring and biomedical diagnostics. It has attracted federal funding under the National Science Foundation’s (NSF) Engineering Research Centers program. North Carolina’s Research Triangle region is also contributing to the photonics supply chain through various companies producing high-performance gallium nitride and silicon carbide.

The Midwest is becoming a significant contributor to the national photonics ecosystem, mainly through its manufacturing strength, university-led research, and investments in quantum photonics. Illinois, Ohio, and Michigan are leading the way, with a focus on industrial and automotive photonics applications. The University of Illinois Urbana-Champaign, through its Holonyak Micro and Nanotechnology Lab, for example, has become a central hub for research on photonic integrated circuits and quantum light sources.

Ohio’s photonics space is strongly tied to defense and aerospace, especially around the Dayton region, home to Wright-Patterson Air Force Base and the Air Force Research Laboratory (AFRL). AFRL has ongoing collaborations with Midwest manufacturers to develop optical sensing and imaging technologies for UAVs and hypersonic vehicles. Michigan, on the other hand, is investing in LIDAR, infrared sensing, and 3D imaging systems for autonomous vehicles.

The U.S. photonics market houses several multinational companies and highly specialized domestic firms with distinct clusters forming around Silicon Valley, Rochester, and Boston. These hubs foster collaboration between academia, start-ups, and established corporations, enabling a pipeline of innovation in optical components and integrated photonics. Key players are actively investing in silicon photonics to support high-speed data transmission in data centers and AI workloads. Defense-focused firms continue to accelerate photonic sensing and imaging systems.

The U.S. photonics market is projected to reach US$ 138.9 Bn in 2025.

Rising adoption of LiDAR in autonomous vehicles and ongoing expansion of telemedicine are the key market drivers.

The market is poised to witness a CAGR of 4.5% from 2025 to 2032.

Quantum communication initiatives and automotive HUDs using holographic photonics are the key market opportunities.

Intel Corporation, Infinera Corporation, and Neophotonics Corporation (Lumentum Holdings) are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Application

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author