ID: PMRREP12565| 198 Pages | 9 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

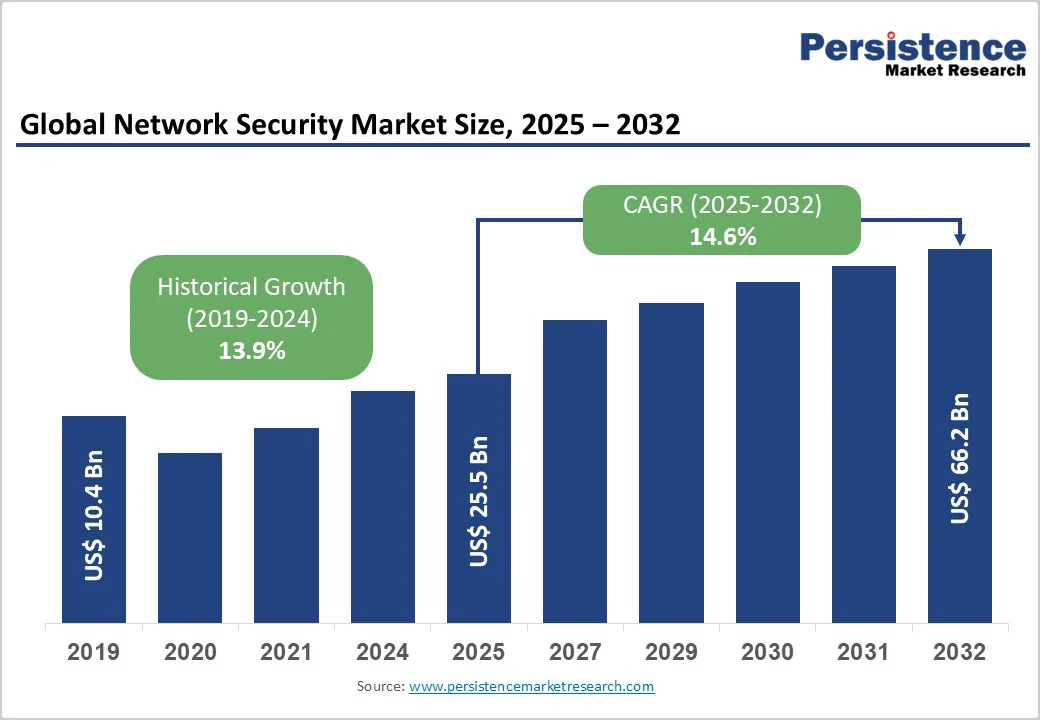

The global network security market size is likely to be valued US$25.5 Biilion in 2025, estimated to reach at US$66.2 Billion by 2032 achieving at a CAGR of 14.6% during the forecast period from 2025 to 2032. The market is experiencing robust growth driven by the escalating cyber threats, rising adoption of cloud and IoT technologies, and stringent regulatory compliance requirements across industries. The market is further propelled by innovations in AI-driven threat detection and zero-trust architectures, catering to preferences for scalable, real-time security. The growing acceptance of network security as a critical enabler for remote work and hybrid environments is a key growth factor.

| Key Insights | Details |

|---|---|

|

Network Security Market Size (2025E) |

US$25.5 Bn |

|

Market Value Forecast (2032F) |

US$66.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

14.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

13.9% |

Escalating Cyber Threats and Regulatory Compliance Driving Adoption

The escalating frequency and sophistication of cyber threats, coupled with stringent regulatory mandates, are primary drivers of the network security market. The growing reliance on digital infrastructure, cloud services, and connected devices has increased exposure to ransomware, phishing, and advanced persistent threats, creating strong demand for robust security solutions. Network security tools such as firewalls, VPNs, and intrusion detection systems provide multi-layered protection, enhancing threat visibility, reducing breach risks, and ensuring business continuity. Organizations are investing in AI-driven threat intelligence, automated response systems, and zero-trust architectures to proactively detect and mitigate evolving cyberattacks.

