ID: PMRREP35888| 188 Pages | 21 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

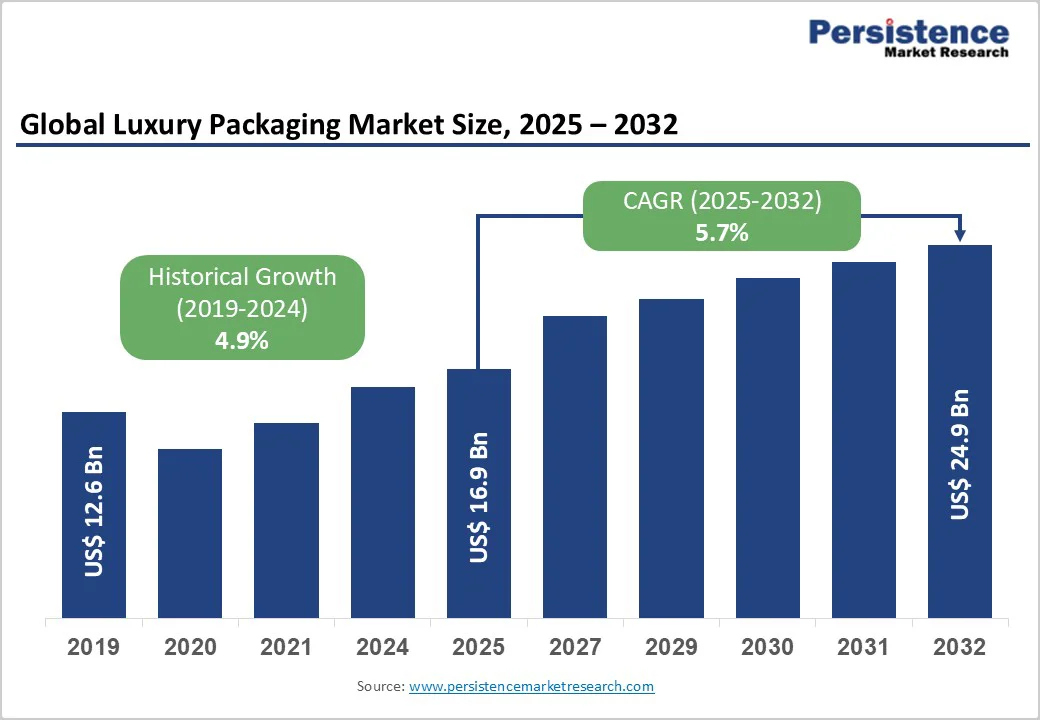

The global luxury packaging market size is likely to be valued at US$16.9 billion in 2025 and is projected to reach US$24.9 billion, growing at a CAGR of 5.7% between 2025 and 2032.

The luxury packaging sector is growing as consumers demand premium experiences that balance aesthetic appeal with functionality, particularly in the cosmetics and beverage industries. This growth is driven by affluent consumers seeking exclusive unboxing experiences, further supported by the rise of e-commerce, which amplifies the need for personalized packaging.

Additionally, sustainability mandates from regulations such as the EU Packaging and Packaging Waste Regulation are encouraging brands to adopt eco-friendly innovations. These changes not only enhance market value but also align with global environmental goals.

| Key Insights | Details |

|---|---|

| Global Luxury Packaging Market Size (2025E) | US$16.9 Bn |

| Market Value Forecast (2032F) | US$24.9 Bn |

| Projected Growth CAGR (2025 - 2032) | 5.7% |

| Historical Market Growth (2019 - 2024) | 4.9% |

The growing shift toward eco-friendly materials is a key driver in the luxury packaging market, as brands adapt to consumer demand for sustainable yet premium packaging. Surveys show that over 71% of European consumers prefer sustainable packaging, prompting luxury companies to invest in recyclable paperboard and bio-based materials that maintain elegance while reducing environmental impact.

This shift is further supported by regulations such as the EU Circular Economy Action Plan, which mandates all packaging to be recyclable by 2030. As a result, luxury brands are redesigning their materials and supply chains to meet these requirements. Adopting sustainable materials not only reduces carbon footprints but also strengthens customer loyalty among environmentally conscious buyers, driving long-term market growth through responsible and innovative luxury experiences.

The rapid growth of e-commerce is transforming the luxury packaging market, driving demand for packaging that is both protective and visually appealing. As online luxury sales expand, brands are focusing on delivering premium unboxing experiences that match the prestige of in-store purchases. Digital platforms now offer personalized designs with engravings, monograms, and custom motifs, meeting the expectations of 70% of high-net-worth customers seeking unique products.

Collaborations between luxury brands and online retailers show that customized packaging enhances perceived value and reduces return rates. With e-commerce contributing to a larger share of luxury sales, companies are innovating lightweight and durable packaging that safeguards products in transit while enhancing consumer satisfaction and repeat purchases.

