ID: PMRREP18364| 180 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

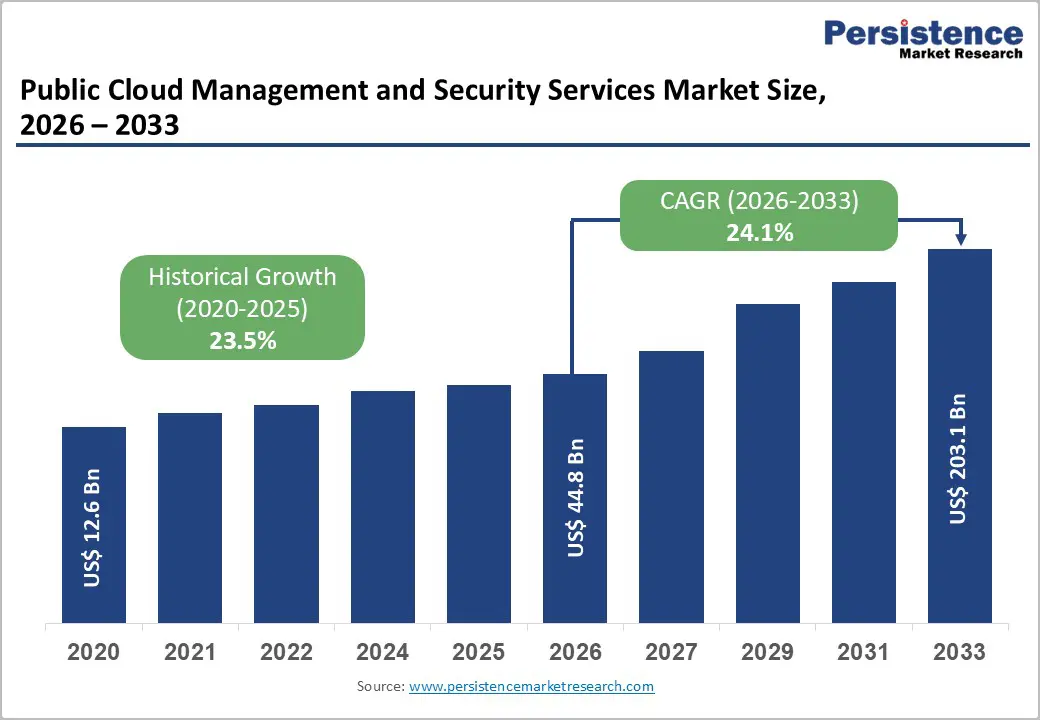

The global Public Cloud Management and Security Services Market size is expected to be valued at US$ 44.8 billion in 2026 and projected to reach US$ 203.1 billion by 2033, growing at a CAGR of 24.1% between 2026 and 2033.

This strong expansion reflects the accelerating pace of digital transformation and the rising reliance of enterprises on public cloud platforms for scalability, flexibility, and operational efficiency. As organizations migrate mission-critical workloads to cloud environments, the need for robust management and security solutions has intensified. Increasing cyber threats, including ransomware and data breaches, combined with strict regulatory requirements such as GDPR and HIPAA, are further driving demand for integrated cloud governance, risk management, and security services across industries.

| Global Market Attributes | Key Insights |

|---|---|

| Public Cloud Management and Security Services Market Size (2026E) | US$ 44.8 billion |

| Market Value Forecast (2033F) | US$ 203.1 billion |

| Projected Growth CAGR (2026-2033) | 24.1% |

| Historical Market Growth (2020-2025) | 23.5% |

Rising Cyber Threats and Security Incidents

Enterprises are facing a sharp escalation in cyber threats as cloud adoption expands across critical business functions. Ransomware attacks surged by more than 30% between 2024 and 2025, with attack frequency accelerating to nearly one incident every few seconds at the global level. At the same time, data breach costs remain extremely high, placing heavy financial and operational pressure on cloud-dependent organizations.

The increasing exposure of cloud environments to malware, credential theft, and data exfiltration has made security a strategic priority rather than an IT function. Organizations are therefore investing heavily in cloud-based identity management, threat detection, and incident response platforms to reduce vulnerabilities. This growing dependence on advanced cloud security and governance frameworks continues to drive strong demand for integrated management and security services.

Regulatory Compliance and Data Protection Requirements

Governments and regulatory bodies worldwide are enforcing stricter data protection and cloud governance standards, pushing enterprises to upgrade their cloud security infrastructure. Regulations such as GDPR in Europe, along with financial, healthcare, and data-sovereignty frameworks, require organizations to ensure continuous monitoring, encrypted data handling, and strict access controls across cloud environments, particularly when handling sensitive or personally identifiable information.

