ID: PMRREP32757| 248 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

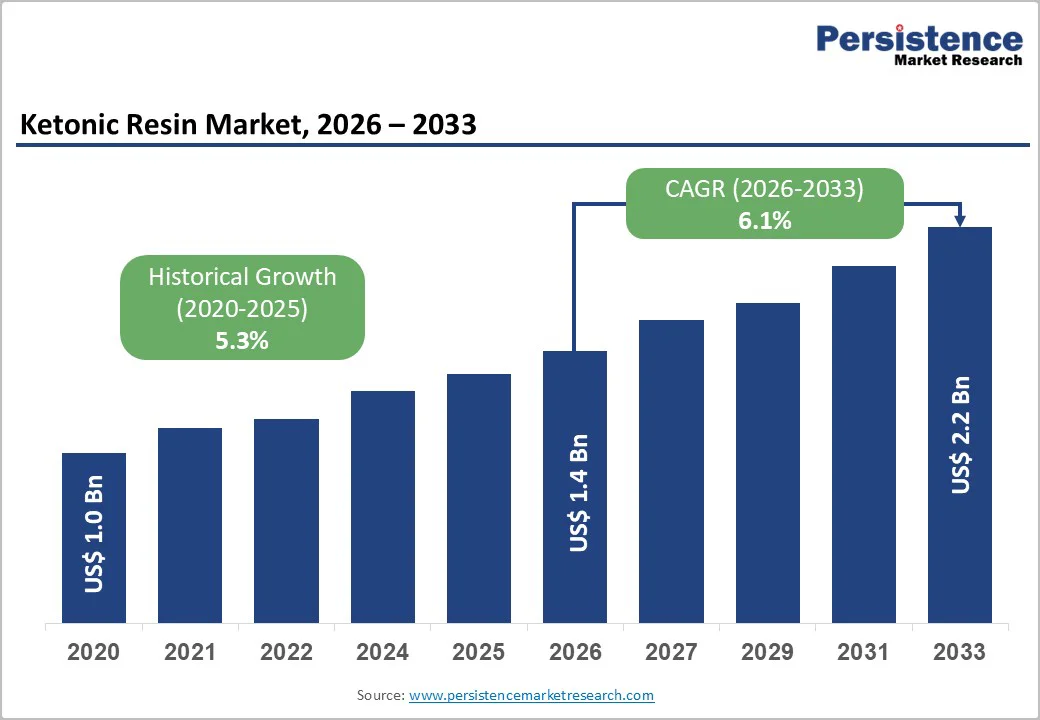

The global ketonic resin market is estimated to grow from US$ 1.4 Bn in 2026 to US$ 2.2 Bn by 2033. The market is projected to record a CAGR of 6.1% from 2026 to 2033.

