ID: PMRREP35350| 187 Pages | 23 May 2025 | Format: PDF, Excel, PPT* | Healthcare

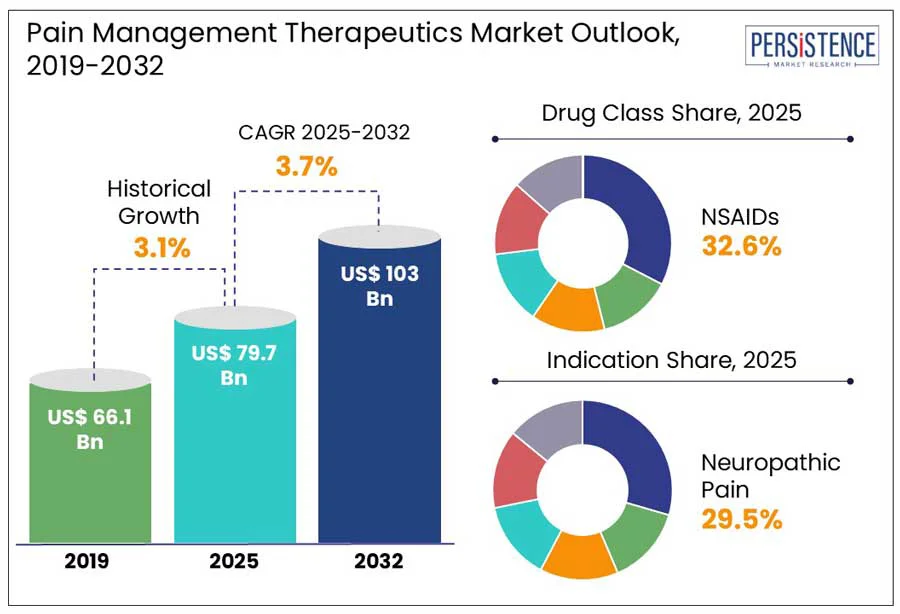

The global pain management therapeutics market size is predicted to reach US$ 103.0 Bn in 2032 from US$ 79.7 Bn in 2025. It will likely witness a CAGR of around 3.7% in the forecast period between 2025 and 2032.

Pain management therapeutics stand at the forefront of modern medicine, addressing one of the most complex challenges faced by the healthcare sector today. According to the 2024 Global Burden of Disease study, chronic pain affects more than 20% of the adult population worldwide. Hence, demand for effective, safe, and targeted pain relief solutions has never been more urgent. The evolving landscape is marked by a rising emphasis on personalized medicine, regulatory scrutiny, and innovations in pharmaceuticals.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Pain Management Therapeutics Market Size (2025E) |

US$ 79.7 Bn |

|

Market Value Forecast (2032F) |

US$ 103.0 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.1% |

Increasing prevalence of chronic back pain and arthritis is anticipated to significantly push the pain management therapeutics market growth in the foreseeable future, finds Persistence Market Research. This is particularly evident among the geriatric population with the rising inclination toward early clinical intervention. As per the 2023 Global Burden of Disease Study, for instance, low back pain is now considered the main cause of disability globally, affecting approximately 620 Mn individuals.

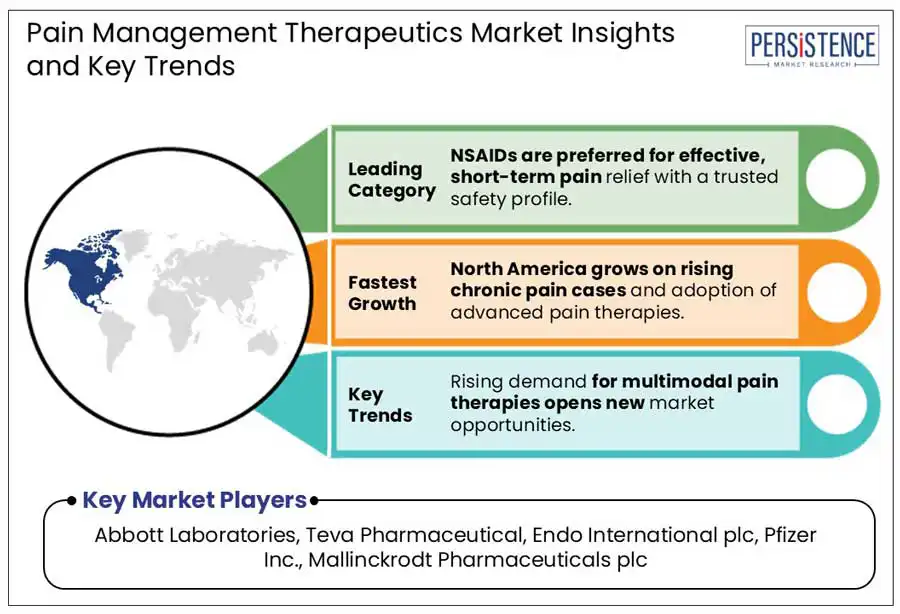

The study further mentioned that osteoarthritis affects over 528 Mn individuals worldwide. These conditions are increasingly being diagnosed at early stages, mainly due to rising public awareness campaigns and enhanced diagnostic access. This supports a long-term and continuous demand for pharmacological pain relief, including non-opioid pain patches. A key trend in the market is the ongoing shift toward multimodal therapies such as topical pain relief formulations and NSAIDs.

