ID: PMRREP35800| 198 Pages | 31 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

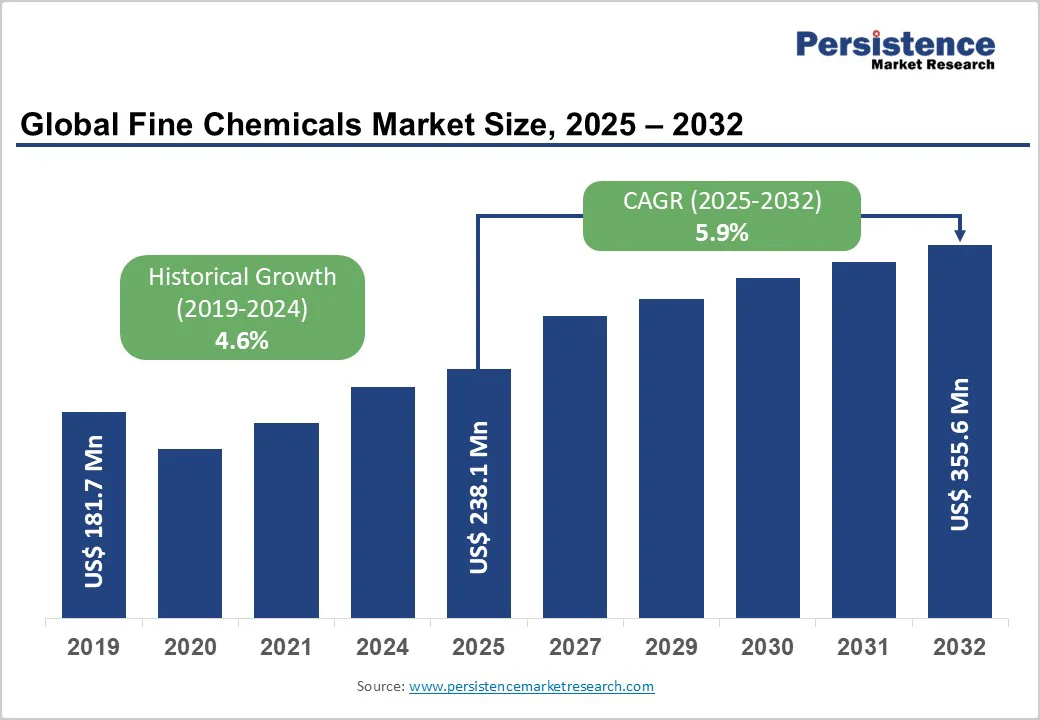

The global fine chemicals market size is likely to be valued at US$238.1 billion in 2025, and is projected to reach US$355.6 billion by 2032, growing at a CAGR of 5.9% during the forecast period 2025 - 2032.

Growth is led by the rising use of high-purity active pharmaceutical ingredients (APIs) and intermediates in drug pipelines, the expansion of biotechnology-driven therapeutics, and the adoption of continuous and modular production.

Demand is further supported by the prevalence of chronic diseases and the push toward precision therapies and complex small molecules requiring stringent purity and regulatory compliance.

| Key Insights | Details |

|---|---|

| Fine Chemicals Market Size (2025E) | US$238.1 Bn |

| Market Value Forecast (2032F) | US$355.7 Bn |

| Projected Growth CAGR (2025 - 2032) | 5.9% |

| Historical Market Growth (2019 - 2024) | 4.6% |

The rapidly increasing complexity of pharmaceutical products, especially biological drugs, antibody-drug conjugates, and oligonucleotides, has driven unprecedented demand for fine chemicals with exceptional purity and functionalization.

The US$1.6 trillion global pharmaceutical industry increasingly requires sophisticated custom synthesis and advanced building blocks for proprietary molecules, while major regulatory agencies enforce ever-stricter controls around process validation and quality.

The expansion of COVID-19 vaccine manufacturing in 2021-2023 served as a model for how the agility and supply resilience of fine chemicals are now central to global health preparedness. Furthermore, Asia, led by India’s US$50 billion API sector, continues to expand fine chemical exports, solidifying the strategic importance of fine chemical producers in the international pharmaceutical value chain.

Another major driver is the electrification wave in the automotive industry, the rollout of 5G networks, and the persistent intensification of AI applications have triggered a surge in demand for electronic chemicals and ultra-high-purity reagents.

