ID: PMRREP2840| 200 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

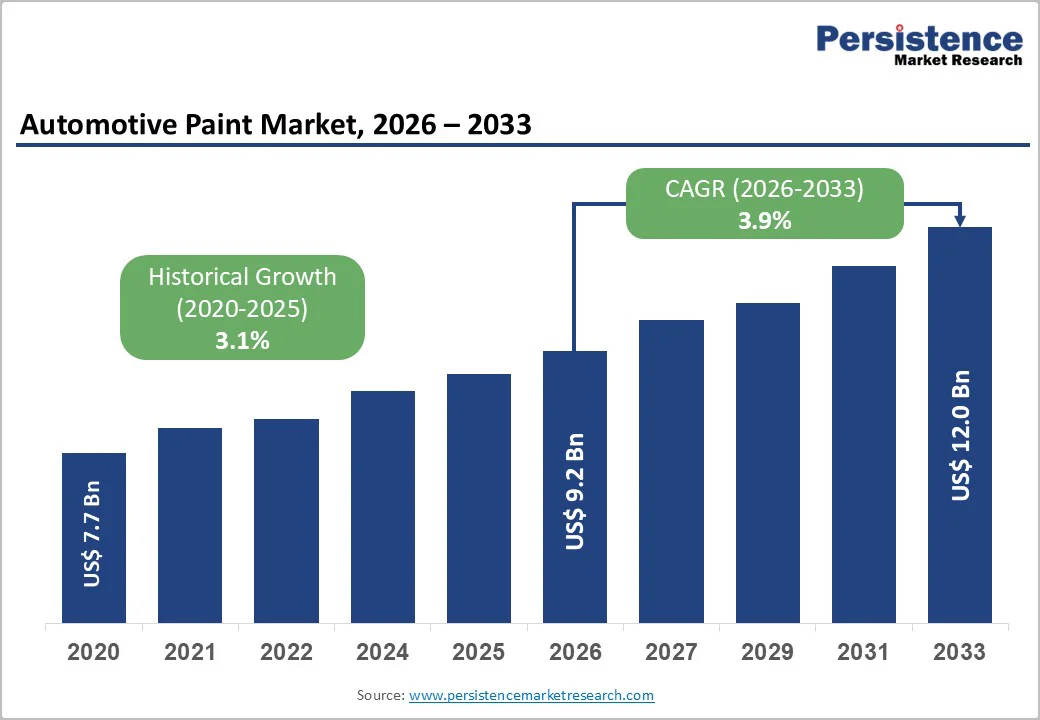

The global automotive paint market size is likely to be valued at US$ 9.2 Billion in 2026 and is expected to reach US$ 12.0 Billion by 2033, growing at a CAGR of 3.9% during the forecast period from 2026 and 2033.

The consistent expansion of the automotive paint sector is fundamentally driven by the recovery in global vehicle production rates following supply chain stabilizations and the aggressive shift toward electric vehicle (EV) manufacturing, which demands specialized coatings.

| Key Insights | Details |

|---|---|

| Automotive Paint Market Size (2026E) | US$ 9.2 Billion |

| Market Value Forecast (2033F) | US$ 12.0 Billion |

| Projected Growth CAGR (2026 - 2033) | 3.9% |

| Historical Market Growth (2020 - 2025) | 3.1% |

Global environmental agencies, such as the U.S. EPA and Europe’s ECHA, are enforcing strict VOC emission norms, pushing automakers and paint manufacturers to shift rapidly toward eco-friendly waterborne and high-solid coatings. These rules are not just compliance barriers; they are accelerating a major technological shift across the automotive value chain. Waterborne systems require advanced resin chemistry, which increases product value and lifts overall market revenue.

Emerging markets such as China and India are also enforcing strong “Blue Sky” regulations, raising demand for sustainable coating solutions. In November 2025, Covestro and Nippon Paint announced a partnership to jointly develop low-carbon, VOC-free technologies for OEM and refinish lines. By combining Covestro’s resin innovations with Nippon Paint’s application expertise, the collaboration directly supports stricter Asian and European emission mandates, proving that tightening regulations are a major catalyst for high-value sustainable coatings.