The risks of adverse effects, addiction, and dependence have become key limitations in the prescription and development of pain management therapeutics. In the U.S. alone, opioid-related overdose deaths surpassed 81,000 in 2023, as reported by the Centers for Disease Control and Prevention (CDC). This highlighted how dependence risks have accelerated widespread regulatory pushbacks. It has resulted in a drop in opioid prescriptions and has also left a therapeutic gap for chronic pain patients, mainly those unresponsive to non-opioid alternatives. Even advanced cancer pain management has faced complications with clinicians increasingly demanding safe yet effective multimodal approaches to lower long-term opioid exposure.

Apart from opioids, adverse effects associated with commonly prescribed drugs, including gabapentinoids and NSAIDs, are contributing to therapeutic hesitancy. Long-term NSAID usage has been linked to high risks of cardiovascular complications, kidney injury, and gastrointestinal bleeding, especially among the aging population. In Europe, the European Medicines Agency (EMA) issued a 2023 safety norm pointing to neuropsychiatric and renal adverse events related to prolonged gabapentinoid use such as gabapentin and pregabalin. This has led to new recommendations for stringent monitoring and dose adjustments in vulnerable groups.

?Developments in personalized medicine are predicted to create new opportunities in the field of pain management therapeutics through 2032. These are likely to enable safe, effective, and precise treatment approaches meeting the requirements of individual patient profiles. One of the most significant areas is pharmacogenomics, which involves analyzing genetic variations that influence how patients metabolize pain medications.

A 2023 study published in Nature Genetics found that more than 35% of variability in opioid response among chronic pain patients is predicted to be linked to genetic polymorphisms in CYP2D6 and OPRM1 genes. This has opened the door for genotype-guided therapy selection, mainly for antidepressants and opioids utilized in neuropathic pain. Personalized approaches are also influencing how over-the-counter pain medication is recommended. Future models aim to detect which patients are likely to experience reduced efficacy or high risk of side effects from commonly used drugs, including acetaminophen or ibuprofen.

Based on drug class, the market is segregated into NSAIDs, opioids, anesthetics, antidepressants, and anticonvulsants. Among these, NSAIDs are anticipated to generate a share of approximately 32.6% in 2025. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) are highly preferred due to their dual functionality. They can reduce inflammation and simultaneously lower pain by inhibiting cyclooxygenase (COX) enzymes. This mechanism provides a clear advantage over other analgesics, including acetaminophen, which lacks anti-inflammatory properties.

In clinical settings, NSAID APIs are the first-line therapy for a wide range of conditions such as post-operative pain, rheumatoid arthritis, and osteoarthritis. A 2024 study published in The Lancet Rheumatology, for instance, revealed that more than 65% of osteoarthritis prescriptions in North America still include NSAIDs as the initial pharmacologic intervention, despite the availability of new biologics.

Antidepressants, on the other hand, have become a significant drug class owing to their ability to modulate central pain pathways independent of their mood-altering effects. These drugs help improve the descending inhibitory pain pathways by raising norepinephrine and serotonin levels in the spinal cord. This further suppresses pain signal transmission. A 2023 report published in the Journal of Pain, for example, found that Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs) can significantly lower pain intensity in patients with fibromyalgia and diabetic peripheral neuropathy, making them widely recognized as fibromyalgia antidepressants in clinical practice. The inclusion of antidepressants in pain guidelines is further supported by insurance reimbursements and regulatory approvals for specific conditions.

In terms of indication, the market is divided into arthritic pain, neuropathic pain, chronic back pain, cancer pain, and post-operative pain. Out of these, the neuropathic pain segment will likely to hold nearly 29.5% of the pain management therapeutics market share in 2025. This is attributed to its rising prevalence, resistance to traditional analgesics, and complex pathology. The global burden of chemotherapy-induced peripheral neuropathy, postherpetic neuralgia, and diabetic peripheral neuropathy is increasing rapidly.

As per the International Diabetes Federation, nearly 30% of the 537 Mn adults living with diabetes worldwide experience diabetic neuropathy, a key contributor to chronic pain and disability. Hence, several pharmaceutical companies are innovating their existing products to cater to this rising number of patients. Drugs such as amitriptyline, duloxetine, gabapentin, and pregabalin are being prescribed for neuropathic pain syndromes. Statista found that pregabalin alone generated more than US$ 1.1 Bn in global revenue in 2024.

