ID: PMRREP35268| 192 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

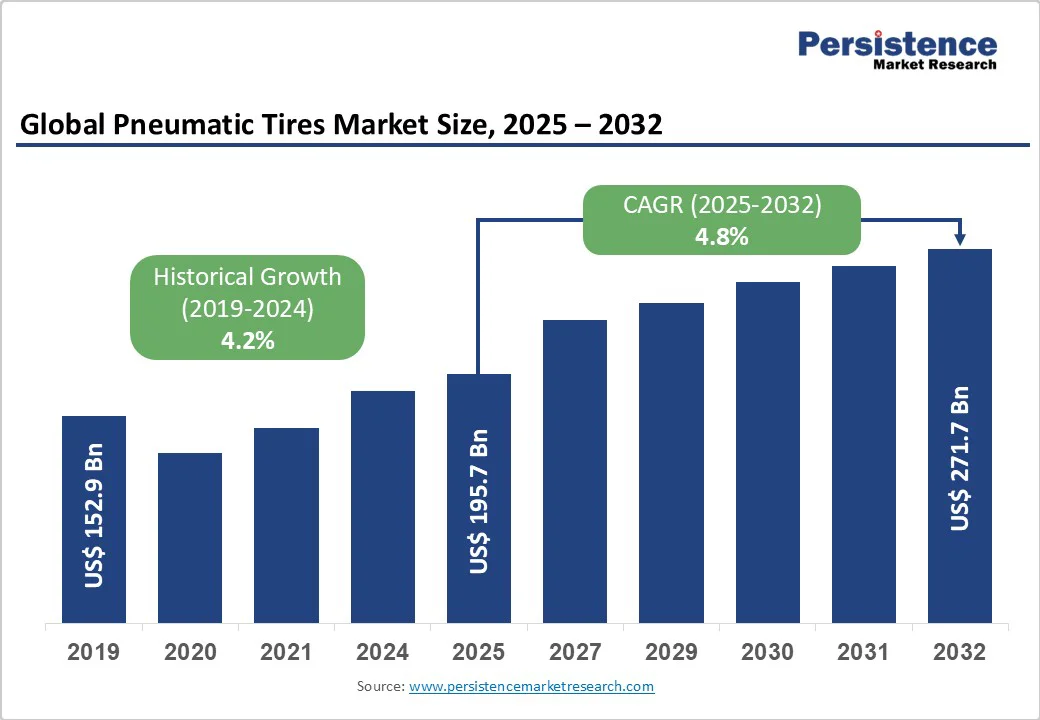

The global pneumatic tires market size is likely to be valued at US$ 195.7 billion in 2025, and is projected to reach US$ 271.7 billion by 2032, growing at a CAGR of 4.8% during the forecast period 2025 - 2032.

The market is expanding due to surging global vehicle production and the rising adoption of electric vehicles (EVs), which require specialized pneumatic tires for enhanced efficiency and performance.

The International Organization of Motor Vehicle Manufacturers (OICA) reported a 10% increase in worldwide vehicle production to 93,546,599 units in 2023, driving tire demand across passenger and commercial segments. Furthermore, advancements in tire technology, including low-rolling-resistance designs, align with stricter emission regulations, further boosting market momentum as manufacturers innovate to meet consumer and regulatory needs for fuel-efficient solutions.

| Key Insights | Details |

|---|---|

| Pneumatic Tires Market Size (2025E) | US$ 195.7 Bn |

| Market Value Forecast (2032F) | US$ 271.7 Bn |

| Projected Growth CAGR (2025 - 2032) | 4.8% |

| Historical Market Growth (2019-2024) | 4.2% |

Global vehicle production continues to rise, particularly in China and India, fueling the demand for pneumatic tires among original equipment manufacturers (OEMs) as well as replacement channels. According to the India Brand Equity Foundation (IBEF), passenger vehicles, three-wheelers, two-wheelers, and quadricycles output reached 1,921,268 units in December 2024, highlighting robust automotive growth that directly translates to higher tire consumption.

Pneumatic tires, essential for vehicle stability and load bearing, benefit from this trend as manufacturers scale production to meet rising sales volumes. The integration with the automotive tire market further amplifies this, as pneumatic variants dominate vehicle fitments for superior traction and durability.

Consumers and fleets are increasingly prioritizing fuel-efficient pneumatic tires to reduce operational costs and comply with environmental standards, driving market expansion through technological innovations.