High production costs are a major challenge in the luxury packaging market, mainly due to the use of premium materials such as crystal glass, metals, and intricate decorative finishes. These materials require skilled craftsmanship and specialized processes, raising costs by up to 30% when sustainable alternatives are used.

Smaller luxury brands often struggle to absorb these expenses, which limits their competitiveness. Additionally, disruptions in the supply chain for high-quality inputs further increase prices and delay production. Balancing luxury appeal with affordability remains a key challenge, particularly for new entrants in price-sensitive regions, potentially slowing the market’s overall expansion.

Strict environmental regulations are another restraint on the luxury packaging market, as global brands must comply with evolving packaging and waste-management rules. The EU Packaging and Packaging Waste Regulation, which requires all packaging to be reusable or recyclable by 2030, compels companies to redesign products and invest heavily in R&D.

Differences in regional policies, such as varying plastic bans across the Asia Pacific, make compliance complex and costly. These inconsistencies often delay new product launches and increase operational expenses, particularly for smaller brands with limited regulatory resources. As a result, companies must navigate diverse environmental standards while maintaining innovation and product appeal.

Emerging smart packaging technologies such as NFC tags, QR codes, and augmented reality (AR) are creating new growth opportunities in the luxury packaging industry. These innovations allow brands to verify authenticity, improve traceability, and engage consumers through interactive experiences. Counterfeiting costs luxury brands billions annually, making NFC-enabled packaging a valuable solution for product verification. Studies show that around 80% of affluent customers value digital traceability features.

TOPPAN Digital’s plastic-free NFC tags, launched in January 2024, demonstrate how technology can seamlessly integrate into premium packaging. As 5G connectivity expands, smart packaging is expected to gain popularity in high-end segments like jewelry and fragrances, offering brands a new way to connect with customers and stand out in the market.

Sustainable personalization is becoming a strong growth opportunity in emerging markets, combining eco-friendly materials with local customization. Rapidly rising disposable incomes in Asia Pacific and Latin America, where luxury consumption is growing around 7% annually, are driving demand for premium packaging that reflects both sustainability and individuality. Brands are using biodegradable inks, recycled materials, and modular designs to create locally relevant, personalized packaging.

Government initiatives such as China’s green manufacturing policy further promote low-impact production methods. A recent example is Mars Wrigley China’s 100% recycled PET packaging introduced in October 2024, which aligns with national sustainability goals. Such approaches appeal to younger, environmentally conscious consumers, creating new opportunities in fast-growing sectors such as premium beverages and cosmetics.

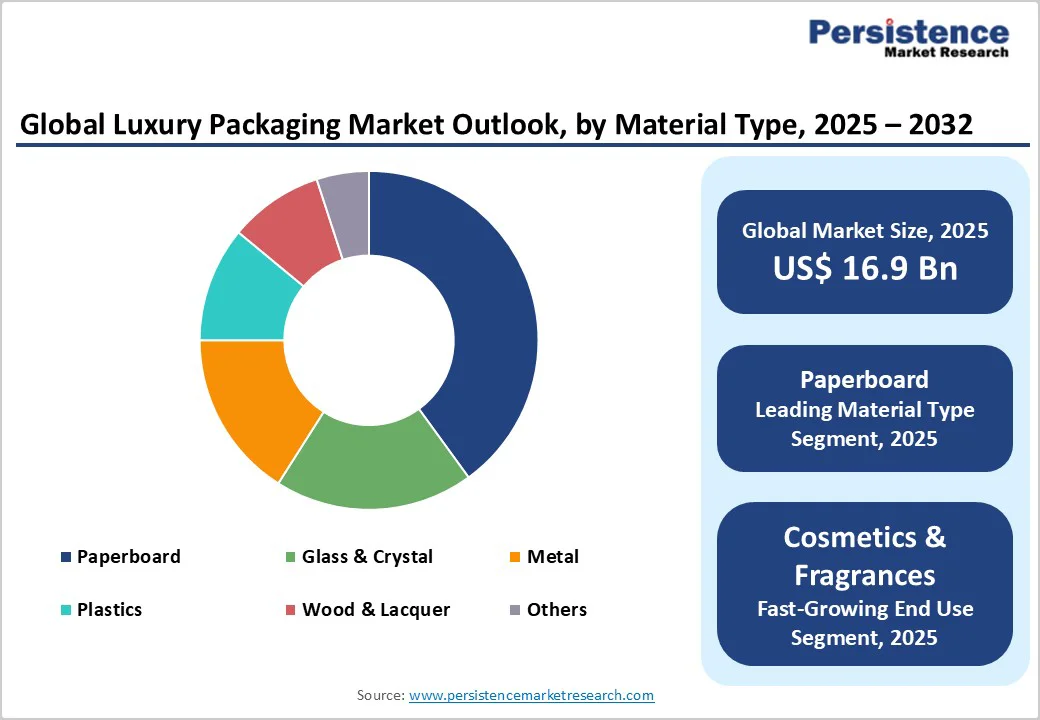

Paperboard dominates the material segment of the luxury packaging market with about 40% market share. Its popularity stems from its versatility, lightweight properties, and strong alignment with sustainability trends. Paperboard enables detailed printing, embossing, and texturing, which are essential for creating a luxurious brand image, especially in cosmetics and fashion.

