ID: PMRREP35665| 198 Pages | 30 Sep 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

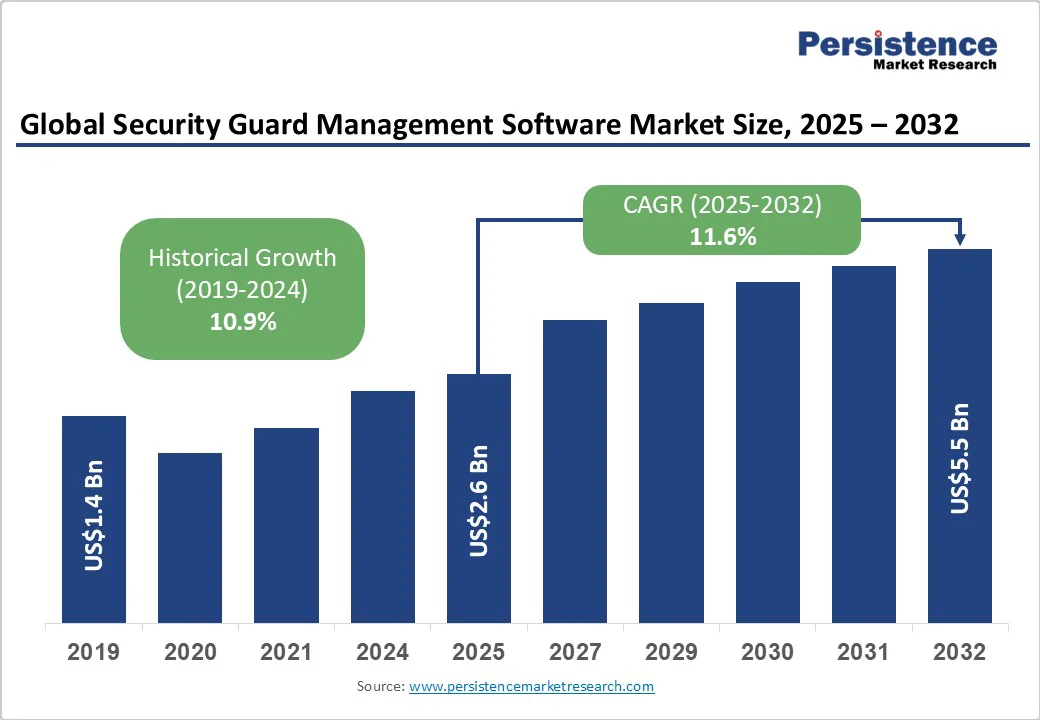

The global security guard management software market size is likely to be valued at US$2.6 Bn in 2025 and is estimated to reach US$5.5 Bn in 2032, growing at a CAGR of 11.6% during the forecast period 2025 - 2032, driven by surging requirements for real-time monitoring, automated patrol management, and instant incident reporting in organizations.

| Key Insights | Details |

|---|---|

| Security Guard Management Software Market Size (2025E) | US$2.6 Bn |

| Market Value Forecast (2032F) | US$5.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 11.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 10.9% |

The requirement for instant visibility and control over security operations is boosting the adoption of security guard management software. Organizations are under increasing pressure to respond quickly to incidents, monitor multiple sites simultaneously, and ensure compliance with safety protocols. Novel platforms now integrate real-time dashboards, mobile alerts, and AI-backed incident detection, enabling managers to track guard activities, patrols, and breaches as they occur.

For example, Trackforce Valiant’s platform provides live updates on guard movements and automated incident notifications, helping security teams react immediately to potential threats. This capability helps improve operational efficiency and strengthens accountability. At the same time, it reduces response times and minimizes security lapses, further making real-time management a key driver for software adoption.

The push toward automating routine tasks and workforce management is a key growth factor for security guard management software. Industries such as commercial real estate, BFSI, healthcare, and retail are now utilizing software to streamline guard scheduling, shift tracking, payroll, and compliance reporting. Automation reduces administrative burdens, eliminates human errors, and allows security teams to focus on critical incident response rather than manual processes.

Connecteam, for instance, delivers a platform that automates guard scheduling and task assignments, enabling real-time oversight and efficient workforce allocation. As more industries embrace digital solutions to optimize operational efficiency, the demand for integrated and automated security management systems continues to rise.

