ID: PMRREP32934| 200 Pages | 11 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

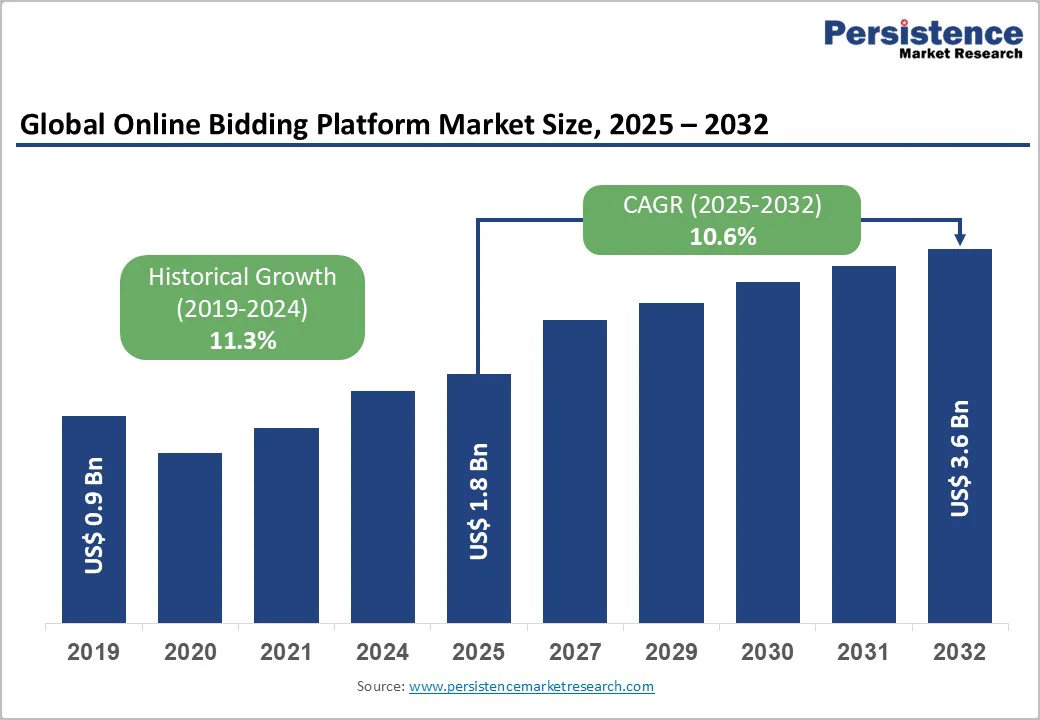

The global online bidding platform market size is valued at US$ 1.8 billion in 2025 and projected to reach US$ 3.6 billion by 2032, growing at a CAGR of 10.6% between 2025 and 2032.

This expansion reflects the market's accelerating digital transformation driven by technological innovation, regulatory modernization, and growing adoption of automated procurement systems across diverse sectors.

The market is expanding due to increased investment in e-procurement solutions, widespread adoption of reverse auction technologies for government and corporate procurement, and rising demand for transparent bidding mechanisms that reduce costs and enhance efficiency.

| Key Insights | Details |

|---|---|

| Online Bidding Platform Market Size (2025E) | US$ 1.8 Bn |

| Market Value Forecast (2032F) | US$ 3.6 Bn |

| Projected Growth CAGR (2025-2032) | 10.6% |

| Historical Market Growth (2019-2024) | 11.3% |

Government digitalization initiatives worldwide have emerged as a primary growth driver for the online bidding platform market. Regulatory bodies across North America, Europe, and Asia-Pacific are mandating digital procurement systems to enhance transparency, reduce corruption, and improve operational efficiency.

The Federal Acquisition Regulation (FAR) in the United States increasingly requires federal agencies to utilize reverse auction platforms for competitive bidding, directly driving platform adoption across government contracting.

