ID: PMRREP35764| 210 Pages | 22 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

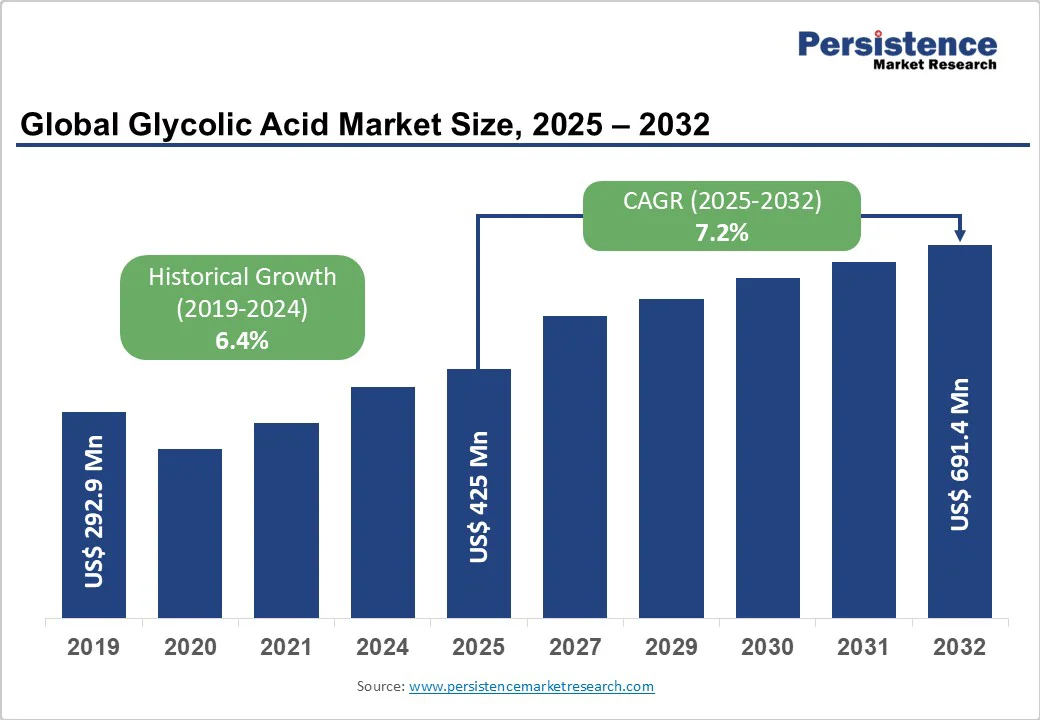

The global glycolic acid market size is expected to be valued at US$425.0 million in 2025 and is projected to reach US$691.4 million by 2032, growing at a CAGR of 7.2% between 2025 and 2032. The global glycolic acid market is driven by escalating demand in cosmetic and personal care applications owing to its superior exfoliating and anti-aging properties. Aging-related properties are supported by rising consumer spending on skincare and robust research and development (R&D) investments by leading manufacturers.

| Key Insights | Details |

|---|---|

|

Glycolic Acid Market Size (2025E) |

US$425.0 Million |

|

Market Value Forecast (2032F) |

US$691.4 Million |

|

Projected Growth CAGR (2025 – 2032) |

7.2% |

|

Historical Market Growth (2019 – 2024) |

6.4% |

The surging global beauty and personal care industry, valued at over US$600 billion in 2024, is a primary driver for the Glycolic Acid Market. Consumers are increasingly seeking formulations with potent exfoliants, driving the adoption of glycolic acid in peels, cleansers, and serums. Scientific studies indicate that glycolic acid concentrations between 5% and 10% improve skin texture by up to 30% over 12 weeks, reinforcing its status as a high-performance ingredient. Additionally, the trend toward natural and clean-label cosmetics has increased demand for bio-derived glycolic acid, thereby augmenting overall market growth and prompting major cosmetic companies to invest in sustainable sourcing and innovative delivery systems.

Technological innovations in synthesis processes, such as improved continuous?flow reactors and green chemistry approaches, have significantly reduced production costs and environmental impact. For instance, new catalysts developed in 2023 achieved yields exceeding 95% with reduced wastewater generation by up to 40%. These advancements enable manufacturers to scale up operations efficiently and maintain consistent purity levels, thereby meeting the stringent requirements of pharmaceutical and cosmetic grades. Enhanced process automation and modular production units have lowered entry barriers for regional players, fostering increased competition and wider availability across emerging markets.

Glycolic acid usage is governed by strict regulations in key markets, including the U.S., the EU, and Japan. Maximum allowable concentrations vary between 10% (for over-the-counter applications) and 70% (for professional use), necessitating extensive safety testing and compliance documentation. Regulatory approvals under frameworks such as the FDA’s OTC Monograph and the EU’s Cosmetics Regulation (EC 1223/2009) involve rigorous assessment of toxicity and stability, which can prolong product launch timelines by 6–12 months and incur additional costs. Smaller manufacturers may struggle with these barriers, which can limit product diversification and delay market entry.

Glycolic acid production relies on feedstocks like sugarcane, molasses, and petrochemical precursors. Fluctuations in sugar prices, driven by weather conditions and geopolitical factors, can lead to raw material cost swings of up to 25% annually. Similarly, volatility in ethylene oxide prices directly impacts synthetic glycolic acid manufacturing costs. Such unpredictability can compress profit margins, particularly for commodities. Grade products, and deter long-term investments in capacity expansion among risk-averse producers.

The growing prevalence of skin disorders and the rising geriatric population present a lucrative opportunity for glycolic acid in therapeutic dermatology. Clinical research published in the Journal of Dermatological Treatment (2024) reports that glycolic acid formulations reduce acne scars by 45% and hyperpigmentation by 35% over eight weeks. Pharmaceutical companies are increasingly incorporating glycolic acid into prescription products. Strength peels and combination therapies drive demand for high-purity grades (≥ 99%). Partnerships between chemical suppliers and contract manufacturers to develop injectable and topical formulations will unlock new revenue streams.

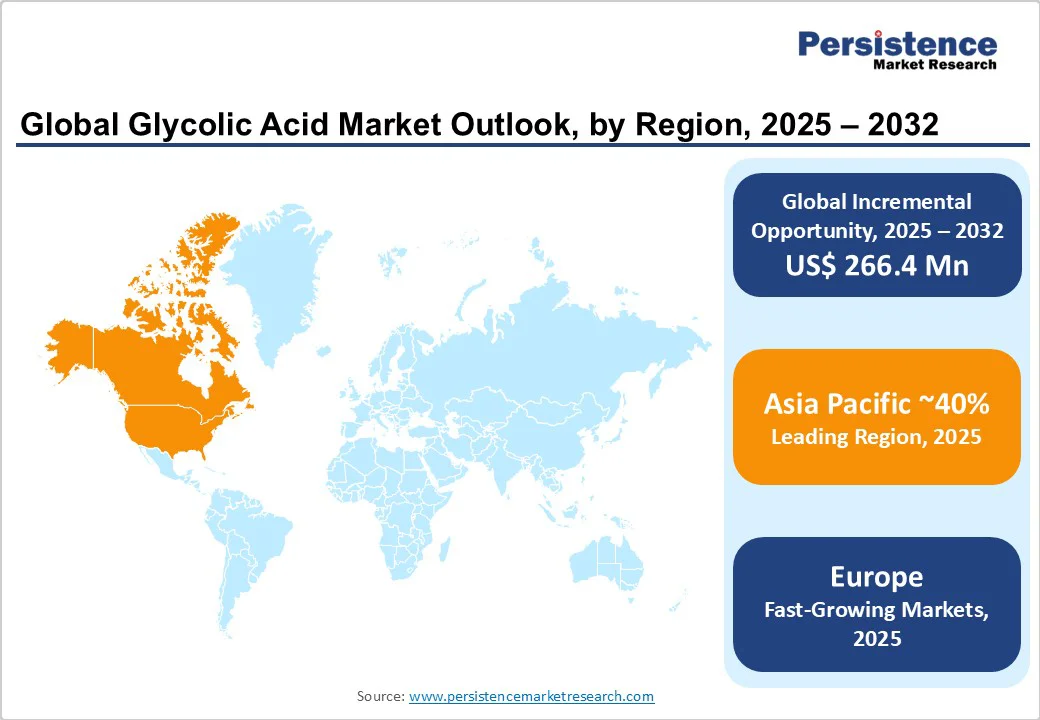

Asia Pacific is witnessing accelerated urbanization and a burgeoning middle-income group with rising disposable incomes, creating demand for premium skin-care products. The Government initiatives to promote local chemical manufacturing and investments in specialty chemical parks in Malaysia and Thailand further enhance regional production capacities. Establishing local partnerships and technology transfer agreements will enable players to capitalize on cost advantages and cater to domestic demand.

