ID: PMRREP3924| 186 Pages | 11 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

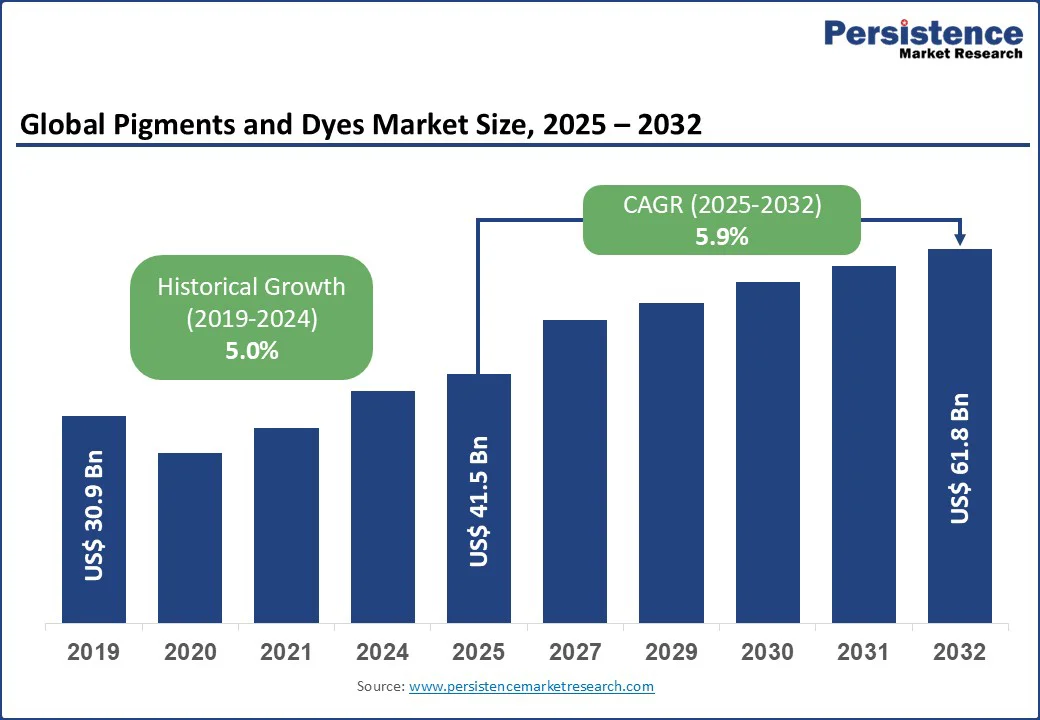

The global pigments and dyes market size is likely to be valued at US$ 41.5 Bn in 2025 and is expected to reach US$ 61.8 Bn by 2032, growing at a CAGR of 5.9% during the forecast period from 2025 to 2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Pigments and Dyes Market Size (2025E) |

US$ 41.5 Bn |

|

Market Value Forecast (2032F) |

US$ 61.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

The pigments and dyes market has witnessed robust growth, driven by increasing demand across diverse industries such as paints and coatings, textiles, and printing inks, coupled with advancements in eco-friendly and high-performance pigment technologies.

The increasing demand for eco-friendly and sustainable pigments is a key factor driving growth in the global pigments and dyes Market. This trend is fueled by greater environmental awareness and stricter regulations governing chemical emissions and hazardous substances. Conventional pigments often contain heavy metals, toxic solvents, and require energy-intensive manufacturing processes, which contribute to environmental pollution and pose health risks. As a result, industries are turning to alternatives that reduce ecological impact while maintaining product performance.

Sustainable pigments, including water-based, bio-based, and low-carbon-footprint options, are gaining popularity across industries such as textiles, paints and coatings, plastics, and inks. Companies are investing in advanced technologies to produce pigments that are non-toxic, biodegradable, and energy-efficient. Growing consumer preference for green products is also boosting adoption. Moreover, using these pigments helps companies comply with international regulations, such as REACH in Europe and EPA standards in the U.S., facilitating smoother global trade. For instance, BASF has launched bio-based pigment solutions made from renewable raw materials, designed to conserve fossil resources and reduce carbon emissions. Their offerings include products such as Basonal PLUS 7988, a topcoat binder that lowers carbon footprint while maintaining high performance.

High production costs and raw material volatility are significant restraints affecting the global pigments and dyes market. Manufacturing pigments involves complex chemical processes that require specialized equipment, energy-intensive operations, and adherence to strict environmental regulations. These factors contribute to elevated production expenses, which can limit profit margins for manufacturers and increase the overall cost of products for end-users. Additionally, the pigments industry heavily relies on key raw materials such as aromatic compounds, titanium dioxide, and specialty chemicals, whose prices are subject to frequent fluctuations due to global supply-demand dynamics, geopolitical factors, and currency volatility.

