ID: PMRREP24805| 200 Pages | 3 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

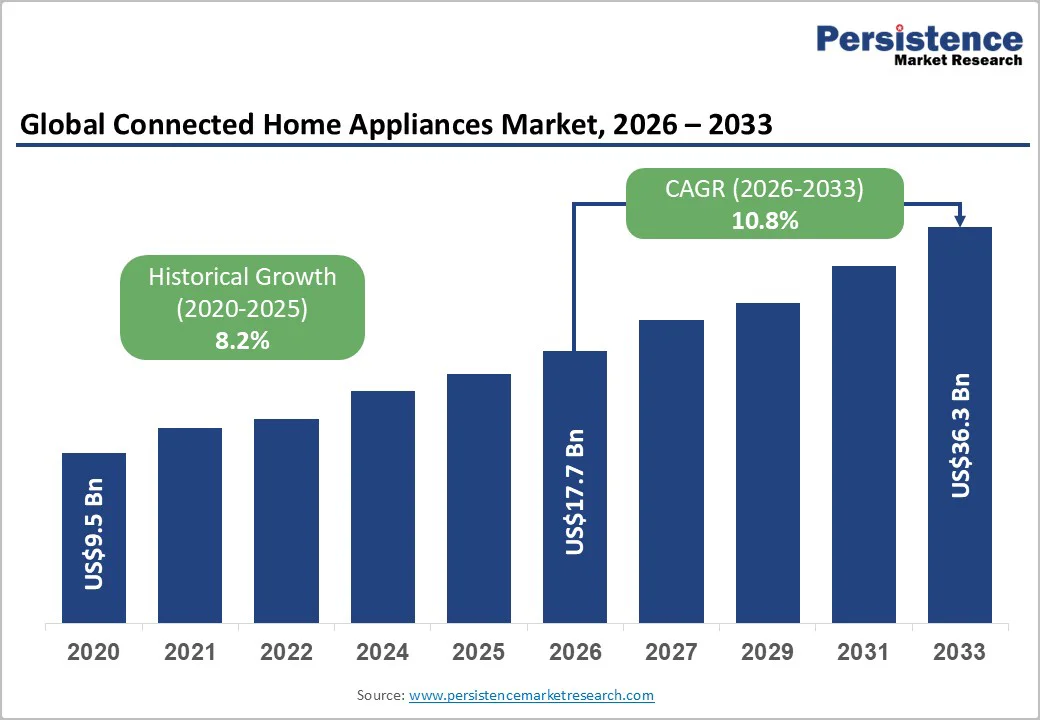

The global connected home appliances market size is likely to be valued at US$17.7 Billion in 2026 and is expected to reach US$36.3 Billion by 2033, growing at a CAGR of 10.8% during the forecast period from 2026 to 2033, driven by the rapid expansion of smart home ecosystems, surging consumer demand for energy-efficient and remotely controllable devices, and seamless integration with voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri.

The rise of 5G networks and affordable IoT sensors is rapidly transforming traditional appliances into smart, connected systems that enable real-time monitoring, predictive maintenance, and meaningful energy savings. Growing urbanization, higher disposable incomes, and stronger environmental awareness are further accelerating adoption across residential and commercial sectors.

| Key Insights | Details |

|---|---|

| Connected Home Appliances Market Size (2026E) | US$17.7 Bn |

| Market Value Forecast (2033F) | US$36.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 10.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 8.5% |

The global smart home market is witnessing rapid growth, driven by the increasing adoption of connected home appliances that integrate seamlessly into comprehensive IoT-based ecosystems.

Consumers are embracing devices such as smart refrigerators, washing machines, air conditioners, and security systems that can be monitored and controlled via smartphones, apps, or voice assistants. The convenience, automation, and improved user experience of these systems are prompting households to expand their smart home setups.

The demand for energy-efficient appliances is fueling market growth. Connected appliances optimize power usage by intelligently managing operational cycles and providing real-time insights into energy consumption. This capability allows households to lower utility costs while supporting sustainability initiatives and regulatory compliance.

High-speed internet, advanced communication protocols such as Wi-Fi, Zigbee, and Z-Wave, along with AI-powered platforms, enable seamless connectivity and operation of multiple devices, stimulating the adoption of connected appliances across urban and semi-urban regions.

