ID: PMRREP29644| 200 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

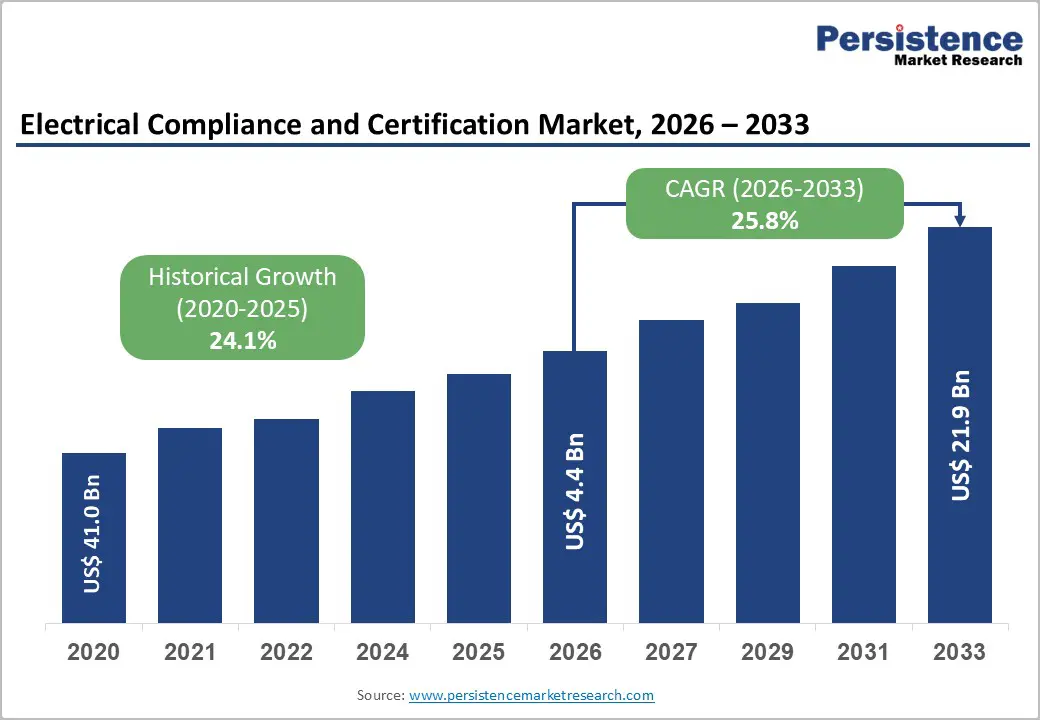

The global electrical compliance and certification market is projected to reach US$ 4.4 billion in 2026 and US$ 21.9 billion by 2033, growing at a CAGR of 25.8% from 2026 to 2033.

The market has seen robust growth driven by rising regulatory mandates and rapid technological advancements across multiple industries. Rising concerns regarding electrical safety, especially in developing regions, and the adoption of stringent standards by international organizations have accelerated market growth.

| Key Insights | Details |

|---|---|

| Electrical Compliance and Certification Market Size (2026E) | US$ 4.4 Billion |

| Electrical Compliance and Certification Market Value Forecast (2033F) | US$ 21.9 Billion |

| Projected Growth CAGR (2026 - 2033) | 25.8% |

| Historical Market Growth (2020 - 2025) | 24.1% |

Strict regulatory mandates are becoming a powerful driver of demand for compliance and certification services across global industries. Governments and standards bodies such as the IEC, NEC, OSHA, and the European Union have tightened safety, performance, and security requirements for electrical and electronic products. In the U.S., OSHA continues to update safety rules for industrial and commercial installations, while the EU’s Low Voltage and Electromagnetic Compatibility Directives ensure that only certified products can be sold in Europe. These rules particularly affect energy, manufacturing, transportation, and connected device sectors.

