ID: PMRREP33134| 150 Pages | 18 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

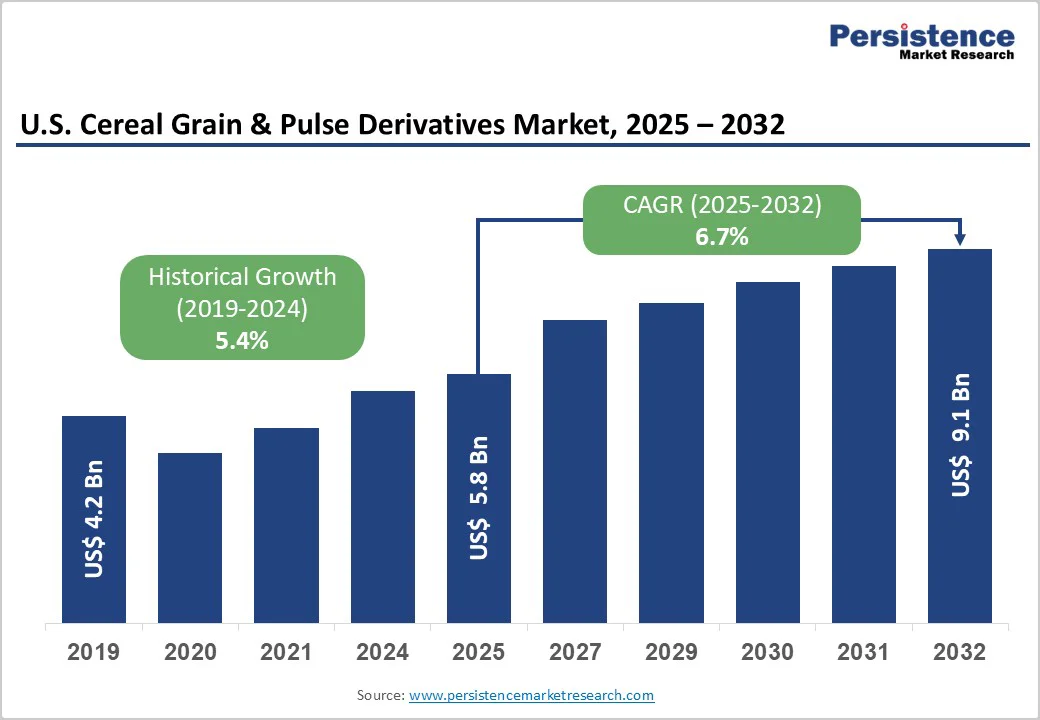

The U.S. cereal grain & pulse derivatives market size is likely to value at US$ 5.8 billion in 2025 and is projected to reach US$ 9.1 billion at a CAGR of 6.7% during the forecast period from 2025 to 2032.

The U.S. cereal grain & pulse derivatives market is experiencing robust growth, driven by rising consumer demand for plant-based proteins, gluten-free alternatives, and ancient grain products that offer superior nutritional profiles. Increasing health consciousness among American consumers, coupled with growing awareness of sustainable food sources, is accelerating adoption across food manufacturing, foodservice, and retail sectors.

| Key Insights | Details |

|---|---|

|

Cereal Grain & Pulse Derivatives Market Size (2025E) |

US$ 5.8 Bn |

|

Market Value Forecast (2032F) |

US$ 9.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.4% |

The U.S. cereal grain and pulse derivatives market is witnessing robust growth, primarily driven by the surging demand for gluten-free, nutritious, and sustainable food alternatives. Consumers are becoming increasingly aware of the negative health effects associated with gluten consumption, such as intestinal damage, indigestion, and chronic diarrhea. This shift has encouraged a widespread transition toward gluten-free products, leading to higher adoption of flours derived from sorghum, buckwheat, peas, and chickpeas. These alternatives not only cater to gluten-intolerant individuals but also appeal to the growing base of health-conscious consumers seeking functional and easily digestible ingredients.