The global boom in Electric Vehicles (EVs) is creating a strong demand for specialised coatings engineered for battery efficiency, safety, and autonomous driving compatibility. Unlike traditional vehicles, EVs require thermal-management coatings for battery cooling and radar-transparent pigments to ensure smooth sensor performance. Their lightweight bodies, made from a mix of aluminium, steel, and carbon fiber, need primers and basecoats that bond uniformly across different materials. As EV production rapidly expands, led by Tesla, NIO, BYD, and Volkswagen, manufacturers require high-performance coating systems tailored to new engineering needs.

In September 2025, Akzo Nobel and NIO won the “Altair Enlighten Award” for a breakthrough Interpon A1000 coating that triples battery-plate durability and improves spraying efficiency by 50%. This example highlights how EV-specific technical requirements are driving demand for innovative, high-value coatings, making the EV industry one of the strongest growth engines for the Automotive OEM Coatings Market.

The automotive coatings industry depends heavily on petrochemical derivatives, pigments, titanium dioxide, and specialty resins-all materials highly impacted by fluctuations in crude oil prices and global supply disruptions. Recent geopolitical tensions and shipping bottlenecks have increased price volatility for these essential inputs. Because most coating suppliers operate under long-term pricing agreements with OEMs, they cannot fully pass on rising costs, which directly pressures profit margins. For many companies, unpredictable raw material costs force a shift in priorities from innovation to cost control, slowing R&D spending and new product development.

These challenges also affect delivery timelines and production planning, leading to delays across the automotive supply chain. Overall, raw material volatility creates financial instability for manufacturers and limits their flexibility to invest in advanced technologies, particularly during periods of high inflation or constrained chemical supply.

Shifting from solvent-borne coatings to advanced waterborne, UV-cured, and low-VOC systems requires substantial investment in new equipment and production infrastructure. Modern coating lines need specialized drying ovens, electrostatic sprayers, humidity control units, and energy-efficient curing systems-far different from legacy equipment. For many small and mid-sized manufacturers, especially in developing markets, the required capital expenditure is a barrier.

The ROI for these upgrades can be slow, making companies hesitant to adopt new technologies quickly. This challenge is especially visible in the automotive refinish sector and independent body shops, where older solvent-based systems remain common due to lower operational costs. The Automotive Wheel Coatings Market sees slower adoption rates because many regional plants still rely on conventional production lines. Consequently, high investment requirements limit the speed of technology transition, slowing down the widespread adoption of sustainable, high-performance coating solutions across developing economies.

Smart and functional coatings represent one of the most lucrative opportunities in the automotive coatings industry. Self-healing paints that repair scratches through heat or UV activation and solar-reflective coatings that reduce cabin temperature are gaining traction, especially among premium car buyers and EV manufacturers seeking efficiency benefits. These advanced coatings enhance vehicle longevity, improve performance, and support digitalization trends such as LiDAR and radar compatibility.

PPG Industries’ “Purple Basil” 2025 Color of the Year, launched under the “Kinetic” theme, which integrates both aesthetic and functional elements. The coating is engineered to work seamlessly with autonomous-vehicle sensors while offering region-specific finishes. As consumer demand shifts toward technology-enabled features, suppliers investing in smart coatings will gain access to higher-margin segments and strengthen their competitive position in next-generation mobility markets.

Emerging economies such as India, Indonesia, Brazil, and Vietnam are experiencing rapid growth in vehicle ownership, ageing fleets, and a booming used-car market-driving strong demand for refinish coatings. More vehicles on the road naturally increase collisions, repairs, repainting needs, and aesthetic upgrades for resale. This trend presents major opportunities for coating manufacturers to expand distribution networks, establish service centers, and offer affordable, high-quality refinish solutions tailored to cost-sensitive markets.