In 2025, Eurofins Scientific strengthened its role as a key compliance partner by helping manufacturers meet new EU regulations on network protection, data privacy, and fraud prevention. Under these rules, products must include secure default settings, access controls, encryption, and secure software update mechanisms before entering the EU market. As a result, companies producing IoT devices, automotive electronics, smart home products, and wireless equipment are driving sustained demand for testing and certification services to avoid delays, redesign costs, or market exclusion.

Rapid technological progress and digital transformation are reshaping electrical infrastructure and driving strong demand for advanced certification services. As smart technologies and IoT become embedded in power systems, industries must ensure that new solutions such as smart meters, automated testing tools, and cloud-based compliance platforms meet strict safety, reliability, and interoperability standards. Industry 4.0 and smart manufacturing are accelerating this shift, pushing companies to adopt digital compliance models that can keep pace with fast innovation.

This trend is especially visible in high-risk sectors like automotive, aerospace, energy, and telecommunications, where failure or downtime is not an option. Reflecting this momentum, Bureau Veritas has expanded its role in certifying next-generation technologies. The company recently delivered certification for liquefied hydrogen containment systems and LNG dual-fuel container ships, highlighting the growing need to validate new energy solutions. It also secured major renewable energy certification projects, including large solar and battery storage systems, demonstrating how smart grids and clean energy infrastructure are fueling sustained growth in certification demand worldwide.

High certification costs and complex procedures remain major restraints on the electrical compliance and certification market. Obtaining certification typically involves extensive testing, documentation, audits, and periodic renewals, all of which can be costly and time-consuming. These expenses can discourage small and medium-sized enterprises (SMEs), especially those operating in highly price-sensitive markets, from pursuing certification. In addition, companies that operate across multiple regions face further challenges due to fragmented regulatory frameworks and varying compliance standards.

Managing different certification requirements across countries increases administrative workloads and operational costs. This complexity often forces organizations to allocate additional resources to compliance management rather than innovation or expansion. As a result, some businesses delay certification or limit market entry to specific regions, restricting overall market growth. While large multinational companies can absorb these costs more easily, SMEs frequently struggle to balance compliance investments with profitability, making certification a significant barrier to entry in certain markets.

The global shortage of skilled professionals capable of performing electrical compliance assessments and certifications is another key market restraint. Certification bodies often face difficulties in recruiting and retaining experts with in-depth knowledge of evolving electrical standards, cybersecurity requirements, and emerging technologies. As regulations become more complex and technology advances rapidly, the demand for highly specialized auditors, inspectors, and engineers continues to grow.

This talent gap slows down certification timelines and increases operational pressure on existing personnel. In many developing regions, limited access to advanced technical education and professional training further worsens the shortage. As a result, certification processes may experience delays, increasing time-to-market for manufacturers. The lack of skilled professionals also limits certification bodies' ability to scale operations efficiently, particularly in fast-growing markets such as renewable energy, electric vehicles, and smart infrastructure. Without sufficient workforce development and training initiatives, this constraint may continue to restrict market expansion.

The global shift toward renewable energy and smart grids is creating strong growth opportunities for compliance and certification providers. As countries such as Germany, China, and the United States rapidly expand solar, wind, energy storage, and hydrogen projects, ensuring safe and reliable grid integration has become critical. Every new renewable installation must meet strict technical, safety, and performance standards before it can connect to national power networks. This has increased the need for specialized testing, validation, and ongoing inspection services.

Certification bodies are now working closely with utilities, project developers, and equipment manufacturers to support this transition. TÜV SÜD is a key example, offering end-to-end certification across the renewable energy lifecycle. Its services range from wind resource assessments and structural safety checks to grid compatibility testing, battery storage certification, and hydrogen value-chain validation. TÜV SÜD also provides technical due diligence and technology readiness assessments to help investors reduce risk. Ongoing inspections under regulations such as Germany’s Industrial Safety Ordinance further ensure long-term safety, compliance, and reliability of renewable energy assets.