The volatility of raw material costs can lead to inconsistent pricing and challenges in long-term planning, particularly for small and medium-sized manufacturers. Sudden spikes in raw material prices often force companies to either absorb the increased costs, affecting profitability, or pass them on to customers, potentially impacting demand.

For instance, the cost of titanium dioxide surged by 8–15% due to supply constraints and rising demand in the construction and coatings sectors, impacting both BASF and LANXESS. Moreover, the reliance on imported raw materials in certain regions exposes manufacturers to supply chain disruptions, transportation delays, and tariff fluctuations. Consequently, these factors act as barriers to growth, compelling companies to adopt cost-optimization strategies, explore alternative raw materials, and invest in research and development to enhance efficiency while mitigating the impact of market volatility.

Advancements in high-performance and functional pigments present a significant growth opportunity for the pigments and dyes market. High-performance pigments (HPPs), characterized by superior heat resistance, lightfastness, and chemical stability, are increasingly sought after in industries such as automotive, aerospace, and electronics, where durability and aesthetic appeal are critical.

For instance, companies such as Heubach GmbH and Sudarshan Chemical Industries have developed HPPs for automotive coatings that withstand extreme weather conditions and maintain color vibrancy over extended periods. These pigments are also being integrated into smart coatings that offer functionalities such as self-cleaning, anti-corrosion, and UV protection, expanding their applications in construction and industrial sectors.

The integration of nanotechnology into pigment production is further enhancing performance by enabling the development of nano-pigments with superior dispersion, color strength, and environmental resistance.

For instance, nano-based pigments are used in printing inks to achieve sharper and more vibrant prints, catering to the growing demand for high-quality packaging in the e-commerce sector. Additionally, innovations in functional pigments, such as those with thermal regulation or conductive properties, are opening new avenues in electronics and renewable energy applications. As industries increasingly prioritize advanced materials, the development of high-performance and functional pigments is expected to drive long-term market growth and innovation.

Synthetic pigments are dominant and is expected to account for approximately 85% of the share in 2025. Their dominance stems from their cost-effectiveness, versatility, and ability to meet diverse industrial requirements in paints, plastics, and textiles. Synthetic pigments, such as azo and phthalocyanine pigments offered by BASF and DIC Corporation, provide consistent color quality, high durability, and scalability, making them a preferred choice for large-scale manufacturing. Their adaptability to various formulations and applications drives widespread adoption among commercial and industrial end-users.

Natural pigments are the fastest-growing segment, fueled by rising consumer demand for eco-friendly and sustainable products. Natural pigments, derived from sources such as plants, minerals, and insects, are gaining traction in textiles and food packaging due to their non-toxic and biodegradable properties. Innovations in bio-based pigment production further enhance their appeal for environmentally sensitive applications.