The European Union's Regulation (EC) No 661/2009 mandates low-rolling-resistance tires to cut CO2 emissions, prompting manufacturers to develop advanced rubber compounds and tread patterns that enhance fuel economy by up to 5-7% in passenger vehicles. This shift is evident in the growing adoption of radial pneumatic tires, which offer better aerodynamics and longevity compared to traditional options.

Fluctuations in natural rubber and synthetic material costs pose significant challenges to pneumatic tire manufacturers, squeezing margins and slowing production scalability. Natural rubber prices surged by 20% in 2024 due to supply disruptions in major producers like Thailand and Indonesia, as reported by the Association of Natural Rubber Producing Countries (ANRPC), impacting the cost structure of tire production which relies heavily on these inputs.

This volatility leads to higher end-product prices, deterring price-sensitive consumers in developing regions and potentially reducing replacement demand. Furthermore, geopolitical tensions and weather-related crop failures exacerbate shortages, forcing companies to seek alternatives that may compromise tire quality.

Increasing regulatory scrutiny on tire emissions and waste is restraining growth by raising compliance costs and limiting material usage in pneumatic tire manufacturing. The European Union (EU)'s Euro 7 Regulation (EU) 2024/1257 targets a 30% reduction in microplastic emissions from tire wear by 2030, requiring costly reforms in production processes and materials, which could increase manufacturing expenses by 10-15%.

In the U.S., similar mandates under the Environmental Protection Agency (EPA) for reduced particulate matter from brakes and tires add layers of testing and certification burdens. These regulations, while promoting sustainability, slow innovation timelines and deter investment in traditional pneumatic designs, especially in regions with fragmented supply chains.

Market participants can capitalize on the shift toward eco-friendly pneumatic tires integrated with IoT sensors, targeting the growing electric vehicle segment for enhanced performance monitoring. With global EV sales reaching 17 million units in 2024 per the International Energy Agency (IEA), the demand for low-rolling-resistance pneumatic tires with embedded sensors for pressure and wear tracking is surging.

Recent developments, such as Michelin's investment in bio-based rubber compounds, demonstrate how companies can reduce carbon footprints while improving durability, aligning with consumer preferences for green products. This opportunity extends to fleet operators seeking predictive maintenance to cut downtime, fostering partnerships with OEMs.

Opportunities abound in Asia Pacific's infrastructure boom, where pneumatic tires for commercial vehicles will see heightened demand from road construction and urbanization initiatives. The Asian Development Bank (ADB) forecasts US$ 1.7 trillion in infrastructure spending across the region by 2030, generating a massive need for durable off-road pneumatic tires through projects such as India's Bharatmala Pariyojana, which aims to construct 34,800 km of highways. Such multi-year, large-scale projects create avenues for manufacturers to supply specialized tires for heavy machinery, with growth potential in the industrial tires market as e-commerce logistics expand.

The radial segment is expected to lead with approximately 70% of the pneumatic tires market revenue share in 2025, driven by the superior fuel efficiency and handling characteristics of radial tires that outperform cross-ply alternatives in modern vehicles.

Radial construction, with cords aligned perpendicular to the direction of travel, reduces rolling resistance and enhances tread life by 20-30%, making it ideal for high-speed applications as per data from the U.S. Department of Transportation (DOT) on vehicle safety standards.

This dominance is justified by widespread adoption in passenger cars and trucks, where radial tires contribute to better fuel economy amid rising oil prices. The Society of Automotive Engineers (SAE) reports that radial designs handle 15% higher loads without deformation, supporting their prevalence in commercial fleets.