Compliance-as-a-Service (CaaS) is rapidly reshaping how companies manage regulatory requirements. Instead of handling complex compliance processes internally, organizations are increasingly outsourcing them through digital, cloud-based platforms. These CaaS solutions streamline documentation, maintain audit trails, and provide real-time regulatory updates, helping businesses reduce administrative workload, compliance risk, and overall costs. Leading certification providers such as TÜV SÜD and SGS SA have introduced cloud-enabled compliance tools, making certification services easier to access for both small and large organizations.

This model is gaining momentum as regulations become more complex and companies accelerate digital transformation. To support this shift, Applus+ Laboratories is expanding its digital certification offerings to include integrated management system certification services. Its platform helps organizations demonstrate compliance with international standards covering quality, environmental management, workplace safety, and information security-all through a single system. By enabling companies to manage multiple regulatory frameworks simultaneously, Applus+ significantly simplifies compliance across regions, lowers operational costs, and underscores how CaaS models are becoming a scalable, efficient solution for modern regulatory challenges.

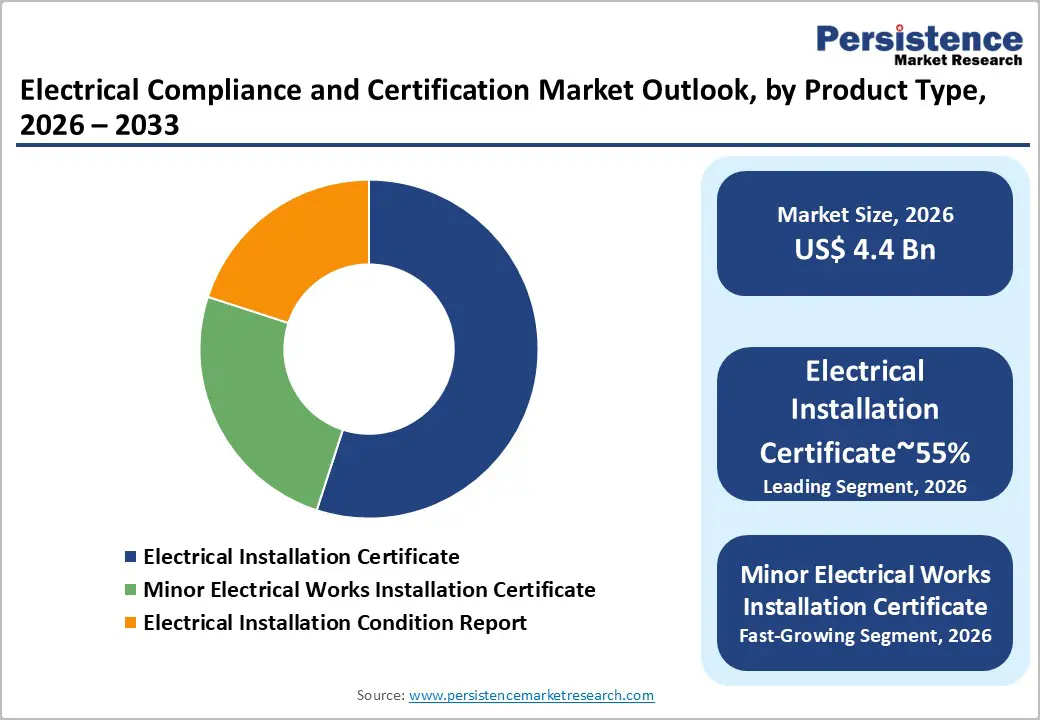

The Electrical Installation Certificate segment dominates the certificate type category, accounting for approximately 55% of the total market share. This leadership is primarily due to the mandatory requirement for electrical installations to be certified before commissioning in residential, commercial, and industrial settings. Regulatory standards such as the United Kingdom’s BS 7671 Wiring Regulations and the international IEC 60364 standard require installation certification to ensure electrical safety and compliance.