One of the main restraints for security guard management software is its operational complexity, which can create a steep learning curve for staff. To use novel features such as AI-based patrol analysis, real-time dashboards, and automated incident reporting effectively, proper training is essential. Organizations with limited technical expertise may struggle to implement and manage these platforms, leading to underutilization or errors in security operations.

For instance, small security firms adopting platforms such as TrackTik have reported initial difficulties in configuring automated workflows and mobile reporting features. This complexity can slow adoption and may necessitate additional investments in training, further reducing the immediate benefits of the software.

Another key restraint is the difficulty of integrating security guard management software with the existing IT infrastructure. Various organizations already use legacy HR, payroll, or access control systems. Compatibility issues can create data silos or operational inefficiencies. Integrating real-time monitoring and reporting modules with aging systems often requires additional customization, increasing cost and deployment time.

For example, some commercial building operators have faced challenges linking Connecteam or GuardsPro platforms with legacy visitor management and CCTV systems, slowing smooth adoption. These integration hurdles tend to deter organizations from upgrading to novel software despite the potential benefits.

The development of sophisticated mobile applications presents a key growth opportunity for security guard management software. Mobile platforms allow guards and supervisors to communicate instantly, submit incident reports on the go, and receive updates from command centers in real-time.

Features such as GPS-enabled check-ins, photo and video evidence uploads, and automated notifications streamline operations and improve accountability. As security teams increasingly operate across multiple sites and require instant coordination, mobile solutions deliver flexibility and operational efficiency, making this a key avenue for market growth.

Cloud-based security guard management platforms are emerging as a leading growth avenue by providing cost-effective and accessible solutions. Cloud systems allow real-time data storage, centralized monitoring, and integration with other enterprise software without the requirement for heavy on-premise infrastructure.

This flexibility is valuable for organizations managing multiple locations or large security teams. As more organizations prioritize remote accessibility, disaster recovery, and effortless data management, cloud adoption is predicted to bolster substantial growth in the security guard management software market.

Software is predicted to account for nearly 68.6% of the market share in 2025, as organizations are under increasing pressure to improve security operations while optimizing workforce efficiency. Digital solutions provide real-time monitoring, automated incident reporting, and predictive analytics, which reduce human errors and improve response times. For example, platforms such as Trackforce Valiant now integrate AI-backed patrol analytics, helping companies anticipate security breaches before they occur.

Services in the security landscape are gaining traction as businesses prefer comprehensive solutions that combine software with on-ground personnel management. Integrated services enable smooth scheduling, real-time communication, and compliance tracking, reducing operational complexities for security firms. For instance, Connecteam’s service model allows companies to manage guards’ shifts, incidents, and performance in a single dashboard, improving accountability and client satisfaction.

