ID: PMRREP33307| 200 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

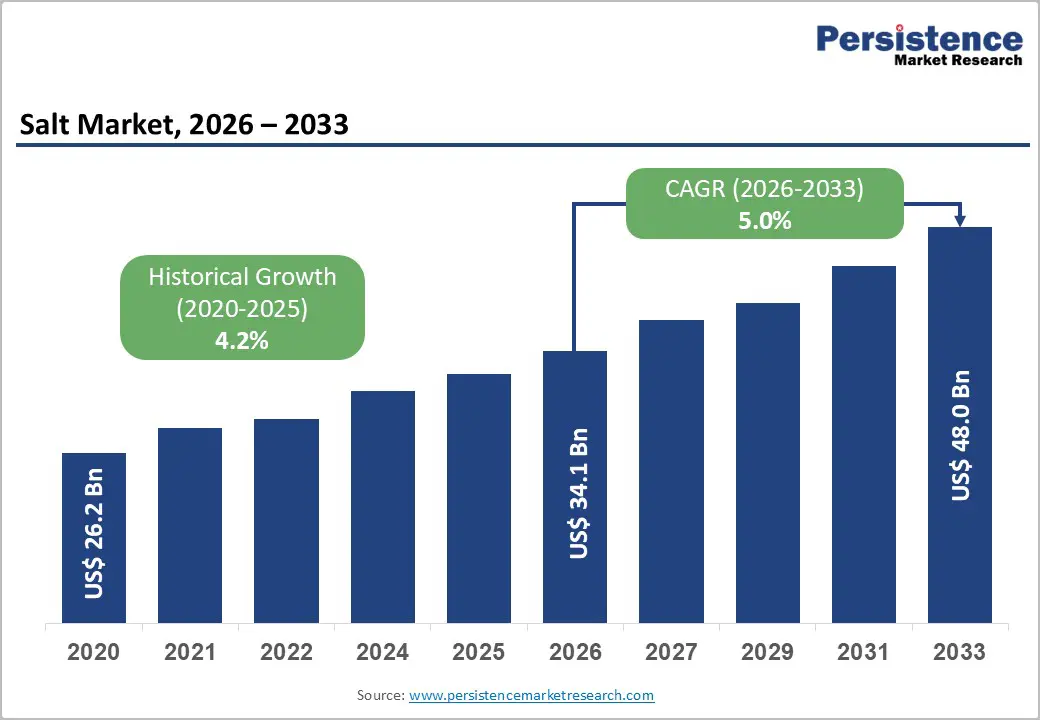

The global salt market size is likely to be valued at US$ 34.1 billion in 2026 to US$ 48.0 billion by 2033. The market is projected to record a CAGR of 5.0% during the forecast period from 2026 to 2033.

