ID: PMRREP34355| 220 Pages | 25 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

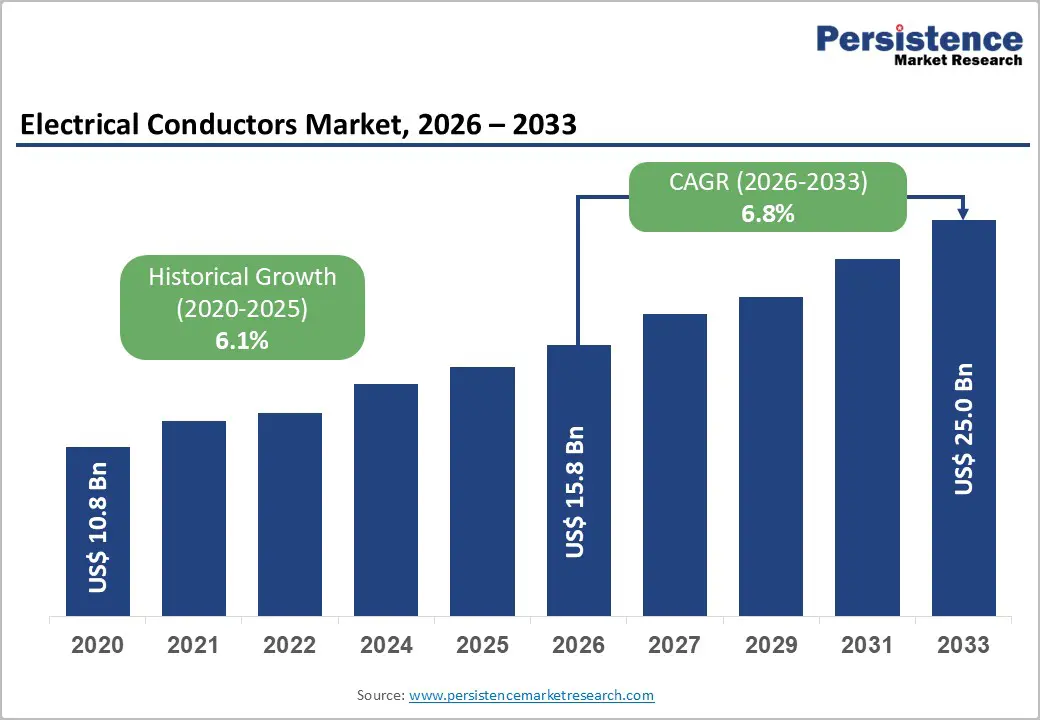

The global electrical conductors market size is likely to be valued at US$15.8 billion in 2026, and is expected to reach US$25.0 billion by 2033, growing at a CAGR of 6.8% during the forecast period from 2026 to 2033, driven by the increasing prevalence of renewable energy infrastructure, rising demand for high-voltage power transmission in urbanization projects, and advancements in lightweight aluminum and composite core conductors.

Growing demand for efficient, low-loss electrical conductors, especially power cables and copper materials for data centers, is accelerating adoption across applications. Advances in submarine power cables and silver-enhanced busbars are further boosting uptake by offering better conductivity and corrosion resistance. The increasing recognition of electrical conductors as critical to grid modernization and electrification in emerging markets remains a major driver of market growth.

| Global Market Attributes | Key Insights |

|---|---|

| Electrical Conductors Market Size (2026E) | US$15.8 Bn |

| Market Value Forecast (2033F) | US$25.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.1% |

Rising Demand for Renewable Energy Infrastructure and High-Voltage Transmission

Rising demand for renewable energy infrastructure and high-voltage transmission is emerging as a major driver across global power and energy systems. Rapid expansion of renewable sources such as solar, wind, and hydropower is reshaping electricity generation, often locating capacity far from urban consumption centers. This geographical separation has increased the need for robust high-voltage transmission networks capable of efficiently transporting large volumes of power over long distances with minimal losses. High-voltage and extra-high-voltage lines enable grid operators to integrate intermittent renewable generation while maintaining system stability and reliability.

Governments and utilities are prioritizing grid modernization to accommodate rising electricity consumption, electrification of transport, and decarbonization targets. Renewable energy projects typically require new transmission corridors, upgraded conductors, and advanced grid components that can handle higher thermal loads and fluctuating power flows. High-voltage transmission infrastructure also supports cross-regional power exchange, allowing surplus renewable energy to be redistributed to deficit areas. Aging transmission assets in many regions are being replaced or reinforced to meet higher capacity requirements driven by renewable integration.

Stringent Regulatory and Environmental Norms

Stringent regulatory and environmental norms significantly constrain the electrical conductors market, influencing manufacturing processes, project timelines, and overall cost structures. Governments and regulatory bodies across regions enforce strict standards for environmental protection, worker safety, and product quality, particularly in industries involving metal extraction, smelting, and large-scale manufacturing. Compliance with these regulations requires conductor manufacturers to invest heavily in pollution-control systems, energy-efficient production technologies, waste-management practices, and continuous environmental monitoring.

Environmental clearance processes for mining activities related to copper and aluminum sourcing are often lengthy and complex, leading to supply uncertainties and delays in raw material availability. Transmission and distribution projects using electrical conductors must also comply with land-use regulations, right-of-way approvals, and ecological impact assessments, which can delay project execution. Non-compliance can result in penalties, production shutdowns, or loss of operating licenses, increasing operational risk for manufacturers. Frequent updates to technical and safety standards necessitate ongoing product redesign, testing, and certification, thereby increasing development costs and extending time-to-market.

Opportunities in Lightweight Aluminum and Composite Core Platforms

The shift toward lightweight aluminum and composite core conductor systems is creating significant growth opportunities in the electrical conductors market. Traditional copper conductors, while highly conductive, are heavy and less suitable for long-distance, high-voltage applications due to mechanical and thermal limitations. Aluminum, being lighter and more cost-effective, combined with advanced composite cores, provides a solution that balances high conductivity, strength, and reduced sag under high loads. These characteristics make composite-core aluminum conductors ideal for high-voltage and extra-high-voltage transmission lines, long-distance power evacuation from renewable energy projects, and challenging terrain where heavy copper conductors are difficult to install.

The adoption of these technologies is further encouraged by the rising demand for grid modernization and the integration of renewable energy sources. Composite cores improve thermal performance and allow conductors to operate at higher temperatures without losing mechanical stability, increasing the capacity and reliability of power transmission networks. Lighter conductors reduce the structural load on towers and supporting infrastructure, enabling cost savings in construction and maintenance. As utilities and energy developers increasingly focus on efficiency, sustainability, and reducing transmission losses, the market for lightweight aluminum and composite core conductor systems is poised for steady growth, offering manufacturers opportunities to innovate and meet evolving energy infrastructure needs.

