- Executive Summary

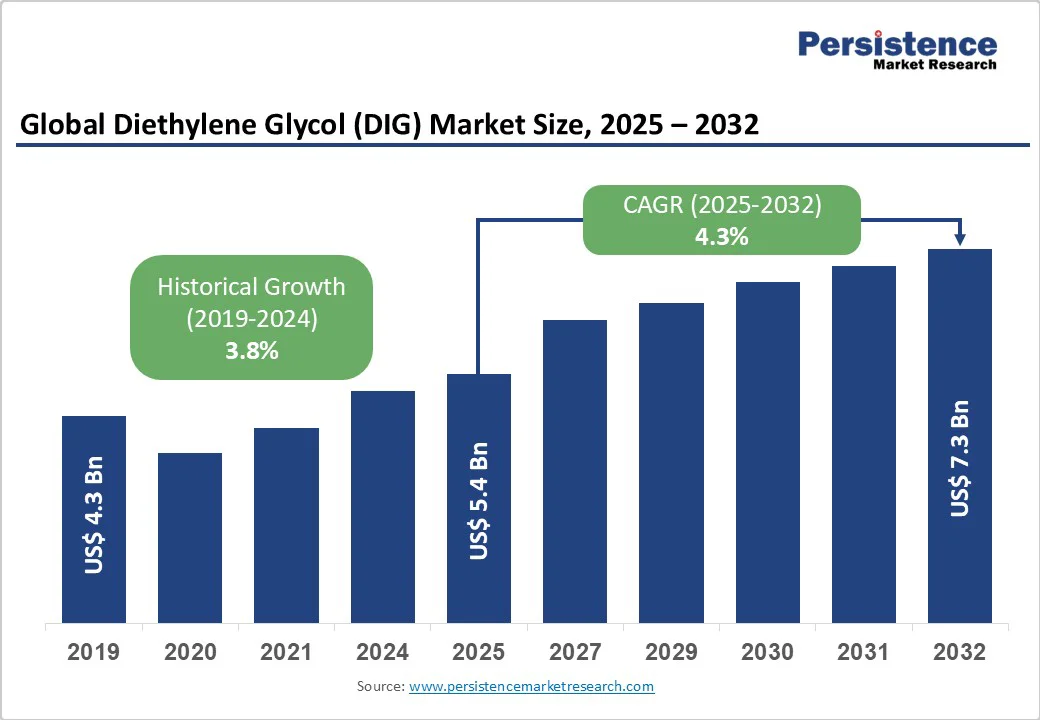

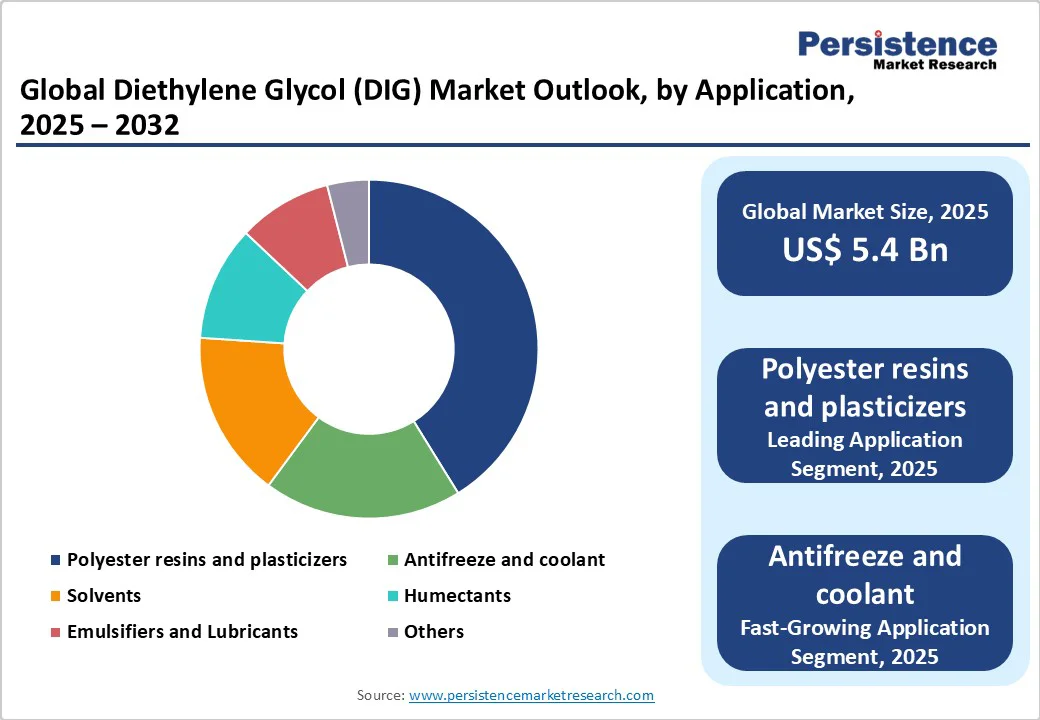

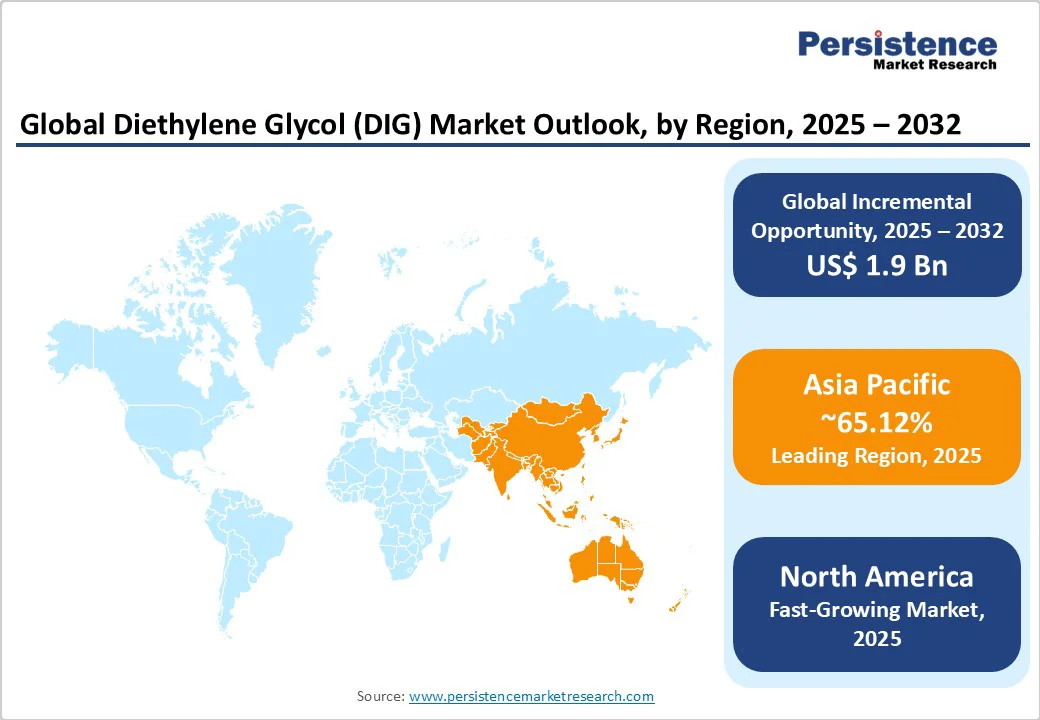

- Global Diethylene Glycol Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Value Chain Analysis

- Key Market Players

- Regulatory Landscape

- PESTLE Analysis

- Porter’s Five Forces Analysis

- Consumer Behavior Analysis

- Price Trend Analysis, 2019 - 2032

- Key Factors Impacting Product Prices

- Pricing Analysis, by Application

- Regional Prices and Product Preferences

- Global Diethylene Glycol Market Outlook

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size (US$ Mn) Analysis, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, 2025-2032

- Global Diethylene Glycol Market Outlook: By Application

- Historical Market Size (US$ Mn) Analysis, By Application, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Attractiveness Analysis: Application

- Global Diethylene Glycol Market Outlook: End-use

- Historical Market Size (US$ Mn) Analysis, By End-use, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis: End-use

- Market Size (US$ Mn) Analysis and Forecast

- Global Diethylene Glycol Market Outlook: Region

- Historical Market Size (US$ Mn) Analysis, By Region, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, By Region, 2025-2032

- North America

- Latin America

- Europe

- East Asia

- South Asia and Oceania

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Diethylene Glycol Market Outlook

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By End-use

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025-2032

- U.S.

- Canada

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- Europe Diethylene Glycol Market Outlook

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By End-use

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025-2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Rest of Europe