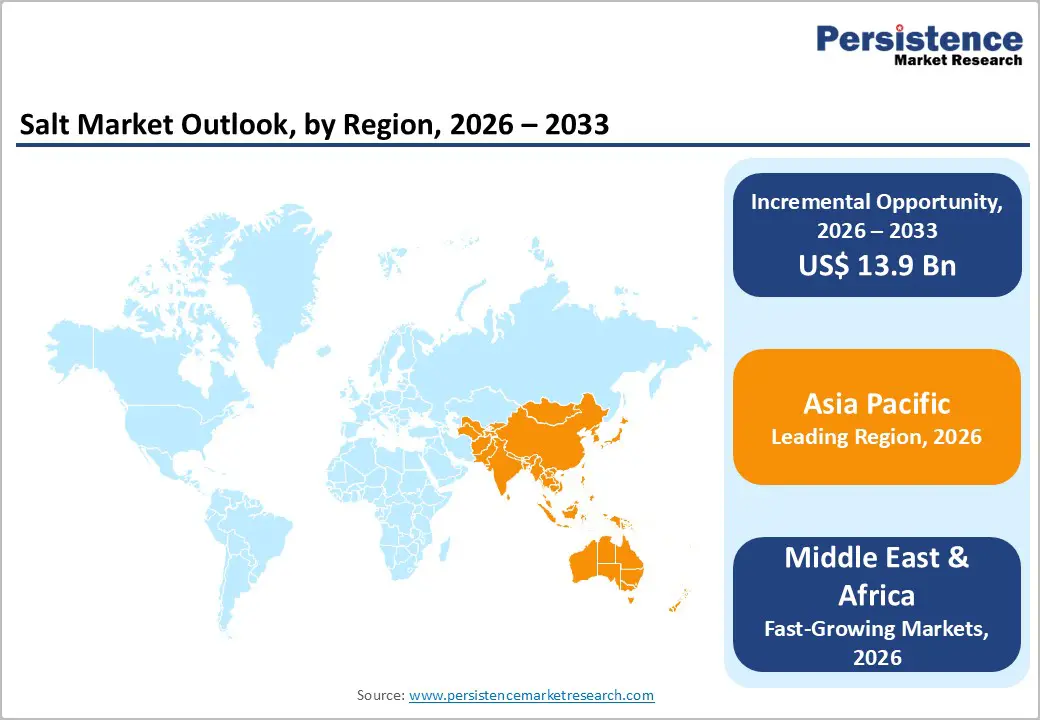

The global market is growing steadily, fueled by rising digestive health awareness, increasing gut-related disorders, and preventive healthcare adoption. Asia-Pacific leads and grows fastest, driven by shifting lifestyles, expanding nutraceutical retail and e-commerce, higher disposable incomes, and growing consumer focus on probiotics, prebiotics, and gut wellness, boosting demand for functional and specialty salts.

| Key Insights | Details |

|---|---|

| Global Salt Market Size (2026E) | US$ 34.1 Bn |

| Market Value Forecast (2033F) | US$ 48.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.0% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.2% |

Expansion of food processing significantly drives salt consumption because processed and packaged foods contain high levels of sodium chloride for preservation, flavour, and texture. In many developed countries, 75-80% of sodium intake comes from processed foods and ready meals, rather than from salt added at the table or in cooking, highlighting the role of industrial food production in salt use. This reliance on processed foods for daily sodium highlights how growth in food manufacturing directly boosts demand for salt across supply chains from ingredient sourcing to finished products.

Food processing drives salt demand further because it contributes to iodine nutrition and food safety. Research in Thailand showed that iodized salt in processed foods met nearly 100% of the estimated average requirement for adults, indicating that salt used in industrial food production is a major dietary source of essential micronutrients. Additionally, dietary sodium from packaged foods contributes substantially to overall salt intake, with studies finding that about one-third of dietary sodium in China comes from pre-packaged foods, underscoring the scale of salt used in food processing.

Environmental concerns around salt production increasingly restrain market growth, particularly in mining and solar evaporation operations. Salt mining alters land surfaces and can disrupt local ecosystems; for example, the U.S. Environmental Protection Agency notes that underground mining and solution mining of salts can lead to subsidence and groundwater contamination if not properly managed. In coastal areas, extensive salt pan development for solar-evaporated salt has been linked to loss of mangroves and wetland habitats, which the United Nations Environment Programme (UNEP) identifies as critical for biodiversity and coastal protection. These environmental risks create regulatory scrutiny and higher compliance costs for producers.

In agriculture and water systems, salinization the accumulation of salts in soil and water is a growing environmental issue that feeds back into the salt industry’s reputation. The Food and Agriculture Organization (FAO) reports that over 20% of irrigated lands worldwide are affected by salinity, reducing productivity and stressing ecosystems. Elevated salinity also degrades freshwater resources, with the U.S. Geological Survey (USGS) noting that road salt runoff contributes to higher chloride levels in rivers and lakes, impacting aquatic life and freshwater quality. (USGS Water-Quality Information). These environmental constraints pressure producers to adopt cleaner technologies and can limit expansion in sensitive regions.