These compliance obligations have transformed cloud security from a best-practice choice into a mandatory operational requirement. Organizations must maintain audit trails, enforce policies, and manage risk across multiple regions and platforms. As regulatory scrutiny increases and cross-border cloud deployments grow, enterprises are increasingly adopting specialized cloud management and security services to ensure compliance, transparency, and legal accountability.

High Implementation and Operational Costs

The deployment of advanced public cloud management and security platforms requires significant upfront investment in technology, skilled personnel, and system integration. Organizations must allocate budgets for security software, compliance tools, staff training, and third-party consulting services to build an effective cloud security framework. For small and mid-sized enterprises, these costs can be prohibitively high.

In addition to initial spending, enterprises incur ongoing expenses for software subscriptions, threat intelligence feeds, continuous monitoring, and regulatory audits. These recurring costs increase the total cost of ownership and place pressure on IT budgets. As a result, organizations with limited financial flexibility may delay or restrict investments in cloud management and security services, slowing adoption across price-sensitive segments.

Complexity of Multi-Cloud and Hybrid Cloud Management

As enterprises increasingly adopt multi-cloud and hybrid cloud architectures, managing security and governance across diverse environments becomes significantly more complex. Different cloud platforms have unique security models, interfaces, and compliance frameworks, making it difficult for organizations to maintain consistent visibility and control across their infrastructure.

This fragmentation increases the risk of misconfigurations, policy gaps, and data exposure, particularly when security tools and management platforms are not fully integrated. Organizations must invest additional time and resources to coordinate security operations across providers and on-premises systems. For enterprises lacking advanced cloud expertise, this complexity creates operational inefficiencies and heightens security risks, restraining wider adoption of public cloud management and security solutions.

Zero Trust Architecture Adoption and Identity Security Focus

Zero Trust security is rapidly becoming the foundation of modern cloud protection strategies, replacing traditional perimeter-based models with continuous identity verification and least-privilege access controls. As organizations move critical workloads to public cloud platforms, protecting user identities, applications, and data access points has become central to cybersecurity planning, driving strong demand for cloud-based identity and access management solutions.

The rising adoption of multi-factor authentication, identity governance, and behavioral analytics is creating significant growth opportunities for providers delivering Zero Trust–aligned platforms. Enterprises increasingly seek integrated solutions that combine identity security with real-time threat detection and automated incident response. This shift is opening new revenue streams for vendors offering comprehensive Zero Trust ecosystems tailored to cloud-first and remote-work environments.

Cloud Security Posture Management and Automated Compliance Solutions

The growing complexity of hybrid and multi-cloud environments is driving strong demand for Cloud Security Posture Management solutions that provide continuous visibility and automated risk remediation. Organizations must monitor thousands of configurations, access controls, and compliance requirements across distributed cloud infrastructures, making manual oversight impractical and highly error-prone.

CSPM platforms address this challenge by enabling real-time scanning, automated policy enforcement, and compliance reporting across multiple cloud providers. As regulatory scrutiny intensifies and cloud environments expand, enterprises are prioritizing automated compliance and risk management. Vendors offering advanced CSPM solutions, particularly those integrating artificial intelligence for predictive risk detection and proactive remediation, are well-positioned to capture high-growth opportunities within the public cloud management and security services market.

