ID: PMRREP35921| 189 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

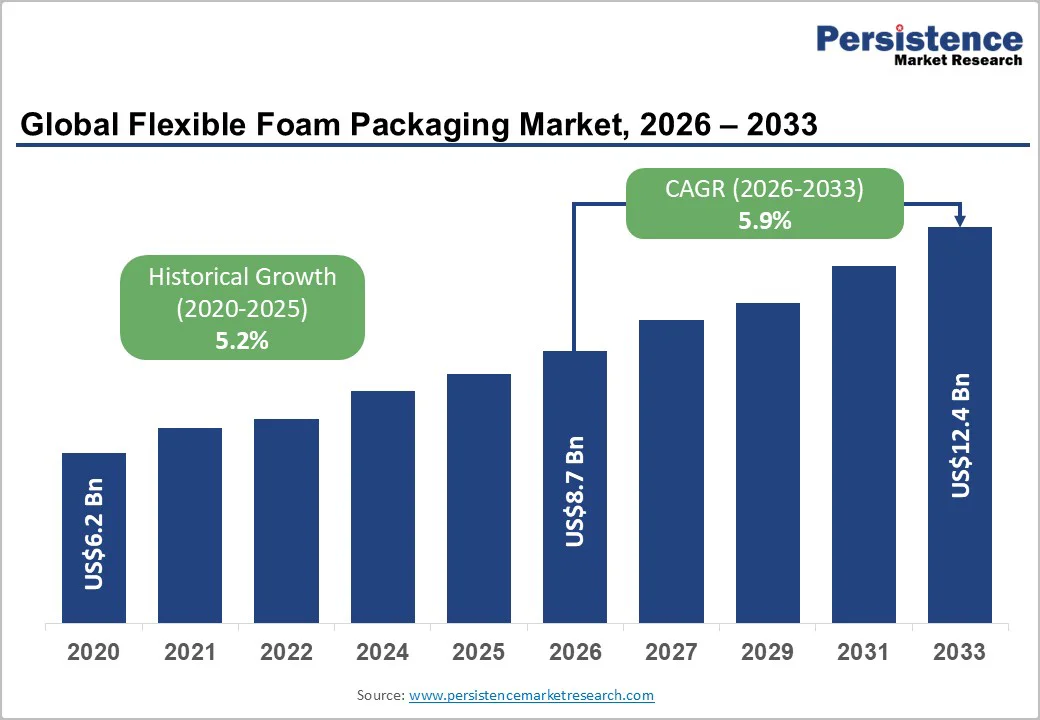

The global flexible foam packaging market is expected to reach US$8.7 billion in 2026. It is expected to reach US$12.4 billion by 2033, growing at a CAGR of 5.9% from 2026 to 2033, driven by rising e-commerce shipments, increased electronics and automotive production, and regulatory pressure to encourage lighter, recyclable packaging formats.