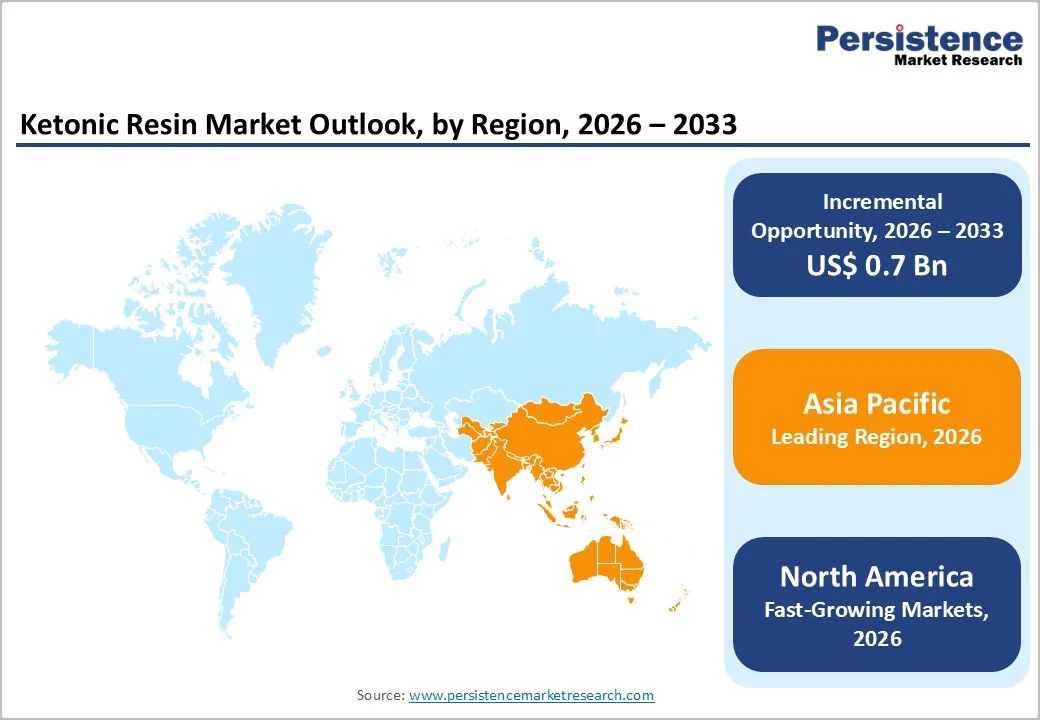

The ketonic resin industry is growing steadily, driven by rising industrial demand in coatings, printing inks, adhesives, and plastics. North America leads with established manufacturing and advanced industrial infrastructure. At the same time, Asia-Pacific exhibits rapid growth driven by expanding manufacturing bases, rising construction and automotive activity, and increasing adoption of high-performance resins across multiple applications.

| Key Insights | Details |

|---|---|

| Global Ketonic Resin Market Size (2026E) | US$ 1.4 Bn |

| Market Value Forecast (2033F) | US$ 2.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.3% |

The expansion of the automotive sector significantly drives demand for ketonic resins, particularly in coatings, adhesives, and specialty components. In India, the automotive industry contributes about 7.1% of GDP and nearly half of manufacturing output. At the same time, the country stands as the fourth-largest vehicle producer globally, with over 28 million units manufactured in FY2023?24. This scale of production correlates with rising use of industrial resins for high-performance automotive paints, primers, and bonding applications, essential for corrosion resistance, aesthetic finishes, and structural integrity in vehicles.

Growth in construction output further supports ketonic resin demand through increased use of resins in protective coatings, sealants, and adhesives across infrastructure and building projects. Government data show India’s infrastructure output—a proxy for construction activity—expanded by 3.8% in March 2025, with key materials like cement rising over 11% and steel by 7%, which underpins activity in coatings and resin-based products for structural and surface protection. These expanding industrial and infrastructure activities amplify requirements for high-performance resin formulations in paints, protective coatings, and adhesives, directly benefiting the ketonic resin market as construction demand rises domestically and in other fast-growing economies.

Volatility in raw material prices poses a significant restraint on the ketonic resin market because key feedstocks—such as benzene, propylene, and acetone precursors—are closely tied to crude petroleum and petrochemical derivatives, which exhibit unpredictable cost movements. For example, benzene price indices in late 2025 ranged around US$0.74–0.79/kg across major regions, showing ongoing price variability driven by crude markets and regional supply dynamics. Benzene and propylene feedstocks can constitute a substantial share of intermediate resin production costs, amplifying exposure to upstream price swings. Such raw material volatility complicates budgeting, contract pricing, and cost forecasting for resin manufacturers, compressing margins when input costs rise without corresponding increases in product prices.

National economic price indices further illustrate input cost pressures in chemical manufacturing. The U.S. Producer Price Index (PPI) for chemicals and allied products rose to around 297.3 (index base 1982=100) by September 2025, reflecting broader increases in wholesale chemical costs, which often correlate with raw feedstock inflation and shifts in energy prices. Fluctuating conditions in energy and petrochemical markets—key drivers of chemical feedstock pricing—have heightened uncertainty in production economics for resins and related intermediates. Such volatility hinders long-term planning and can force manufacturers to reduce utilization or delay investments when raw material price paths are unclear.

