ID: PMRREP12898| 205 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

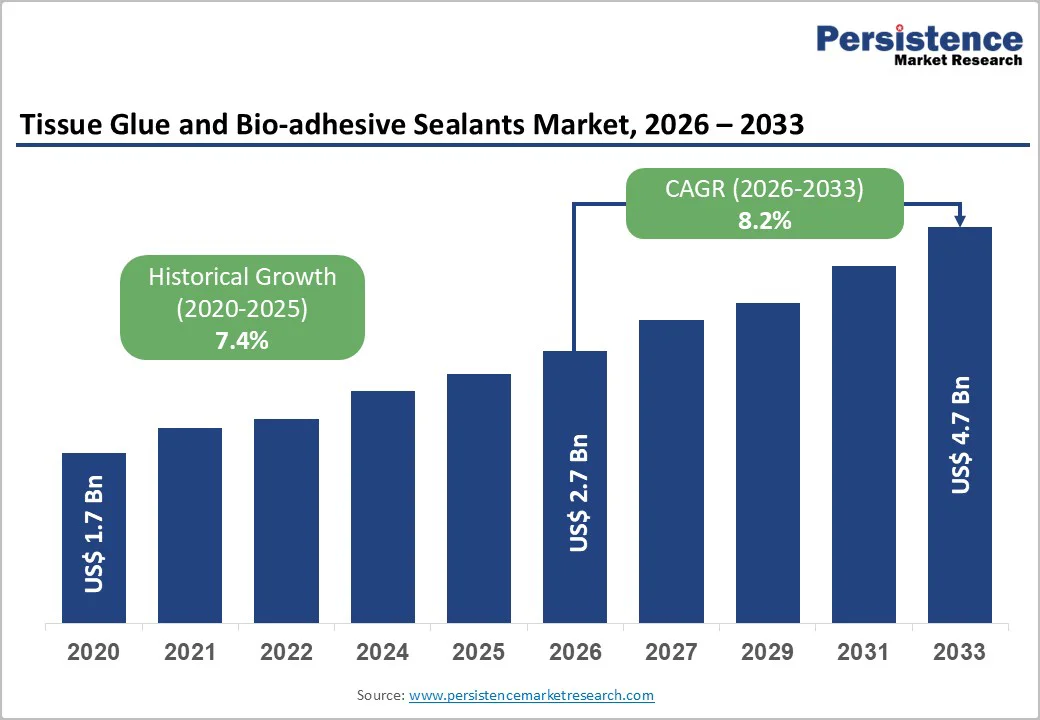

The global tissue glue and bio-adhesive sealants market size is likely to value at US$ 2.7 billion in 2026 to US$ 4.7 billion by 2033, growing at a CAGR of 8.2% during the forecast period from 2026 to 2033.