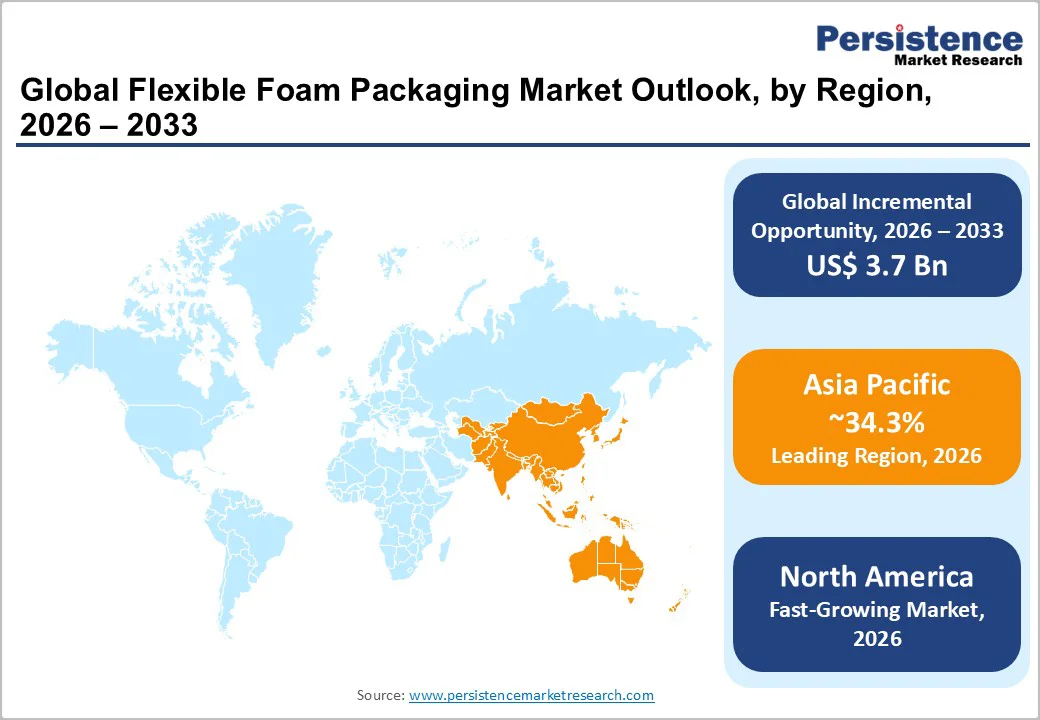

Manufacturing scale-up in the Asia Pacific and targeted mergers and acquisitions among converters are supporting capacity growth and product innovation. Short-term risks include feedstock price volatility and tightening recyclability laws in Europe and selected U.S. states.

| Key Insights | Details |

|---|---|

| Flexible Foam Packaging Market Size (2026E) | US$8.7 Bn |

| Market Value Forecast (2033F) | US$12.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.2% |

Global e-commerce sales have grown sharply, with business e-commerce expanding notably between 2016 and 2022, and online retail value reaching multi-trillion-dollar levels by 2024 - 2025. This surge increases demand for lightweight protective packaging, including foam inserts, pouches, and bags.

Higher shipment frequency of small consumer electronics and direct-to-consumer goods requires customizable foam solutions. Packaging converters report increased orders for protective foam that balances cushioning strength with low dimensional weight. The rising need for parcel-level protection remains a major structural driver.

Flexible foam packaging is widely used for consumer electronics, automotive components, and precision-engineered parts. Growth in smartphone demand, increased electronics production, and steady automotive output are driving the consumption of EPE, PU, and EPS foams.

These foams offer anti-static, lightweight, and shock-absorbing characteristics essential for sensitive devices. As devices become more compact and valuable, foam converters supply tailored inserts, wraps, and pouches that deliver stronger margins. Electronics and automotive remain among the largest contributors to overall foam packaging consumption.

Global regulatory trends such as EPR schemes and evolving packaging waste rules require packaging that is recyclable, lightweight, or incorporates recycled content. These mandates push brand owners toward improved design and material choices.

The shift is prompting investments in mono-material foams, bio-based formats, and closed-loop recycling partnerships. While compliance raises near-term costs, suppliers with recyclable and regulation-ready foam solutions are gaining competitive advantages and securing longer-term contracts.

Flexible foam relies on polymer feedstocks including polyethylene, polystyrene, and polyols. Fluctuations in crude oil markets quickly affect resin costs, putting pressure on converters' margins. Cost swings may trigger price adjustments or delayed orders from cost-sensitive buyers. This volatility often limits investment in new capacity and slows adoption of higher-priced recyclable or specialty foams unless supported by long-term contracts.

Even where recyclable foam formats are available, the supporting collection and recycling infrastructure remains inconsistent across regions. Labelling laws and environmental claim guidelines require strong evidence of recyclability and facility availability, complicating product claims. In emerging markets, limited recycling capability increases the likelihood of landfill disposal, leading to reputational and compliance challenges for brands.

Developers of mono-material recyclable foams, such as PE-based cushioning compatible with existing recycling streams, stand to benefit from procurement shifts among global retailers and electronics OEMs. Transitioning even 10 to 15 percent of current consumption to certified recyclable foam represents a substantial value opportunity. Early movers with validated life-cycle assessment data and recycling partnerships are positioned to secure premium contracts.

Foam-in-place and automated on-demand systems simplify supply chains by reducing inventory, optimizing dimensional weight, and improving protection. Converters that provide integrated services, such as kitting or near-site converting, generate recurring logistics-related revenue. Adoption is accelerating in electronics, healthcare, and fulfillment center environments.