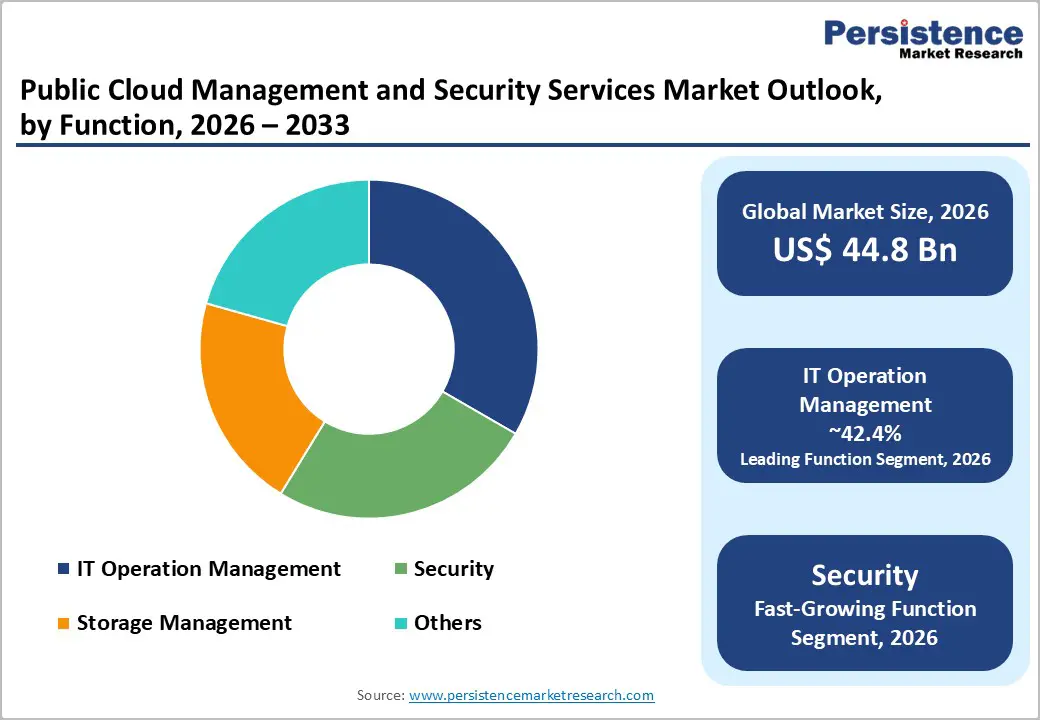

IT Operations Management represents the leading functional segment in the public cloud management and security services market, accounting for approximately 42.4% of total demand in 2025. Enterprises prioritize this function to ensure optimal performance, cost efficiency, and system reliability across dynamic cloud environments. Core capabilities such as infrastructure monitoring, capacity planning, automation, and incident management make IT operations management indispensable for both large enterprises and growing organizations.

The security function is emerging as the fastest-growing category, driven by intensifying cyber threats, regulatory pressure, and the rising volume of sensitive data hosted in cloud platforms. Organizations are expanding investments in identity protection, threat detection, and incident response to safeguard workloads. As cloud adoption deepens across industries, security services are becoming a strategic necessity rather than a supporting function.

Banking, Financial Services and Insurance (BFSI) dominate the public cloud management and security services market, holding an estimated 28.3% share in 2025. Financial institutions rely heavily on cloud platforms while remaining subject to strict regulatory requirements, including data protection, transaction security, and auditability. High-value customer data and the need for continuous system availability drive sustained investments in encryption, identity management, and threat monitoring solutions.

Healthcare is the fastest-growing vertical as hospitals, insurers, and life sciences organizations rapidly migrate clinical systems, patient records, and analytics platforms to the cloud. Protecting sensitive health data and ensuring uninterrupted service delivery are now critical priorities. The sector’s shift toward digital healthcare, telemedicine, and cloud-based research platforms is accelerating demand for robust cloud management and security solutions.

Large enterprises account for the largest share of the public cloud management and security services market, representing approximately 65.7% in 2025. Their complex multi-cloud infrastructures, global operations, and regulatory obligations require enterprise-grade platforms that provide centralized governance, advanced security, and seamless integration across business units. These organizations typically invest in high-end solutions offering scalability, automation, and comprehensive risk management capabilities.

Small and medium-sized enterprises are emerging as the fastest-growing customer segment, increasingly adopting public cloud services to support digital transformation. Rising cyber risks and compliance requirements are prompting SMEs to invest in cloud security and management platforms to enhance resilience and operational efficiency. Vendors offering scalable, easy-to-deploy, and cost-effective solutions are seeing strong traction within this expanding customer base.

Identity and Access Management (IAM) and user authentication represent the leading security service category, capturing approximately 30.5% of total demand in 2025. IAM serves as the foundation of cloud security by controlling who can access cloud resources and under what conditions. Widespread adoption of multi-factor authentication, single sign-on, and identity governance reflects enterprises’ focus on securing user access across distributed cloud environments.

Security Information and Event Management (SIEM) is the fastest-growing security service category as organizations seek real-time visibility into threats and anomalies across their cloud infrastructure. Increasing cyberattack sophistication and regulatory requirements for continuous monitoring are driving demand for advanced log analysis, incident detection, and response capabilities. SIEM platforms are becoming central to enterprise cloud security strategies.