In 2025, Nippon Paint’s expansion of its “n-SHIELD” brand in India, introducing paint protection films, ceramic coatings, and dedicated “n-SHIELD Studios” across major cities. With localized manufacturing, technician training programs, and a growing car-care culture, global players can capture substantial aftermarket revenue. This segment is becoming one of the fastest-growing opportunities in the global automotive coatings landscape, especially in Asia and Latin America.

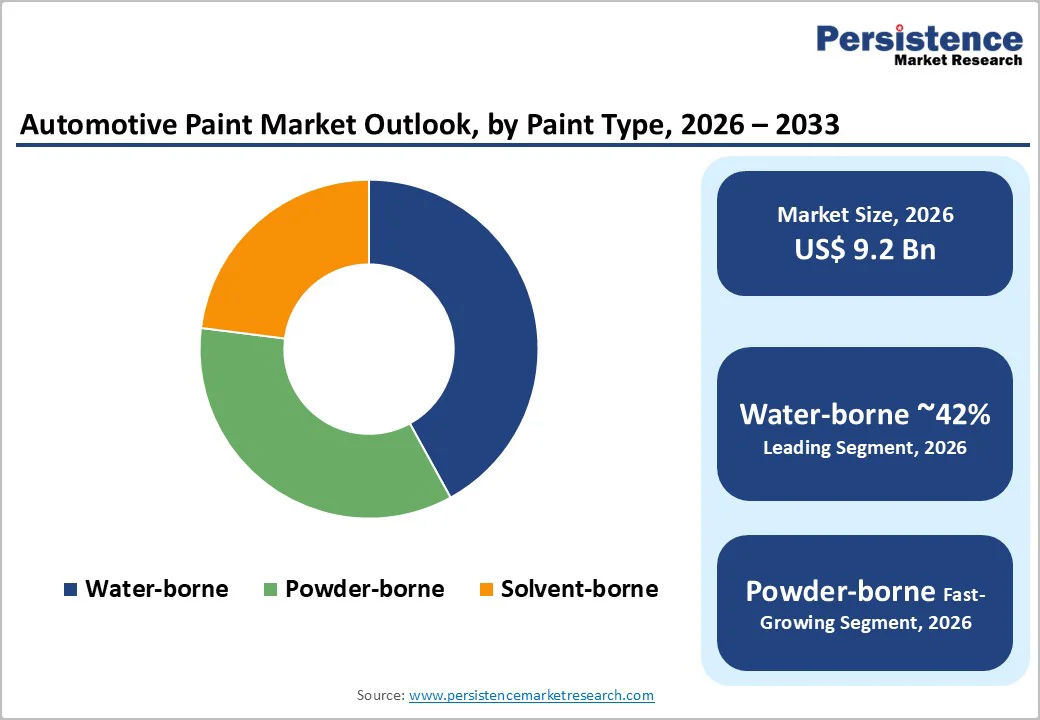

Water-borne paints lead the automotive paint market with nearly 42% share, driven by strict global regulations targeting VOC reduction. These coatings use water instead of harmful solvents, cutting emissions by up to 80%, making them the preferred choice in sustainability-focused regions like Europe and North America. Automakers have widely adopted water-borne basecoats to meet environmental standards without compromising performance. Recent advancements have improved their durability, gloss retention, and color vibrancy, making them comparable to traditional solvent-borne coatings. As sustainability becomes central to automotive manufacturing, demand for water-borne paints continues to rise, solidifying their leadership position in the global market.

Mid-sized passenger cars account for an estimated 35% market share due to their strong global production volumes and broad consumer appeal. Compact cars follow closely, driven by high demand in Asia-Pacific and Europe. Premium and luxury passenger cars, though smaller in volume, contribute disproportionately to value because they require multi-layer, high-end finishes. Light commercial vehicles (LCVs) maintain steady demand for durable protective coatings, while heavy commercial vehicles (HCVs) represent a smaller but essential segment focused on corrosion resistance. Electric vehicles (EVs) are the fastest-growing category, driven by distinct color styling and advanced paint requirements, further reshaping OEM coating strategies across regions.

Metallic paints remain the leading finish type with around 38% market share, favored for their premium look and ability to mask minor scratches and dust better than solid colors. The addition of aluminum flakes creates a depth and sparkle effect that appeals strongly to mid-range and premium vehicle buyers. Metallic coatings offer an ideal balance of style, affordability, and durability, making them a popular upgrade option offered by most OEMs worldwide. While matte finishes are gaining attention as a niche trend, metallic paints continue to dominate due to their wide consumer acceptance and compatibility with diverse vehicle designs and price segments.

The OEM segment holds the largest share of the automotive paint market at 72%, driven by the high volume of coatings used in new vehicle production. OEMs apply multiple layers, including primer, basecoat, and clearcoat, using automated, high-efficiency paint lines that require consistent and large-scale coating supplies. This segment adopts advanced technologies first, such as robotic spray systems, low-VOC formulations, and energy-efficient curing processes, strengthening its technological edge. Although the aftermarket is essential for repairs and refurbishment, its demand is smaller and more variable compared to OEM production. As global vehicle output continues to rise, OEMs will remain the primary revenue source for the automotive paint industry.

North America continues to lead in advanced automotive paint technologies, driven by strict environmental rules from the EPA and progressive state mandates such as California’s low-VOC requirements. These regulations have accelerated the widespread adoption of waterborne and eco-friendly refinish systems. A major trend in the region is the modernization of automotive manufacturing infrastructure to support electric vehicle (EV) production.

Companies such as Toyota, Tesla, and Ford are investing heavily in new paint shop upgrades that improve energy efficiency and meet EV-specific coating needs. North America is also becoming a strong innovation hub for automotive adhesives and sealants, which complement paints in lightweight vehicle manufacturing. Although the market is mature, value growth is being fueled by rising demand for premium factory finishes, matte coatings, and customized color options that require advanced clearcoats. Overall, the region remains focused on sustainability, energy efficiency, and high-performance coating technologies.