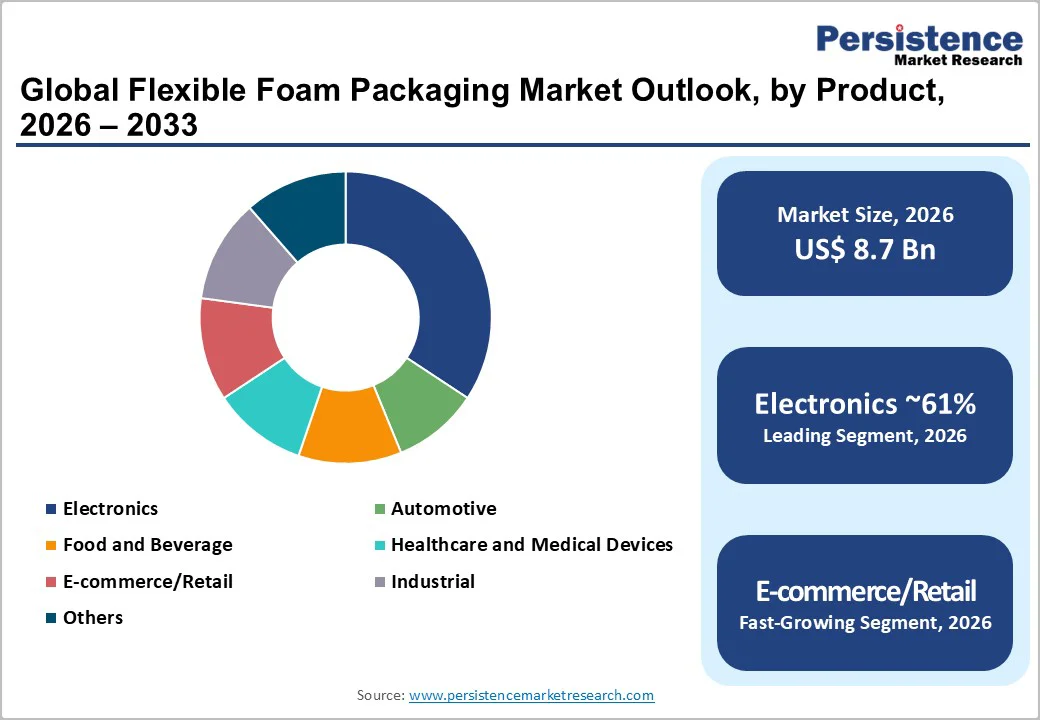

Polyurethane and polyolefin foams remain the dominant materials in flexible foam packaging, collectively accounting for an estimated 61% market share in 2026, supported by their balance of cushioning performance, durability, and design adaptability. PU foam is extensively used in protective packaging for consumer electronics, industrial instruments, precision components, and small appliances, where vibration resistance and surface protection are essential.

Polyolefin foams, including EPE and cross-linked PE, are preferred for lightweight wraps, corner protectors, and custom inserts as they offer excellent flexibility and cost efficiency. Their widespread availability across global converters, strong compatibility with die-cutting and lamination processes, and broad adoption in e-commerce and electronics workflows reinforce their leadership.

EPS and advanced expanded polyolefin variants such as EPE and EPP constitute the fastest-growing materials segment. These foams deliver strong protective performance at low densities, which makes them attractive for parcel shipping, food service packaging, appliance cushioning, and high-volume consumer goods.

Growth is supported by innovations in bead molding, improved density control, enhanced energy absorption, and developments that increase recyclability, such as cold-chain-compatible EPS trays and return-stream EPE programs. Despite regulatory scrutiny in certain regions, engineered EPS and EPP solutions are gaining traction in automotive parts packaging, medical device transport, and last-mile shipment protection.

Electronics remains the largest application segment for flexible foam packaging, accounting for an estimated 36% of the market share in 2026, driven by the need for precise cushioning, anti-static protection, and robust impact absorption. Foam inserts, die-cut pads, layered sheets, and multi-component assemblies are widely used for items such as laptops, smartphones, servers, sensors, and industrial electronics.

High-value hardware and sensitive components often demand custom-engineered foam structures for drop protection and vibration dampening. Growth in online retail of electronics, especially small consumer devices and refurbished electronics, has increased unit-level packaging requirements. Brands such as major smartphone manufacturers, peripherals suppliers, and semiconductor equipment producers utilize foam-intensive packaging formats.

E-commerce and direct-to-consumer shipping represent the fastest-expanding application area. Rising shipment frequency, greater variability in parcel handling, and high return rates are driving fulfillment centers to adopt reliable cushioning materials, such as foam pouches, pre-cut sheets, and foam-in-place systems.

On-demand systems are increasingly used in warehouses for fragile home goods, cosmetics, electronic accessories, and specialty equipment. Growth is also supported by D2C brands in sectors such as personalized electronics, small appliances, and premium consumer goods, where custom cushioning is essential to reduce damage and maintain brand presentation during last-mile delivery.

