ID: PMRREP4429| 199 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

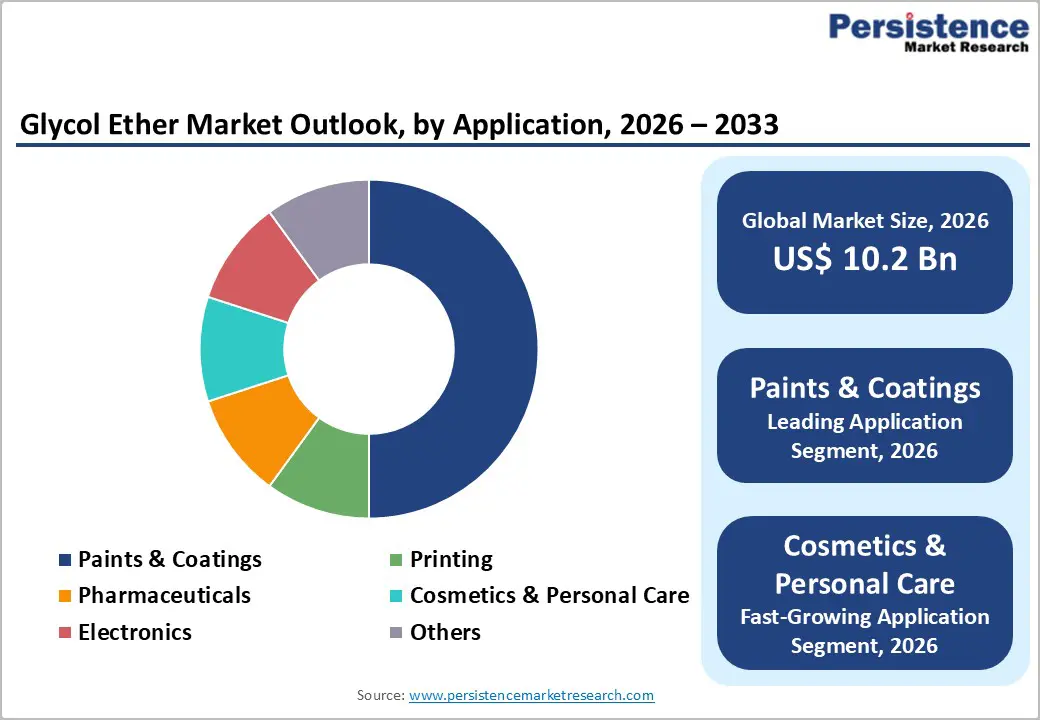

The global glycol ethers market size is likely to be valued at US$ 10.2 billion in 2026 and is projected to reach US$ 15.5 billion by 2033, growing at a CAGR of 6.2% between 2026 and 2033.

Market expansion is driven by accelerating global demand for low-VOC solvent solutions, which is supported by stringent environmental regulations, including EU Directive 2004/42/EC, EPA aerosol coatings standards, and LEED green building certification requirements that establish regulatory compliance requirements for sustainable glycol ether formulations.

| Key Insights | Details |

|---|---|

| Glycol Ethers Market Size (2026E) | US$ 10.2 Bn |

| Market Value Forecast (2033F) | US$ 15.5 Bn |

| Projected Growth CAGR (2026 - 2033) | 6.2% |

| Historical Market Growth (2020 - 2025) | 5.8% |

The tightening global regulatory framework aimed at reducing volatile organic compound (VOC) emissions is a major growth driver for the glycol ether market, particularly for low-volatility and safer product variants. Regulations such as EU Directive 2004/42/EC mandate strict VOC content limits for decorative paints and vehicle refinishing products, thereby compelling formulators to replace conventional high-VOC solvents with compliant alternatives, such as advanced glycol ethers. Similarly, emission standards enforced by the U.S. Environmental Protection Agency for aerosol coatings and sustainability requirements under LEED certification for construction materials are accelerating the adoption of low-VOC solvents across architectural, industrial, and automotive coatings.