The growing number of construction projects, infrastructure upgrades, and industrial expansions continues to support high demand for this certificate type. Urbanization, smart building development, and increased electrification across industries further contribute to its dominance. Electrical Installation Certificates are also required for modifications, upgrades, and periodic inspections, creating recurring demand. Because electrical safety is a critical concern for regulators, insurers, and property owners, this certificate type remains essential across markets. As a result, certification bodies continue to prioritize this segment as a stable and high-volume revenue source.

Quality management system certification holds a leading position in the certification scheme segment, accounting for around 30% of the market share. Standards such as ISO 9001 are widely adopted across industries to ensure consistent operational quality and compliance with safety requirements. Organizations pursue ISO 9001 certification to enhance internal processes, improve risk management, and demonstrate regulatory compliance to customers and authorities.

This certification is often a prerequisite for participating in government tenders, large infrastructure projects, and global supply chains. Its broad applicability across manufacturing, construction, healthcare, energy, and service industries contributes to its strong market presence. Quality management certification also supports continuous improvement initiatives, making it valuable beyond regulatory compliance. As companies increasingly focus on operational efficiency and risk mitigation, demand for quality management system certification continues to grow. This widespread adoption reinforces its position as the most prominent certification scheme in the electrical compliance market.

The Manufacturing, Construction, and Engineering sector is the largest end-use industry segment, accounting for approximately 35% of the market. This dominance is driven by the extensive use of electrical systems, machinery, and automation technologies in industrial environments. Compliance with electrical safety standards is essential to prevent accidents, equipment failures, and regulatory penalties. Standards such as OSHA’s General Industry Standards and IEC 60204, which governs the electrical safety of machinery, are widely implemented across this sector

Large-scale industrial facilities require regular inspections, testing, and recertification, generating continuous demand for compliance services. Rapid industrial expansion, infrastructure development, and adoption of smart manufacturing technologies further strengthen this segment’s market position. Engineering and construction projects also require certification at multiple stages, from design to commissioning. Given the high risk of electrical failures in industrial settings, companies in this sector prioritize certification, making it the largest contributor to overall market revenue.