The global smart home market faces challenges due to the high initial cost of connected home appliances. Advanced features, IoT integration, and smart functionality often make these appliances more expensive than conventional alternatives, which can limit adoption, especially in price-sensitive markets and emerging economies.

Many consumers hesitate to invest in a full suite of smart devices due to the upfront financial commitment, slowing market penetration despite growing interest in smart home solutions.

Cybersecurity concerns are restraining market growth. Connected appliances collect and transmit data over the internet, making them potential targets for hacking, data breaches, and unauthorized access. Privacy-conscious consumers are wary of sharing personal and household information with smart devices, which can deter adoption.

Manufacturers use encryption, secure networks, and firmware updates to address these risks, but data security concerns still limit widespread adoption.

The smart home market is set to benefit from the widespread rollout of 5G networks, which enable faster, more reliable connectivity for connected home appliances. Enhanced network speeds and low latency allow devices to communicate seamlessly, supporting real-time monitoring, remote control, and improved automation within smart home ecosystems.

This connectivity expansion is expected to drive higher adoption of smart appliances across both residential and commercial segments.

AI-driven preventive maintenance presents a significant growth opportunity. Connected appliances equipped with AI can analyze usage patterns, detect potential faults, and predict maintenance needs before breakdowns occur. This proactive approach minimizes downtime, extends appliance lifespan, and reduces repair costs, offering tangible value to consumers.

Advanced connectivity and AI-driven maintenance make connected appliances essential to smart homes, boosting adoption and market growth.

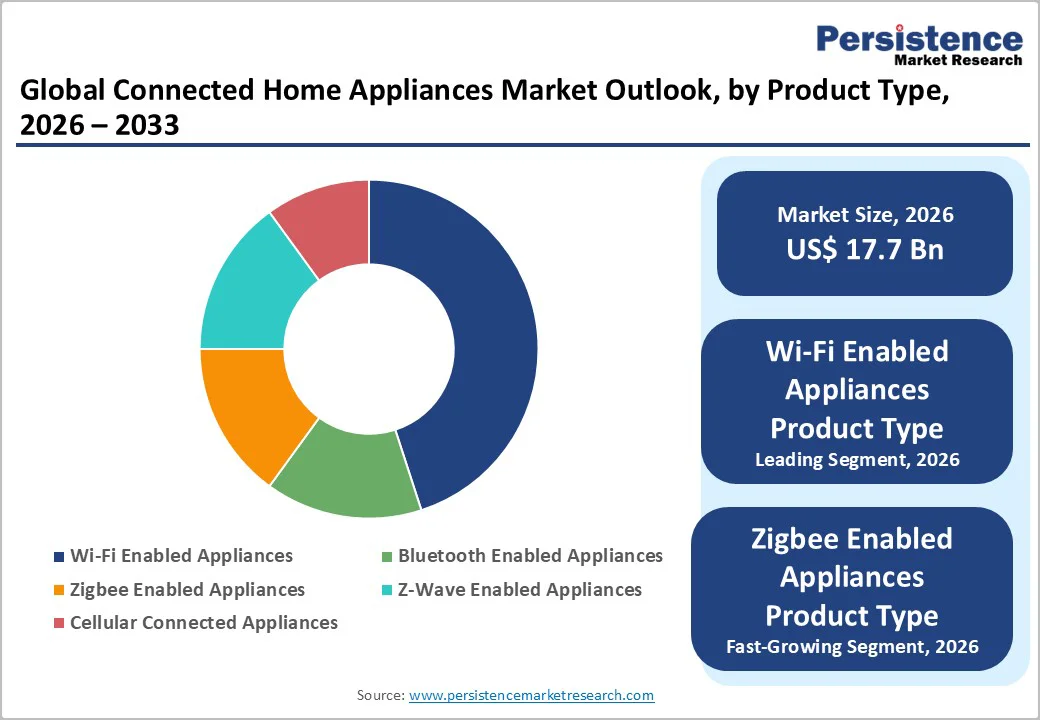

Wi-Fi-enabled appliances are expected to dominate the global connected home appliances market, accounting for approximately 45% of total revenue in 2026. Their widespread adoption is driven by compatibility with various devices, such as smartphones, tablets, and voice assistants, which allows users to monitor and control appliances remotely.