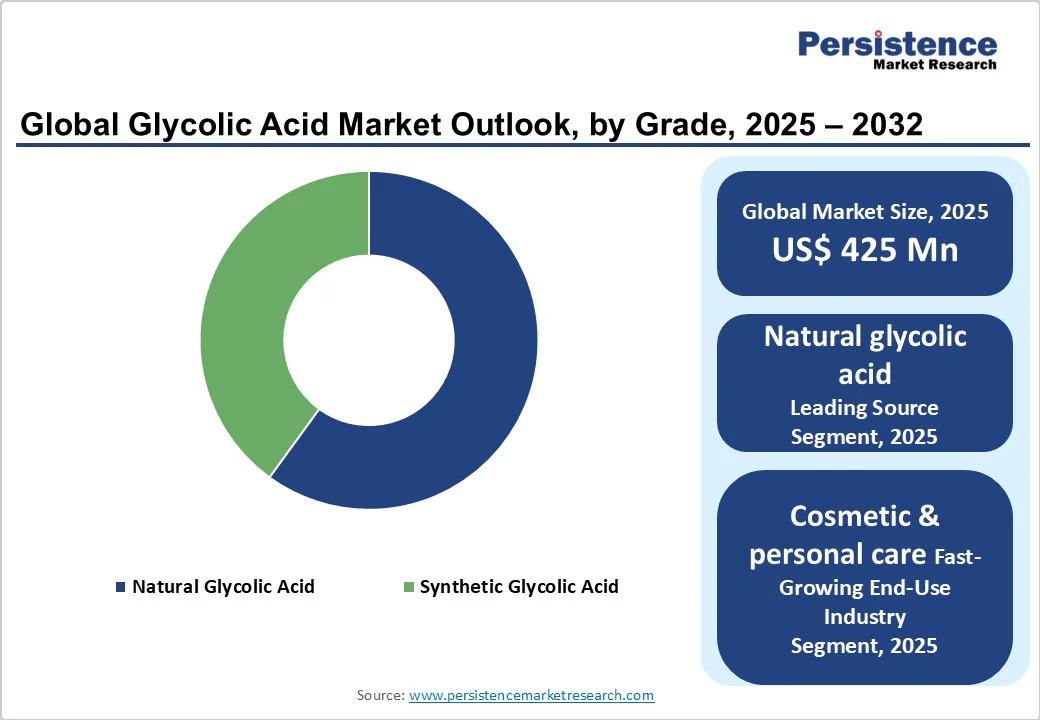

Natural glycolic acid dominates the source category with an approximate 60% market share, driven by consumer preference for bio?based ingredients and sustainability mandates. Extraction from sugarcane and sugar beet molasses, coupled with certifications like COSMOS and Ecocert, underpin its leadership. Synthetic glycolic acid, while offering consistent quality and lower cost, captures the remaining 40%, primarily in industrial and technical applications where purity and batch reliability are imperative.

Cosmetic grade accounts for the largest share at around 55%, supported by extensive use in cleansers, toners, and peels. The cosmetic sector’s demand surge, along with stringent purity standards (≥ 70% concentration), cements this segment’s position. Pharmaceutical grade follows at 25%, driven by therapeutic dermatology applications requiring ≥ 99% purity. Technical grade holds 15% in industrial uses such as textile processing, while high?purity grades for electronics and specialty chemicals occupy the balance.

The ≥ 99% purity segment leads with 50% market share, buoyed by pharmaceutical, cosmetic, and electronics applications that demand minimal impurities. Growth in high-end skincare and precision etching processes in semiconductor manufacturing fuels this segment’s dominance. The 70–98% purity tier represents 35%, favored by cosmetic product formulators seeking cost-effective exfoliants, while ≤ 70% purity covers 15% in agricultural and basic industrial uses.

