ID: PMRREP35991| 200 Pages | 2 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

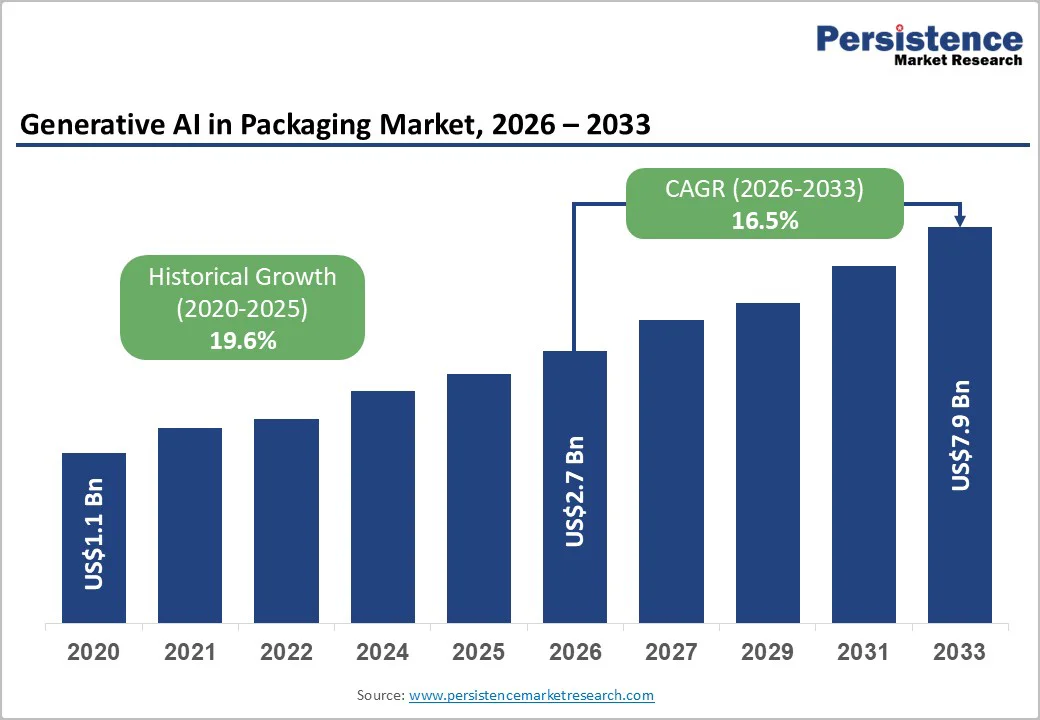

The global generative AI in packaging market size is likely to be valued at US$2.7 billion in 2026 and is expected to reach US$7.9 billion by 2033, expanding at a CAGR of 16.5% during the forecast period of 2026 to 2033, driven by three converging forces: rapid adoption of AI-enabled packaging design and personalization in consumer-packaged goods, efficiency gains across packaging engineering and factory operations, and enterprise-wide AI investments that integrate design, production, and supply-chain workflows.

These drivers enable faster SKU-level customization, reduced time-to-market for new packaging formats, and measurable reductions in material usage and logistics costs. These outcomes create clear revenue and margin improvement opportunities for brand owners, packaging converters, and equipment manufacturers.

| Key Insights | Details |

|---|---|

| Generative AI in Packaging Market Size (2026E) | US$2.7 Bn |

| Market Value Forecast (2033F) | US$7.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 16.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 19.6% |

Brands across consumer markets are increasingly investing in personalized packaging formats, including dynamic graphics, QR-enabled content, and micro-segmented artwork, to improve conversion rates, brand loyalty, and product traceability. Generative AI automates the creation of thousands of packaging design variations, significantly reducing manual creative effort while enabling rapid A/B testing at scale. This shortens design cycles and lowers reliance on external agencies. From an operational perspective, AI-generated designs reduce tooling changes and simplify production planning. The combined effect is faster launch timelines for limited-edition and seasonal SKUs, improved sell-through performance, and lower per-unit design costs, directly enhancing return on marketing and innovation spend.

Generative AI is increasingly applied to packaging structure simulation, palletization optimization, and logistics planning. These capabilities enable reductions in material consumption, freight volume, and handling costs. When combined with computer vision systems, generative models also enhance predictive maintenance and real-time process control, reducing unplanned downtime and scrap rates. Packaging manufacturing typically operates on thin margins, making even modest improvements in yield and equipment utilization financially significant. Companies integrating generative AI into factory operations report improved throughput and more consistent quality without major capital expansion, supporting EBITDA improvement through operational leverage.