Product Type Insights

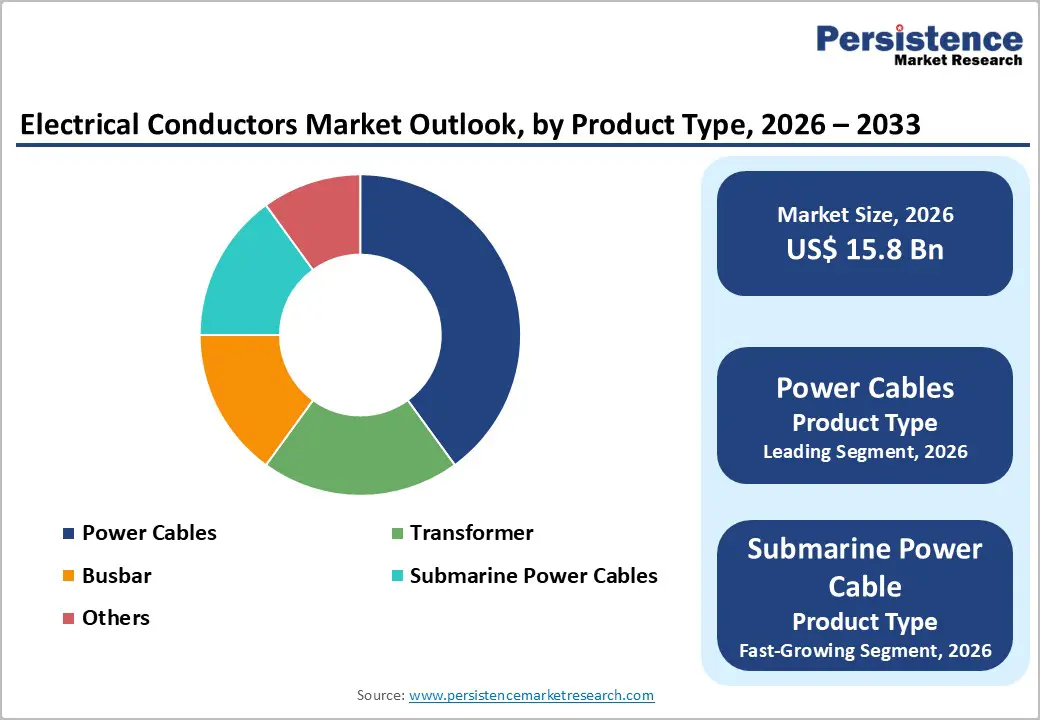

Power cables are anticipated to dominate the market, accounting for approximately 50% of the market share in 2026, due to their critical role in transmitting electricity across residential, commercial, and industrial sectors. Increasing electrification, expansion of power distribution networks, and the growing deployment of high-voltage transmission lines are driving demand for reliable, high-performance cables. Power cables are essential for connecting generation sources, including renewable energy plants, to the grid, ensuring efficient and safe energy delivery. Diamond Power Infrastructure has secured a major power cable supply contract from solar EPC contractor Hild Projects. Scheduled for execution in 2026, the order entails providing high-voltage (HV) and medium-voltage (MV) power cables for large-scale solar power generation and transmission projects.

Submarine power cables represent the fastest-growing segment, fueled by the rapid expansion of offshore renewable energy projects, particularly wind farms, and the increasing need for cross-border electricity interconnections. These cables enable the transmission of large volumes of power from offshore generation sites to onshore grids, often over long distances, while maintaining efficiency and reliability. Advancements in insulation materials, cable design, and installation techniques have significantly improved the durability of cables in harsh marine environments. LS Cable & System, along with its subsidiary LS Marine Solution, has been selected as the preferred bidder to supply submarine cables and construct the underwater connections for the Taean Offshore Wind Power Project in South Chungcheong Province, South Korea. Developed by Vena Energy, the project will involve installing high-voltage subsea cables to link a ~500 MW offshore wind farm to the onshore grid, facilitating renewable energy transmission and supporting infrastructure expansion.

Material Insights

Copper is anticipated to lead the market, holding 55% of the share in 2026, driven by its superior electrical conductivity, reliability, and thermal performance. It is widely used across power generation, transmission, distribution, and industrial applications where efficiency and safety are critical. Copper’s high ductility and corrosion resistance make it ideal for both low-voltage and high-voltage conductors, including cables, busbars, and winding applications. Prysmian Group, one of the world’s largest cable manufacturers, has a strong competitive position owing to its extensive use of copper conductors in power and energy transmission cables. Prysmian’s business and stock performance have been highlighted in industry coverage as benefiting from its significant copper sourcing and production capabilities, especially for copper intensive power grids and high voltage transmission cables used in electrification and infrastructure projects.

Aluminum is likely to be the fastest-growing segment, due to its favorable combination of light weight, cost efficiency, and scalability for long-distance transmission projects. Its lower density compared with copper reduces structural load on towers and eases installation, particularly in high-voltage and extra-high-voltage networks. Aluminum’s cost advantages make it attractive for utilities and large infrastructure developers managing tight budgets, especially in emerging economies. 230 kV reconductoring project in the Big Creek Transmission Corridor in California saw ACCC® conductors increase line capacity from 936 A to 1,520 A and reduce construction time significantly compared with traditional designs. This deployment underscores the expanding use of aluminum-based conductors in large infrastructure projects due to their efficiency, lighter weight, and performance benefits.