The growing demand for specialty high-performance resins presents a clear opportunity for the Ketonic Resin Market, as downstream sectors such as automotive and industrial coatings require advanced materials with superior adhesion, durability, and chemical resistance. Global vehicle production exceeded 92.5 million units in 2024, underscoring sustained automotive manufacturing activity that drives coatings and related resin consumption for OEM and refinish applications. This production scale highlights ongoing demand for resilient resin systems in protective and performance coatings used on vehicle bodies and components. Ketonic resins, with strong film-forming and adhesion properties, align well with these stringent performance requirements in modern automotive finishes.

Urbanization trends further justify the opportunity for specialty resins in high-performance applications. According to the World Bank, more than half of the global population now lives in cities, a share expected to rise to nearly 70 percent by 2050, indicating significant expansion of urban infrastructure and construction activities. As cities grow, demand for protective coatings on bridges, public transit, and commercial buildings increases, requiring resins capable of long-term durability and environmental resistance. These structural coating needs create a favorable environment for specialty ketonic resin adoption in industrial and construction coatings, where performance specifications are increasingly stringent.

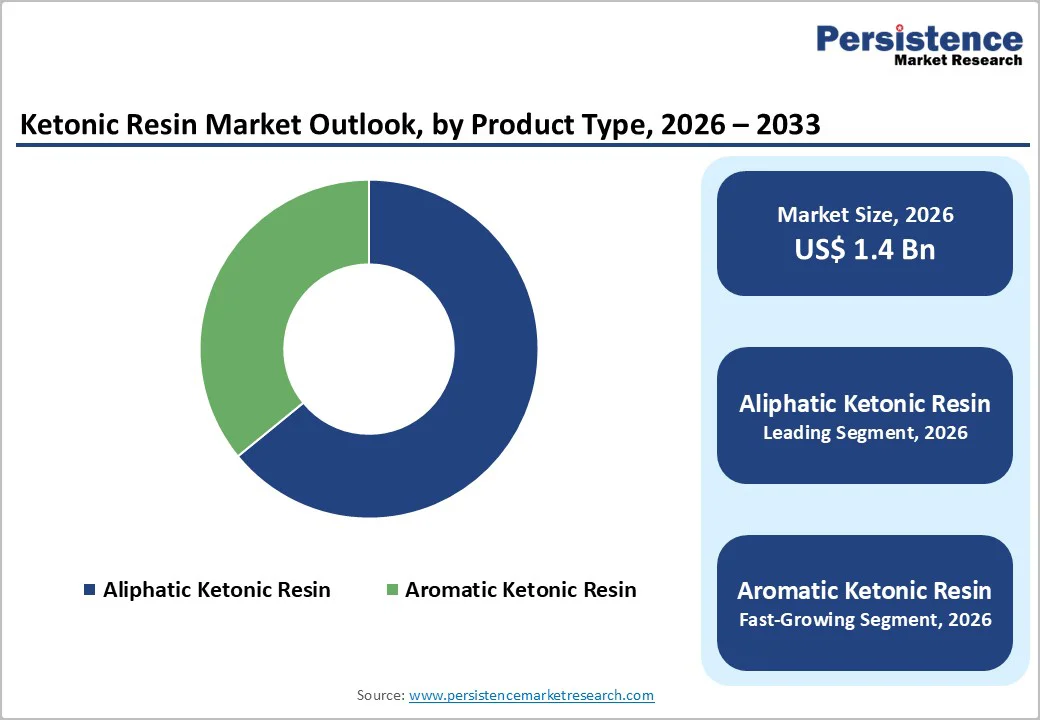

Aliphatic ketonic resin dominates with a 64.1% share in 2025, as its molecular structure delivers broad compatibility, lower colour impact, and excellent performance in general-purpose industrial applications. Aliphatic variants mix readily with diverse solvent systems and resin bases, improving gloss, adhesion, drying speed, and film formation in coatings, inks, and adhesives—properties prized in high-throughput manufacturing. Ketonic resins enhance pigment wetting and adhesion on various substrates, such as metal, plastics, and paper, boosting performance without introducing the colour or structural rigidity that aromatic types may impart. Their favourable solubility in common organic solvents supports formulation flexibility across multiple end uses, making them preferable for everyday industrial coatings and printing applications.