Semiconductors represented significant growth in global revenues, with production capacity concentrated in Taiwan, South Korea, and China. Essential to fabrication below 7 nanometers, fine chemicals with 99.999% purity (or greater) are crucial for lithography, deposition, cleaning, etching, and planarization.

Multinational chemical groups and niche Asian suppliers are heavily investing in new production lines and R&D to address anticipated chip shortages and maintain strict quality assurance standards.

The fine chemicals sector faces a mounting regulatory burden. Compliance with GMP protocols, REACH in Europe, U.S. FDA regulations, China's Green Manufacturing standards, and the proliferation of environment-focused regulations introduce ongoing costs and documentation requirements.

For instance, registering a single new substance under ECHA's REACH can cost nearly US$300,000. Small and mid-size enterprises (SMEs) operating in emerging markets often struggle to meet these fast-evolving benchmarks.

Moreover, the production of fine chemicals relies heavily on high-purity, specialty reagents often derived from oil, natural gas, or rare earths. Volatile energy prices, logistical disruptions (as seen during the pandemic and recent geopolitical tensions), and concentrated sources for specialty solvents or catalysts mean that procurement costs and continuity are constant concerns.

Stakeholders across the pharmaceutical and agrochemical sectors increasingly insist on lower carbon footprints and safer, more sustainable synthesis. The adoption of continuous flow techniques, enzymatic catalysis, and circular waste minimization not only supports regulatory compliance but also opens new business with sustainability-focused brands.

Major European players have led green chemistry innovation, while Asian firms are rapidly adapting biotechnological advances for cost-effective manufacturing. Companies embracing this shift, through investment in renewable feedstock or advanced recycling logistics, can secure premium customers and regulatory goodwill.

The trend toward outsourcing complex chemical synthesis and process development to merchant manufacturers, especially for SMEs and virtual biotech startups, remains strong. CDMOs offer flexibility, multi-stage synthesis know-how, and scale-up expertise essential for rapid product launches.

With a large number of new drug substances now involving at least one CDMO, the merchant fine chemicals sector is expected to command increasing market share, particularly in North America and Europe.

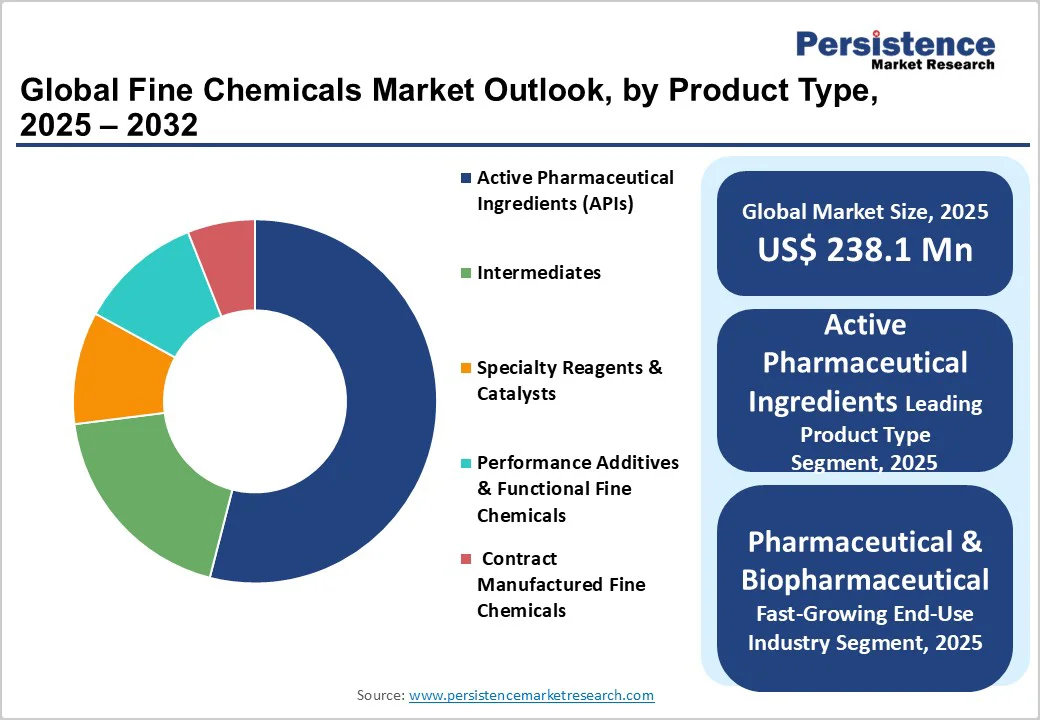

Pharmaceuticals are expected to account for around 28% of the fine chemicals market revenue share in 2025, reflecting both volume (billions of doses annually) and value (stringent quality requirements and premium pricing).