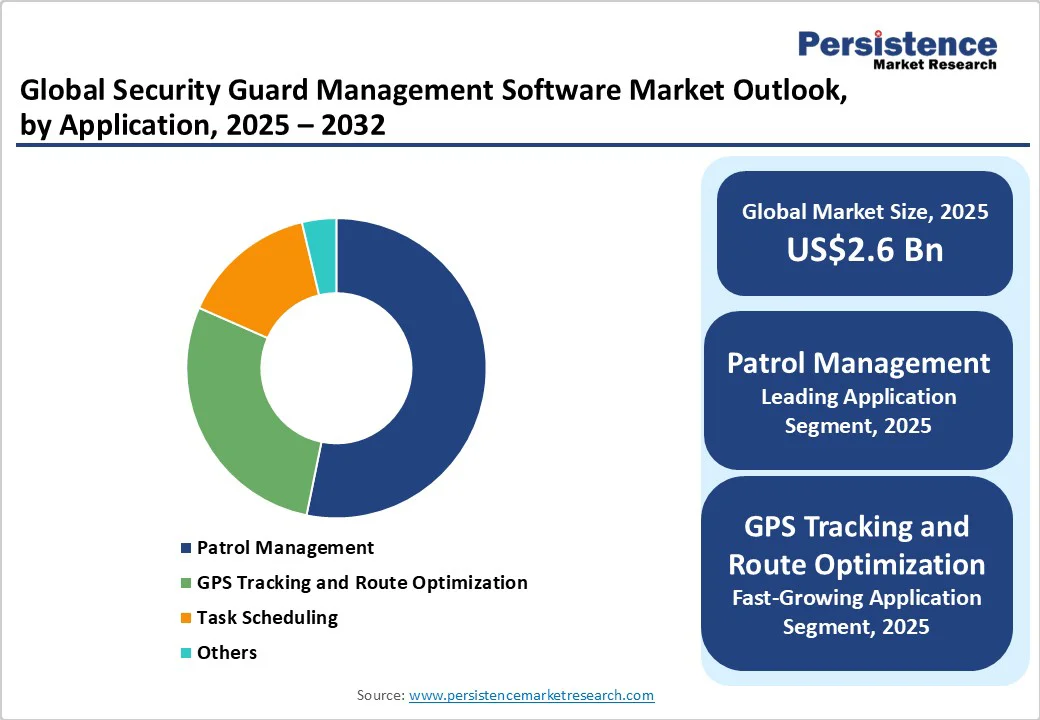

Patrol management is expected to hold approximately 53.2% of the market share in 2025, as it ensures systematic and accountable security operations. By automating patrol schedules and tracking guard activities in real-time, these systems help prevent missed checkpoints and unauthorized deviations from assigned routes. For instance, OfficerReports employs wireless sensors and GPS to monitor guard movements. This helps in providing managers with immediate visibility into patrol compliance and performance.

GPS tracking and route optimization are estimated to witness the highest CAGR through 2032 as they improve operational efficiency and accountability. GPS tracking allows supervisors to confirm that guards are present at designated locations and following prescribed routes, while route optimization minimizes travel time and maximizes coverage. TrackTik’s software, for example, delivers optimal route suggestions for patrols, reducing unnecessary travel and improving security operations.

Commercial buildings are poised to account for approximately 39.6% of the market share in 2025, backed by their complex, high-traffic environments that necessitate strict security measures. These facilities often operate 24/7, requiring continuous monitoring and efficient coordination of security personnel.

Software solutions streamline operations by automating tasks such as scheduling, time and attendance tracking, incident reporting, and communication. Features, including real-time location tracking of guards, mobile patrolling verification, and sophisticated reporting dashboards, improve operational efficiency, reduce labor costs, and improve security response times.

BFSI is anticipated to see the fastest growth in the foreseeable future due to the industry's urgent requirement for safeguarding sensitive financial data and assets, thereby ensuring compliance with stringent regulatory requirements.

Financial institutions face rising security threats, including cyberattacks and physical breaches, necessitating superior security measures. Software solutions in this segment provide real-time monitoring, incident reporting, and compliance tracking, enabling financial institutions to manage security risks and maintain regulatory compliance. The increasing demand for cost-effective and efficient BFSI security is driving growth.