Glycol ethers offer an optimal balance of solvency, evaporation control, and regulatory compliance, enabling manufacturers to meet environmental mandates without sacrificing performance. Recent formulation innovations by BASF and strong eco-efficient coating sales growth reported by Sherwin-Williams highlight the commercial scalability of compliant glycol ether solutions. Additionally, increased emphasis on worker safety and occupational health further supports the shift toward lower-toxicity glycol ether variants, reinforcing sustained regulatory-driven market expansion.

The rapid expansion of the pharmaceutical and cosmetics industries is significantly increasing demand for glycol ethers, owing to their critical roles as solvents, intermediates, and formulation aids. In the pharmaceutical sector, the growing pipeline of injectable drugs, vaccines, and complex formulations requires high-purity solvents to ensure drug stability, solubility, and bioavailability, functions where glycol ethers are particularly effective. Rising healthcare expenditure, aging populations, and increased emphasis on preventive care are further driving global pharmaceutical production volumes. In parallel, the global beauty and personal care industry continues to expand, driven by increasing consumer demand for premium skincare, hair care, and hygiene products.

Glycol ethers contribute to improved texture, enhanced shelf life, and superior sensory performance in cosmetic formulations, making them difficult to substitute in high-value products. Emerging manufacturing hubs in India and China are also increasing glycol ether consumption through large-scale generic drug production and growth in contract manufacturing. Moreover, advancements in biopharmaceuticals and drug-delivery technologies require specialized glycol ether grades, sustaining long-term demand momentum across both pharmaceutical and cosmetics sectors throughout the forecast period.

Competition from alternative solvents has emerged as a significant restraint on the global glycol ether market as end-use industries increasingly shift toward more sustainable and low-toxicity solvent systems. Water-based formulations, bio-based solvents, esters, and advanced alcohol derivatives are gaining strong acceptance across paints and coatings, cleaners, inks, and adhesive applications. Regulatory pressure to reduce VOC emissions, combined with corporate ESG commitments and green labeling requirements, is encouraging manufacturers to substitute glycol ethers with solvents that offer easier regulatory compliance and improved environmental profiles.

Technological advancements in resin and surfactant chemistry have further enhanced the performance of water-based systems, narrowing the functional gap with glycol ether-based formulations. This competitive landscape is particularly challenging in consumer-facing and eco-sensitive applications, where sustainability credentials heavily influence purchasing decisions. As a result, glycol ether producers face pricing pressure, reduced formulation flexibility, and gradual erosion of demand in select applications.

Supply chain disruptions and production challenges represent another major restraint affecting the global glycol ether market. Glycol ether manufacturing relies heavily on petrochemical feedstocks such as ethylene oxide and propylene oxide, whose availability and pricing are highly sensitive to fluctuations in crude oil prices, refinery operating rates, and geopolitical tensions. Any disruption in feedstock supply can lead to production delays, cost inflation, and reduced output reliability.

Glycol ether production involves complex chemical processes requiring strict safety controls, specialized equipment, and compliance with environmental regulations, increasing operational complexity and capital intensity. Logistics constraints, trade restrictions, and regional imbalances in raw material availability further exacerbate supply risks, particularly for manufacturers serving global markets. These challenges limit producers’ ability to maintain consistent pricing, scale capacity efficiently, and respond quickly to shifts in demand, thereby restraining overall market growth.

The accelerating shift toward sustainability and green chemistry is creating a strong market opportunity for bio-based and environmentally friendly glycol ether solutions. Growing consumer awareness of environmental impacts, coupled with stringent regulatory mandates that promote low-toxicity and renewable chemicals, is encouraging manufacturers to invest in the development of sustainable solvents. The introduction of bio-based glycol ether product lines by Eastman Chemical Company highlights the industry’s transition toward eco-friendly alternatives that align with regulatory compliance and evolving customer preferences.