Application Insights

Power transmission is expected to account for nearly 40% of market revenue in 2026, as it remains the primary application for high-voltage lines, large-scale grid projects, and the management of diverse networks requiring long-distance conductivity. Factors such as strong system integration, skilled utility teams, and the capability to handle high-capacity or renewable energy blends are driving increased demand. Transmission sectors are at the forefront of power cable deployments and are also leading emerging submarine cable trials. Prysmian Group, a leading global cable manufacturer, has been chosen as the preferred bidder for the £2 billion (US$2.68 billion) Eastern Green Link 4 high-voltage direct current (HVDC) transmission project, which will install both undersea and onshore power cables between Scotland and England, enhancing grid stability and supporting the integration of renewable energy.

Power distribution represents the fastest-growing segment, driven by its strong urban presence and expanding role in smart grids. They offer convenient, quick, and accessible connectivity, attracting utilities that prefer reliable, low-maintenance settings. Increased outreach programs, EV focus, and wider availability of routine and premium conductors further accelerate uptake, boosting rapid adoption across both urban and suburban areas. Torrent Power Limited, a major Indian utility company, has announced an INR 3,110 crore (US$375 million) investment plan to build a modern power distribution network in Nagpur and the surrounding areas. The proposal includes the implementation of advanced infrastructure such as smart metering, SCADA automation, and 100% underground cabling in urban zones, which aims to improve reliability, reduce outages, and enhance service quality for residential and commercial consumers.

North America Electrical Conductors Market Trends

North America is propelled by the region’s advanced grid infrastructure, strong research and development capabilities, and high public awareness of efficiency benefits. Network systems in the U.S. and Canada provide extensive support for conductor programs, ensuring wide accessibility of electrical conductors across power transmission, distribution, and generation populations. Increasing demand for aluminum, convenient, and easy-to-install forms is further accelerating adoption, as these formats improve capacity and reduce barriers associated with copper.

Innovation in electrical conductor technology, including stable HTLS, improved composite delivery, and targeted renewable enhancement, is attracting significant investment from both public and private sectors. Government initiatives and DOE campaigns continue to promote use against loss risks, grid congestion, and emerging EV threats, creating sustained market demand. The growing focus on submarine grades and specialty uses, particularly for offshore and other applications, is expanding the target applications for electrical conductors.

Europe Electrical Conductors Market Trends

Europe shows significant growth by increasing awareness of efficiency benefits, strong grid systems, and government-led renewable programs. Countries such as Germany, France, and the U.K. have well-established energy frameworks that support routine conductor use and encourage the adoption of innovative delivery methods, including electrical conductors. These high-capacity formulations are particularly appealing for transmission populations, regulation-conscious utilities, and distribution users, improving reliability and coverage rates.

Technological advancements in electrical conductor development, such as enhanced composites, application-targeted delivery, and improved low-loss grades, are further boosting market potential. European authorities are increasingly supporting research and trials for conductors against both routine and specialized needs, strengthening market confidence. The growing emphasis on convenient, sustainable options is aligned with the region’s focus on preventive decarbonization and reducing imports. Public awareness campaigns and promotion drives are expanding reach in both urban and rural areas, while suppliers are investing in alloys and novel variants to increase efficacy.