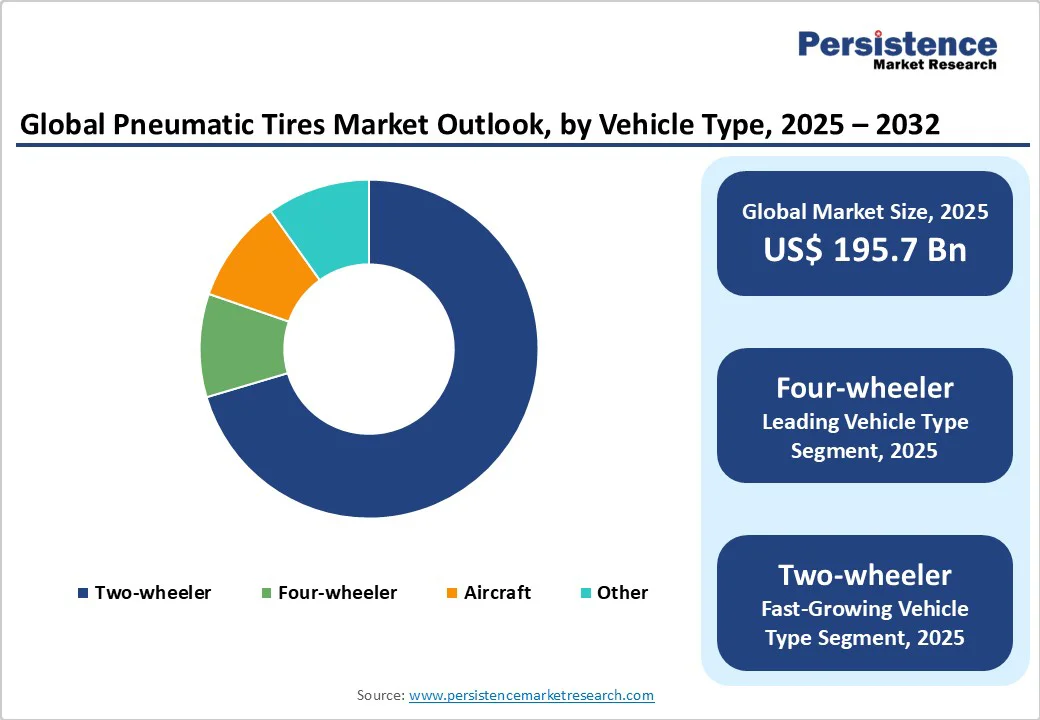

Four-wheelers, encompassing passenger cars and commercial vehicles, are likely to command about 65% of the pneumatic tires market revenues in 2025, propelled by the surge in personal and freight transportation needs worldwide. This segment's leadership stems from the high volume of vehicle production, with the OICA noting over 70 million four-wheeler units manufactured globally in 2023, necessitating robust pneumatic tires for stability and load capacity.

Passenger cars alone account for the bulk due to consumer demand for comfort and safety, while commercial vehicles benefit from pneumatic tires' ability to withstand heavy payloads, reducing downtime by 25% as per Federal Highway Administration (FHWA) studies. This justifies the segment's dominance, especially in logistics-driven economies.

The replacement segment is anticipated to hold roughly 75% market share in 2025, fueled by aging vehicle fleets and routine maintenance requirements that outpace new vehicle sales. With the average vehicle age reaching 12 years in the U.S., according to the Bureau of Transportation Statistics (BTS), replacement demand surges as tires wear out every 40,000-60,000 miles, ensuring steady aftermarket volumes.

This leadership is supported by economic factors, where cost-conscious consumers opt for replacements over upgrades, contributing to 80% of tire sales in mature markets such as Europe. Data from the European Tyre and Rubber Manufacturers' Association (ETRMA) indicates a 5% annual increase in replacement volumes due to extended vehicle lifespans.

