ID: PMRREP35766| 193 Pages | 23 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

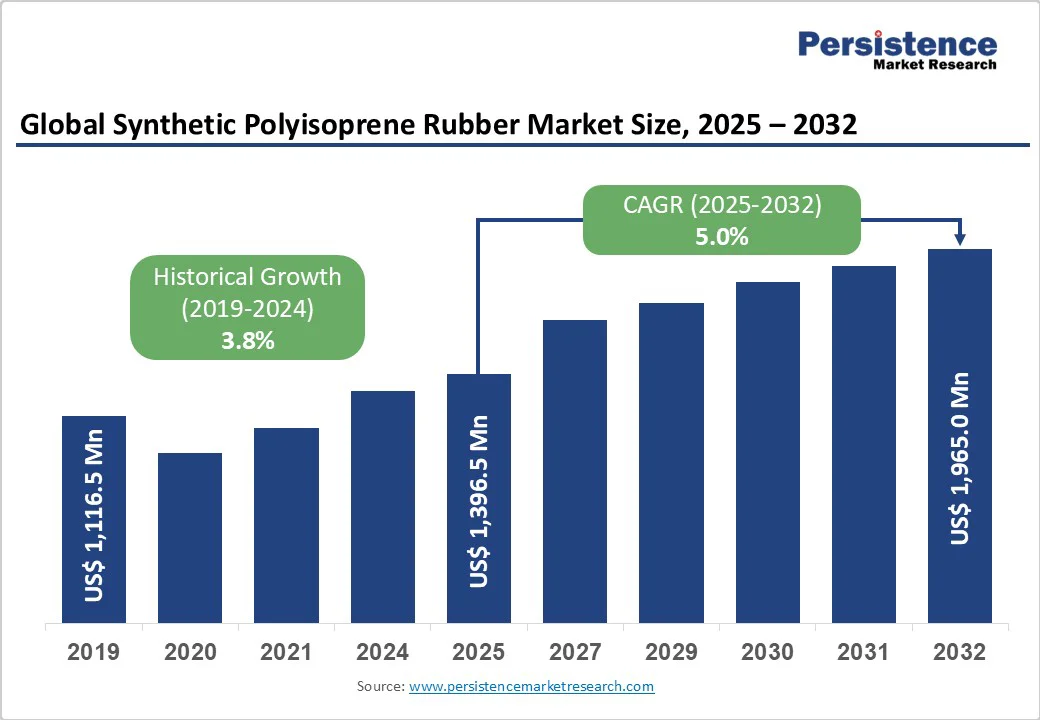

The global synthetic polyisoprene rubber market is expected to reach US$1,396.5 million in 2025. It is projected to reach US$1,965.0 million by 2032, growing at a CAGR of 5.0% during the forecast period 2025 - 2032.

Growing demand in the automotive sector for high-performance tires and components, coupled with rising adoption of latex-free medical products in healthcare to address allergy concerns, has driven growth.

Global vehicle production reached approximately 90 million units in 2023, according to the International Organization of Motor Vehicle Manufacturers (OICA), boosting tire applications where synthetic polyisoprene offers superior elasticity and durability.a

| Key Insights | Details |

|---|---|

| Synthetic Polyisoprene Rubber Market Size (2025E) | US$ 1,396.5 Mn |

| Market Value Forecast (2032F) | US$ 1,965.0 Mn |

| Projected Growth CAGR (2025 - 2032) | 5.0% |

| Historical Market Growth (2019-2024) | 3.8% |

The expansion of the automotive industry will significantly drive growth in the synthetic polyisoprene rubber market, particularly through its critical role in tire manufacturing and in components such as belts and hoses.

With global EV sales surging beyond 17 million units in 2024, according to the International Energy Agency (IEA), demand for low-rolling-resistance tires has intensified, and synthetic polyisoprene offers exceptional elasticity and abrasion resistance akin to natural rubber, with greater consistency.

The ability of this material to enhance fuel efficiency and reduce emissions aligns with stringent regulations such as the EU's CO2 emission standards, which mandate average fleet emissions below 95 g/km by 2025.

Moreover, increasing awareness of latex allergies has accelerated the use of synthetic polyisoprene rubber in medical applications, such as gloves, catheters, and seals, driving market momentum. The Centers for Disease Control and Prevention (CDC) estimates that around 15% of healthcare workers experience type I latex allergies, prompting a global shift to hypoallergenic synthetics that maintain biocompatibility and sterilizability.

