ID: PMRREP11332| 187 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

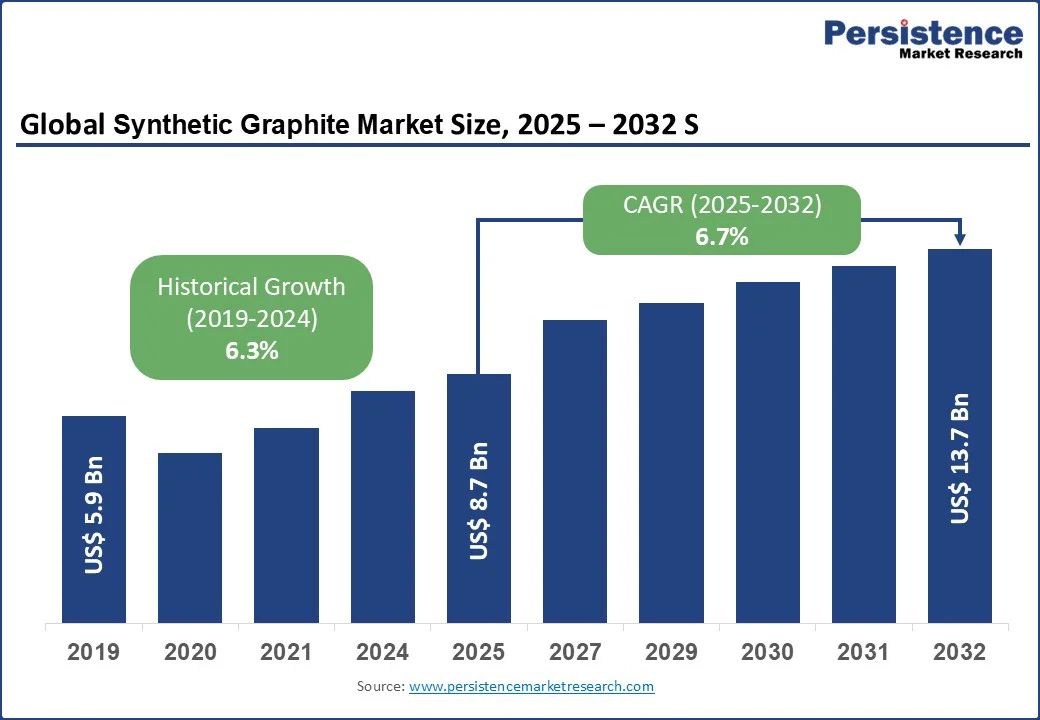

The global synthetic graphite market size is likely to be valued at US$8.7 bn in 2025 and is expected to reach US$13.7 bn by 2032, growing at a CAGR of 6.7% during the forecast period from 2025 to 2032 based on the rapid expansion of electric vehicle production and renewable energy storage, which drives strong demand for high-performance graphite.

Key Industry Highlights:

|

Key Insights |

Details |

|

Synthetic Graphite Market Size (2025E) |

US$ 8.7 Bn |

|

Market Value Forecast (2032F) |

US$ 13.7 Bn |

|

Projected Growth (CAGR 2025–2032) |

6.7% |

|

Historical Market Growth (CAGR 2019–2024) |

6.3% |

The surge in electric vehicle (EV) production and renewable energy storage is a key driver of the synthetic graphite market. Synthetic graphite plays a vital role in lithium-ion batteries, serving as a preferred material for anodes due to its high purity and stable performance. With EV adoption rising worldwide, governments are actively investing in strengthening domestic supply chains for battery materials. For instance, the U.S. Department of Energy announced a conditional commitment of more than $750 million to support large-scale production of synthetic graphite in Tennessee to meet the growing demand from the EV sector. Such initiatives highlight the critical role of synthetic graphite in enabling the clean mobility transition.

Renewable energy storage is another factor boosting demand, as grid-scale batteries are essential for balancing solar and wind intermittency. Government strategies, such as Australia’s National Battery Strategy, aim to scale energy storage capacity significantly by 2030, emphasizing the importance of graphite-based battery technologies. These policies reinforce synthetic graphite’s strategic position in the shift toward sustainable energy infrastructure.

Supply chain volatility presents a significant restraint for the synthetic graphite market. The production process relies heavily on petroleum needle coke and other carbon-based feedstocks, which face fluctuating availability and pricing due to global trade disruptions and geopolitical tensions. Any imbalance in raw material supply directly impacts cost structures and production efficiency, creating uncertainty for manufacturers and end-users in sectors such as EV batteries and energy storage.

Environmental regulations further constrain market expansion, as synthetic graphite production is energy-intensive and associated with carbon emissions. Stringent rules on emissions, waste management, and energy consumption are pushing producers to invest in cleaner technologies, increasing operational costs. These regulatory pressures can slow capacity expansion, affecting the pace of adoption in fast-growing applications.