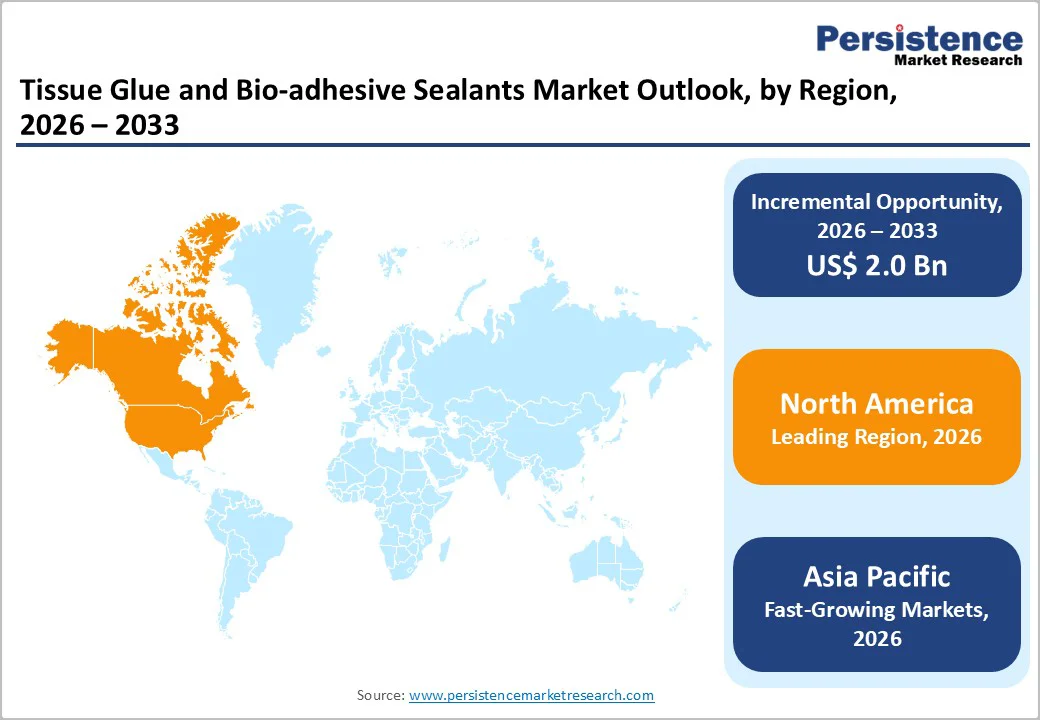

The market is expanding steadily, supported by rising surgical volumes, aging populations, and increased use of minimally invasive procedures. North America leads due to advanced healthcare systems and high adoption of surgical adhesives, while Asia Pacific is the fastest-growing region, driven by expanding hospital infrastructure, rising chronic diseases, and growing acceptance of modern wound-closure technologies.

| Key Insights | Details |

|---|---|

|

Tissue Glue and Bio-adhesive Sealants Market Size (2026E) |

US$ 2.7Bn |

|

Market Value Forecast (2033F) |

US$ 4.7 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

8.2% |

|

Historical Market Growth (CAGR 2020 to 2025) |

7.4% |

The global need for surgery is substantial and increasing steadily. Around 313 million operations were performed worldwide in 2012, up from approximately 234 million in 2004, representing a 34% increase over eight years. More recent estimates suggest that over 300 million major surgical procedures are conducted annually across all specialties. In countries with high unmet surgical demand, studies indicate that thousands of additional procedures per 100,000 population are required to meet healthcare needs. This rising surgical volume creates a direct and growing opportunity for the use of tissue glue and bio-adhesive sealants.

As the number of surgeries rises across cardiovascular, general, trauma, reconstructive, and cosmetic procedures, the demand for effective hemostasis, tissue sealing, and wound closure grows proportionally. Each procedure represents a potential use case for bio-adhesive sealants. High-volume surgical markets, including both developed and emerging economies, are increasingly adopting reliable and easy-to-use adhesives that reduce complications, accelerate recovery, and simplify closure. Consequently, the growth in surgical volume directly expands the addressable market for tissue glues and bio-adhesives globally, positioning them as essential tools in modern surgical care.

Many commonly used bio-adhesives, such as fibrin-based sealants, require deep-freezing or strict cold-chain storage until use. For example, a widely used fibrin sealant must be stored at ≤ –18 °C and maintain frozen status until just before surgery; once thawed, the product typically must be used within 48–72 hours and cannot be refrozen. Prepared syringes lose validity quickly if storage conditions deviate, and unused portions are discarded after a short time. These requirements impose substantial logistical burdens on several hospitals (especially smaller or resource-limited ones) that lack reliable freezing, a continuous cold chain, or backup power, leading to waste or even the inability to use sealants.

When cold-chain integrity cannot be guaranteed, for example, during transport or in regions with unstable electricity, the risk of product degradation or loss of adhesive efficacy rises. Manufacturers of fibrin sealants have shown that improper storage or delays can lead to instability in key components (fibrinogen, thrombin), jeopardizing clot formation and adhesive strength. In addition, even synthetic adhesives (e.g., cyanoacrylates) often have short shelf lives (6–12 months unopened, and much less once opened). They are sensitive to heat, humidity, and light, making long-term storage and distribution challenging. These storage and stability constraints limit adoption in many settings, especially in low- and middle-income countries, rural hospitals, and emergency-care centers, slowing broader market penetration.