This transition is supported by FDA guidelines under 21 CFR 177.2600, which endorse synthetic polyisoprene for indirect food contact and medical devices due to its purity and low extractables.

Volatility in petrochemical prices poses a major restraint to the synthetic polyisoprene rubber market, as production relies heavily on isoprene derived from petroleum. Crude oil price swings, with Brent crude averaging US$ 80 per barrel in 2024 per OPEC reports, have increased raw material costs by up to 25% year-over-year, squeezing manufacturer margins and deterring investment in capacity expansion.

This dependency exacerbates supply chain disruptions, as seen during the 2022 Russia-Ukraine conflict, which spiked isoprene costs and delayed deliveries to end-users in automotive and construction sectors. Smaller producers struggle to compete, leading to market consolidation and reduced innovation, while end-users like tire makers seek costlier alternatives, ultimately hindering overall market accessibility and growth potential in price-sensitive regions.

At the same time, intense competition from natural rubber and other synthetic rubbers has dampened the prospects of this market, particularly in cost-driven applications such as footwear and adhesives. Natural rubber production reached 14 million tons in 2023, according to the International Rubber Study Group (IRSG), benefiting from lower extraction costs of around US$ 1.50 per kg versus US$ 2.50 per kg for synthetic polyisoprene.

This price advantage, combined with natural rubber's established supply chains in Southeast Asia, discourages substitution in non-critical uses, where environmental concerns over deforestation are offset by abundant availability.

Regulatory pushes such as the EU Deforestation Regulation (EUDR) have further complicated the adoption of synthetic materials by favoring traceable natural sources, resulting in slower penetration rates and constrained revenue opportunities for synthetic producers amid fluctuating demand dynamics.

Emerging bio-based production methods present another compelling opportunity for synthetic polyisoprene rubber market participants, enabling sustainable alternatives to petroleum-derived feedstock and aligning with global eco-regulations. Fermentation processes using sugarcane or biomass can reduce CO2 emissions by up to 70%.

The EU's Green Deal targets a 55% emissions reduction by 2030, incentivizing investments in such technologies through subsidies. This shift also opens avenues in the EV industry, which offers substantial growth potential for synthetic polyisoprene rubber companies specializing in tires and seals, capitalizing on its low-noise and high-grip properties.

With EV adoption expected to reach 60% of global sales by 2030 under Net Zero Emissions scenarios from the IEA, the demand for quiet, durable components is set to surge in the coming years

