ID: PMRREP35928| 197 Pages | 1 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

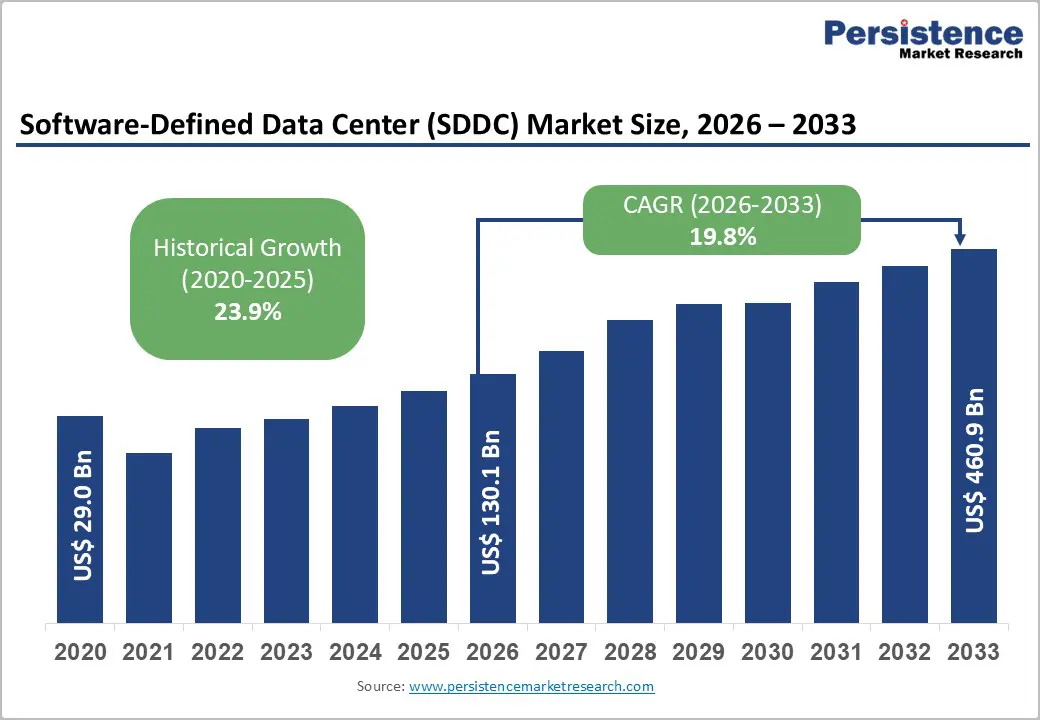

The global software-defined data center (SDDC) market size is likely to be valued at US$130.1 Billion in 2026, and is estimated to reach US$460.9 Billion by 2033, growing at a CAGR of 19.8% during the forecast period 2026 - 2033, driven by aggressive enterprise digital transformation initiatives requiring agile infrastructure, exponential growth in AI workload demands necessitating flexible compute architectures, and the shift toward hybrid and multi-cloud deployments that demand centralized orchestration and policy-driven management.

The SDDC market has evolved into mission-critical infrastructure, enabling organizations to separate hardware from service delivery, boost efficiency, cut costs, and strengthen security across sectors like finance, telecom, healthcare, government, and manufacturing.

| Key Insights | Details |

|---|---|

| Software-Defined Data Center (SDDC) Market Size (2026E) | US$130.1 Bn |

| Market Value Forecast (2033F) | US$460.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 19.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 23.9% |

The rapid growth of AI and machine learning (ML) workloads is driving a significant transformation in data center infrastructure. The global demand for AI-ready data centers is projected to grow steadily over the next several years, necessitating software-defined architectures that allow dynamic workload management and autonomous operations.

SDDCs enable the separation of compute, storage, and networking resources, allowing efficient scaling of AI workloads without equivalent hardware costs. Enterprises are increasingly adopting AI-powered platforms that predict failures, optimize energy use, and reallocate resources automatically, reducing operational complexity and workforce needs.

The rise of hybrid and multi-cloud environments, spanning public clouds such as AWS and Microsoft Azure, private clouds, and on-premises data centers, is driving the demand for unified policy enforcement and centralized governance, which SDDC solutions facilitate by enabling seamless workload mobility and consistent security across heterogeneous environments.

An SDDC also reduces the total cost of ownership by decoupling software management from hardware, enabling the use of commodity hardware with improved utilization rates, cutting infrastructure costs by nearly half. This shift also reduces vendor lock-in and transitions the IT workforce's focus from hardware maintenance to strategic infrastructure management.