Additionally, there is a notable increase in consumer inclination toward nutritional and environmentally sustainable food products. Cereal grains and pulses are recognized for their health benefits, including reducing the risks of diabetes, obesity, and cardiovascular diseases, while offering an eco-friendly alternative to animal-based ingredients. Moreover, the resurgence of “ancient grains” such as quinoa, millet, and amaranth is fueling innovation in product formulations. Their unmodified nature, distinct flavor, and superior nutrient composition have made them increasingly popular among modern consumers. Food manufacturers are leveraging this trend by launching diverse product lines highlighting ancient grains, which not only enhance nutritional value but also appeal to consumers seeking authenticity and wholesome eating experiences, collectively propelling the market forward.

One of the major challenges for the cereal grain & pulse derivatives market is the price instability of grains due to several factors such as seasonal & climatic variations, and the negative impact of uneven cultivation and harvesting practices on crops. Reduction in rainfall or uneven rainfall patterns also has an adverse effect on the yield of crops, which leads to high fluctuation in the prices of crops/grains. There have been pricing variations in chemicals & fertilizers, and energy, which have led to a variation in the final prices of grains & pulses.

The availability of low-priced gluten-free alternatives to cereal grains may restrict market growth to some extent. Corn is one of the staple crops in the U.S. and holds a significant share in the overall flour market. Corn is largely produced in the U.S. and is also a major export commodity. Corn is usually priced lower than other cereal grains and pulses. Lower price range and easy availability make it attractive for several processed food product manufacturers. However, increasing awareness of the benefits of food products from cereal grains and pulses is outpacing the demand for corn and its derivatives.

The rapidly expanding meat analogue segment presents exceptional growth opportunities for cereal grain & pulse derivative suppliers to develop innovative protein solutions. The U.S. plant-based meat market is experiencing dynamic evolution, with manufacturers seeking improved texture, taste, and nutritional profiles that more closely mimic conventional meat products. AGT Food and Ingredients, operating flagship pulse ingredient facilities in Minot, North Dakota, produces texturized pulse proteins and specialized blends combining cereal grains and pulses to achieve complete protein profiles with optimal amino acid composition. Research demonstrates that blending wheat and pulse proteins at specific ratios significantly enhances protein quality while maintaining functional performance in extrusion and formulation applications. The market potential extends beyond burgers and sausages to include innovative applications in nuggets, meatballs, seafood analogues, and prepared meals, creating substantial opportunities for ingredient suppliers offering functional, nutritious, and sustainable protein solutions.

The flour form segment dominates the U.S. cereal grain & pulse derivatives market due to superior versatility, ease of incorporation into existing food manufacturing processes, and functional properties that enable diverse applications across multiple food categories. Pulse flours derived from peas, lentils, chickpeas, and beans provide 19% minimum protein content with excellent nutritional profiles, including dietary fiber, essential minerals, and complex carbohydrates. Ancient grain flours from quinoa, millet, sorghum, and oats offer gluten-free alternatives with distinct flavor profiles and nutritional advantages.

Food manufacturers prefer flour forms because they integrate seamlessly into bakery formulations, snack applications, ready-to-eat products, and beverage applications without requiring significant recipe reformulation. AGT Foods and other major processors utilize advanced milling, air classification, and micronization technologies to produce fine pulse and grain flours with controlled particle size distribution and functional characteristics. The flour segment benefits from established distribution networks, technical support services, and formulation expertise that help manufacturers optimize product performance while achieving clean-label, high-protein, and gluten-free claims.