Advancements in sustainable graphite present a strong growth opportunity for the synthetic graphite market. Increasing R&D investments are focused on developing eco-friendly production methods, such as low-carbon synthetic graphite and recycling of graphite from spent batteries. These innovations aim to reduce the environmental footprint while maintaining performance, aligning with global sustainability goals. Companies adopting greener technologies are likely to gain a competitive edge as industries demand cleaner and more resilient supply chains.

Emerging markets also provide significant opportunities, driven by rapid urbanization, industrialization, and rising adoption of electric mobility. Countries in Asia Pacific, Latin America, and Africa are scaling up renewable energy projects and EV infrastructure, boosting demand for energy storage solutions. With governments supporting local battery manufacturing, synthetic graphite producers have the chance to expand operations in these high-growth regions and strengthen their global market presence.

Graphite electrodes are set to dominate the synthetic graphite market with a 50% share in 2025, primarily driven by their indispensable role in electric arc furnaces (EAF) for steelmaking. With global steel production shifting toward EAF technology due to its lower carbon footprint and energy efficiency, demand for graphite electrodes remains strong. Their superior thermal conductivity, high current-carrying capacity, and durability make them a critical component in sustainable steel production.

On the other hand, graphite powder is emerging as the fastest-growing segment, fueled by its expanding applications in batteries, lubricants, and conductive materials. The rapid rise of electric vehicles and renewable energy storage systems has significantly increased the need for high-performance graphite powder in lithium-ion battery anodes, supporting robust market growth.

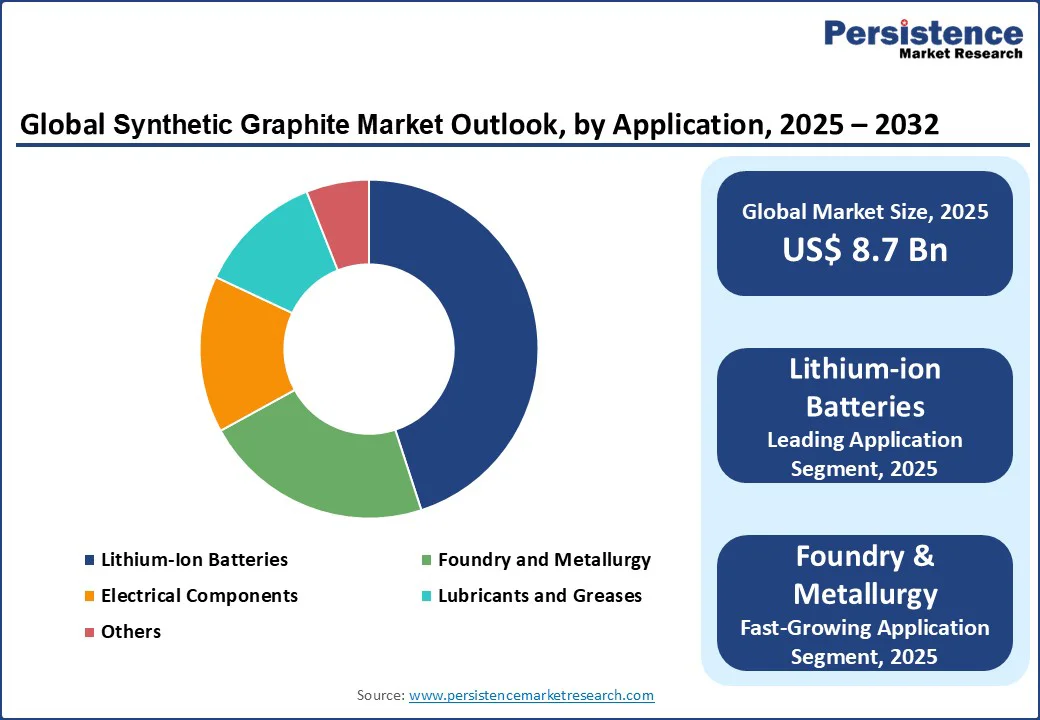

Lithium-ion batteries are projected to dominate the synthetic graphite market with a 45% share in 2025, as they remain the preferred energy storage solution for electric vehicles, consumer electronics, and renewable energy systems. Synthetic graphite is widely used as an anode material in these batteries due to its high purity, consistency, and superior performance compared to natural graphite. The global push toward clean mobility and large-scale renewable integration is expected to sustain strong demand in this segment.

Meanwhile, the foundry and metallurgy sector is identified as the fastest-growing application area. The rising demand for lightweight alloys in automotive and aerospace industries, coupled with advancements in casting technologies, is fueling graphite’s use as a key additive and refractory material, driving its rapid expansion.