Software-defined data centers promise streamlined operations but require advanced technical skills in virtualization, container management, cloud-native architectures, and policy-based governance.

There is a significant talent shortage of specialists with expertise in these areas, complicating adoption for many organizations that must invest heavily in training and consulting. Resistance also arises from IT departments' reluctance to shift control to centralized software-defined models, especially in decentralized organizations.

Legacy systems and monitoring tools often require costly integration or replacement, making the transition complex. Furthermore, upfront capital investment is substantial, as many organizations need to upgrade or replace existing hardware to support SDDC platforms.

Software licensing costs add ongoing expenses, and unclear total cost of ownership details can prolong procurement decisions. These factors can collectively subdue widespread SDDC adoption, especially among mid-sized companies with limited budgets.

The growth of 5G networks, IoT device expansion, and low-latency application demands are driving the need for distributed software-defined infrastructures that extend from central data centers to edge computing locations.

This architecture allows consistent policy enforcement, orchestration, and security across cloud, edge, and remote sites. Vendors such as Dell, Cisco, and Microsoft are developing edge-optimized SDDC solutions to support use cases such as autonomous vehicles, real-time analytics, and industrial automation.

The edge SDDC market is growing faster than traditional SDDC segments, with significant opportunities arising from the relatively low maturity of edge deployments.

Similarly, there is a growing focus on security-centric SDDC platforms that integrate zero-trust principles, continuous compliance, and automated threat response to meet evolving regulatory standards across sectors like healthcare, financial services, and government. Managed SDDC services with integrated cybersecurity are increasingly pursued by organizations lacking internal security expertise, representing a substantial and growing market opportunity.

Software-defined compute (SDC) is the leading component segment, holding about 36.5% of the software-defined data center market revenue share in 2026. This reflects increasing prioritization among enterprises for flexible workload orchestration and dynamic resource allocation through virtualization and container management technologies such as ESXi, Hyper-V, Kubernetes, and VMware vSphere.

The growing adoption of cloud-native and containerized applications is driving the demand for sophisticated compute abstraction layers. SDC improves resource utilization significantly compared to traditional virtualization, enhancing infrastructure ROI.

The segment is also the fastest growing through 2033, driven by increasing AI and ML workloads, autonomous system needs, and the convergence of edge computing, requiring consistent compute management across centralized and distributed environments. Its growth is also supported by the rise of open-source orchestration platforms that enable broader access to advanced compute management beyond large cloud providers.

Cloud-based deployment models, including public, private, and hybrid clouds, dominate the software-defined data center market with over 50% share in 2026. This dominance is powered by an active shift among enterprises toward cloud-first strategies for greater scalability, flexibility, and simplified management. Cloud-based SDDC enables infrastructure automation, continuous deployment, and global scaling without physical data center constraints.

Hybrid cloud, combining on-premises and public cloud resources, emerges as the preferred model for balancing control, cost efficiency, and flexibility.

Growth in this segment is driven by ongoing digital transformation, increased AI workload demands benefiting from cloud GPU access, and organizational trends favoring remote work and distributed teams. Cloud deployment is expected to see the fastest growth rate of about 23% between 2026 and 2033, as businesses continue migrating from traditional on-premises setups to cloud-centric infrastructures.

The IT & telecommunications industry is set to be the largest end-use vertical, commanding 26.3% of the market share in 2026. IT services providers (including system integrators, managed service providers, and consulting firms) are early SDDC adopters, investing in capabilities to address enterprise customer requirements.

Telecommunications service providers face intense pressure to modernize infrastructure, virtualize network functions, transition from proprietary telecom equipment toward software-defined implementations, and reduce operational complexity.

The shift toward 5G telecommunications infrastructure particularly drives SDDC adoption, as service providers must deploy distributed, software-defined network infrastructure spanning core networks, regional hubs, and edge facilities. Cloud service providers and hyperscalers such as AWS and Microsoft Azure maintain massive SDDC deployments enabling service delivery at scale.

Government and public sector organizations are the fastest-growing SDDC end-user vertical through 2033. Agencies worldwide are consolidating IT infrastructure, modernizing legacy systems, and pursuing digital transformation. SDDC adoption enhances cost efficiency, security, and operational performance while meeting data residency and compliance requirements.

U.S. federal agencies increasingly mandate SDDC architectures in procurement, setting modernization benchmarks. Growth is driven by supportive policies, targeted budget allocations, and recognition that legacy systems cannot meet emerging demands, positioning specialized SDDC solutions as critical for government digital transformation initiatives globally.

North America is expected to hold around 40% of the software-defined data center market share in 2026, driven by its mature technology adoption, advanced cloud infrastructure, and concentration of major technology vendors primarily in the U.S., with Canada and Mexico as secondary markets.

The regional market benefits from ongoing infrastructure investments by hyperscale cloud providers and aggressive SDDC adoption by large enterprises. Innovation hubs such as Silicon Valley and AI research centers further bolster technology development and early adoption.

The North America market is projected to grow at the highest CAGR during the 2026 - 2033 period, fueled by increased mid-market adoption, workforce skill expansion, and emerging technologies like edge computing and AI autonomy. The U.S., accounting for most of the region’s market, is home to several large enterprises as primary spenders, whose operations are strongly governed by regulatory mandates, including cybersecurity and data compliance standards.

Leading vendors such as VMware, Microsoft, Cisco, HPE, IBM, and Dell dominate the market, supported by strong sales channels and service networks. Investment priorities include AI infrastructure, cloud cost optimization, and security modernization, which collectively shape the region’s strategic focus in SDDC deployments.

Europe market spans Western Europe, covering Germany, the U.K., France, and Spain, as well as Central Europe and Scandinavia. The Europe market growth is shaped by stringent data privacy laws, such as the General Data Protection Regulation (GDPR) of the European Union (EU), driving the demand for SDDC solutions with advanced data handling, encryption, and residency controls.

The market is projected to grow, fueled by public sector digitalization, healthcare modernization, and Industry 4.0 manufacturing initiatives. Germany leads with a strong manufacturing base, followed by the U.K.’s financial services and fintech prowess, France’s telecom and public sector investments, and Spain’s telecom expansion.

Regulatory compliance, digital transformation of public infrastructure, and manufacturing modernization are key growth drivers, but complex regulations can also slow adoption among smaller organizations. Emerging preferences to reduce reliance on U.S.-based technology vendors are creating opportunities for European providers such as Hewlett Packard Enterprise and local integrators. The market’s regulatory environment demands sophisticated security, geographic data enforcement, and extensive compliance auditing, balancing growth opportunities with implementation challenges.

Asia Pacific is anticipated to be the second-largest market for software-defined data centers, powered by China, Japan, India, South Korea, ASEAN countries, Australia, and New Zealand, with varying levels of technology adoption and infrastructure maturity.

China leads the market with around 35% share, driven by hyperscale cloud expansions and government cloud initiatives, while India holds about 20% share, fueled by rapid IT infrastructure growth and government digitalization programs. Japan accounts for 18%, characterized by mature industrial and telecom modernization, while ASEAN countries collectively hold 27%, benefiting from rapid digital transformation and manufacturing growth.

Asia Pacific is the fastest-growing regional SDDC market, propelled by emerging markets leapfrogging legacy infrastructure, expanding manufacturing sectors, and government initiatives such as Made in China 2025 and Digital India. The region also serves as a global manufacturing hub, generating a sustained demand for advanced SDDC infrastructure to support supply chains and industrial digitalization.

This dynamic growth reflects the significant variation across APAC sub-regions, from mature economies investing steadily in modernization to emerging markets aggressively adopting cloud-native and software-defined architectures. The emphasis on manufacturing digitization combined with government-led infrastructural support is accelerating SDDC adoption, positioning APAC for long-term market leadership and innovation in distributed data center technologies.

The global software-defined data center (SDDC) market is dominated by top vendors holding 45-50% of the market, alongside mid-tier and regional players. High entry barriers stem from R&D demands, enterprise partnerships, and complex integration across compute, storage, and networking. VMware leads historically with a 16-18% share, now navigating strategic shifts post-Broadcom acquisition, while Microsoft leverages hybrid cloud offerings.

Key players focus on networking, hyperconvergence, and infrastructure solutions, with Nutanix, Pure Storage, and NetApp capturing notable segments. Regional vendors such as Huawei, NEC, and Fujitsu serve Asia, while cloud giants Amazon and Google intensify competition and innovation.

The global software-defined data center (SDDC) market is projected to reach US$130.1 Billion in 2026.

Aggressive enterprise digital transformation initiatives requiring agile infrastructure and exponential growth in AI workload demands necessitating flexible compute architectures are driving the market.

The software-defined data center (SDDC) market is poised to witness a CAGR of 19.8% from 2026 to 2033.

The shift toward hybrid and multi-cloud deployments that demand centralized orchestration and policy-driven management, and the decoupling of physical hardware from service delivery by organizations to optimize operational efficiency, reduce capital expenditure, and enhance security posture across global operations, are key market opportunities.

VMware, Microsoft Corporation, Cisco Systems, and Dell Technologies are some of the key players in the software-defined data center (SDDC) market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Deployment Mode

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author