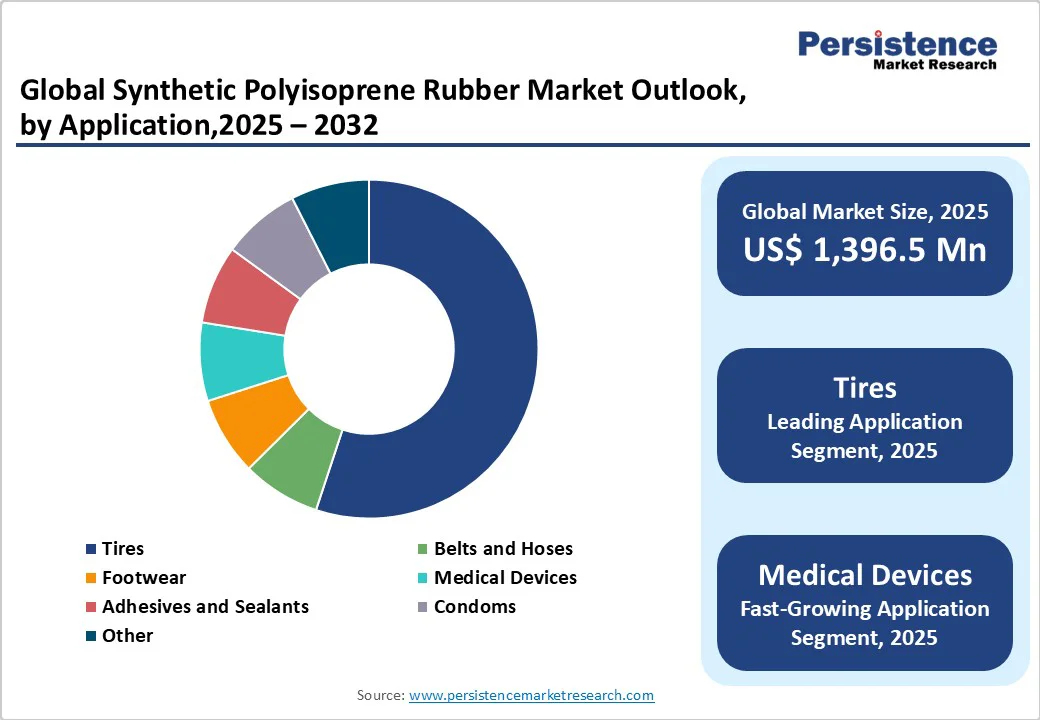

The tires segment is poised to lead the synthetic polyisoprene rubber market, commanding approximately 55% market share in 2025 due to its indispensable role in providing elasticity and abrasion resistance for high-performance vehicles. This dominance is justified by the automotive sector's reliance on synthetic polyisoprene for low-rolling-resistance tires, which improve fuel efficiency amid rising EV production.

In the industrial tires market, synthetic variants offer consistent quality without natural rubber impurities, reducing defects by 30% as reported in International Rubber Conference proceedings, making them ideal for heavy-duty applications.

Major tire producers such as Bridgestone Corporation prioritize this material for its compatibility with advanced compounding, ensuring superior traction and longevity, which solidifies tires as the cornerstone of application demand and innovation.

The automotive segment is likely to dominate with about 50% of the synthetic polyisoprene rubber market revenue share in 2025, driven by its essential use in tires, belts, and hoses for enhanced durability and performance.

This leadership is substantiated by surging vehicle manufacturing: Asia Pacific alone produced over 50 million units in 2024, according to OICA data, and synthetic polyisoprene's resilience supports EV torque demands and emission compliance under EPA standards.

Its integration into the bicycle tire market further amplifies adoption, offering lightweight options that boost efficiency in urban mobility. Automotive OEMs such as The Goodyear Tire & Rubber Company leverage its properties for vibration absorption, thereby underpinning the segment's pivotal position in driving overall market volume and technological advancements.