Regulatory compliance, data privacy requirements, and the need to secure hybrid and multi-cloud environments further accelerate adoption. For instance, Implementations by Cisco Systems have demonstrated significantly faster incident response in BFSI sectors, ensuring compliance with GDPR and HIPAA while minimizing downtime and operational losses. Additionally, the rapid adoption of IoT has amplified vulnerabilities, prompting increased investments in cybersecurity and accelerating deployment of advanced solutions. The emphasis on zero-trust models, supported by frameworks such as NIST, continues to drive market growth, particularly in high-risk industries such as healthcare and finance across North America and Europe.

High Implementation Costs and Complexity in Integration

The high implementation costs and technical complexity of network security solutions pose significant restraints on market growth. Comprehensive deployments involving firewalls, antivirus, and VPNs require substantial investment, with ongoing maintenance and updates adding to operational expenses, often deterring small and medium-sized businesses. Integration with legacy systems can create delays and compatibility challenges, while regulatory compliance and data privacy requirements further extend deployment timelines. Additionally, a shortage of skilled cybersecurity professionals limits effective implementation and management, increasing reliance on external consultants.

Organizations also face challenges in keeping pace with rapidly evolving threats, ensuring continuous monitoring, and managing multi-cloud or hybrid environments. For example, migrations by Palo Alto Networks customers have faced 25% cost overruns due to customization needs. Smaller firms struggle against giants such as Fortinet, limiting penetration in resource-constrained sectors where basic antivirus suffices.

Expansion in AI-Driven Security and 5G/Iot Ecosystems

Expansion in AI-powered threat intelligence and the proliferation of 5G and IoT networks present significant growth opportunities for the network security market. AI-enhanced firewalls enable predictive analytics, reduce false positives, and support zero-trust architectures in dynamic environments. These innovations align with the widespread adoption of 5G and the increasing number of connected IoT devices.

The rise of remote work, smart cities, and digital services is driving demand for real-time threat detection and automated response systems. For instance, companies such as Trend Micro are investing in edge security, with trials showing 75% improved response times. Cloud-native solutions cut deployment costs by 40%, and blockchain integration boosts secure data sharing. As digital transformation drives US$6.8 Tn in IT spending by 2025, these opportunities are set to fuel expansion in high-growth regions such as Asia Pacific and North America.