Cancer pain, on the other hand, is predicted to witness a considerable CAGR from 2025 to 2032. This is because of its increasing prevalence across all stages of the disease and its multifaceted origin, ranging from tumor invasion to treatment-induced neuropathy. A 2023 study published in The Lancet Oncology revealed that more than 55% of patients undergoing active cancer treatment and 66% of those with advanced-stage cancer report moderate to severe pain. Hence, the requirement of a layered pharmacological strategy that includes non-pharmacological interventions, adjuvant analgesics, and opioid analgesics is rising.

North America is expected to account for a share of about 31.2% in 2025. This is attributed to a robust pharmaceutical pipeline, favorable reimbursement policies, and a high disease burden. The U.S. pain management therapeutics market will likely remain at the forefront through 2032 with the early adoption of novel treatments and the presence of a well-established healthcare infrastructure. As per a 2024 report by the Centers for Disease Control and Prevention (CDC), around 51.6 Mn adults in the U.S. live with chronic pain. This figure has been rising steadily owing to the surging prevalence of cancer, arthritis, and diabetes, as well as increased aging demographics.

The U.S. is further expanding due to the dominance of branded formulations, mainly in cancer and neuropathic pain segments. Drugs, including tapentadol (Nucynta), duloxetine (Cymbalta), and pregabalin (Lyrica) have witnessed high prescription volume, backed by clinician familiarity and their targeted efficacy. Regulatory scrutiny over opioid use, however, has influenced prescribing behaviors. Since the implementation of CDC’s revised opioid guidelines in 2022, healthcare professionals have turned to non-opioid pain treatments and adjuvant therapies. This has spurred innovations, including the development of extended-release local anesthetics and spinal cord stimulators.

In Europe, the market is currently undergoing a significant transition due to a rising focus on opioid scrutiny and evolving regulatory frameworks. According to the European Pain Federation, as of 2024, more than 150 Mn individuals in Europe suffer from chronic pain, with cancer pain, neuropathic pain, and musculoskeletal disorders being the primary indications. The economic burden is hence rising, encouraging government bodies to emphasize access to novel pharmacological options and multidisciplinary pain therapies, including cold pain therapy.

Unlike North America, where opioid use was promoted until recently, countries in Europe have traditionally followed more conservative prescribing patterns. Recent data from the European Monitoring Center for Drugs and Drug Addiction (EMCDDA), however, highlights a modest uptick in opioid prescriptions in Eastern and Southern Europe. It is primarily propelled by increasing cases of post-operative and cancer pain. Countries, including France and Germany, have shifted toward non-opioid therapies, specifically for chronic non-cancer pain. The German Federal Joint Committee (G-BA) recommended pregabalin and duloxetine as first-line treatments for diabetic neuropathy in 2023, eliminating opioids because of long-term safety concerns.

In Asia Pacific, the market is experiencing steady growth due to expanding healthcare access and rising disease burden. As per the World Health Organization’s (WHO) 2024 regional health report, chronic pain affects more than 30% of adults in countries such as South Korea, China, and Japan, with neuropathic and musculoskeletal conditions being the main causes. China is emerging as a prominent market owing to supportive regulatory reforms and robust domestic pharmaceutical activity.

In 2023, the country’s National Medical Products Administration (NMPA), for example, approved mirogabalin, a next-generation gabapentinoid, for diabetic peripheral neuropathic pain. This marked a shift toward non-opioid solutions to comply with global safety standards. Pain relief patches, especially those using buprenorphine or capsaicin are also gaining traction in China as localized, safer alternatives for managing chronic pain.

Japan is expected to be a significant hub in terms of clinical research and pain management infrastructure. According to a report by the Health and Global Policy Institute (HGPI), nearly 22.5% of adults in the country suffer from chronic pain. It is often managed through a combination of interventional and pharmacological therapies. The Japanese Pain Society has also been actively supporting the early use of SNRIs, including duloxetine and the transdermal buprenorphine patch for chronic musculoskeletal conditions. Eisai’s pain portfolio further witnessed a 15% year-over-year growth in 2023, spurred by rising demand for Lyrica and the increasing use of ramosetron-based agents in chemotherapy-induced pain.

The pain management therapeutics market is currently witnessing intense competition among start-ups, biotechnology companies, and well-established pharmaceutical manufacturers. They are focusing on digital and non-opioid therapeutics to attract the attention of patients. Leading companies are extending their portfolio of branded and generic analgesics. They are also investing in new formulations with rising scrutiny revolving around opioid misuse. Biotech companies and emerging players are striving to address the unmet requirements in chronic pain management through non-addictive mechanisms of action. They are exploring angiotensin receptor antagonists and sodium channel blockers for neuropathic pain.

The market is projected to reach US$ 79.7 Bn in 2025.

The increasing prevalence of chronic back pain and surging demand for multidisciplinary pain therapies are the key market drivers.

The market is poised to witness a CAGR of 3.7% from 2025 to 2032.

Strict government guidelines restricting the use of opioids and ongoing innovations in personalized medicine are the key market opportunities.

Abbott Laboratories, Teva Pharmaceutical, and Endo International plc are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Drug Class

By Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author