With direct internet connectivity, these devices offer real-time updates, seamless software integration, and instant notifications, significantly enhancing convenience and the overall smart home experience.

For example, Samsung Family Hub refrigerators provide Wi-Fi-enabled remote temperature control, smart diagnostics, and full integration with the SmartThings ecosystem. Wi-Fi-enabled appliances, such as LG ThinQ washing machines, allow users to remotely start or stop cycles, monitor progress, and optimize energy usage via a smartphone app.

Zigbee and Z-Wave appliances are likely to represent the fastest-growing product types in 2026, benefiting from low power consumption and mesh networking capabilities that support whole-home ecosystems. These protocols enable multiple devices to communicate reliably over longer distances within a home, making them ideal for integrated smart home solutions.

The adoption is rising rapidly, particularly in energy-conscious and tech-savvy markets. For example, Philips Hue smart lighting systems use Zigbee to enable reliable, low-power communication and seamless automation across a home.

Energy management application is projected to lead the connected home appliances market, capturing around 30% of the total revenue share in 2026, driven by smart thermostats and intelligent lighting systems. These solutions allow households and commercial spaces to monitor and optimize energy consumption in real time, reducing utility costs and enhancing sustainability.

The growing focus on energy efficiency, coupled with regulatory incentives and consumer demand for environmentally friendly solutions, has reinforced the dominance of energy management applications globally.

Voice command and virtual assistant integration application is likely to be the fastest-growing product type in 2026, fueled by the rapid expansion of ecosystems such as Amazon Alexa, Google Assistant, and Apple Siri. Consumers increasingly prefer hands-free control over appliances, enabling seamless operation, automation, and scheduling.

The widespread adoption of smart speakers and voice-enabled devices, combined with AI-driven personalization, is accelerating market growth.

The residential segment is projected to lead the market in 2026, capturing around 75% of the total revenue share. Homeowners are increasingly investing in smart devices to enhance convenience, automate daily tasks, and improve lifestyle quality. The integration of appliances such as smart refrigerators, washing machines, HVAC systems, and lighting with mobile apps and voice assistants makes residential settings the primary driver of market demand.

The commercial segment is likely to be the fastest-growing end-user category in 2026, driven by hotels, offices, and smart buildings adopting centralized control systems. Connected appliances in commercial environments enable energy efficiency, remote monitoring, and operational automation.

The rising focus on sustainability, cost savings, and improved occupant comfort is accelerating the deployment of smart appliances in commercial spaces, making this segment a key growth opportunity in the market.