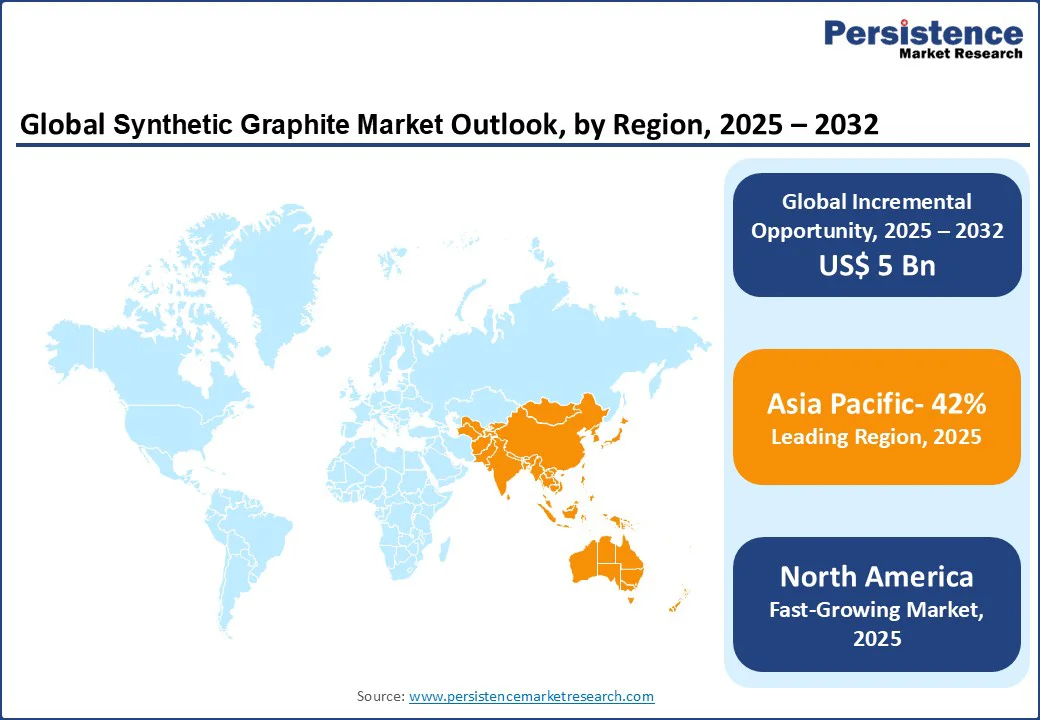

North America is emerging as the fastest-growing region in the synthetic graphite market, driven by robust investments in electric vehicle production, renewable energy storage, and advanced manufacturing. The United States and Canada are strengthening their domestic battery supply chains to reduce dependence on imports, with government-backed initiatives supporting large-scale production of synthetic graphite for lithium-ion batteries. Additionally, rising adoption of electric arc furnaces in steelmaking and growing demand from aerospace and electronics industries further accelerate regional growth. Strong regulatory support, technological innovation, and increasing private sector investments position North America as a pivotal hub for synthetic graphite expansion.

Europe holds a significant share in the synthetic graphite market, supported by its strong industrial base and sustainability-driven policies. The region is at the forefront of electric vehicle adoption, with leading automakers heavily investing in lithium-ion battery production. Synthetic graphite demand is also reinforced by Europe’s emphasis on renewable energy storage and the integration of clean technologies across industries. Furthermore, the widespread use of electric arc furnaces in the steel sector enhances consumption of graphite electrodes. Combined with strict environmental regulations encouraging low-carbon technologies, Europe continues to play a vital role in shaping the global market landscape.

Asia Pacific is projected to dominate the synthetic graphite market with a 42% share in 2025, driven by its strong manufacturing ecosystem and expanding energy storage needs. China, Japan, South Korea, and India lead the region with significant investments in electric vehicle production, battery manufacturing, and renewable energy projects. The region also accounts for the largest steel production capacity, fueling demand for graphite electrodes in electric arc furnaces. Rapid urbanization, government incentives for clean energy, and the presence of key battery and electronics manufacturers further reinforce Asia Pacific’s leadership, positioning it as the central hub for synthetic graphite consumption and production.

The global synthetic graphite market is characterized by continuous innovation, capacity expansion, and strategic collaborations. Companies are investing heavily in research to develop high-performance and sustainable graphite products that meet the growing demand from electric vehicles, renewable energy storage, and advanced metallurgy. Manufacturers are also focusing on regional production facilities to strengthen supply chains and reduce import dependence. Additionally, partnerships with battery producers and technology developers are reshaping the industry, fostering long-term growth opportunities across multiple industries.

The synthetic graphite market is projected to reach US$8.7 bn in 2025, driven by demand for lithium-ion batteries and metallurgy.

The surge in EV production, renewable energy storage, and foundry applications fuel market growth.

The synthetic graphite market will grow from US$8.7 bn in 2025 to US$13.7 bn by 2032, with a CAGR of 6.7%.

Advancements in bio-based graphite and expansion in emerging markets such as Asia Pacific drive growth opportunities.

Leading players include GrafTech International Ltd., HEG Limited, Imerys Graphite & Carbon, Mersen S.A., Nippon Carbon Co., Ltd., SGL Carbon SE, Showa Denko K.K., Superior Graphite, Tokai Carbon Co., Ltd., and Toyo Tanso Co., Ltd.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author