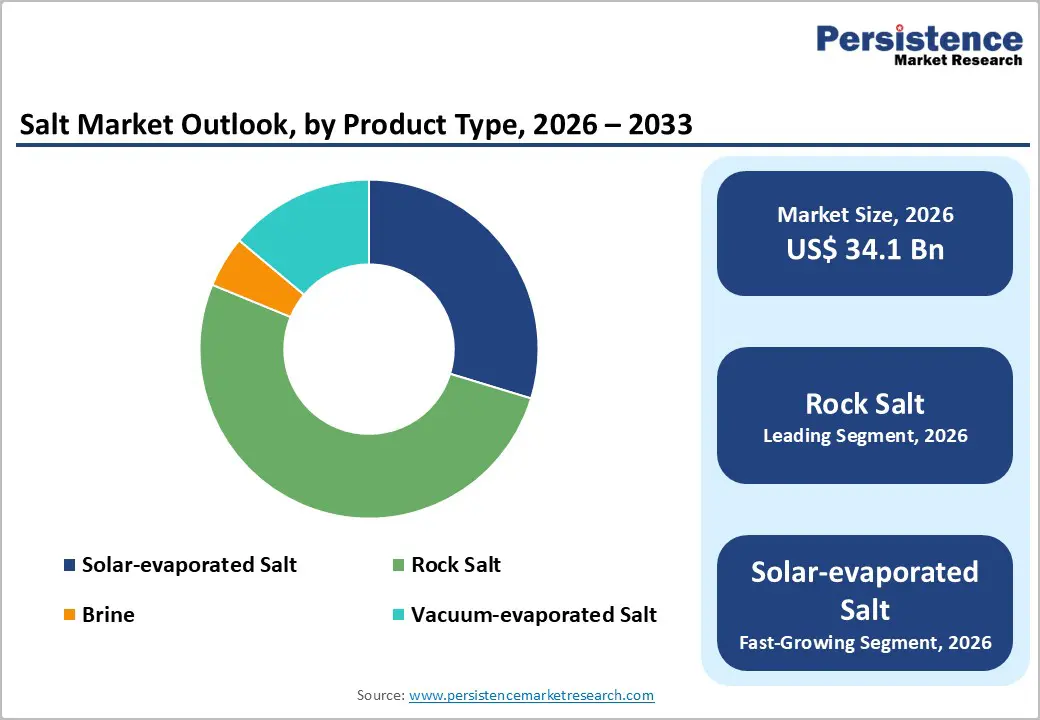

Solar-evaporated salt production leverages natural sunlight and wind to concentrate seawater, reducing energy use and carbon emissions compared with energy-intensive mechanical evaporation. According to the U.S. Energy Information Administration (EIA), renewable thermal processes such as solar evaporation can significantly cut fossil fuel consumption in industrial applications. This presents an opportunity for salt producers to lower operational costs and environmental impact while meeting sustainability commitments. Governments increasingly support renewable-based production: for example, India’s Ministry of New and Renewable Energy actively promotes solar utilization in industrial processes, providing policy incentives that can benefit solar salt producers.

Adoption of solar-evaporated methods also aligns with water conservation priorities. The United Nations Water Assessment Programme (UN WWAP) reports that efficient use of natural evaporation conserves water resources versus conventional processing that often requires heated inputs. In coastal regions where solar evaporation is feasible, solar salt works reduce dependence on fossil fuels and help manage saline effluent more naturally, lowering regulatory risks linked to wastewater discharge. These environmental and policy trends create a clear growth path for solar-evaporated and sustainable salt production within the broader Salt Market.

Rock Salt product occupies 51.5% share of the global market in 2025, due to its versatility, availability, and cost-effectiveness, supporting a wide range of applications in industrial, food, and infrastructure sectors. In the United States, rock salt accounts for roughly 40-43% of total salt usage, with highway de-icing alone consuming around 41-42%, highlighting its critical role in public safety during winter. Beyond de-icing, rock salt is a primary raw material for chemical industries, including caustic soda, chlorine, and other chloride-based products, due to its high purity and large natural deposits. Its cost-efficient extraction, combined with year-round demand across industrial, municipal, and food processing sectors, ensures rock salt remains the dominant product type globally.