Regulatory bodies and retailers are imposing stricter requirements for packaging transparency, sustainability labeling, and supply-chain traceability. Generative AI accelerates the creation and validation of regulatory text, ingredient disclosures, recycling instructions, and multi-market label variants. It also supports emerging requirements such as digital product passports and standardized sustainability claims. By automating these processes, companies reduce compliance-related labor costs and minimize the risk of labeling errors across regions. Faster compliance cycles also allow brands to bring products to market more quickly while strengthening credibility around environmental and circular economy commitments.

Generative AI systems depend on high-quality training data, including packaging templates, CAD files, and manufacturing tolerances. Inconsistent or poorly governed data can produce designs that fail in real-world production, leading to rework, delays, and additional cost. Intellectual property risks also arise when models inadvertently replicate proprietary design elements across clients. As a result, companies must invest in strong data governance, model validation, and traceability frameworks. These requirements increase upfront implementation costs and slow adoption, particularly in regulated sectors such as pharmaceuticals, where validation standards are stringent.

AI regulation continues to evolve across regions, creating uncertainty for global packaging programs. In applications linked to health, safety, or consumer protection, AI-generated outputs may be subject to enhanced scrutiny and documentation requirements. Divergent regulatory approaches across jurisdictions complicate deployment for multinational companies and can delay procurement decisions. To mitigate these risks, firms must establish robust governance, testing, and documentation processes that ensure AI systems remain auditable and compliant throughout their lifecycle, increasing both cost and implementation timelines.

The convergence of generative AI and digital printing enables profitable mass customization of packaging. Brands can economically produce small-batch, localized SKUs with margins approaching those of traditional high-volume production. Scenario analysis indicates that if a modest share of global packaging volumes transitions to on-demand customized formats by 2030, the incremental revenue opportunity for AI-driven design and orchestration platforms would represent a significant portion of total market growth through 2033. The strongest use cases are found in premium consumer goods, cosmetics, and limited-edition product launches, where customization reduces inventory risk and supports higher price realization.

Pharmaceutical packaging requires strict validation, serialization, and traceability. Generative AI streamlines the creation of compliant label variants, batch-specific instructions, and serialized artwork while embedding automated compliance checks. Although adoption volumes are lower than in mass consumer packaging, the value per deployment is significantly higher due to regulatory complexity and risk sensitivity. Companies that combine generative AI with auditable governance frameworks and validated workflows are well-positioned to capture premium margins in this regulated segment.

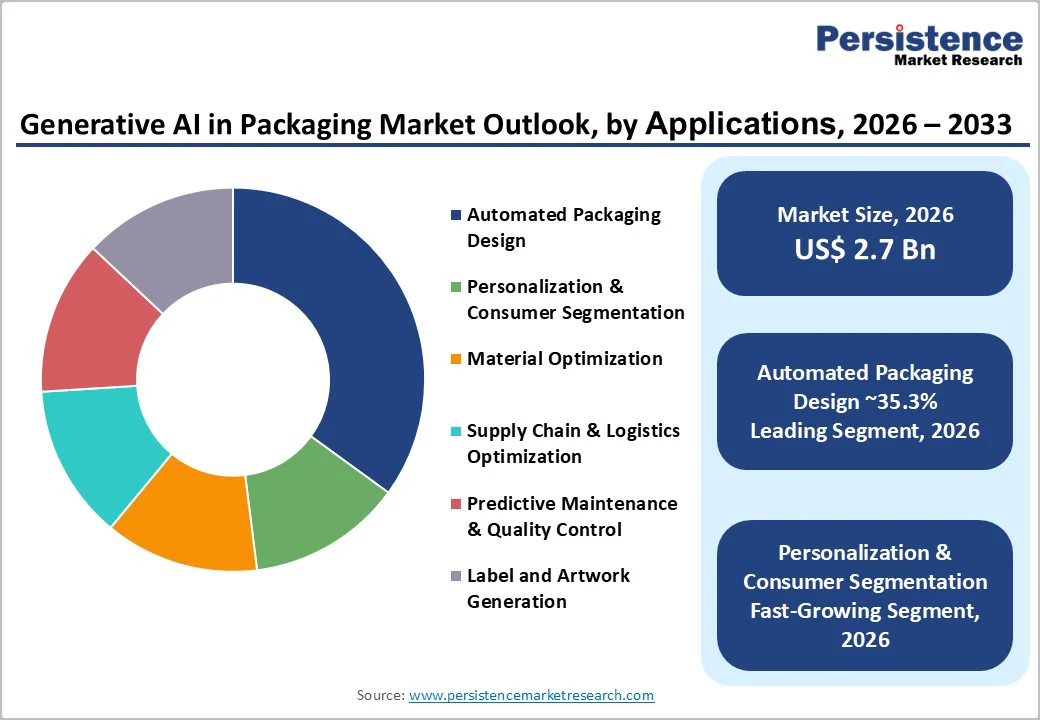

Automated packaging design is anticipated to account for approximately 35.3% of the total generative AI in packaging market revenue in 2026, making it the largest application segment. This leadership is driven by the immediate and quantifiable return on investment achieved through AI-led structural design optimization, automated artwork generation, and rapid dieline development. Generative AI enables packaging engineers to evaluate thousands of structural configurations simultaneously, optimizing for strength, material efficiency, pallet utilization, and cost constraints.