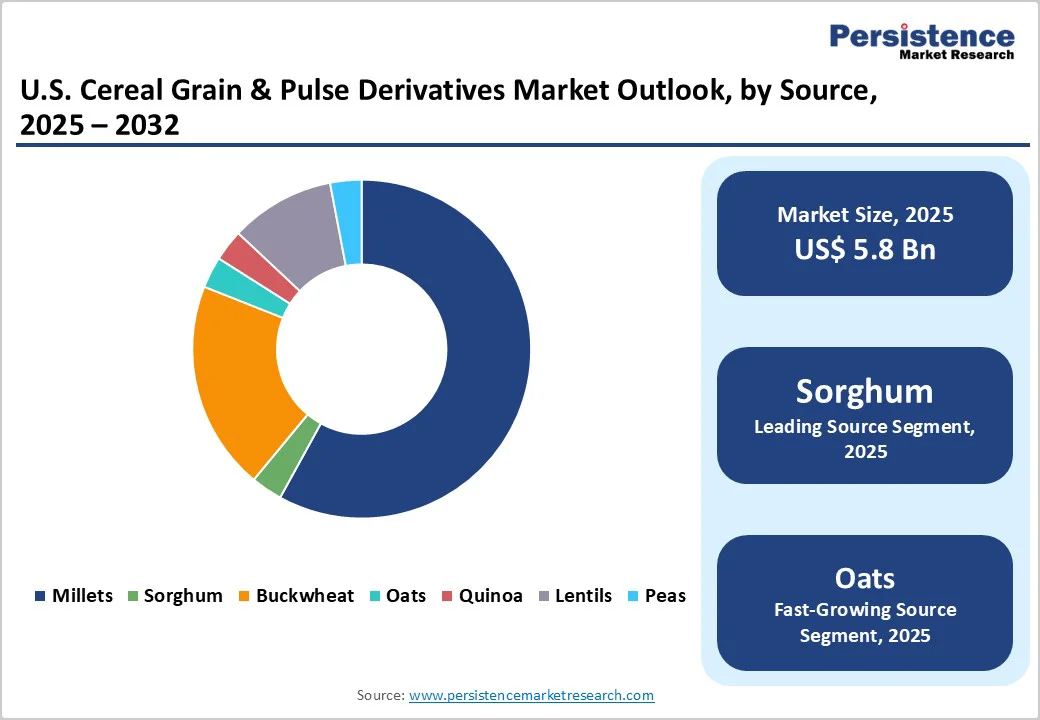

Sorghum dominates the U.S. cereal grain and pulse derivatives market owing to its versatility, high nutritional value, and adaptability to dry climates. It is widely utilized in multiple industries—serving as a key ingredient in sweeteners, bakery formulations, and animal feed, while also playing an essential role in ethanol production due to its high starch content. Its gluten-free nature and rich fiber profile make it a preferred option among health-conscious consumers and manufacturers seeking sustainable grain sources.

Oats are emerging as the fastest-growing source segment, driven by the rising demand for high-fiber, heart-healthy, and plant-based food products. Increasing consumer adoption of oat-based beverages, snacks, and dairy alternatives such as oat milk has further accelerated market expansion. The growing popularity of functional and clean-label foods continues to strengthen the presence of oats in both household and industrial food formulations, reinforcing their rapid growth trajectory in the U.S. market.

The U.S. cereal grain & pulse derivatives market exhibits moderate consolidation with several major processors dominating production capacity, while numerous regional and specialty suppliers serve niche markets and specific customer requirements. Market leaders including AGT Food and Ingredients, Ingredion Incorporated, and Bunge Limited compete through vertical integration, processing technology innovation, product portfolio breadth, technical support capabilities, and supply chain efficiency. Companies focus on strategic differentiation through organic certification, non-GMO verification, specialized processing capabilities, including deflavoring and texturization, and development of proprietary ingredient blends optimized for specific applications. Emerging business trends include partnerships between pulse processors and food manufacturers for co-development of innovative products, investment in extrusion and functional ingredient technologies, and expansion of clean-label product portfolios. The market benefits from collaboration between ingredient suppliers and end-users to develop tailored solutions addressing specific formulation challenges, taste requirements, and nutritional objectives.

The U.S. cereal grain & pulse derivatives market is projected to be valued at US$ 5.8 Bn in 2025.

U.S. cereal grain & pulse derivatives market growth is driven by rising plant-based demand, gluten-free trends, health focus, meat analogue innovation, and sustainable food production.

The U.S. market is poised to witness a CAGR of 6.7% between 2025 and 2032.

Innovating meat analogues using cereal and pulse proteins to enhance texture, nutrition, and clean-label, gluten-free convenience food offerings.

The prominent players in the market are AGT Food and Ingredients, Anchor Ingredients Co., LLC, Bunge Limited, Ingredion Incorporated, Batory Foods, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn and Volume (if Available) |

|

U.S. Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Form

By Source

By Application

By Distribution Channel

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author