Chemical manufacturing dominates the salt market because sodium chloride is a critical raw material for foundational industrial chemistry, particularly the chlor-alkali process used to produce chlorine and caustic soda, which are indispensable in manufacturing PVC, water-treatment chemicals, detergents, glass, and other commodities. According to the U.S. Geological Survey (USGS), the chemical industry accounted for about 38-39% of total salt sales in the United States, with most salt used as brine feedstock in chlorine and caustic soda production. Chlor-alkali processes rely on electrolyzing salt brine to yield these basic chemicals, and this demand underpins consumption in textiles, paper, plastics, and metal processing worldwide. Global chlor-alkali output exceeds 65 million metric tons annually, reflecting the scale of salt requirements tied to chemical manufacturing.

Asia Pacific dominates the salt market with 40.5% share in 2025, because it hosts the largest salt producers and consumers globally, with China alone consuming around 66-79 million tons annually, far exceeding other countries in the region. China’s massive industrial base, including chlor-alkali, chemicals, textiles, and water treatment, drives huge salt demand, while India is a top-three global producer with about 30 million tons of production annually and significant exports to neighbouring markets. India’s output supports both domestic industrial use and international demand, especially for chlor-alkali feedstock. The region’s extensive coastline and favourable climates also enable large-scale solar-evaporated salt production, supplying both local industries and export markets. These factors together make Asia Pacific the largest and fastest-growing salt market worldwide.

Europe is an important region in the salt market because it combines significant production capacity, diverse end-use demand, and well-developed industrial infrastructure. European salt production capacity is substantial, with estimates showing production near 58?million tons, led by countries such as Germany (about 14?million tons), France, and the Netherlands, reflecting strong local supply and industrial usage. Consumption remains high, with major uses in chemical manufacturing and de-icing across Northern and Eastern Europe, where seasonal winters drive infrastructure demand. European salt consumption patterns such as high per-capita usage in countries like Bulgaria (around 369?kg per person) and Germany (~150?kg per person) illustrate robust regional demand. These production and consumption dynamics ensure Europe remains a key contributor to global salt supply and usage.

North America is one of the fastest-growing regions in the salt market due to persistent demand from highway de-icing, chemical manufacturing, and water treatment sectors. In the United States alone, salt production was about 42?million metric tons in 2024, with roughly 41?percent used for road de-icing during winter, reflecting strong infrastructure-driven consumption. Domestic salt sold or used for chemical applications such as chlor-alkali feedstock accounts for another significant portion, underpinning year-round industrial demand. U.S. Geological Survey data also show growth in domestic salt production over the past decade, driven by expanded capacity in states like Kansas, Louisiana, and Michigan. Simultaneously, increasing municipal and industrial water-softening applications further support rising salt use, reinforcing North America’s position as a rapidly expanding regional market.

Leading salt market companies focus on high-quality, sustainable, and versatile products. Investments target purity, specialty formulations, and diverse applications. R&D emphasizes efficiency, environmental compliance, and safe production methods, while collaborations with industry and regulatory experts enhance reliability. These strategies drive innovation, expand industrial and consumer usage, and strengthen the global adoption of rock, solar, and specialty salts.

The global salt market is projected to be valued at US$ 34.1 Bn in 2026.

Rising industrial demand, food processing expansion, highway de-icing, chemical manufacturing, and specialty salt consumption drive growth.

The global salt market is poised to witness a CAGR of 5.0% between 2026 and 2033.

Specialty salts, solar-evaporated production, sustainable practices, fortified salts, clean-label products, and emerging market expansion offer opportunities.

Ahir Salt Industries, Amagansett Sea Salt, Cargill Incorporated, Compass Minerals, Detroit Salt Co., ITsC LIMITED.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author