Asia Pacific Electrical Conductors Market Trends

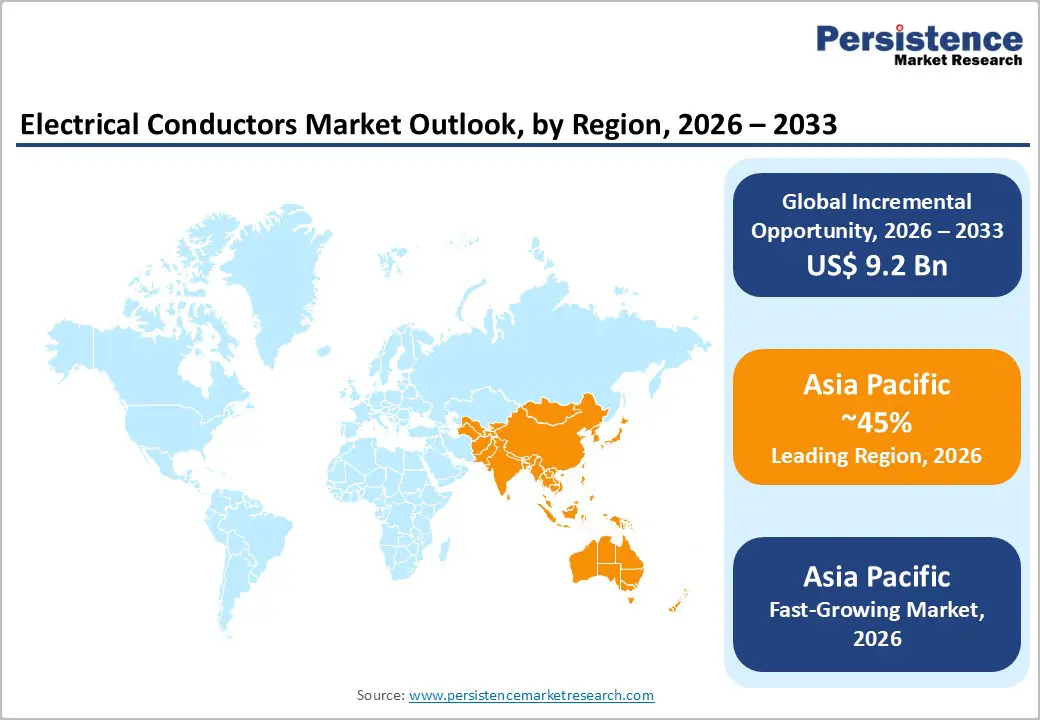

Asia Pacific is projected to dominate and is expected to be the fastest-growing market, capturing 45% of the share in 2026, driven by rising energy awareness, increasing government initiatives, and expanding application programs across the region. Countries such as India, China, Japan, and Southeast Asian nations are actively promoting conductor campaigns to address grid growth and emerging renewable needs. Electrical conductors are particularly attractive in these regions due to their scalable administration, ease of installation, and suitability for large-scale transmission drives in both urban and rural populations.

Technological advancements are supporting the development of stable, effective, and easy-to-deploy electrical conductors, which can withstand challenging climatic conditions and minimize loss of dependence. These innovations are critical for reaching remote facilities and improving overall grid coverage. Growing demand for power transmission, distribution, and generation applications is contributing to market expansion. Public-private partnerships, increased energy expenditure, and rising investment in conductor research and manufacturing capacity are further accelerating growth. The convenience of conductor delivery, combined with improved conductivity and reduced risk of failure, positions electrical conductors as a preferred choice.

The global electrical conductors market features competition between established cable leaders and emerging composite suppliers. In North America and Europe, Nexans and General Cable lead through strong R&D, distribution networks, and utility ties, bolstered by innovative HTLS and submarine programs. In Asia Pacific, Apar Industries advances with localized solutions, enhancing accessibility. Lightweight delivery boosts capacity, cuts sag risks, and enables mass integrations across regions. Strategic partnerships, collaborations, and acquisitions merge expertise, expand portfolios, and speed commercialization. Composite formulations solve weight issues, aiding penetration in renewable areas.

Key Industry Developments

The global electrical conductors market is projected to reach US$15.8 billion in 2026.

The rising prevalence of renewable energy infrastructure and demand for high-voltage transmission are key drivers.

The electrical conductors market is poised to witness a CAGR of 3.6% from 2026 to 2033.

Advancements in lightweight aluminum and composite core platforms are key opportunities.

Nexans, General Cable, Apar Industries, CTC Global, and Sterlite Technologies are the key players.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020–2025 |

| Forecast Period | 2026–2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author