North America is likely to be the fastest-growing region, driven by strong demand from electronics, medical devices, aerospace components, and the automotive aftermarket. The U.S. leads regional consumption, supported by extensive fulfillment networks, high-value electronics assembly, and consistent investment in automated cushioning systems.

Growth in sectors such as consumer electronics, diagnostic equipment, and industrial automation continues to raise packaging performance requirements, driving higher average selling prices.

Regulatory momentum is accelerating, with state-level EPR rules in California, Oregon, and Colorado requiring verifiable recyclability claims, standardized labeling, and increased reporting. These policies are pushing manufacturers toward recyclable polyolefin foams and advanced take-back programs.

Recent developments include expansions by protective packaging specialists in the Midwest and Southwest to support e-commerce hubs, and new pilot programs by foam converters testing post-consumer EPE recovery streams with logistics companies. The region hosts several leading converters focused on protective systems integration, warehouse-level automation, and high-performance engineered foam technologies.

Europe is anticipated to hold a substantial share of the global market, underpinned by mature industrial production, stringent packaging specifications, and advanced recycling frameworks. Germany remains the strongest demand center, supported by automotive, electronics, and industrial machinery exports.

The U.K. and France contribute significantly through large retail networks, omnichannel fulfilment volumes, and high adoption rates of customized protective packaging.

The regulatory landscape is defined by the Packaging and Packaging Waste Regulation (PPWR), which mandates recyclability, labeling, and recycled-content thresholds, creating clear incentives for mono-material foams and certified recycling partnerships.

Major converters have recently invested in lightweight EPE lines that meet regional recyclability standards, and several European manufacturers have announced collaborations with chemical recyclers to expand polyolefin recovery capacity. Innovation efforts increasingly focus on bio-based blends, advanced density control, and closed-loop logistics models, making sustainability credentials and engineering capability key competitive differentiators across the region.

Asia Pacific is the largest market, anticipated to hold 34.3% of the market share in 2026, supported by high concentrations of electronics, appliance, and semiconductor manufacturing, a rapidly expanding e-commerce ecosystem, and cost-efficient foam converting capacity.

China dominates regional production through large-scale EPE and PU foam facilities serving consumer electronics, home appliances, and industrial components. Japan leads in precision foam packaging for medical devices, sensors, and high-value electronics, while India and Southeast Asia are seeing robust growth driven by rising manufacturing activity and increased cross-border e-commerce shipments.

Regulatory maturity varies across the region. Developed markets such as Japan and South Korea are advancing stricter waste management rules and encouraging recyclability standards, while emerging markets are prioritizing infrastructure expansion and efficiency upgrades.

Recent developments include new molded EPP capacity additions in China, sustainability-oriented foam innovation centers launched by Japanese manufacturers, and investment in automated on-demand foam systems by fulfillment operators in India and Indonesia. Strong local manufacturing ecosystems, competitive labor structures, and ready access to resin feedstocks reinforce APAC’s position as the production engine of the market.

The global flexible foam packaging market is moderately concentrated, with global packaging groups and specialized foam manufacturers holding notable shares. A long tail of regional converters competes on price and proximity, especially in sheet and roll formats. Larger multinationals drive innovation through automated systems, recyclable materials, and integrated service offerings.

Market leaders focus on recyclable and mono-material foam innovations, integration of on-demand foam systems and kitting services at fulfillment centers, and selective consolidation to enhance scale. Strategies emphasize validated recyclability claims, strong retailer partnerships, and automation-driven efficiency to preserve margins in competitive segments.

The global flexible foam packaging market size is estimated to reach US$8.7 Billion in 2026.

By 2033, the flexible foam packaging market is projected to reach US$12.4 Billion.

Key trends include the shift toward recyclable and mono-material foam solutions, expansion of foam-in-place and on-demand packaging systems, growing adoption of engineered EPE/EPP foams, and increased investment in automation and fulfillment-center packaging technologies.

By application, electronics is the leading segment, accounting for the largest share due to high requirements for shock absorption, anti-static protection, and customized die-cut inserts.

The flexible foam packaging market is expected to grow at a CAGR of 5.9% from 2026 to 2033.

Major companies include Sealed Air Corporation, Toppan Holdings, UFP Technologies, Zotefoams plc, and Pregis/Storopack.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Application

By Product Format

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author