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- East Asia Diethylene Glycol Market Outlook

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By End-use

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025-2032

- China

- Japan

- South Korea

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- South Asia & Oceania Diethylene Glycol Market Outlook

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By End-use

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025-2032

- India

- Indonesia

- Thailand

- Singapore

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- Latin America Diethylene Glycol Market Outlook

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By End-use

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025-2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- Middle East & Africa Diethylene Glycol Market Outlook

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- By Country

- By Application

- By End-use

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025-2032

- Antifreeze and Coolants

- Polycarbonate

- Humectants

- Polyester Resins and Plasticizers

- Emulsifiers and Lubricants

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End-use, 2025-2032

- Agrochemical

- Automotive

- Cosmetic and Personal Care

- Paints and Coatings

- Oil and Gas

- Textiles

- Plastics

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Mn) Analysis, By Market, 2019-2024

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- BASF SE

- Overview

- Segments and Application

- Key Financials

- Market Developments

- Market Strategy

- India Glycols Limited

- Indorama Ventures Public Company Limited

- LyondellBasell Industries Holdings B.V.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co. Ltd.

- Pon Pure Chemicals Group

- Reliance Industries Limited

- Saudi Basic Industries Corporation (Saudi Aramco)

- Shell plc

- TCI Chemicals (India) Pvt. Ltd.

- Others

- BASF SE

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment