ID: PMRREP35881| 197 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

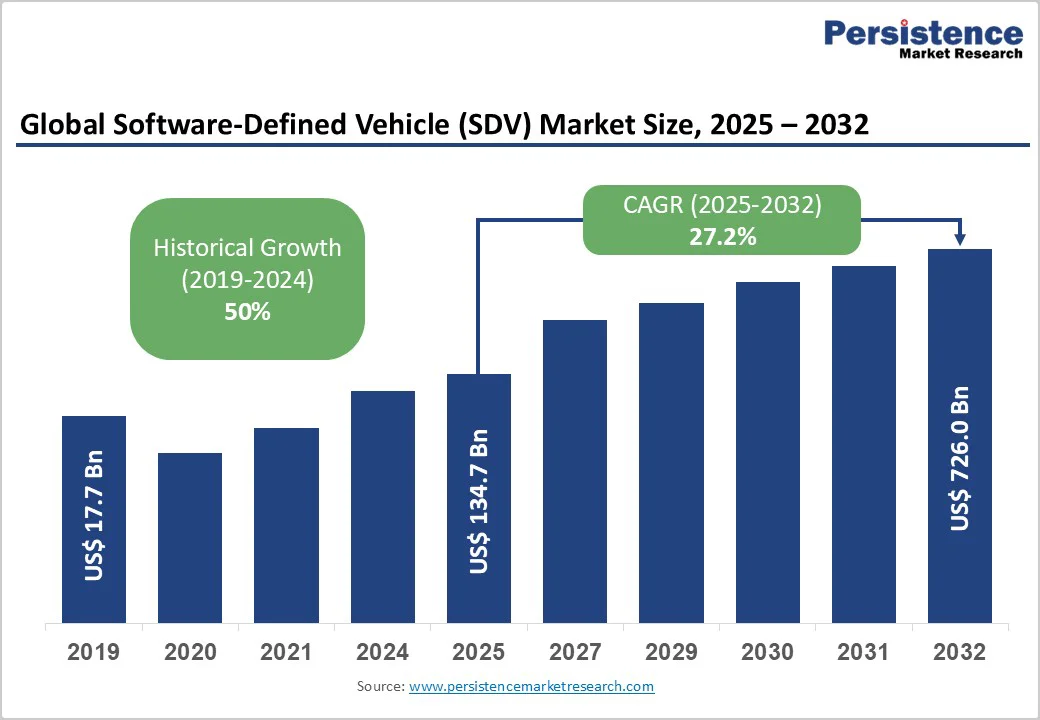

The global software-defined vehicle (SDV) market size is likely to be valued at US$134.7 Billion in 2025, and is estimated to reach US$726.0 Billion by 2032, growing at a CAGR of 27.2% during the forecast period 2025 - 2032, driven by rapid advancements in automotive software architecture, electrification, and autonomous driving technologies.

The rising adoption of EVs, stricter emissions and safety regulations, and the widespread integration of OTA updates are anticipated to drive market growth. OEM investments in zonal architectures and ADAS, alongside 5G expansion, consumer demand for customization, and the shift toward autonomous driving, position SDVs as key to future mobility.

| Key Insights | Details |

|---|---|

| Software-Defined Vehicle (SDV) Market Size (2025E) | US$134.7 Bn |

| Market Value Forecast (2032F) | US$726.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 27.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 50% |

Governments globally are issuing stringent emissions targets and autonomous vehicle regulations, catalyzing SDV adoption.

The European Union (EU)'s Green Deal and the U.S. Environmental Protection Agency (EPA)’s Advanced Clean Car regulations mandate significant reductions in passenger vehicle emissions and incentivize EV penetration, which inherently relies on sophisticated SDV architecture. China’s New Energy Vehicle quota system enforces EV production-share requirements, promoting SDV growth in the world's largest car market.

National-level safety standards, including autonomous vehicle testing frameworks from NHTSA (National Highway Traffic Safety Administration) in the U.S., and the United Nations Economic Commission for Europe (UNECE) global technical regulations, are accelerating the development of ADAS and autonomous software.

According to the International Energy Agency (IEA), global electric car sales accounted for more than 20% of total car sales worldwide in 2024. This will prove critical for advancing SDV integration, as electric platforms are intrinsically software-enabled. Regulatory incentives are fostering rapid SDV diffusion and highlighting the substantial financial impetus from public policy for OEM investments in scalable software platforms.

The complexity of software-defined vehicle systems requires significant R&D investment in advanced software platforms, domain controllers, sensors, and high-performance computing units. Despite economies of scale, the scarcity and rising costs of semiconductors, exacerbated by geopolitical tensions and supply chain disruptions, pose critical barriers to SDV proliferation.

Component shortages have led to increased lead times and production cost inflation, driving integrated circuit (IC) prices higher as well. Domain-centralized and zonal architectures intensify the demand for specialized chips, pushing OEM capital expenditures for in-house software development and integration.

Software validation and cybersecurity assurance add developmental complexity and cost. The nascent nature of many regulatory frameworks for SDVs also creates compliance uncertainties, potentially delaying product launches. This environment challenges profitability margins and necessitates innovative cost-sharing or collaborative strategies among OEMs and technology suppliers to sustain SDV market momentum.

The ability of software-defined vehicles to provide OTA software updates unlocks recurring revenue streams for OEMs beyond traditional vehicle sales. Feature-on-demand (FoD) models enable consumers to activate new features such as enhanced driver assistance, infotainment upgrades, or autonomous capabilities post-purchase.

Emerging 5G/6G networks and edge cloud computing enhance OTA capabilities, driving customer engagement and allowing OEMs to differentiate through continuous innovation. Additionally, commercial fleet operators increasingly rely on subscription-based SDV services for fleet optimization, predictive maintenance, and compliance monitoring, representing a rapidly growing, high-margin market.

This opportunity necessitates strategic investments in secure update infrastructure, analytics, and platform development, reinforcing software-defined vehicles as transformative revenue engines for manufacturers and suppliers.

The domain-centralized architecture segment presently dominates with an estimated 48% of the SDV market revenue share in 2025, attributable to its mature integration model that segments vehicle functions into domains such as ADAS, infotainment, powertrain, and body control. This architectural approach enables enhanced modularity with domain controllers coordinating specific subsystems, streamlining complexity, and improving system reliability.

Leading OEMs such as Volkswagen Group and BMW have extensively embedded this architecture, promoting faster feature rollout cycles and better integration between hardware and software layers. It also simplifies compliance with evolving safety and cybersecurity regulations by compartmentalizing system vulnerabilities.

Zonal control architecture is likely to be the fastest-growing E/E architecture through 2032, driven by its superior scalability and wiring-simplification capabilities. Unlike domain-centralized models, zonal architectures structure vehicle electronics by physical zones, front, rear, left, and right, with a centralized high-performance computing unit.

This enables enhanced computational efficiency and real-time data processing, critical for Level 4+ autonomous driving, as well as reducing wiring complexity and supporting agile OTA software management. Investments by Mercedes-Benz, Stellantis, and Volkswagen Group underscore the strategic prioritization of zonal architectures as future-proof platforms that can expedite innovation and reduce system costs.

In 2025, ADAS is expected to lead, with an estimated 36% share of the software-defined vehicle market, backed by regulatory mandates for vehicle safety and consumer demand for risk-mitigation features such as adaptive cruise control, lane-keeping assist, and autonomous emergency braking.

ADAS has become foundational to SDV adoption, serving as an entry point for automakers into connected and autonomous functionalities while fostering incremental safety improvements. This segment is also supported by expanding sensor deployments and AI-powered algorithms that leverage data from radar, lidar, and cameras to enhance predictive driving safety.

Autonomous driving software is likely to be the fastest-growing segment, driven by advances in artificial intelligence, sensor fusion, and machine learning, which enable incremental autonomy from Level 3 conditional automation to Level 5 full autonomy.