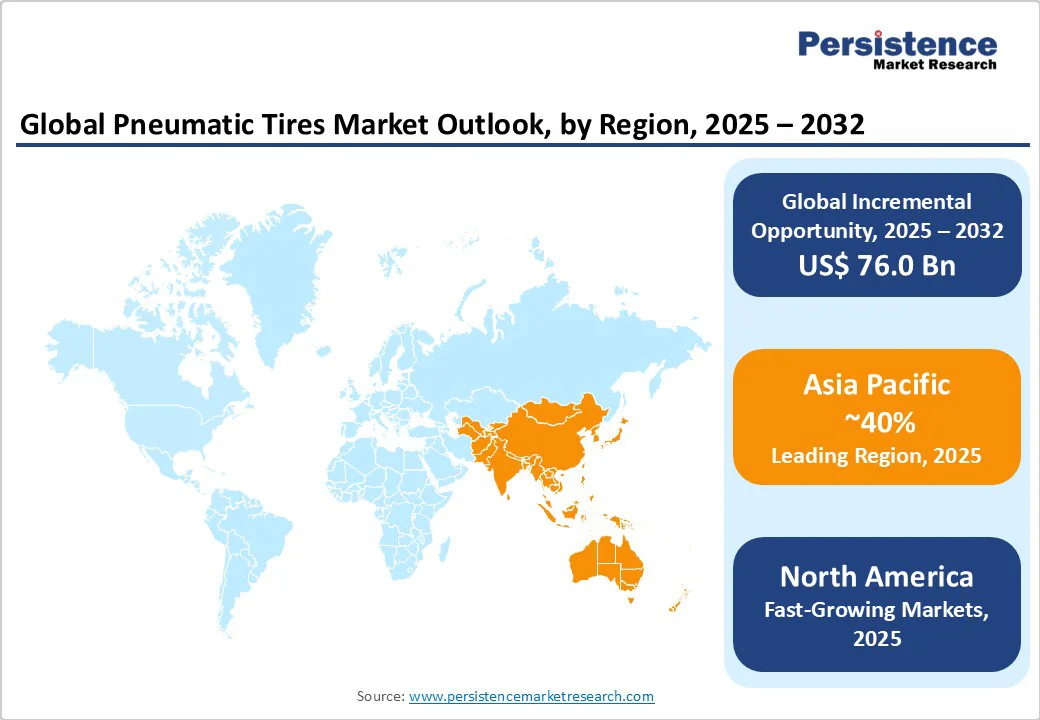

North America is forecasted to lead the pneumatic tire market share, with the U.S. dominating due to its advanced automotive ecosystem and stringent safety regulations. The National Highway Traffic Safety Administration (NHTSA) has mandated the incorporation of Tire Pressure Monitoring Systems (TPMS) on all vehicles since 2008, boosting the demand for compliant pneumatic tires that enhance safety and efficiency.

Notable developments, such as Goodyear's 2024 launch of EV-optimized tires, underscore the focus of the regional stakeholders on performance amid rising EV adoption. Being a pioneering innovation hub in automotive technologies, the North America market for pneumatic tires benefits from robust R&D investments, with companies leveraging proximity to OEMs such as Ford and General Motors for customized solutions. Regulatory frameworks, including the EPA's emission standards, are further promoting sustainable tire development, positioning North America as a benchmark for quality.

In Europe, the pneumatic tires market expansion is contingent on regulatory harmonization and sustainability considerations, with Germany, the U.K., France, and Spain at the forefront of performance-driven growth. The Euro 7 Regulation introduced in 2024 targets tire wear particles, compelling manufacturers to innovate low-emission designs, potentially cutting microplastics by 30% by 2030, as per European Commission goals. In Germany, the Federal Motor Transport Authority (KBA) reports a 7% rise in premium pneumatic tire sales in 2024, fueled by strict EU Tyre Labelling Regulation that rates tires on fuel efficiency and wet grip.

France and Spain are accruing gains from infrastructure projects, while the U.K. post-Brexit aligns with EU standards for seamless trade. The ETRMA highlights a 3% increase in all-season pneumatic tires in Q1 2025, reflecting consumer shifts toward versatile options amid variable weather. This regulatory environment fosters a mature market focused on eco-innovation.

Asia Pacific is anticipated to exhibits explosive growth in pneumatic tires, led by China, Japan, India, and ASEAN nations' manufacturing prowess and urbanization. China's new-energy vehicle sales hit 35.8% of passenger cars in 2024, per the China Association of Automobile Manufacturers (CAAM), spurring huge demand for specialized pneumatic tires with reinforced sidewalls for EV performance.

In India, the Bharatmala project aims at adding 83,677 km of roads by 2025, according to the Ministry of Road Transport and Highways (MoRTH), boosting commercial vehicle tire needs in the process. Japan's focus on precision engineering drives high-performance variants, while ASEAN's logistics surge, with 12% GDP growth in e-commerce, amplifies the demand for replacement services.

The global pneumatic tires market exhibits a consolidated structure, with top players such as Michelin, Bridgestone, and Goodyear controlling over 50% share through extensive R&D and global supply chains. Companies pursue expansion via strategic acquisitions and joint ventures, such as facility investments in Asia for cost efficiency.

Key differentiators include sustainable materials and smart technologies, while emerging models emphasize direct-to-consumer sales and subscription-based fleet services. This concentration fosters innovation but pressures smaller firms to specialize in niches.

The global pneumatic tires market is projected to reach US$ 195.7 billion in 2025.

Increasing global vehicle output, with 93.5 million units in 2023 per OICA, and rising EV adoption are fueling the demand for efficient pneumatic tires.

The market is poised to witness a CAGR of 4.8% from 2025 to 2032.

Sustainable smart tires for EVs, projected to add US$ 5-7 billion in revenue by 2030, and IoT integration for predictive maintenance are key market opportunities.

Some leading market players include Michelin, Bridgestone Corporation, and Goodyear.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Vehicle Type

By Sales Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author