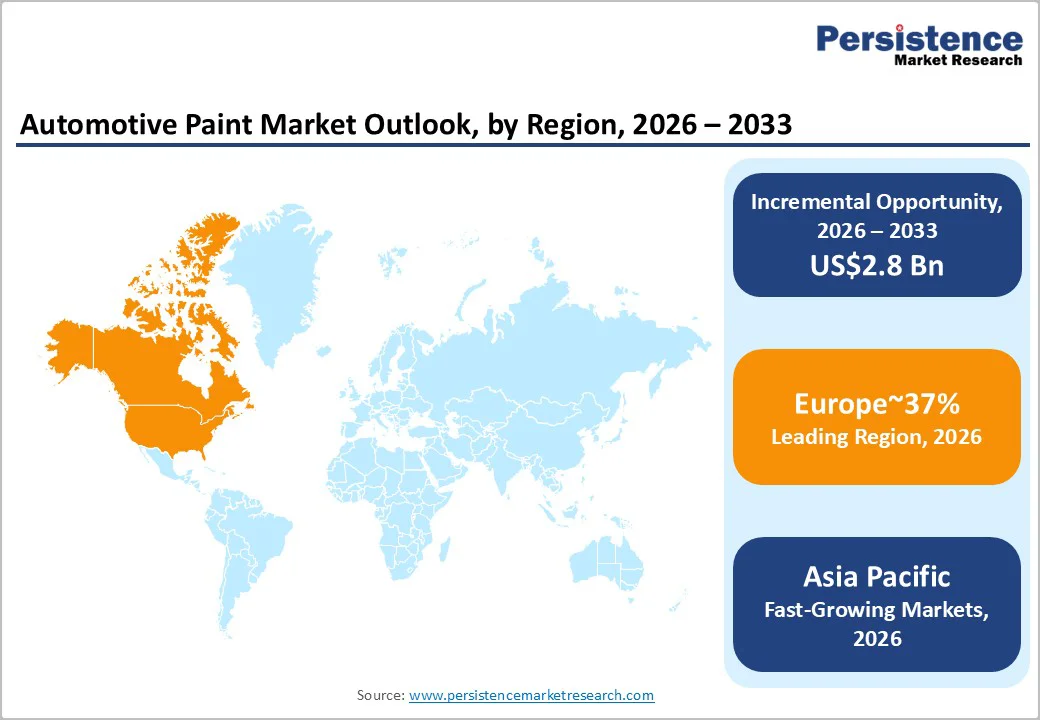

Europe remains the global leader in sustainable automotive manufacturing, heavily guided by strict REACH regulations and the European Green Deal. These policies prioritize reducing carbon emissions and energy consumption across vehicle production lines. As a result, European automakers widely use compact paint processes that remove baking stages and significantly lower energy use. Germany, home to BMW, Mercedes-Benz, Audi, and Volkswagen, drives demand for advanced waterborne, high-solid, and ultra-durable coatings.

A major regional trend is industry consolidation, with mergers and integrated distribution networks strengthening supply chain efficiency. The refinish market in Europe is also adopting UV-cured coatings at a fast pace because they reduce repair time and operational costs in body shops. Additionally, rising energy prices and geopolitical uncertainties are pushing manufacturers to develop low-temperature curing paints that help reduce natural gas dependency. Together, these trends reinforce Europe’s position as the benchmark for high-quality and environmentally responsible automotive coatings.

Asia Pacific is the fastest-growing and largest automotive paint market, supported by major manufacturing hubs in China, Japan, India, and South Korea. The region is experiencing two parallel trends: strong volume growth in emerging markets like India and Southeast Asia, and rapid technological advancement in mature markets like China and Japan. China’s aggressive push for New Energy Vehicles (NEVs) has created strong demand for EV-friendly coatings, thermal-management paints, and trendy color palettes aimed at younger buyers.

India is witnessing a shift toward more vibrant and premium exterior colors as consumer purchasing power rises, boosting demand for high-value pigments and specialty finishes. Asia Pacific is also a major export hub for global automakers, increasing the adoption of international quality standards for both OEM and wheel coating applications. With expanding production capacities, rising local competition, and strong EV adoption, the region is set to remain the primary growth engine for the global automotive coatings Market.

The global automotive paint market is highly consolidated, with the top five players controlling a substantial majority of the market share. This oligopolistic structure is defined by high barriers to entry, including extensive capital requirements for R&D, stringent OEM approval processes, and the need for vast global distribution networks. Market leaders like PPG Industries, Sherwin-Williams, and BASF dominate through vertical integration and broad product portfolios that cover every layer of the coating system. Competitive strategies are increasingly focused on sustainability and digitalization, with major players launching automated color-matching tools and AI-driven mixing systems to lock in body shop customers. Mergers and acquisitions remain a key tactic for expansion, allowing giants to acquire niche technologies and expand their footprint in high-growth emerging markets, effectively squeezing out smaller, regional competitors.

The market is expected to reach US$ 12.0 billion by 2033, growing at a CAGR of 3.9% from 2026.

Key drivers include stringent VOC emission regulations enforcing eco-friendly paints and the rising production of Electric Vehicles requiring specialized lightweight coatings.

The Water-borne paint segment is the leader, favored for its low environmental impact and compliance with global sustainability standards.

Europe remains the leading region, driven by advanced sustainable manufacturing and strict REACH and Green Deal regulations.

Developing Smart Coatings, such as self-healing and sensor-compatible paints for autonomous vehicles, represents a significant future revenue opportunity.

Major players include Sherwin-Williams Company, PPG Industries, BASF SE, Akzo Nobel N.V., and Axalta Coating Systems Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Litres |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Paint Type

By Vehicle Type

By Finish Type

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author