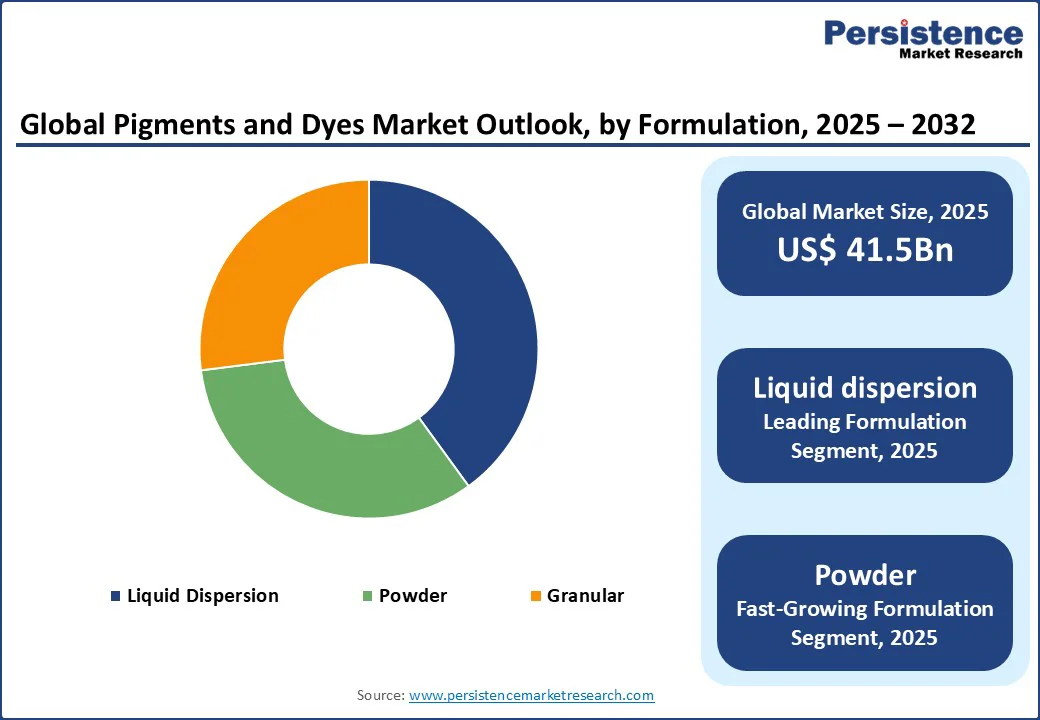

The Liquid dispersion formulations lead the pigments and dyes market, holding a 40% share in 2025. It is driven by the increasing demand for ready-to-use colorants in printing inks and textiles. Liquid dispersions offer superior dispersion properties, enabling vibrant and uniform color application, particularly in high-speed printing and textile dyeing processes. The rise of digital printing technologies and the growing textile industry in the Asia Pacific are accelerating the adoption of liquid dispersions, with significant growth potential in customized and small-batch production.

The powder formulations segment is the fastest-growing. Powder pigments are widely used in paints, coatings, and plastics due to their ease of handling, long shelf life, and compatibility with various substrates. Companies such as LANXESS AG and Cabot Corporation offer powder pigments that streamline manufacturing processes and reduce production errors, making them critical for high-volume industries such as construction and automotive.

Paints and coatings account for a large revenue share in 2025. The dominance is driven by the booming construction and automotive industries, which require durable and aesthetically appealing colorants. Pigments used in paints and coatings, offered by vendors such as BASF and Atul Ltd, provide high-performance solutions for architectural, industrial, and automotive applications, ensuring long-lasting color and protection.

The textiles are the fastest-growing end-user segment fueled by the rapid expansion of the global textile industry and increasing demand for sustainable dyes. The rise of eco-friendly fashion and the growing export of textiles from Asia Pacific countries such as India and Bangladesh are driving the adoption of natural and low-impact dyes. Textile manufacturers are increasingly leveraging advanced dyeing technologies to meet consumer demands for vibrant and environmentally friendly products, particularly in North America and Europe.

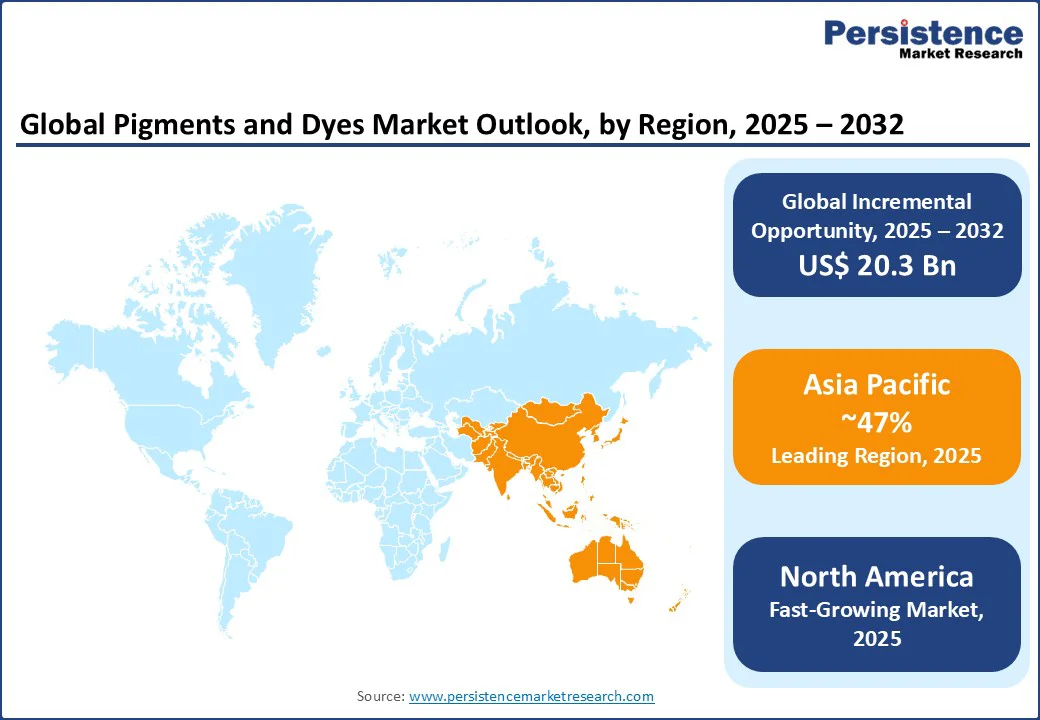

North America is emerging as the fastest-growing market for dyes and pigments, driven by a combination of regulatory and consumer trends. Stringent environmental regulations, including the U.S. Environmental Protection Agency (EPA) guidelines and state-level initiatives, are compelling manufacturers to adopt eco-friendly and sustainable pigment solutions. This regulatory push encourages the development of non-toxic, low-VOC (volatile organic compounds), and bio-based pigments, fostering innovation across the region.

Additionally, growing consumer awareness and demand for “green” products in industries such as paints and coatings, packaging, textiles, and plastics are accelerating the adoption of sustainable pigments. Companies are responding by investing heavily in research and development, launching high-performance, functional, and environmentally friendly pigment products. Technological advancements, including nano-based pigments, specialty coatings, and smart pigments, are also contributing to market expansion.

The combined effect of regulatory compliance, consumer demand, and technological innovation is driving significant growth in the North American pigments and dyes market, making it the fastest-growing region globally. This growth trend is expected to continue over the coming years as manufacturers prioritize sustainability and advanced pigment solutions to meet evolving market requirements.

Europe is emerging as a significant player in the pigments and dyes market, supported by strong regulatory frameworks and a focus on sustainability. Leading countries such as Germany, France, and the UK are driving market growth through investments in eco-friendly pigment technologies and advanced manufacturing. European Union’s REACH regulations and sustainability initiatives are pushing manufacturers such as LANXESS AG and Heubach GmbH to develop low-VOC and bio-based pigments for paints, coatings, and textiles.

The region’s textile and automotive industries are key consumers of high-performance pigments, with Germany leading in automotive coatings and France excelling in sustainable. Europe’s emphasis on circular economy principles and reducing environmental impact is encouraging R&D in natural and functional pigments. The growing demand for high-quality printing inks for packaging, driven by the e-commerce boom, further strengthens Europe’s market position, ensuring steady growth in the coming years.

Asia Pacific is projected to dominate the global pigments and dyes market in 2025, holding an estimated 47% market share. This dominance is largely driven by rapid industrialization, expanding urban infrastructure, and large-scale manufacturing across key countries such as China and India. The region’s robust industrial base fuels high demand for pigments across multiple end-use industries, including paints and coatings, textiles, plastics, and printing inks. In particular, the textile industry in countries such as India and Bangladesh continues to drive demand for dyes, while China’s growing automotive and construction sectors significantly contribute to the consumption of high-performance pigments. Moreover, Asia Pacific offers cost-effective manufacturing capabilities, which attract both domestic and international players, enhancing production volumes and competitiveness.

Governments in the region are also investing in infrastructure projects, urban housing, and industrial parks, further increasing the requirement for durable and aesthetically appealing pigments in paints, plastics, and coatings. Rising disposable incomes and expanding middle-class populations in countries such as India, Vietnam, and Indonesia are boosting the consumption of consumer goods, textiles, and packaged products, indirectly driving pigment demand. Collectively, these factors position Asia-Pacific as the largest and most influential market for dyes and pigments in 2025, with sustained growth anticipated over the coming decade.

The global pigments and dyes market is highly competitive, featuring both global leaders and regional specialists. In North America and Europe, major companies such as BASF SE, LANXESS AG, DIC Corporation, and Cabot Corporation dominate through large-scale operations, advanced R&D, and established industry partnerships. In the Asia-Pacific region, growing industrialization, robust textile and automotive sectors, and rising demand for paints and plastics attract investments from international and regional players such as Heubach GmbH, Sudarshan Chemical Industries, and Atul Ltd. Market competition is driven by product innovation, including eco-friendly, bio-based, and high-performance functional pigments. Companies focus on sustainability, modular solutions, and strategic collaborations to differentiate themselves. While global giants consolidate the top tier, numerous niche and regional players cater to local preferences, cost-sensitive segments, and specialized applications, maintaining a dynamic and fragmented market landscape.

The global pigments and dyes market is projected to reach US$ 41.5 Bn in 2025.

The growing demand for eco-friendly and sustainable pigments is a key driver.

The pigments and dyes market is poised to witness a CAGR of 5.9% from 2025 to 2032.

Advancements in high-performance and functional pigments are a key opportunity.

BASF, DIC Corporation, Heubach GmbH, LANXESS AG, and Sudarshan Chemical Industries Ltd. are key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source

By Formulation

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author