Advances in production technologies, such as renewable feedstock utilization and energy-efficient synthesis routes, are reducing life-cycle environmental impact and simplifying environmental impact assessments, improving the commercial viability of bio-based glycol ethers. The rapid adoption of water-based paints and coatings necessitates compatible coalescing agents and solvents, thereby sustaining demand for next-generation glycol ethers. The expansion of lower-toxicity methyl ether derivatives and propylene glycol ether (P-series) products further enhances application potential, enabling portfolio diversification and premium positioning across coatings, cleaners, and industrial formulations throughout the forecast period.

The electronics, semiconductors, and advanced manufacturing sectors are expanding rapidly, creating substantial growth opportunities for glycol ether producers, particularly those offering high-purity and specialty grades. Glycol ethers play a critical role in these industries due to their exceptional solvency, low residue properties, and controlled evaporation rates, which make them ideal for use in sensitive applications such as photoresists, precision cleaning solutions, etching processes, and protective coatings for electronic components.

The increasing complexity of semiconductor devices, higher transistor densities, and miniaturization of chips require ultra-clean and highly consistent solvents to prevent contamination and ensure manufacturing yield. The growth of electric vehicles, wearable electronics, high-performance sensors, and advanced industrial automation is driving demand for more specialized manufacturing processes that require glycol ethers.

Suppliers capable of producing high-purity and low-toxicity formulations can support these industries’ stringent quality and regulatory requirements, including ISO and semiconductor-grade certifications. Furthermore, as semiconductor fabrication plants expand globally, particularly in the Asia-Pacific region, solvent consumption is increasing, creating a high-value, long-term opportunity for glycol ether manufacturers seeking to diversify their product portfolios and establish strategic partnerships with advanced electronics manufacturers.

E-series glycol ethers, including ethylene glycol butyl ether (EGBE), ethylene glycol propyl ether, and ethylene glycol butyl ether acetate, account for an estimated 55% share, driven by exceptional solvent properties, strong compatibility, and low volatility, thereby establishing industry-standard positioning. EGBE's dominance, with a 32.6% market share, reflects superior solvency, low evaporation rates, and universal compatibility across architectural coatings, automotive finishes, and industrial maintenance applications. E-series pharmaceutical and cosmetics application specialization leveraging excellent coupling efficiency, miscibility with water and organic liquids, and slow evaporation characteristics enabling injectable formulation development, vaccine production, and premium personal-care product creation.

Low molecular weight e-series segment capturing 54.8% market revenue driven by superior volatility control, high solvency power, and exceptional formulation compatibility supporting paint and coating performance optimization. P-series glycol ethers (methyl ether, butyl ether, methyl ether acetate) expansion with lower toxicity profiles, addressing occupational health concerns and regulatory pressure, maintaining e-series market leadership throughout the forecast period.

Paints and coatings are commanding a dominant market position with 26.7% market revenue in 2026, driven by critical glycol ether functionality enabling uniform coverage, smooth finishing, enhanced durability, and superior aesthetic quality. Adoption of architectural coatings is driven by regulatory pressure to reduce volatile organic compound emissions and consumer demand for eco-friendly solutions, with BASF's confirmed low-VOC paint formulation and Sherwin-Williams' 12% growth in eco-efficient coatings demonstrating the commercial viability of glycol ether-based sustainable alternatives.

Automotive refinish and industrial maintenance applications requiring glycol ethers for superior flow control, leveling characteristics, and brush-mark elimination have established high-volume demand across the vehicle aftermarket and industrial maintenance sectors. General industrial coatings, wood coatings, and protective coatings applications are increasing the utilization of glycol ethers to enhance durability and optimize performance. The printing inks segment is capturing substantial market share, with flexographic printing and graphic arts applications requiring glycol ethers for color stability, image clarity, and formulation compatibility, thereby sustaining paints and coatings' dominance throughout the forecast period.