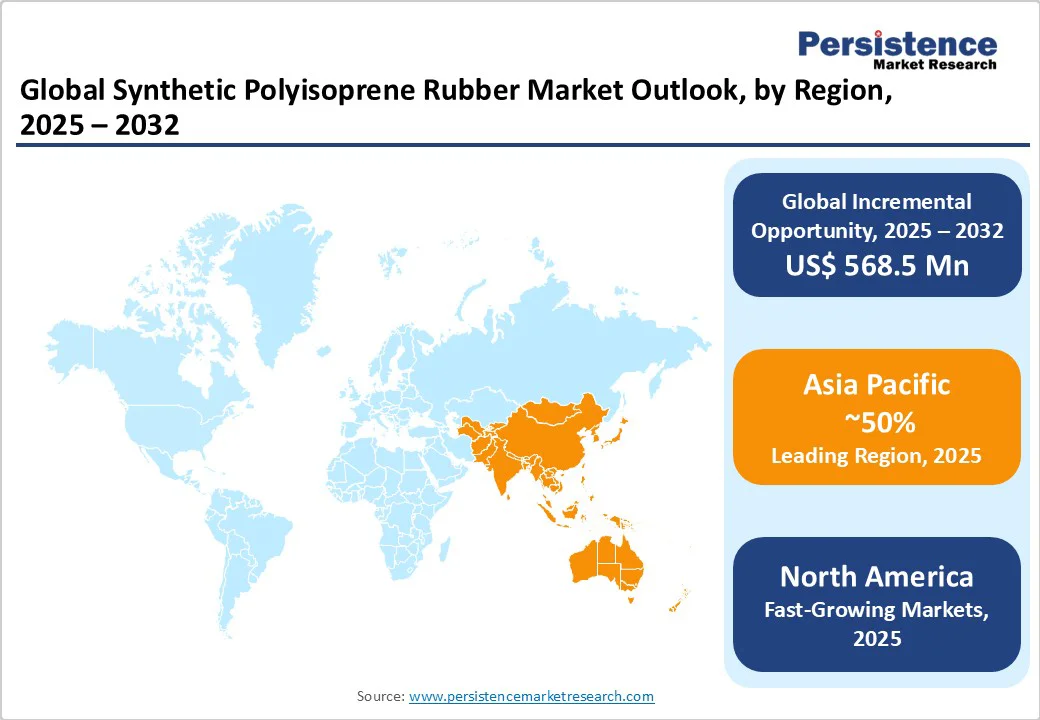

North America exhibits robust growth in the synthetic polyisoprene rubber market, led by the U.S.' dominant position in the advanced automotive and healthcare sectors. The U.S. FDA enforces stringent regulations under 21 CFR 177.2600 for rubber materials used in medical devices, promoting hypoallergenic synthetics to address latex allergies affecting 1-6% of the general population, according to CDC estimates.

Innovation ecosystems, including R&D hubs in Ohio and Texas, focus on EV tire compounds, with Goodyear's 2024 facility upgrades enhancing production for low-emission vehicles aligned with the Inflation Reduction Act's clean energy incentives.

The demand for advanced synthetic materials in healthcare has further accelerated regional market growth, as hospitals have been adopting synthetic polyisoprene gloves post-COVID-19, with procurement rising 20% in 2024, according to Healthcare Supply Chain Association data. Regulatory frameworks such as USP <381> ensure biocompatibility, fostering a mature market environment that balances innovation with safety.

The European synthetic polyisoprene rubber market is characterized by strong performance in Germany, the U.K., France, and Spain, steered by harmonized regulations and automotive prowess. The EUDR, effective 2025, distinguishes synthetics from natural rubber, exempting them from traceability mandates and boosting adoption in tires to meet Euro 7 emission norms, reducing NOx by 50%.

Germany's Fraunhofer Institute leads in sustainable compounding, with 2024 projects integrating bio-isoprene into Porsche's EV models to enhance grip while complying with REACH chemical safety standards. U.K.'s post-Brexit alignment with EU standards supports Bridgestone's expansions, driving efficiency in the Automotive Engine Belt and Hoses Market amid rising EV infrastructure investments.

Asia Pacific drives dynamic growth in the synthetic polyisoprene rubber market, with China, Japan, and India leveraging manufacturing advantages and rapid industrialization.

China's production ecosystem, bolstered by state-owned enterprises such as SIBUR and fueled by Made in China 2025 initiatives, emphasizes high-performance materials for EV tires amid 30 million annual vehicle sales. Japan's technological edge, via companies such as KURARAY CO., LTD, is driving innovation in precision polymerization, meeting JIS standards for abrasion-resistant components.

India and ASEAN nations are experiencing explosive growth through cost-effective manufacturing, with India's auto sector expanding by 12% in 2024, according to data from the Society of Indian Automobile Manufacturers (SIAM).

Simultaneously, tire manufacturers are integrating synthetics in other applications, such as bicycles and scooters, which are the heart of urban commuting. Government policies such as Japan's FY2024 budget, allocating US$220 million for material innovation, further enhance supply chain resilience and export competitiveness.

The global synthetic polyisoprene rubber market displays an oligopolistic structure, dominated by a handful of multinational players controlling more than half of global capacity through integrated petrochemical operations. This concentration fosters strategic expansions, such as joint ventures for bio-based R&D, and heavy investments in sustainable technologies to meet EUDR and EPA regulations.

Key differentiators include proprietary polymerization processes, such as KURARAY's high-purity grades, enabling premium pricing in medical segments. Emerging models emphasize circular economy practices, with recycling initiatives reducing waste by 30%, while leaders prioritize EV-focused innovations to capture growth in high-margin applications, ensuring resilience amid feedstock volatility.

The global synthetic polyisoprene rubber market is expected to reach US$ 1,396.5 million in 2025.

Key drivers include surging EV adoption requiring low-rolling-resistance tires and rising latex allergy concerns boosting medical applications.

The market is poised to witness a CAGR of 5.0% from 2025 to 2032.

Advancements in bio-based production offer multiple opportunities, cutting CO2 emissions by 70% for sustainable tires, aligning with EU Green Deal targets through 2025 pilots.

Leading market players include KURARAY CO., LTD., JSR Corporation, and Kraton Corporation, among others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author