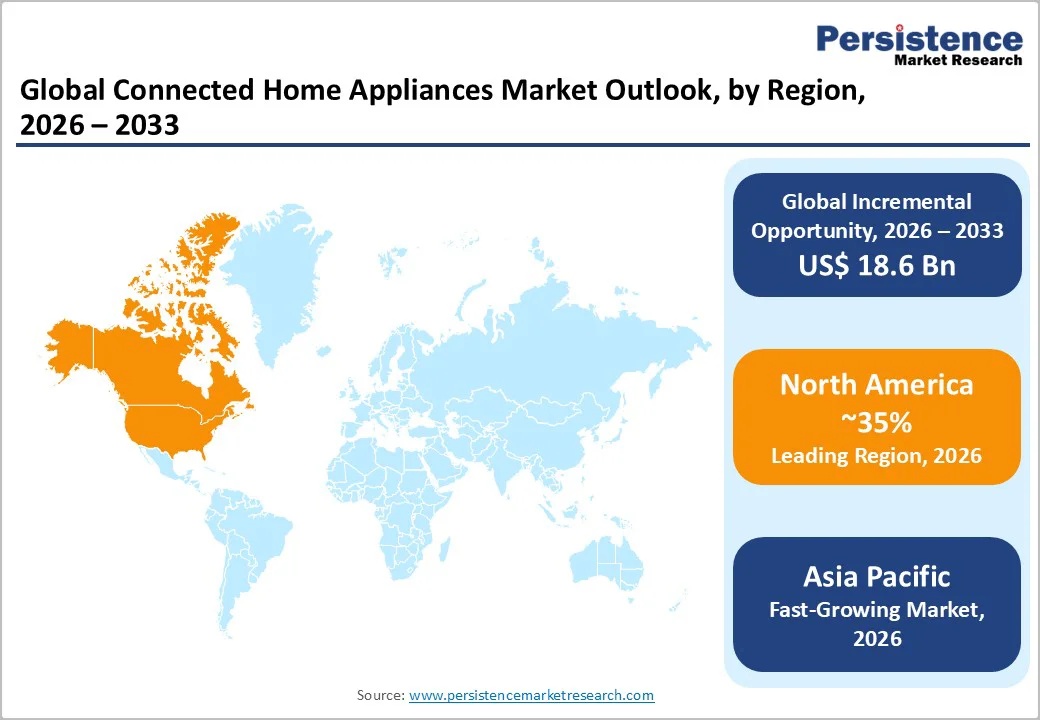

North America is expected to be the leading region in the home application market, holding 35% of the global share in 2026, due to strong digital infrastructure, high household IoT awareness, and widespread internet penetration. High-speed broadband and stable connectivity enable seamless operation of smart appliances, allowing remote control, energy management, and integration with voice assistants.

This mature market supports both incremental upgrades and full smart home conversions, particularly among tech-savvy urban and suburban households.

Consumer preferences are shifting from standalone smart devices to fully-integrated home ecosystems. The adoption of IoT-enabled refrigerators, washers, HVAC systems, and smart kitchen devices is increasing, driven by demand for convenience, automation, and energy efficiency. Smart air purifiers and HVAC-linked appliances are among the fastest-growing segments, reflecting focus on health, comfort, and sustainable living.

Europe is likely to be a significant market for connected home appliances in 2026, due to the increasing adoption of IoT-enabled devices for convenience, energy efficiency, and home automation.

Widespread internet penetration, eco-conscious consumer behavior, and regulatory emphasis on energy-efficient solutions support strong market growth across the region. Smart kitchens, IoT-enabled HVAC systems, energy-efficient washing machines, and other advanced appliances are becoming increasingly popular in European households.

Consumer demand is shifting from standalone smart devices to fully integrated home automation ecosystems. Households prefer solutions that combine lighting, kitchen, climate, and security systems under unified control platforms, offering remote access, voice or app integration, and energy-saving features. Rising disposable incomes, urbanization, and the growth of e-commerce and omnichannel retail enhance accessibility.

The Asia Pacific region is anticipated to be the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and expanding smart home adoption across countries such as China, India, Japan, and South Korea. As more consumers shift from basic appliances to smart, IoT enabled devices, including smart washing machines, air purifiers, refrigerators, and kitchen appliances, demand is surging.

The combination of expanding 5G / high-speed internet infrastructure, growing e-commerce penetration, and increasing awareness of energy efficiency and convenience is fueling adoption.

Smart appliances integrated with IoT, AI, and home automation platforms are becoming more affordable and accessible, enabling consumers in both major metros and smaller cities to invest in smart home lifestyles. Asia Pacific is not only expanding its share of global smart home appliance demand but also evolving into a region characterized by strong growth.

The global connected home appliances market exhibits a moderately fragmented structure, driven by a mix of legacy appliance giants, traditional appliance makers transitioning to smart, and newer entrants focusing on IoT and automation.

With key leaders including Samsung Electronics, LG Electronics, Whirlpool Corporation, Haier Group, Panasonic Corporation, and Electrolux, these firms lead owing to wide smart appliance portfolios, refrigerators, washers, HVAC, kitchen appliances, global distribution networks, and investment in IoT, AI, and energy efficient technologies.

These players compete through continuous product innovation, launching IoT enabled, AI driven appliances with energy saving, remote control, and home automation capabilities.

They also engage in strategic partnerships and platform integration, e.g., smart home platforms, cross brand compatibility, and cloud services to enhance user experience and stickiness. Premium brands focus on performance and smart features, while others target affordability to expand reach in emerging markets.

The global connected home appliances market is projected to reach US$17.7 Billion in 2026.

Rapid smart home adoption, demand for energy efficiency, and seamless integration with voice assistants (Alexa, Google Home, Siri) are the primary drivers.

The connected home appliances market is expected to grow at a CAGR of 10.8% from 2026 to 2033.

5G integration, AI-powered preventive maintenance, and usage analytics present the strongest growth opportunities.

Samsung, LG Electronics, Haier, Whirlpool Corporation, Midea Group, BSH Hausgeräte, Xiaomi Corporation, and GE Appliances are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author