OEMs and technology companies are channeling investments into neural network-based perception and decision-making stacks and redundant safety architectures. This growth is catalyzed by consumer willingness to adopt autonomous features, coupled with regulatory approvals for limited operational domains under defined scenarios.

The battery electric vehicle (BEV) segment is the market leader in 2025, commanding approximately 45.2% revenue share, reflecting the intrinsic alignment between electric drivetrains and software-defined vehicle architectures. BEVs inherently require sophisticated battery management systems, powertrain software controls, and integrated thermal management.

Coupled with rising consumer preference for zero-emission vehicles and aggressive government electrification mandates, BEVs represent the most attractive platform for SDV implementations.

BEVs are also expected to sustain robust growth with the highest CAGR between 2025 and 2032, outpacing other propulsion types, as EV manufacturing scales globally and advances in solid-state batteries and fast-charging infrastructure emerge.

Their software-centric frameworks are more readily upgradable via OTA, supporting ongoing feature enhancements and ecosystem connectivity, making them a continuous innovation hub. Hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) remain transitional platforms, while fuel cell electric vehicles (FCEVs) can emerge as a sizeable niche over the next few years.

North America is projected to hold an estimated 32% of the software-defined vehicle market share in 2025, on the back of the advanced technology ecosystem and regulatory clarity in the U.S.

The U.S. Department of Transportation and the NHTSA provide comprehensive guidance facilitating autonomous vehicle testing and deployment, fostering a conducive innovation environment. The market also stands to benefit from the strong presence of world-leading automotive OEMs, technology firms such as Tesla, NVIDIA, and Google, and tier-1 suppliers deeply invested in SDV R&D in the region.

California and Michigan remain innovation hubs supporting pilot programs and fleet deployments, while a significant venture capital influx focused on mobility start-ups sustains ecosystem growth. Investment opportunities abound in scalable platform development, SAE Level 3 and beyond autonomy, and cybersecurity solutions tailored to evolving legal frameworks.

Europe is anticipated to grow owing to its strong automotive heritage, coupled with forward-looking regulatory harmonization under the EU's Green Deal framework. The EU's stringent CO2 emission targets and vehicle safety mandates compel OEMs to integrate robust SDV functionalities, particularly ADAS and electrification architectures.

Germany's industrial prowess enables early deployment of zonal control architectures and software platform standardization aligned with efforts to enhance vehicle safety and infotainment systems. The U.K.'s development of dedicated autonomous vehicle testing zones and France’s investment in connectivity infrastructure exemplify a supportive environment for SDV adoption.

The competitive landscape of the Europe SDV market is characterized by pronounced cooperation between OEMs and technology providers, facilitating interoperability and accelerating innovation cycles. Investment flows focus on cybersecurity, data privacy compliance, and MaaS (mobility-as-a-service) models, reflecting urbanization trends that mandate demand-responsive and sustainable mobility solutions.