Paints and coatings dominate the Ketonic Resin Market because they require resins with excellent adhesion, chemical resistance, and film-forming properties, which ketonic resins provide. These resins improve gloss, durability, and drying performance in both industrial and decorative coatings. Widespread construction and infrastructure development, particularly in urbanizing regions, drives large-scale use of protective and aesthetic coatings. Additionally, industrial applications such as automotive and machinery coatings demand high-performance resins to withstand environmental stress and mechanical wear. Ketonic resins, especially aliphatic types, are versatile and compatible with multiple solvent systems, making them the preferred choice for formulating durable paints and coatings across diverse substrates and environments.

Asia Pacific dominates the Ketonic Resin Market with a 37.5% share in 2025, owing to its status as a global manufacturing hub with immense industrial scale and urban expansion. The region accounted for 56.7% of the world’s manufacturing value added in 2023, underscoring its industrial leadership in chemicals, machinery, and intermediate products that rely on resin inputs such as ketonic resins. This manufacturing strength supports strong downstream demand for coatings, adhesives, and industrial polymers. Asia’s rapid urbanization, with billions moving into cities and driving housing and infrastructure development across China, India, and Southeast Asia, further fuels demand for resins in protective and performance coatings. These structural, industrial, and urban trends create an environment where ketonic resins are widely used and continuously needed.

Europe is an important region in the Ketonic Resin Market because it hosts one of the largest and most diversified chemical industries globally, underpinning strong downstream manufacturing demand for resins in coatings, adhesives, and specialty materials. The European Union generated €830 billion in sales of chemical and related products in 2024, with exports growing 7% year-on-year, underscoring robust chemical trade and industrial activity. The region accounted for around 22 percent of global chemical sales in 2023, reflecting significant scale and integration into global value chains. European manufacturing and industrial output—including chemical intermediates essential for resin formulations—remain key to sectors such as automotive, construction, and industrial coatings, which use ketonic resins extensively.

North America is the fastest-growing region in the Ketonic Resin Market because of strengthening industrial output, expanding construction activity, and robust automotive production, all of which increase demand for high-performance resins. U.S. industrial production has risen steadily, with manufacturing output up about 3.2% year-over-year in mid-2025, reflecting broader utilization of resin-based materials across sectors. The U.S. Census Bureau reported over $1.8 trillion in private construction spending through September 2025, indicating strong coatings and adhesive needs in infrastructure and buildings. Additionally, North America’s chemical sector—supported by abundant feedstocks and advanced processing—remains a major producer of intermediates used in resin synthesis, with chemical shipments exceeding $840 billion annually. These dynamics underpin accelerated regional growth in ketonic resin consumption relative to other markets.

Leading Ketonic Resin applications focus on industrial coatings, printing inks, and adhesives. By providing superior adhesion, chemical resistance, and durability, enhancing formulation flexibility, and supporting high-performance industrial standards, they enable efficient manufacturing, protect surfaces, and meet diverse industrial requirements, driving widespread adoption and fueling growth in the global Ketonic Resin Market.

The global Ketonic Resin Market is projected to be valued at US$ 1.4 Bn in 2026.

Rising industrial demand, automotive and construction growth, high-performance requirements, urbanization, and technological advancements drive the market.

The global Ketonic Resin Market is poised to witness a CAGR of 6.1% between 2026 and 2033.

Development of eco-friendly resins, specialty applications, emerging markets, innovative adhesives, and integration with smart coatings opportunities.

Mitsui Chemicals, Inc., Resinall Corp., BASF SE, Shree Resins, Eastman Chemical Company, D.R. Coats Ink & Resins Pvt. Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author