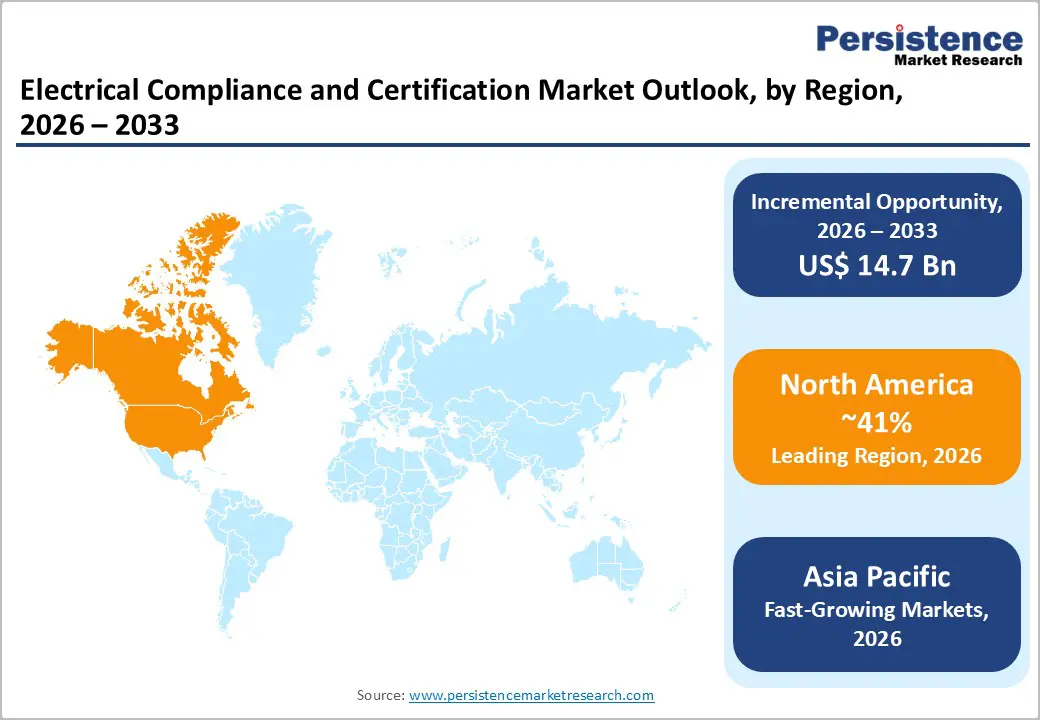

North America leads the global electrical compliance and certification market, with the United States playing a central role. The region benefits from a mature regulatory environment and strong enforcement of safety standards. Organizations such as Underwriters Laboratories (UL) and the National Fire Protection Association (NFPA) are instrumental in developing and updating electrical safety codes.

High adoption of smart technologies, IoT devices, and advanced manufacturing systems further drives the demand for compliance services. Industrial automation, electric vehicles, renewable energy projects, and data centers require extensive certification to meet safety and performance standards. In addition, strict workplace safety regulations enforced by OSHA ensure consistent demand for inspection and certification services. The presence of leading technology manufacturers and innovation hubs also supports market growth. As digital transformation continues across industries, North America is expected to maintain its leadership position in the electrical compliance and certification market.

Europe demonstrates strong growth in the electrical compliance and certification market, supported by regulatory harmonization and a strong focus on sustainability. Countries such as Germany, the United Kingdom, and France have implemented comprehensive electrical safety regulations and actively promote certification for renewable energy systems and smart infrastructure. The European Committee for Electrotechnical Standardization (CENELEC) plays a key role in ensuring consistent standards across member states, enabling smoother cross-border compliance.

Europe’s commitment to green energy, carbon reduction, and circular economy principles is creating new certification requirements across automotive, manufacturing, and energy sectors. Increasing adoption of electric vehicles, hydrogen technologies, and smart grids further expands certification demand. Manufacturers operating in Europe must comply with stringent directives, which strengthens the role of certification bodies. As sustainability regulations continue to evolve, Europe is expected to remain a major growth market for electrical compliance services.

Asia Pacific is experiencing rapid growth in the electrical compliance and certification market due to industrialization, urban development, and expanding manufacturing activity. Countries such as China, India, and Japan are investing heavily in infrastructure, smart cities, renewable energy, and industrial automation. The region serves as a global manufacturing hub, producing a wide range of electrical and electronic products that require certification for domestic and export markets.

Regulatory bodies such as China’s Compulsory Certification (CCC) system and India’s Bureau of Indian Standards (BIS) enforce mandatory compliance for electrical equipment. In addition, ASEAN countries are strengthening safety regulations to align with international standards. Growing awareness of electrical safety, combined with increased export-oriented manufacturing, is driving demand for certification services. As regional governments continue to tighten regulatory oversight, the Asia Pacific is expected to remain one of the fastest-growing markets globally.

The electrical compliance and certification market is moderately fragmented, with a mix of global leaders and regional players. Key differentiators include technical expertise, global accreditation, and the ability to deliver end-to-end solutions. Market leaders such as Eurofins Scientific, TUV SUD, and SGS SA are investing in digital platforms and strategic partnerships to expand their reach and service offerings. Emerging business models, such as compliance-as-a-service and integrated digital solutions, are reshaping the competitive landscape, enabling rapid scaling and improved customer experience.

The market is expected to reach US$ 21.9 Billion by 2033, growing at a CAGR of 25.8%.

Key drivers include stringent regulatory mandates and technological advancements in electrical infrastructure and smart technologies.

The Electrical Installation Certificate segment holds the largest share, around 45%, due to mandatory safety regulations.

North America leads the market due to its robust regulatory framework and innovation ecosystem.

The expansion of renewable energy and smart grids presents the largest opportunity for growth.

Leading companies include Eurofins Scientific, TUV SUD, Bureau Veritas Group, SGS SA, and Intertek Group PLC.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Certificate Type

By Certification Scheme

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author