North America remains a highly developed and mature market for glycol ethers, with the United States taking a leading role in both consumption and regulatory leadership. Key end-use sectors such as automotive refinishing, industrial maintenance, and construction continue to drive steady consumption, requiring glycol ethers for coatings, adhesives, and cleaning formulations that meet performance standards while adhering to environmental limits. The United States’ robust infrastructure for industrial production and innovation further supports sustained market demand, with chemical manufacturers able to leverage advanced distribution networks to maintain reliable supply chains and timely delivery to end users.

The U.S. Green Building Council’s LEED certification program has become a significant driver of glycol ether adoption, particularly in the commercial construction and residential renovation sectors, by mandating strict VOC limits for adhesives, sealants, and coatings. This regulatory push toward low-emission materials creates opportunities for manufacturers offering eco-friendly and compliant glycol ether solutions. Major chemical producers such as BASF, Dow, and Eastman have established strong regional presence through localized production and distribution networks, ensuring accessibility and consistent supply for automotive, pharmaceutical, and personal care applications.

Europe represents another highly developed market for glycol ethers, with Germany and the United Kingdom serving as regional leaders. Germany’s dominance stems from its industrial manufacturing specialization, particularly in automotive, coatings, and chemical processing industries, which require precise and high-quality glycol ether formulations. Strict environmental regulations, particularly EU Directive 2004/42/EC, impose VOC emission limits on paints, coatings, and other industrial chemicals, ensuring that only compliant low-VOC glycol ethers are utilized in manufacturing and product formulations.

European regulations and consumer preferences increasingly favor low-VOC, sustainable, and environmentally friendly formulations, accelerating the adoption of specialized glycol ether products in coatings, paints, and industrial cleaning applications. High-quality and eco-friendly product positioning allows manufacturers to command premium pricing, particularly in architectural coating, automotive refinishing, and specialty industrial applications. As a result, European companies are incentivized to develop innovative, high-margin glycol solutions that meet stringent quality, safety, and environmental standards, supporting sustainable market growth across the region.