Traditional tissue glues rely on fibrin, collagen, gelatin, or simple synthetic adhesives but often face limitations, including variable adhesion strength, poor durability, and short shelf life. Next-generation bio-adhesives, combining synthetic polymers with biomolecules, deliver improved biocompatibility, biodegradability, and mechanical performance. Recent studies show biohybrid hydrogels can increase adhesive strength when exposed to proteins in wet or dynamic tissue environments. Chitosan-based adhesives have demonstrated strong bonding to skin, mucosa, and internal organs, providing safe, biodegradable alternatives. These innovations overcome limitations of classic sealants, expand applications in cardiovascular, gastrointestinal, reconstructive, and orthopedic surgeries, and reduce postoperative complications.

The rising adoption of minimally invasive procedures, complex soft-tissue repair, and regenerative medicine drives demand for adhesives that traditional glues cannot address. Next-generation adhesives, including polymeric hydrogels and adaptive biohybrids, are suited for wound closure, organ sealing, vascular repair, skin grafts, and implant fixation. Biodegradable, biocompatible sealants meet growing clinical and regulatory requirements for safer long-term use. Expanding applications to surgical implants and regenerative therapies further increase potential adoption. With over 300 million surgeries performed each year globally and growing surgical complexity, next-generation bio-adhesives represent a significant market opportunity, enabling broader clinical use and higher revenue potential for the tissue glue and bio-adhesive sealants market.

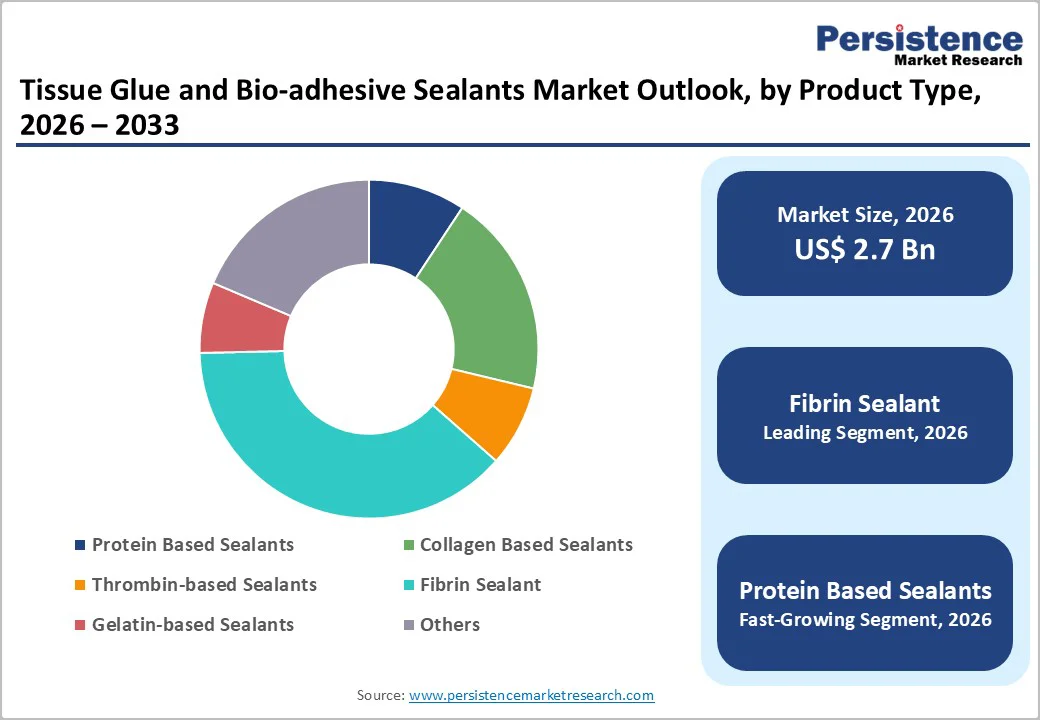

Fibrin Sealant dominates with 38.1% share of the global market in 2025, due to its high biocompatibility, rapid hemostatic action, and versatility across multiple surgical specialties. They mimic the body’s natural clotting process by combining fibrinogen and thrombin, forming a stable clot that controls bleeding and promotes tissue adhesion. Globally, cardiovascular and orthopedic surgeries, which account for a large share of surgical procedures, rely heavily on fibrin sealants; for example, over 300 million major surgeries are performed annually, many of which require hemostatic support. Their predictable performance, minimal immune response, and widespread regulatory approval make fibrin sealants the preferred choice, giving them a dominant share over collagen-, gelatin-, or synthetic-based adhesives.