The European Union's Public Procurement Directive emphasizes digital-first procurement approaches, compelling member states to implement standardized e-procurement platforms for government purchasing. AS the government agencies across developed nations are transitioning to digital bidding systems, it represents a substantial market expansion opportunity.

Government procurement represents approximately 32-35% of total online bidding platform demand, with expected growth acceleration as emerging markets implement digitalization policies.

Reverse auction technology adoption in corporate procurement represents a transformative growth driver, particularly among large enterprises seeking cost optimization and supplier competition. Leading corporations across retail, automotive, healthcare, and manufacturing sectors increasingly utilize reverse auction platforms to systematically reduce procurement costs, with reported savings ranging from 15-25% compared to traditional procurement methods.

Organizations recognize that reverse auction mechanisms create competitive pressure among suppliers, automatically driving price reductions while maintaining quality standards through transparent evaluation criteria. The Asia-Pacific region demonstrates particularly strong reverse auction adoption, with companies in China, India, and Japan leveraging platforms like RainWorx Software and Bidlogix to optimize supplier relationships and procurement efficiency.

Despite promising growth prospects, the online bidding platform market faces significant restraint from high implementation and integration costs, particularly for organizations transitioning from legacy systems.

Deploying enterprise-grade bidding platforms requires substantial capital investment for system infrastructure, staff training, data migration, and integration with existing enterprise resource planning (ERP) systems. Small and medium-sized enterprises (SMEs) face particular challenges, with implementation costs ranging from USD 50,000 to USD 500,000 depending on organizational complexity and customization requirements.

Beyond initial implementation, ongoing operational expenses, including platform licensing fees, transaction processing charges, cybersecurity updates, and vendor support services, accumulate to create substantial operational overhead.

Organizations estimate 3-5year payback periods for bidding platform investments, deterring budget-constrained entities from adoption. Developing economies experience additional barriers due to limited financial resources, lower digital infrastructure maturity, and inadequate technical expertise among procurement professionals, restricting market penetration in emerging regions.

Fragmented cybersecurity requirements and complex data privacy regulations present persistent market challenges. General Data Protection Regulation (GDPR) compliance in Europe, California Consumer Privacy Act (CCPA) requirements in the United States, and evolving data localization regulations in China, India, and other nations create compliance burdens for international bidding platforms.

Approximately 47% of organizations cite cybersecurity concerns as primary barriers to adopting online bidding platforms, particularly regarding the protection of sensitive pricing information, supplier financial data, and procurement strategies.

Platform providers must invest in enterprise-grade encryption, multi-factor authentication, audit trail maintenance, and compliance certification, increasing operational costs and complexity.

Cyber incidents affecting bidding platforms have damaged market confidence, with prominent breaches reported at major procurement platforms in 2023 - 2024, creating reputational risks. Organizations require extensive security compliance certifications, including ISO 27001, SOC 2, and industry-specific standards, which smaller vendors struggle to achieve, creating market consolidation pressure.

Digital transformation of real estate transactions presents a strong growth opportunity for online bidding platforms as sellers, brokers, and institutional investors increasingly shift to transparent, time-bound digital auctions. Property transactions exceeding US$ 2 trillion annually are gradually moving toward online bidding, driven by demand for faster sales cycles, improved price discovery, and wider buyer participation.

Residential and commercial real estate markets in North America, Europe, and parts of Asia are adopting online auctions to reduce brokerage dependency and streamline compliance with disclosure and documentation requirements. Real estate investment firms, banks managing distressed assets, and government land authorities are accelerating adoption, creating a potential US$ 450-500 million market expansion opportunity for platform providers.

Artificial intelligence and advanced analytics adoption offer a major growth opportunity for online bidding platforms by enabling predictive, automated, and intelligence-driven procurement processes. AI-enabled platforms support dynamic price forecasting, supplier risk scoring, automated bid evaluation, and optimized auction design, allowing organizations to improve decision accuracy and reduce manual procurement workloads.

The broader AI-in-procurement ecosystem is projected to expand at a CAGR of more than 20% through 2032, reinforcing demand for integrated bidding solutions. Blockchain capabilities further strengthen compliance and transparency requirements.

These capabilities enable premium pricing models, with AI-enhanced bidding platforms typically commanding 25-40% higher subscription rates and positioning providers for 12-15% market share gains in advanced procurement environments.

English Auctions remain the dominant auction type in the global online bidding platform market, accounting for approximately 40% share in 2025 due to their intuitive ascending-price mechanism and strong user familiarity. This format supports transparent price discovery, encourages competitive bidding, and is widely favored in categories such as real estate, art, antiques, jewelry, and luxury goods.

Online real estate transactions particularly reinforce this dominance, with close to 70% of residential and commercial property auctions using English auction protocols. The format’s simple structure reduces operational friction for platform providers, lowers training requirements for participants, and aligns with procurement standards in major markets, strengthening its long-term market leadership.

Marketplace Bidding Platforms lead the solution landscape with approximately 58% market share in 2025, supported by their multi-vendor architecture that enables simultaneous interactions between multiple buyers and sellers. These platforms generate strong network effects, increasing engagement and transaction volume as user bases expand.

Their broad utility across consumer auctions, B2B procurement, and government supplier interactions reinforces their dominance. Scalability and integrated tools for payments, logistics, dispute resolution, and seller management further boost platform stickiness.

Monetization models, including transaction fees, subscription tiers, and premium seller services, create recurring revenue streams, strengthening commercial viability. Marketplaces remain preferred for global expansion due to multi-currency support and flexible auction configuration capabilities.

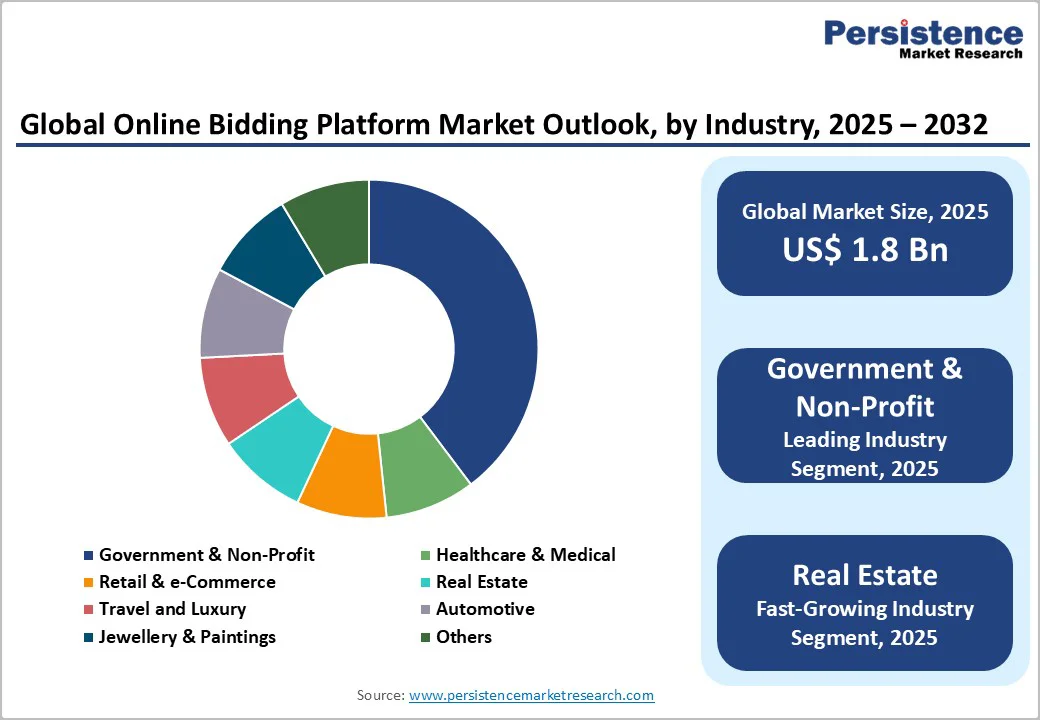

The Government & Non-Profit segment holds the largest industry share at approximately 35% in 2025, driven by strict regulatory mandates, high procurement volumes, and increasing requirements for transparency and auditability. Governments worldwide are shifting procurement processes to digital bidding environments to ensure competitive fairness, streamline vendor participation, and improve compliance with national procurement regulations.

This segment benefits from stable budgets and multi-year contracts that create predictable recurring revenue for platform providers. Non-profit institutions, including universities, healthcare systems, and charitable organizations, also accelerate adoption to improve cost control and donor accountability.

While regulatory complexity increases platform development costs, it simultaneously strengthens competitive barriers and solidifies the segment’s long-term market dominance.

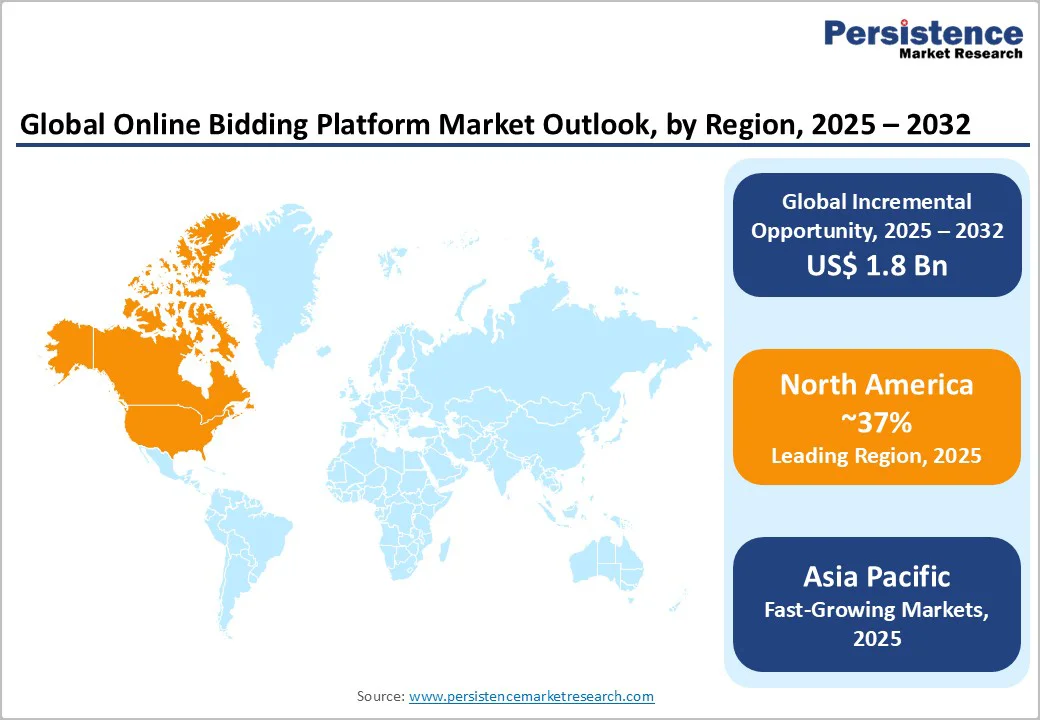

North America maintains its established position as the leading online bidding platform region, commanding approximately 37% global market share in 2025 through mature regulatory frameworks and advanced digital infrastructure.

The United States leads regional development, where the Federal Acquisition Regulation (FAR) continuously evolves to mandate reverse auction adoption for government procurement, establishing enforceable standards for digital bidding.

Corporate adoption accelerates as enterprises recognize competitive advantages from systematic supplier competition, with major retailers including Walmart and Amazon Supply leveraging advanced bidding platforms to manage supplier networks.