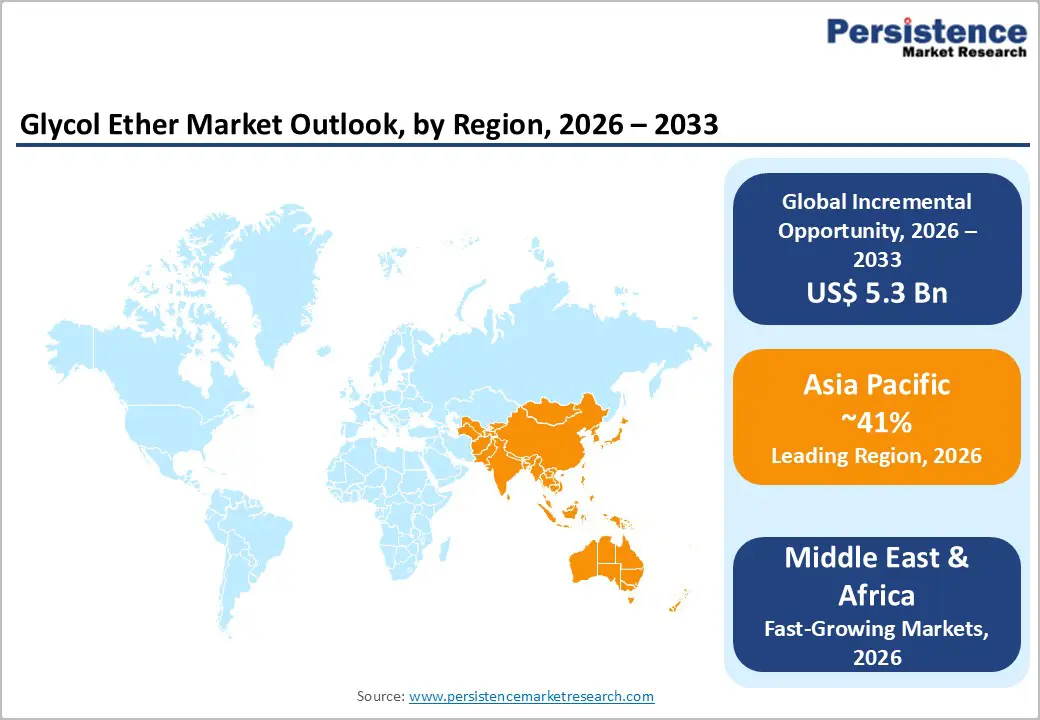

Asia-Pacific is the largest regional market for glycol ethers, accounting for approximately 41.5% of global market share, with China driving most regional consumption and manufacturing. The country’s robust industrial base, rapid urbanization, and construction boom, combined with a CAGR of 11.7%, create massive demand for glycol ethers in paints, coatings, adhesives, and cleaning chemicals. Supportive government policies, including industrial incentives and initiatives to expand domestic chemical manufacturing, have enabled cost-competitive production capacity and diverse product offerings, positioning China as a regional leader in glycol ether supply. This manufacturing dominance allows the region to meet both domestic consumption and global export demand efficiently.

India is emerging as a high-growth market in the Asia-Pacific region, driven by the rapid expansion of its pharmaceutical and cosmetics sectors. The country’s large-scale generic drug manufacturing and growing production of injectable formulations generate substantial demand for glycol ethers as solvents and intermediates, ensuring high-volume consumption in pharmaceutical synthesis. Simultaneously, rising disposable incomes and growing consumer awareness of personal care, beauty, and wellness products are increasing demand for glycol ethers in skincare, hair care, and cosmetic formulations. These factors collectively position Asia-Pacific as a dominant market for glycol ethers, with sustained growth expected throughout the forecast period, supported by both industrial expansion and consumer-driven end-use applications.

The glycol ethers market exhibits moderate to high consolidation dominated by Tier-1 global manufacturers, including BASF SE, Dow, Eastman Chemical Company, Shell, and LyondellBasell Industries, commanding substantial market share through strong production capability, product portfolio diversification, and continuous innovation investment. BASF SE commands the largest industry shares due to its exceptional production capacity and broad product portfolio. Dow and Eastman Chemical Company maintain competitive positions through strategic alliances and regional expansion initiatives.

Shell and LyondellBasell capture firm positions leveraging vertically integrated supply chains and international distribution networks. Strategic R&D focuses on sustainable and eco-friendly glycol ether formulations reflecting competitive differentiation strategy and regulatory adaptation capability. Capacity expansions, acquisitions, and product development initiatives demonstrating commitment to market leadership and sustain competitive positioning.

The global glycol ethers market is projected to reach US$ 15.5 billion by 2033, expanding from US$ 10.2 billion in 2026 to a CAGR of 6.2%, driven by stringent environmental VOC regulations, pharmaceutical and cosmetics sector expansion, paints and coatings industry growth, Asia-Pacific manufacturing scale, and bio-based sustainable product innovation.

The primary factors driving demand for glycol ethers include their extensive use as solvents in paints, coatings, and cleaning products due to excellent solubility and low volatility. Growing industrial and automotive sectors boost demand for high-performance coatings, while rising construction and renovation activities increase paint consumption.

E-series glycol ethers command market leadership with estimated 55% market share, particularly ethylene glycol butyl ether (EGBE) capturing 32% market share, driven by superior solvency, low evaporation rates, exceptional water and organic liquid miscibility.

Asia-Pacific maintains market leadership position with 41% global market share driven by China capturing substantial regional market with exceptional 11.7% CAGR, construction boom intensity, rapid industrialization.

Rising preference for eco‑friendly, low‑VOC products in paints and coatings boosts demand for glycol ethers as effective co‑solvents, and increased industrialization in automotive, construction, and electronics drives solvent needs.

Leading market players include BASF SE commanding global market leadership with largest industry share and diverse product portfolio; Dow Inc. maintaining competitive presence through strategic alliances and June 2024 Asia expansion announcement; Eastman Chemical Company establishing strong positioning through November 2024 bio-based product launch; and Shell, LyondellBasell, Huntsman, SABIC, and regional specialists.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author