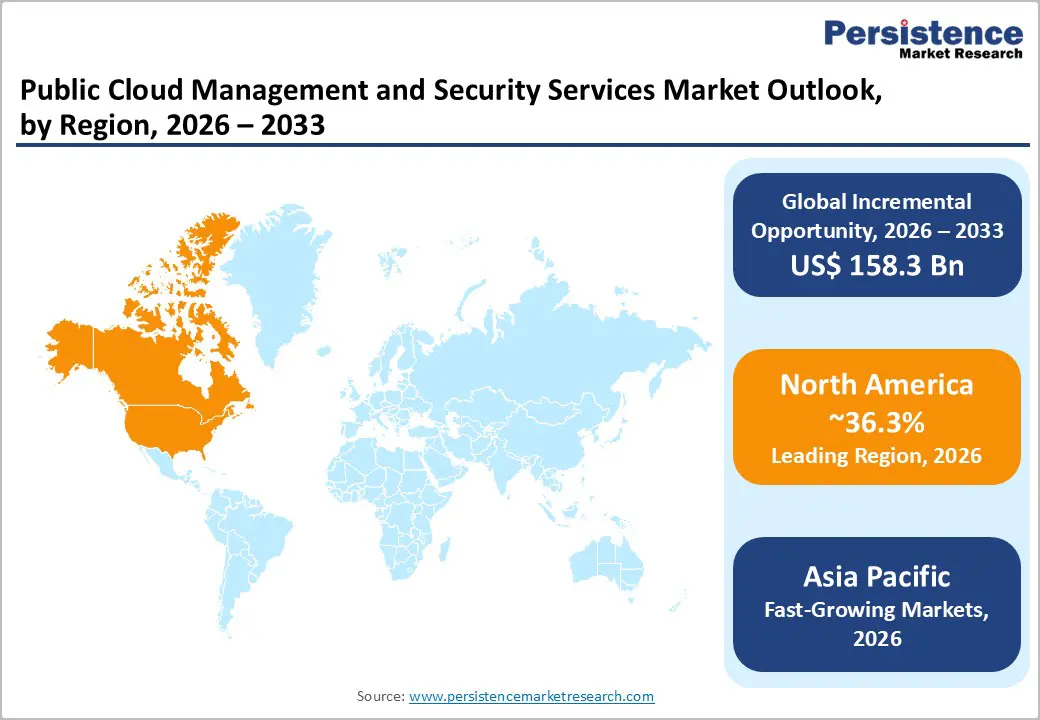

North America leads the public cloud management and security services market, accounting for approximately 36.3% of global revenue in 2025. The region benefits from advanced cloud infrastructure, high enterprise cloud adoption, and strong investments in cybersecurity. Large-scale deployments by technology firms, financial institutions, healthcare organizations, and government agencies generate sustained demand for cloud governance, identity management, and threat monitoring platforms.

Regulatory compliance and cyber risk mitigation are major growth drivers across the region. Organizations must comply with standards such as HIPAA, SOX, FedRAMP, and NIST, which require continuous monitoring and strict access controls. The region is also a hub for innovation in Zero Trust, AI-based threat detection, and cloud security posture management, further strengthening its leadership.

Europe represents a highly regulated and fast-expanding market for public cloud management and security services, driven by strict data protection and compliance mandates. The region’s regulatory framework, led by GDPR and the EU Cloud Code of Conduct, requires organizations to implement strong data governance, access controls, and audit mechanisms. These requirements are contributing to strong investment activity across enterprises and public sector organizations.

The European market is projected to grow at a CAGR of 24.8%, reflecting accelerating cloud adoption across financial services, healthcare, and government sectors. Demand is rising for sovereign cloud platforms, data residency solutions, and continuous compliance tools. As European companies prioritize digital transformation while maintaining privacy and security, cloud management and security services are becoming a strategic necessity.

Asia Pacific is emerging as the fastest-growing regional market, expected to increase its global share from approximately 25.1% in 2025. Rapid digitalization, government-backed cloud initiatives, and expanding IT infrastructure across China, India, Japan, and Southeast Asia are driving strong demand for cloud management and security solutions.

Regulatory developments such as India’s data protection laws, China’s data security regulations, and regional data localization policies are reinforcing the need for secure cloud platforms. Enterprises across manufacturing, financial services, and telecommunications are increasingly adopting cloud-based operations. The region’s expanding 5G networks, IoT deployments, and edge computing environments further accelerate demand for advanced cloud governance and cybersecurity capabilities.

The public cloud management and security services market is moderately consolidated, dominated by hyperscale cloud platform providers offering integrated management, security, and compliance tools. These leaders leverage scale, platform integration, and comprehensive service portfolios to maintain market share and strengthen customer retention, while continuously enhancing native cloud security and automation capabilities.

Specialized cloud security vendors and managed service providers compete through differentiated technologies, industry-specific expertise, and customer-centric delivery models. Strategic acquisitions, focus on cloud-native security, AI-powered threat detection, automated compliance, and Zero Trust frameworks, along with partnerships with systems integrators, are key strategies enabling expansion into enterprise segments with complex cloud governance and security requirements.

The market is projected to reach US$ 44.8 billion in 2026 and expand to US$ 203.1 billion by 2033, at a CAGR of 24.1%, driven by enterprises’ focus on cloud security and regulatory compliance.

Growth is fueled by rising cyber threats, stringent regulations (GDPR, HIPAA, PCI DSS), increasing cloud adoption, digital transformation, and the need for continuous security monitoring across hybrid and multi-cloud environments.

North America leads with approximately 36.3% global market share, supported by advanced IT infrastructure, high cloud adoption, regulatory compliance, and strong enterprise security investments.

Cloud Security Posture Management (CSPM) solutions offer the highest-growth opportunity, driven by automated compliance and multi-cloud monitoring needs.

Major market participants include hyperscale cloud providers Amazon Web Services, Microsoft, Google Cloud, and Oracle.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Function

Vertical

Enterprise

Security

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author