Brand owners and packaging converters often adopt automated design platforms as an initial use case because they integrate seamlessly with existing CAD, product lifecycle management, and digital printing systems. In high-SKU consumer categories such as food, beverages, and personal care, AI-driven design significantly shortens development cycles for new formats and seasonal variants. Rising SKU churn, private-label expansion, and the need for visually differentiated yet cost-efficient packaging continue to reinforce sustained investment in automated packaging design solutions.

Personalization and marketing applications are likely to be the fastest-growing application segment, expanding at a higher CAGR than the overall market. Generative AI enables the creation of hyper-personalized packaging graphics, localized language variants, and campaign-specific designs at scale, while maintaining strict brand governance. These capabilities are increasingly used for regional promotions, limited-edition product launches, and interactive packaging incorporating QR codes and serialized content.

Growth is supported by improved access to first-party consumer data, rapid expansion of short-run digital printing capacity, and AI platforms capable of automating thousands of artwork variations without manual intervention. Direct-to-consumer channels and omnichannel retail strategies further amplify demand, as brands use personalized packaging to improve engagement, traceability, and conversion metrics. As data-driven marketing becomes central to packaging strategy, investment in AI-enabled personalization workflows is expected to accelerate sharply.

Generative design models are expected to hold approximately 26.5% of the technology segment share in 2026, positioning them as the leading technological foundation within the market. Their dominance stems from their ability to replace time-intensive manual engineering processes with algorithm-driven design generation that simultaneously optimizes performance, cost, and sustainability metrics.

These models are trained on packaging-specific geometries, material properties, and manufacturing constraints, enabling highly accurate and production-ready outputs. Their strongest value proposition lies in reducing development timelines, lowering material consumption, and improving structural reliability without increasing tooling complexity. Generative design models are widely deployed across corrugated packaging, flexible packaging formats, and rigid containers, where even marginal reductions in material usage deliver substantial cost savings at scale. Compatibility with established engineering and manufacturing workflows further accelerates enterprise adoption.

Simulation and digital twin technologies are likely to be the fastest-growing technology segment within generative AI in packaging in 2026. By combining AI-generated design concepts with physics-based simulation, these solutions allow companies to virtually test packaging performance under real-world conditions such as compression, vibration, temperature variation, and logistics stress. This significantly reduces reliance on physical prototyping and trial-and-error testing.

Digital twins are increasingly used in both design validation and factory optimization, enabling real-time performance monitoring and continuous improvement across packaging lines. Their role in reducing over-packaging, minimizing waste, and supporting sustainability targets makes them particularly attractive in regions with strict environmental regulations. As simulation accuracy improves and cloud computing costs decline, adoption is expanding rapidly across design, production, and supply-chain applications.

North America is projected to account for the largest share of the market, representing approximately 37.2% of the share in 2026. This leadership is supported by strong brand owner investment, a mature digital printing ecosystem, and early enterprise-scale adoption of AI across design, marketing, and manufacturing functions. The U.S. anchors regional growth, benefiting from a dense concentration of global consumer brands, advanced packaging converters, and AI software providers with deep integration into packaging workflows. Growth across the region is strongly influenced by marketing-led personalization initiatives and automation-driven efficiency gains.

Large consumer packaged goods companies such as Procter & Gamble, PepsiCo, and Coca-Cola increasingly use AI-assisted design platforms to accelerate artwork localization, reduce packaging development timelines, and support rapid SKU expansion across retail and direct-to-consumer channels. In parallel, printing and equipment suppliers, including HP, Esko, and WestRock, have expanded AI-enabled design and prepress solutions that link generative design with digital and flexographic printing lines.

Factory-level adoption is also accelerating, with generative AI integrated into quality inspection, layout optimization, and predictive maintenance. U.S.-based converters are deploying computer vision and generative optimization to reduce waste, improve throughput, and support short-run production economics. Regulatory oversight in North America remains less prescriptive than in Europe; however, regulated industries such as pharmaceuticals and food packaging require validated, auditable AI workflows, driving demand for enterprise-grade platforms with strong traceability and governance features.

Investment activity remains robust, with venture funding and corporate spending concentrated on scalable platforms that unify design automation, production analytics, and lifecycle data. Strategic partnerships between software vendors and packaging manufacturers continue to shape regional leadership, reinforcing North America’s role as the primary commercialization hub for generative AI in packaging.