Cosmetic & personal care manufacturers command the largest share at 45%, capitalizing on the global skincare boom. Pharmaceutical & biotechnology firms follow closely at 25%, leveraging glycolic acid for dermatological therapies. Food & beverage producers and chemical processing companies each account for 10%, utilizing glycolic acid as a preservative and intermediate, respectively. Electronics manufacturers (5%) and textile & leather processors (5%) complete the landscape.

The U.S. market leads in North America, supported by an advanced R&D infrastructure and robust cosmetic industry revenues surpassing US$95 billion in 2024. Regulatory frameworks, such as FDA monographs, streamline the approval of new formulations, while collaborations between chemical suppliers and biotech firms accelerate the development of high-quality products. purity grades. Innovation hubs in New Jersey and California host pilot plants for specialty glycolic acid derivatives targeting the pharmaceutical and electronics sectors.

Canada exhibits steady growth driven by stringent quality standards and a preference for bio-based ingredients, with natural glycolic acid capturing over 65% of domestic demand. Growing investments in skin health research by institutions such as Health Canada and partnerships with contract manufacturers are fostering market expansion.

Germany and France are at the forefront of the European glycolic acid market, together representing over 50% of regional consumption. Strict cosmetic regulations under the EU Cosmetics Regulation ensure safety and quality, promoting consumer confidence in glycolic acid-based products. Major players are establishing local production facilities in Germany’s chemical belt (Rhine?Ruhr) to optimize logistics and comply with REACH requirements.

In the U.K. and Spain, the rising penetration of e-commerce for beauty products and artisanal skincare brands is driving demand for innovative glycolic acid formulations. Regional trade agreements and harmonized standards across the EU facilitate cross-border distribution, while government grants for green chemistry projects in Italy support transitions to bio-derived sourcing.

China leads with over 40% share of Asia Pacific consumption, fueled by rapid growth in domestic cosmetic brands and government incentives for specialty chemical manufacturing. Local producers are investing in continuous fermentation processes, reducing production costs by 20%. Japan’s premium skincare segment, valued at US$14 billion, drives demand for high-purity glycolic acid in luxury formulations, supported by collaborations with academic research institutes.

India presents significant opportunities with its expanding personal care market, growing at a positive CAGR, and “Make in India” initiatives boosting local chemical capacities. ASEAN countries, such as Malaysia and Thailand, are emerging as export hubs, leveraging cost advantages and strategic free trade agreements to meet regional demand.

The global glycolic acid market exhibits a moderately consolidated structure, with the top ten players holding approximately 60% of global revenue. Key strategies include capacity expansions, strategic alliances, and acquisitions to enhance product portfolios and geographic reach. Leading firms are differentiating through sustainable production practices, technological innovations in continuous synthesis, and the development of patented derivatives. Emerging business models involve toll manufacturing agreements and joint ventures with cosmetic and pharmaceutical companies to accelerate market penetration. Investment in facility upgrades and green chemistry platforms remains a priority to meet evolving purity and regulatory requirements.

The global Glycolic Acid Market was valued at US$ 425.0 Million in 2025.

Rising consumer preference for chemical exfoliants in cosmetic products, supported by studies showing up to 30% improvement in skin texture, drives market growth.

Cosmetic grade leads with around 55% market share, owing to extensive use in exfoliants, peels, and anti-aging formulations.

Asia Pacific leads the market with over 40% share, driven by China’s booming cosmetics sector and supportive manufacturing incentives.

Expansion into pharmaceutical dermatology, leveraging clinical evidence of up to 45% reduction in acne scars, represents a major opportunity.

BASF SE, PureTech Scientific Inc., and CABB Chemicals are recognized as top companies based on portfolio strength, production capacity, and technological leadership.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn/Bn, Volume: As Applicable |

|

Geographical Coverage |

North America, Europe, East Asia, South Asia and Oceania, Latin America, Middle East and Africa |

|

Segmental Coverage |

Source, Grade, Purity Level, Industry |

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source

By Grade

By Purity Level

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author