Product Type Insights

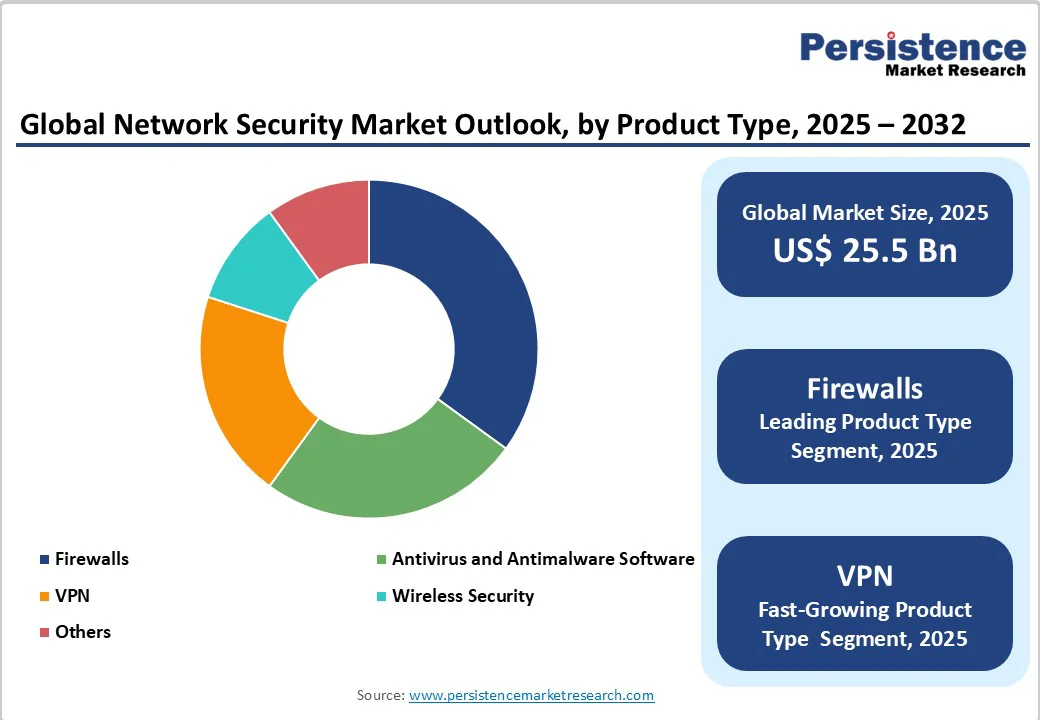

Firewalls dominate the market, expected to account for approximately 30% of the share in 2025. Their dominance is driven by core perimeter protection capabilities and integration with next-gen features such as intrusion prevention, making them indispensable for enterprise networks.

VPN is the fastest-growing segment, driven by the rise of remote work and the need for secure, encrypted access to corporate networks. With increasing hybrid cloud adoption, organizations rely on VPNs to protect sensitive data, ensure uninterrupted connectivity, and maintain compliance, enabling employees to work safely from any location without compromising network security.

Deployment Insights

Cloud leads with over 45% share, favored for its scalability, flexibility, and cost-efficiency. Organizations adopting multi-cloud environments benefit from centralized management, rapid resource allocation, and reduced infrastructure costs. Cloud-based security solutions enable real-time threat monitoring, seamless updates, and easy integration across platforms, making them ideal for dynamic, fast-growing business operations.

On-Premise is the fastest-growing in regulated industries such as government, where data sovereignty and compliance are critical. Organizations prefer on-site solutions to maintain full control over sensitive information, ensure adherence to local regulations, and integrate with legacy systems. This approach enhances security, supports audit requirements, and mitigates risks associated with cloud-based data storage.

Industry Insights

BFSI holds nearly 25% share, driven by the need to prevent cyber fraud and ensure regulatory compliance in financial operations. With growing digital banking, online payments, and fintech integration, institutions are investing in advanced encryption, threat analytics, and AI-driven solutions to safeguard sensitive data and transactional integrity.

IT and Telecommunications is the fastest-growing, driven by the rapid rollout of 5G networks and large-scale data center expansions. These advancements demand robust edge protection to secure high-speed data transmission, prevent network breaches, and support the increasing connectivity of IoT devices and cloud-based infrastructures.