Canada and Mexico demonstrate accelerating adoption, with Canadian federal procurement increasingly requiring digital bidding compliance for government contracts. The region's mature cybersecurity infrastructure, established payment processing systems, and regulatory frameworks supporting digital commerce provide ideal conditions for platform proliferation.

Leading companies including OneCause, RainWorx Software, and ClickBid maintain substantial North American operational presence with extensive feature development focused on regulatory compliance.

Europe represents a mature but increasingly dynamic online bidding platform market, capturing about one-fourth of the global market share in 2025, with emphasis on regulatory harmonization and cross-border procurement standardization.

The European Union's Public Procurement Directive mandates digital procurement approaches across member states, creating unified standards for e-procurement platforms and establishing competitive pressure among providers. Germany, the United Kingdom, and France lead European adoption, with these nations collectively representing more than 50% of the regional bidding platform market share.

Germany demonstrates particular technological sophistication with advanced enterprise bidding platforms serving automotive, manufacturing, and industrial procurement sectors. The United Kingdom, despite Brexit, maintains robust online bidding adoption through continued regulatory alignment with international procurement standards.

The region demonstrates strong emphasis on supplier diversity, environmental sustainability, and ethical procurement, creating opportunities for platforms integrating ESG assessment capabilities and supplier diversity tracking. European data privacy regulations, including GDPR create compliance barriers but also establish market entry protections for established providers meeting stringent requirements.

Asia-Pacific emerges as the fastest-growing online bidding platform region with an anticipated CAGR of 12.4% from 2025 - 2032, substantially exceeding global growth rates and representing primary market expansion opportunities. China represents the region's largest market, driven by government procurement reforms emphasizing transparent, competitive bidding and digital systems integration.

The Chinese government mandates online bidding for state-owned enterprise procurement, with platforms including Bidlogix and regional competitors serving millions of government procurement transactions annually.

Japan maintains an established online bidding infrastructure through both public and private sector adoption, with approximately over 70% procurement digitized by 2030. India's online bidding platform market demonstrates a remarkable growth trajectory, fueled by Digital India government initiative, expanding corporate procurement sophistication, and increasing international business integration.

The deployment of the Government e-Marketplace (GeM), representing India's national digital procurement platform, demonstrates governmental commitment to online bidding adoption. Southeast Asian markets, including Singapore, Thailand, and Vietnam, are witnessing accelerated adoption as digital payment infrastructure matures and manufacturing sectors expand international procurement networks.

The online bidding platform market remains moderately fragmented, with roughly 15-20 notable global players supported by a wide base of regional platforms that specialize in niche domains.

Market concentration is moderate, with leading providers together accounting for just under one-third of the total share, indicating competitive balance rather than dominance. Companies increasingly compete through technology-led strategies, prioritizing AI-driven bid optimization, blockchain-based transaction validation, mobile-first user experiences, and seamless enterprise integrations.

High entry barriers persist due to stringent compliance norms, heavy cybersecurity investments, and the need for scalable, high-availability infrastructure. Business strategies now emphasize end-to-end auction lifecycle management, flexible SaaS models, vertical-specific customization, and integration with procurement ecosystems.

Recent consolidation reflects efforts to broaden capabilities, expand into regulated segments, and strengthen geographic presence, highlighting a shift toward platform sophistication and sector-aligned service differentiation.

The online bidding platform market is projected to reach US$ 3.6 billion by 2032, up from US$ 1.8 billion in 2025.

Growth is driven by government procurement digitalization, rising reverse auction adoption, regulatory mandates, and increasing AI integration.

English Auctions lead with 40% share in 2025, while reverse auctions grow fastest.

North America leads with 37% market share in 2025.

Healthcare and Medical procurement digitalization offers the strongest growth opportunity through 2032.

Major players include RainWorx Software, Bidlogix, OneCause, Clarity Auction eCommerce, and Handbid.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Auction Type

By Solution

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author