In contrast, agrochemicals, including crop protection agents and fertilizers, also constitute a major demand center, especially as food security and sustainable agriculture remain global imperatives. Specialty polymers, pigments & dyes, and additives target high-growth segments in packaging, automotive, and building materials, especially with new regulations on plastic recycling and flame retardancy.

Captive production is expected to account for around 60% of the market value in 2025, largely due to the strategic priorities of major multinational corporations such as BASF, Bayer, and Pfizer.

These global players leverage fully integrated production facilities to achieve tight value chain control, maintain stringent process secrecy, and secure uninterrupted internal supply of critical intermediates and active ingredients. By keeping production in-house, these companies also benefit from proprietary know-how, robust compliance with regulatory requirements, and the flexibility to respond to fluctuations in market demand and innovation cycles.

At the same time, merchant supply is gathering momentum, as leading pharmaceutical and specialty chemical firms increasingly externalize the manufacture of non-core or specialized intermediates. Various pressures, including patent expirations, cost-optimization goals, and the need for geographic diversification, drive this shift.

As the demand for high-purity and highly specialized chemicals expands, more companies are opting for custom manufacturing partnerships and business-to-business transactions, which support faster market entry and access to advanced process technologies without substantial capital investment.

Pharmaceuticals and nutraceuticals are set to maintain a dominant market share of nearly 40% in 2025, reflecting their central role in supplying high-purity intermediates and APIS essential for drug manufacturing and health supplements. However, segments such as agriculture, cosmetics and personal care products, and electronics are achieving above-average growth.

This growth is fueled by rising consumer health awareness, rapid technological innovation, and evolving regulatory frameworks surrounding food additives, plasticizers, and other specialty chemicals.

Advanced paints and coatings, especially those meeting stringent environmental (green), antimicrobial, and functional nanotechnology standards, are also contributing to expanding demand, driven by sustainability trends and functional performance requirements across industries. These diverse applications highlight the market's expanding horizons beyond traditional pharmaceutical uses, supported by innovation and regulatory evolution in adjacent sectors.

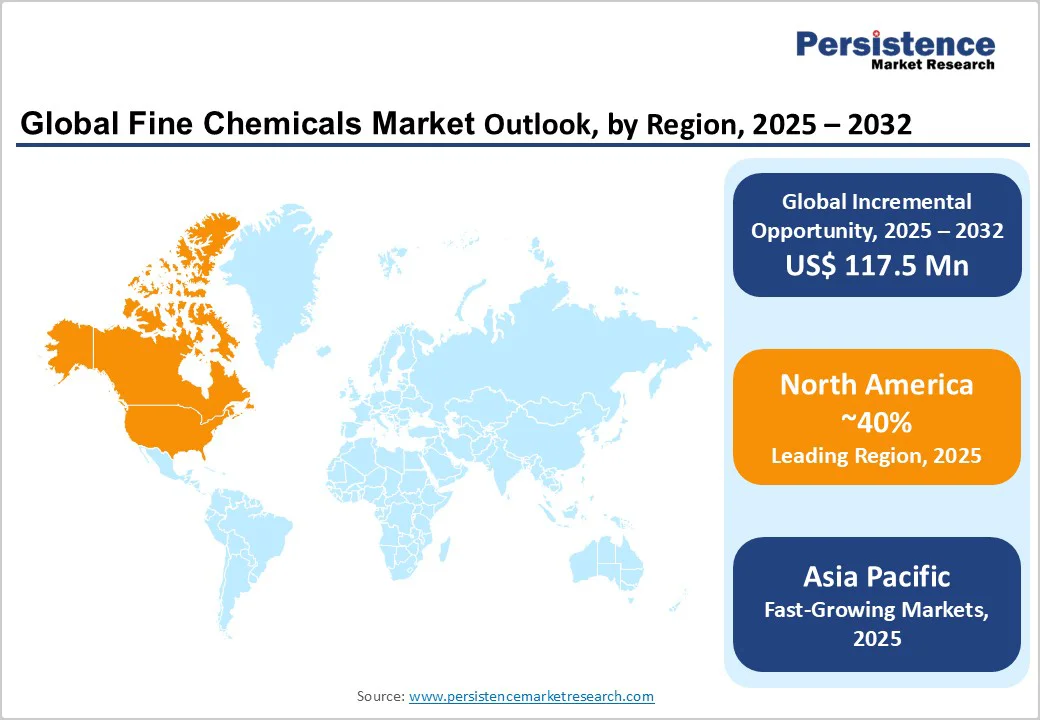

North America, spearheaded by the United States, is expected to command roughly 35% of the fine chemicals market share in 2025, with over 4,600 active FDA-regulated manufacturing sites. North America remains a critical hub for CDMO/CMO operations, with U.S.-based companies leading on innovation, regulatory compliance, and adoption of continuous manufacturing. Increasing emphasis on health supply chain sovereignty and biosecurity, reflected in the BIOSECURE Act, further supports domestic production.

Regulatory innovation here is driven by the U.S. FDA and Health Canada, which continue piloting quality-by-design and real-time release approaches, while environmental standards, such as the U.S. Environmental Protection Agency (EPA)’s push for green chemistry, drive investment in sustainable processes. However, raw material imports, especially from Asia, remain a chokepoint for U.S. specialty chemical manufacturers.

European chemical conglomerates, especially in Germany, Switzerland, France, and the U.K., demonstrate leadership in pharmaceutical and performance fine chemicals, propelled by continuous investments in R&D and manufacturing sustainability. German chemical clusters around Rhine-Ruhr and Frankfurt house many of Europe’s most advanced API and electronic chemical producers. Switzerland’s Lonza and Clariant, as well as the U.K.’s growing biotech footprint, cement the region’s profile as a center for the synthesis of complex molecules.

Europe’s REACH regime poses formidable compliance hurdles but serves as a global benchmark for chemical safety and environmental standards. Post-Brexit, the U.K. maintains parallel compliance frameworks and has become a test bed for agile regulatory initiatives. Sustainability, advanced process intensification, and circular economy principles, especially in packaging and automotive, give European suppliers a clear edge.

Asia Pacific is the fastest-growing market for fine chemicals, underpinned by growth in China, India, and ASEAN. China’s pharmaceutical market is scaling up production of high-purity intermediates for domestic and global APIs. Zhejiang, Jiangsu, and Shandong lead with high-tech chemical clusters; government investment aligns with ambitious Five-Year Plans for GMP-compliant and green-intensity manufacturing capacity.

India’s generic API industry and low-cost manufacturing base anchor its position as a preferred supplier for global pharmaceutical chains. The Make in India policy has spurred extensive new investment in chemical parks and regulatory upgrades, while the transfer of advanced manufacturing technology from Europe and Japan is accelerating quality gains. Japan’s focus on high-value fine chemicals for biologics, electronics, and specialty foods exploits its aging population and technical leadership, while Southeast Asia increases production of specialty agrochemicals and additives.

The global fine chemicals market structure is moderately fragmented for commodity applications (such as simple solvents or reagents) and moderately consolidated for advanced pharmaceutical and high-tech manufacturing.

Multinational groups such as BASF, Lonza, Evonik, and Clariant command significant global share, especially in regulated pharma and electronics. New entrants from India, China, and Southeast Asia, along with niche European biotech CMOs, are beginning to disrupt legacy supply chains through flexible production platforms and unique chiral or biocatalytic capabilities.

The global fine chemicals market size is projected to reach US$ 238.1 billion in 2025.

Key drivers include pharmaceutical industry expansion, rising active pharmaceutical ingredient demand, the increasing complexity of biologics, and the proliferation of advanced manufacturing in electronics, all requiring ultra-high-purity reagents.

The market is poised to witness a CAGR of 5.9% from 2025 to 2032.

Green chemistry, biotechnological process optimization, circular manufacturing, and accelerated outsourcing to CDMOs/CMOs offer high-margin growth areas as regulatory and environmental requirements intensify.

BASF SE, Lonza Group, Evonik Industries AG, and Clariant AG are some of the key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Business Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author