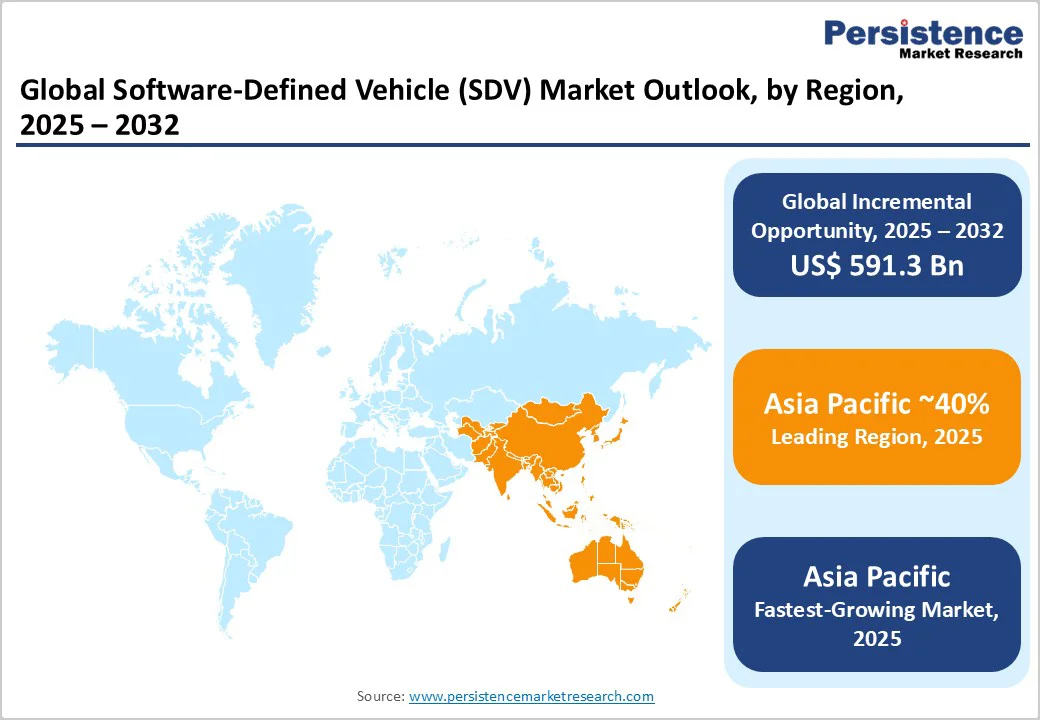

Asia Pacific is expected to be the largest and fastest-growing SDV market, forecast to command an estimated 40% share by 2025 and register the highest CAGR from 2025 to 2032. The regional market is driven predominantly by China's aggressive new energy vehicle (NEV) mandates, an expansive manufacturing base, and cutting-edge digital infrastructure development.

The regulatory support provided in China in the form of NEV credit systems and significant subsidy programs has accelerated EV and SDV adoption. Leading vehicle manufacturers, such as BYD, NIO, and Great Wall Motors, are integrating state-of-the-art software platforms aligned with government objectives.

Japan's strength in automotive electronics and autonomous vehicle testing complements rapid digital transformation. India and ASEAN markets, propelled by increasing urban population densities and digital infrastructure expansion, are adopting software-defined vehicles selectively, emphasizing cost-effective connectivity solutions and software platforms suited for emerging market conditions.

The region’s regulation is formative but increasingly aligned with global standards, offering investment opportunities in software localization, cloud-edge hybrid computing models, and fleet management services tailored to regional mobility needs.

The global software-defined vehicle (SDV) market structure exhibits moderate consolidation, with leading players capturing approximately 55% of the global revenue.

Auto giants such as Volkswagen AG, Toyota Motor Corporation, Tesla, BMW Group, and Daimler AG dominate through proprietary software platforms and strategic alliances. Tier 1 suppliers, including Bosch, Continental, Aptiv, and Infineon, are crucial for embedded systems, sensors, and safety software development.

The SDV market landscape reflects a hybrid competitive ecosystem, balancing integrated OEM control with partnering software providers and emerging pure-play technology firms targeting OTA services and AI-enabled autonomous driving software solutions. Market dynamics favor cross-technology partnerships and platform ecosystems, enabling agility, scalability, and reduced time-to-market.

The global software-defined vehicle (SDV) market is projected to reach US$134.7 Billion in 2025.

The growing adoption of EVs, evolving regulatory mandates for vehicle emissions and safety, and the increasing integration of OTA update capabilities in vehicles worldwide are driving the software-defined vehicle (SDV) market.

The software-defined vehicle (SDV) market is poised to witness a CAGR of 27.2% from 2025 to 2032.

Substantial investments in zonal control architecture and ADAS by OEMs, and the confluence of increasing consumer demand for customization, exponential growth of 5G, and the transition towards autonomous driving are key market opportunities.

Volkswagen AG, Toyota Motor Corporation, Tesla, Inc., and BMW Group are some of the key players in the software-defined vehicle (SDV) market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Electrical/Electronic (E/E) Architecture

By Functionality

By Propulsion Type

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author