Cardiovascular surgery dominates the tissue glue and bio-adhesive sealants market because these procedures often involve high-risk bleeding and delicate tissue repair, where effective hemostasis is critical. Globally, cardiovascular diseases affect over 523 million people, with millions undergoing surgical interventions annually, including bypass, valve repair, and aortic procedures. Each surgery frequently requires reliable tissue adhesives to control bleeding, prevent leaks, and promote safe recovery. Fibrin and collagen-based sealants are widely used due to their rapid clot formation, biocompatibility, and ability to adhere in wet environments, making them essential in cardiac operating rooms. High procedure volume and clinical dependence on sealants sustain cardiovascular surgery as the largest application segment.

North America dominates the tissue glue and bio-adhesive sealants market with 39.9% share in 2025, due to advanced healthcare infrastructure, high surgical volumes, and early adoption of innovative medical technologies. The United States alone performs over 51 million surgical procedures annually, many requiring reliable hemostasis and tissue sealing. Strong regulatory frameworks, widespread availability of fibrin, collagen, and synthetic adhesives, and well-established hospital systems ensure consistent use across cardiovascular, orthopedic, and general surgeries. Additionally, a growing elderly population, nearly 17% of the U.S. population, is aged 65 and above, combined with the rising prevalence of chronic diseases, drives demand for surgical interventions where bio-adhesives are essential, solidifying North America’s leading position in the market.

Europe is an important market region due to its advanced healthcare systems, high surgical procedure rates, and strong adoption of innovative medical technologies. Countries like Germany, France, and the UK perform millions of surgeries annually, including cardiovascular, orthopedic, and reconstructive procedures, many of which rely on tissue sealants for hemostasis and wound closure. Europe also has a large aging population, with over 20% of the population aged 65 and above, increasing demand for surgeries and related adhesives. Additionally, favorable regulatory frameworks, well-established hospital networks, and growing awareness of minimally invasive and safe surgical practices contribute to Europe’s significant market importance.

Asia-Pacific is the fastest-growing region in the tissue glue and bio-adhesive sealants market, driven by rising surgical volumes, expanding healthcare infrastructure, and increasing adoption of advanced medical technologies. Countries like China, India, and Japan are experiencing rapid growth in cardiovascular, orthopedic, and general surgery, driven by a population exceeding 4.7 billion and a rising prevalence of chronic diseases. The elderly population in the Asia-Pacific region is projected to surpass 700 million by 2030, increasing demand for surgical interventions that require reliable hemostasis and tissue adhesion. Additionally, investments in modern hospitals, greater access to minimally invasive procedures, and increasing awareness among clinicians and patients about advanced adhesives contribute to the region’s accelerated market growth.

Leading tissue glue and bio-adhesive sealant companies invest in R&D, clinical trials, and training, collaborating with hospitals and surgical centers. By focusing on safety, efficacy, and expanding adoption across cardiovascular, orthopedic, and reconstructive surgeries, they drive innovation, improve surgical outcomes, meet rising procedural demand, and accelerate global growth in the tissue adhesive market.

The global tissue glue and bio-adhesive sealants market is projected to be valued at US$ 2.7 Bn in 2026.

Rising surgical volumes, aging populations, chronic disease prevalence, technological advancements, and growing adoption of minimally invasive procedures drive market growth.

The global tissue glue and bio-adhesive sealants market is poised to witness a CAGR of 8.2% between 2026 and 2033.

Expansion in emerging markets, next-generation bio-adhesives, minimally invasive surgeries, regenerative medicine, and technological innovations in surgical adhesives present key opportunities.

Cryolife, Baxter International Inc., Luna Innovations Incorporated, B. Braun Melsungen AG, Johnson and Johnson

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author