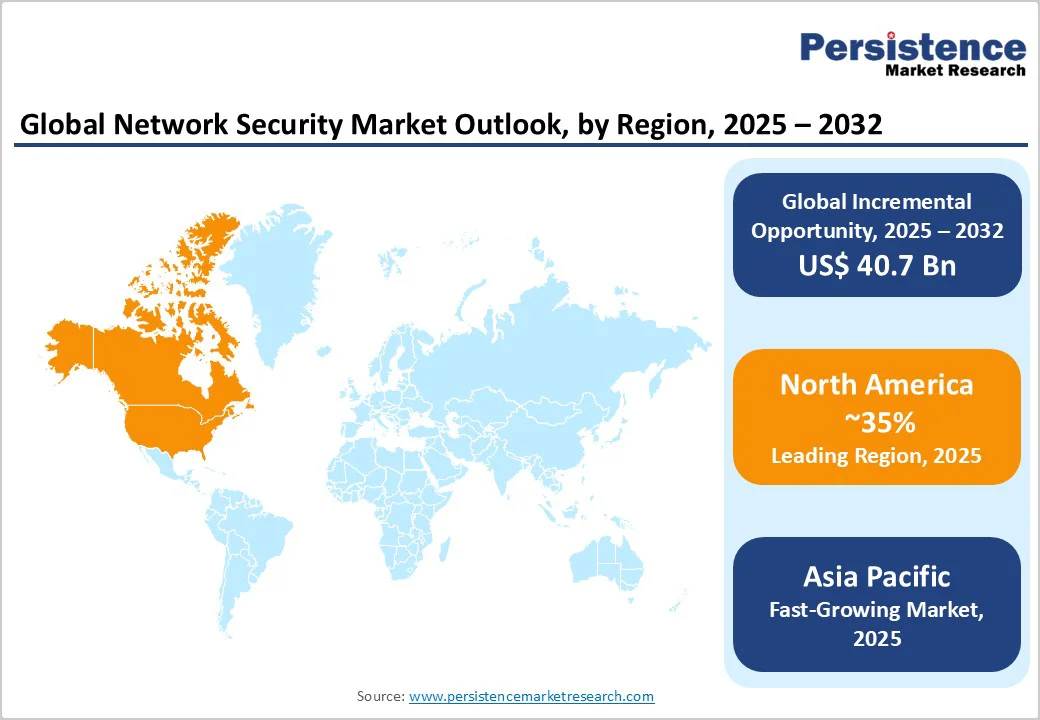

North America Network Security Market Trends

North America accounts for 35% in 2025, driven by an increasingly complex cyber threat landscape and substantial investments in AI-powered security solutions. The region, led by the U.S. and Canada, is witnessing widespread adoption of advanced technologies such as zero-trust security models, cloud-native architectures, and automated threat detection systems. Enterprises across industries, especially finance, healthcare, and critical infrastructure are prioritizing cybersecurity modernization to safeguard digital assets and ensure regulatory compliance.

The surge in ransomware attacks, phishing campaigns, and nation-state cyber threats has prompted organizations to deploy multi-layered security frameworks enhanced by AI and analytics. Although geographically part of Europe, the U.K. market reflects similar dynamics, with rising adoption of next-generation security solutions under the National Cyber Security Centre (NCSC) guidelines.

Europe Network Security Market Trends

Europe holds about 25% market share, led by Germany and France driven by strong regulatory frameworks and proactive government initiatives. The region’s leadership is anchored by countries such as Germany, France, and the United Kingdom, which have established robust cybersecurity infrastructures to comply with stringent data protection regulations. The enforcement of the General Data Protection Regulation (GDPR) has been a major catalyst, compelling organizations to adopt advanced security solutions to ensure compliance and safeguard sensitive data.

The EU Cybersecurity Act and related directives have promoted the development of unified cybersecurity standards across member states, fostering collaboration and enhancing resilience against cross-border threats. The growing digitization of industries, expansion of cloud services, and rising adoption of IoT technologies have further intensified the demand for secure network frameworks.

Asia Pacific Network Security Market Trends

Asia Pacific commands around 25% share and is the fastest-growing region, riven by rapid digital transformation and increasing internet penetration across emerging economies. Countries such as China, India, Japan, and South Korea are witnessing a surge in data traffic, cloud adoption, and connected devices, fuelling the demand for advanced cybersecurity solutions. The region’s digital economy boom supported by over one billion internet users has significantly increased the risk of cyberattacks, prompting governments and enterprises to strengthen data protection frameworks and invest in secure infrastructure.

The proliferation of mobile banking, e-commerce platforms, and IoT applications has heightened the need for network security in both consumer and enterprise segments. Government initiatives such as India’s “Digital India” and China’s “Cybersecurity Law” are further supporting local innovation and regulatory compliance.

The global network security market is highly competitive, characterized by rapid technological advancements and continuous innovation. Leading companies are increasingly focusing on integrating artificial intelligence (AI) and machine learning (ML) into their cybersecurity frameworks to enhance threat prediction, detection, and response capabilities. These technologies enable real-time monitoring, automated threat mitigation, and improved network visibility, which are crucial in combating sophisticated cyberattacks.

Key players are pursuing strategic acquisitions and partnerships to build robust, cloud-native ecosystems that seamlessly integrate with emerging technologies such as 5G, IoT, and edge computing. The shift toward remote work and the expansion of connected devices have further increased the demand for scalable, adaptive security solutions.

Key Industry Developments

The global network security market is projected to reach US$25.5 Billion in 2025, driven by surging cyber threats and regulatory compliance needs worldwide.

Increasing frequency and sophistication of cyber threats, including ransomware, phishing, and advanced persistent threats.

The market is poised to witness a CAGR of 14.6% from 2025 to 2032, supported by AI innovations and expanding cloud security demands.

Advancements in AI threat detection and 5G security offer key opportunities, enabling proactive defenses in IoT and edge computing environments.

Key players include Cisco Systems, Palo Alto Networks, Fortinet, Check Point, and Trend Micro, leading through AI-integrated solutions and global partnerships

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Deployment

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author