Europe represents a significant and structurally distinctive market, shaped by advanced packaging converters, stringent sustainability regulations, and early leadership in AI governance frameworks. Germany leads regional adoption in industrial and factory-focused deployments, where generative AI is applied to structural optimization, material reduction, and production efficiency. The U.K. shows strong momentum in brand-led design, personalization, and marketing applications, while France and Spain contribute to growing demand linked to e-commerce growth and sustainability labeling requirements.

European regulatory frameworks emphasize transparency, explainability, and risk management in AI systems, increasing compliance costs but favoring vendors with robust governance, documentation, and lifecycle control capabilities. The introduction of the EU AI Act has accelerated investment in compliant AI architectures, pushing packaging technology providers to redesign models and workflows to meet classification and audit requirements. This regulatory environment has strengthened the competitive position of established vendors with deep enterprise experience.

Leading European packaging groups such as Smurfit Kappa, DS Smith, and Mondi are actively integrating generative AI into design-to-recycling workflows, using AI-driven structural design to reduce fiber usage and improve recyclability scores. Brand owners, including Unilever and Nestlé have publicly emphasized AI-supported packaging optimization as part of broader sustainability and circular economy strategies, reinforcing demand for tools that align creative flexibility with regulatory compliance.

M&A and partnership activity is increasing as European firms seek to build vertically integrated solutions spanning design, production, and end-of-life recovery. Public and private investment in AI-enabled sorting, recycling, and material identification technologies further supports regional expansion, positioning Europe as a governance-led but innovation-capable market.

Asia Pacific is the fastest-growing regional market, driven by rapid e-commerce expansion, fragmented manufacturing ecosystems, and aggressive digitalization initiatives by large consumer brands. China leads the region in terms of scale and speed of adoption, with generative AI widely applied across packaging design automation, artwork localization, and high-volume production optimization. Chinese packaging manufacturers increasingly deploy AI-enabled platforms to manage complexity across thousands of SKUs serving domestic and export markets. Japan’s adoption is characterized by a strong emphasis on quality assurance, validation, and precision engineering.

Generative AI is used to support high-performance packaging design in pharmaceuticals, electronics, and premium consumer goods, where failure tolerance is low and simulation-driven validation is essential. In India and ASEAN markets, growth is fueled by cost-effective customization, cloud-based deployment models, and the rapid expansion of digital printing capacity supporting regional brands and export-oriented manufacturers.

Lower regulatory friction compared to Europe accelerates adoption across Asia Pacific, although multinational companies operating in regulated sectors align AI workflows with international standards. Global brands such as Unilever, L’Oréal, and Samsung increasingly deploy region-specific AI models to localize packaging content across languages, cultural norms, and regulatory requirements. Vendors are responding by offering localized language models, edge inference solutions, and partnerships with regional digital printing providers to address infrastructure variability and cost sensitivity.

Investment flows are increasingly directed toward scalable, cloud-native platforms that support multi-site deployment and rapid iteration. As e-commerce penetration deepens and manufacturing automation advances, Asia Pacific is expected to remain the primary growth engine for generative AI adoption in packaging over the forecast period.

The global generative AI in packaging market operates at the intersection of packaging manufacturers, brand owners, specialized AI software providers, and cloud infrastructure companies. Market concentration remains moderate, with no single player dominating across all segments. Competitive positioning depends on access to proprietary packaging data, integration with production and printing systems, and the ability to deliver auditable, compliant AI solutions for regulated applications.

Recent strategic activity includes the launch of AI-enabled factory platforms, the expansion of generative design capabilities, and the publication of industry guidance outlining practical deployment pathways. These developments signal a shift from pilot projects to scaled commercial implementation, increasing buyer confidence and accelerating adoption. Leading companies focus on platform-based offerings, strategic partnerships, hybrid deployment models, and usage-based pricing aligned with SKU volumes. Differentiation increasingly depends on data depth, compliance readiness, and end-to-end workflow integration.

The global generative AI in packaging market is estimated to be valued at US$2.7 billion in 2026.

By 2033, the generative AI in packaging market is projected to reach US$7.9 billion, reflecting strong expansion across design, manufacturing, and marketing applications.

Key trends include automation of structural packaging design, AI-driven personalization and marketing, integration of generative models with digital printing, use of simulation and digital twins to reduce prototyping, and hybrid cloud-edge deployment for regulated and factory environments.

Automated packaging design is the leading application segment, accounting for approximately 35.3% of the market, driven by strong ROI from structural optimization, artwork automation, and reduced time-to-market for new SKUs.

The generative AI in packaging market is expected to grow at a CAGR of 16.5% between 2026 and 2033, supported by the rising adoption of AI across packaging design, factory optimization, and personalized consumer engagement.

Major players include Tetra Pak, Amcor, Smurfit Kappa, WestRock, and Berry Global.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Applications

By Technologies

By Deployment Modes

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author