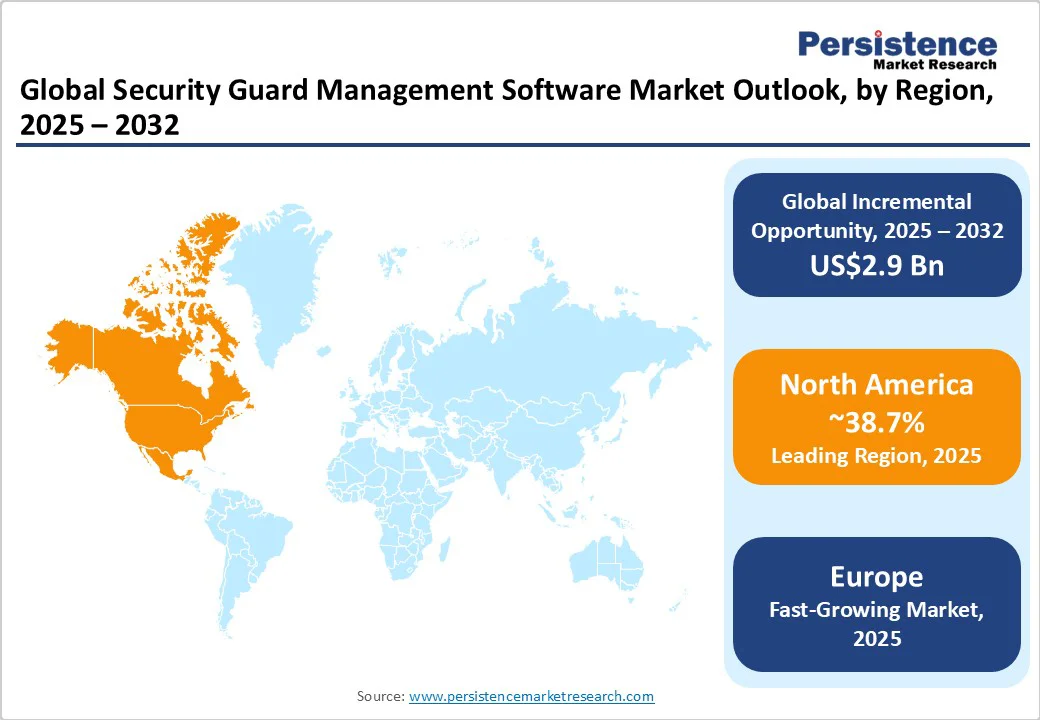

In 2025, North America is likely to account for approximately 38.7% of the market share in 2025. This is attributed to the region's novel technological infrastructure, high digital adoption rates, and a mature security services market. Organizations in North America prioritize automation, analytics, and integration, strengthening the region’s leadership position in the market.

The U.S. market is experiencing steady growth as businesses and public institutions focus on upgrading their security operations to address evolving threats and improve safety. The country’s diverse economic landscape and surging emphasis on technological innovation drive the demand for new security solutions. Organizations are now adopting extendable platforms that provide real-time monitoring and smooth integration with the existing infrastructure, enabling highly efficient management of security personnel and resources.

Europe is experiencing considerable growth due to the increasing demand for efficient security operations and technological developments. The market is projected to expand rapidly, with a focus on integrating AI, IoT, and cloud technologies to improve operational efficiency and scalability. The adoption of cloud-based solutions is gaining momentum in Europe due to their flexibility, remote management capabilities, and reduced infrastructure costs.

Organizations are extensively adopting extensible platforms that provide real-time monitoring and smooth integration with the existing infrastructure, enabling efficient management of security personnel and resources. This trend is evident in countries such as Germany, where the demand for novel security solutions is on the rise. The competitive landscape in Europe is marked by a variety of vendors providing specialized solutions to meet the varying requirements of organizations.

Asia Pacific is experiencing rapid growth, driven by factors such as urbanization, infrastructure development, and increasing security concerns across various sectors. Governments and businesses in the region are investing in smart city projects, digital transformation, and advanced surveillance technologies, which are contributing to market expansion.

Cloud-based solutions have become highly popular in Asia Pacific due to their scalability, cost-effectiveness, and accessibility. The integration of AI and machine learning into security guard management software is improving features such as real-time threat detection, predictive analytics, and automated reporting, thereby improving efficiency. Major economic centers, including Tokyo, Beijing, Shanghai, Singapore, Sydney, and Mumbai, are leading the adoption of security guard management software in the region.

The global security guard management software market is characterized by technological developments and increasing demand for efficient security operations. Key players such as GuardsPro, Trackforce Valiant, and Connecteam lead the market by delivering comprehensive solutions that integrate scheduling, incident reporting, and real-time monitoring. These platforms are now incorporating AI, IoT, and cloud technologies to improve operational efficiency and scalability.

Leading companies focus on innovation, cost leadership, and market expansion to maintain competitiveness. Differentiators include AI-based analytics, cloud-based scalability, and comprehensive mobile solutions. Emerging business models emphasize subscription-based services, integration with IoT devices, and real-time data analytics to improve operational efficiency.

The security guard management software market is projected to reach US$2.6 Bn in 2025.

Rising demand for real-time monitoring and the emergence of automated patrol management are the key market drivers.

The security guard management software market is poised to witness a CAGR of 11.6% from 2025 to 2032.

Launch of cutting-edge mobile apps and integration of AI are the key market opportunities.

Connecteam Inc., Trackforce Valiant, Inc., and GuardsPro, Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Enterprise Size

By Application

By Vertical

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author