Supported by EU regulations encouraging recyclability, paperboard offers an ideal balance between cost-efficiency and premium quality. Its wide availability and ability to deliver elegant finishes make it the top choice for brands looking to merge sustainability with sophistication.

Boxes hold the largest share in the packaging type category, accounting for roughly 35% of the market. Their flexibility and ability to showcase products, such as jewelry, watches, and gourmet items, make them a preferred choice for luxury brands. Boxes enhance visual presentation and offer superior protection, both of which are essential for high-value products.

The unboxing experience has become a crucial factor in luxury branding, especially with the rise of online sales. Growing use of foldable, eco-friendly box designs reduces waste and supports sustainability goals while maintaining elegance, strengthening their dominance in premium product packaging.

The cosmetics and fragrances segment leads the luxury packaging market with around 40% share. Packaging plays a central role in this industry, where design and aesthetics directly influence purchasing decisions. Brands invest heavily in high-end containers, bottles, and boxes that convey exclusivity and sophistication.

Approximately 44% of paperboard luxury packaging is used in beauty and personal care products, reflecting the category’s dominance. Additionally, environmental regulations promoting recyclable beauty packaging have accelerated innovation, supporting brand differentiation and customer retention in a highly competitive market.

North America leads the global luxury packaging market, driven by strong demand in the U.S. for cosmetics, fragrances, and premium beverages. The region accounts for about 34.6% of the paperboard packaging market, supported by advanced manufacturing and environmentally responsible production. U.S. initiatives, such as the EPA’s sustainable packaging guidelines, promote recyclable materials, while companies such as Reis Packaging expanded operations in October 2024 to meet growing demand for premium glass packaging.

North America’s mature luxury market also drives innovation in smart packaging for product authentication, as seen in Vaseline’s fully recyclable pump design introduced in 2024, which sets a new standard for sustainable luxury solutions.

Europe remains the 2nd global leader in luxury packaging, with countries such as France, Germany, Italy, and the U.K. driving innovation through craftsmanship and compliance with EU sustainability laws. The EU Circular Economy Action Plan has encouraged brands to adopt biodegradable materials and eco-luxury designs, boosting luxury retail growth by 5.6% annually.

Italy’s Mosaiq Group consortium, formed in 2024, promotes recycled content packaging for cosmetics and fragrances. France leads in glass packaging for beverages, while Germany excels in smart packaging for jewelry. Europe’s integrated regulatory system and emphasis on design excellence continue to set global benchmarks for sustainable luxury packaging.

Asia Pacific is the fastest-growing region in the luxury packaging market, led by China, Japan, and India. Rising disposable incomes, expanding e-commerce, and sustainability-focused policies are driving growth. China’s initiatives, such as Mars Wrigley’s 100% recycled PET packaging launched in October 2024, align with national green goals and consumer preferences for responsible luxury.

India’s growing luxury sector, with an estimated 7% annual growth rate, supports local paperboard production for accessories and beauty products. Japan excels in precision-crafted metal packaging, while ASEAN countries promote bio-based materials. With China expected to grow at a 7.4% CAGR, the Asia Pacific continues to strengthen its position as a major hub for innovative, sustainable, and personalized luxury packaging solutions.

The luxury packaging market exhibits a moderately consolidated structure, with a handful of global leaders controlling significant shares through vertical integration and innovation in sustainable materials.

Key players pursue expansion via strategic acquisitions and R&D in smart technologies, differentiating via bespoke designs and eco-certifications that command premium pricing. Emerging models emphasize circular-economy partnerships, reducing waste while enabling scalable customization, thereby fostering a competitive edge in fragmented regional segments.

The market is valued at US$ 16.9 Bn in 2025 and expected to reach US$ 24.9 Bn by 2032, reflecting steady expansion driven by premiumization and sustainability.

Key drivers include the surge in e-commerce requiring protective custom designs and sustainability demands, with 71% of consumers preferring eco-friendly options per European surveys.

Cosmetics & Fragrances leads with 40% share, due to emphasis on elegant, sensory packaging that enhances product appeal in beauty applications.

North America leads with 34.64% share, supported by U.S. affluent demand and innovations in recyclable materials for cosmetics and beverages.

Smart packaging technologies like NFC offer opportunities for authentication and interactive experiences, addressing counterfeiting in high-value sectors.

Prominent players include Ardagh Group S.A., Amcor Plc, and DS Smith, focusing on sustainable innovations and global supply chain expansions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Packaging Type

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author