ID: PMRREP35532| 188 Pages | 30 Jul 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

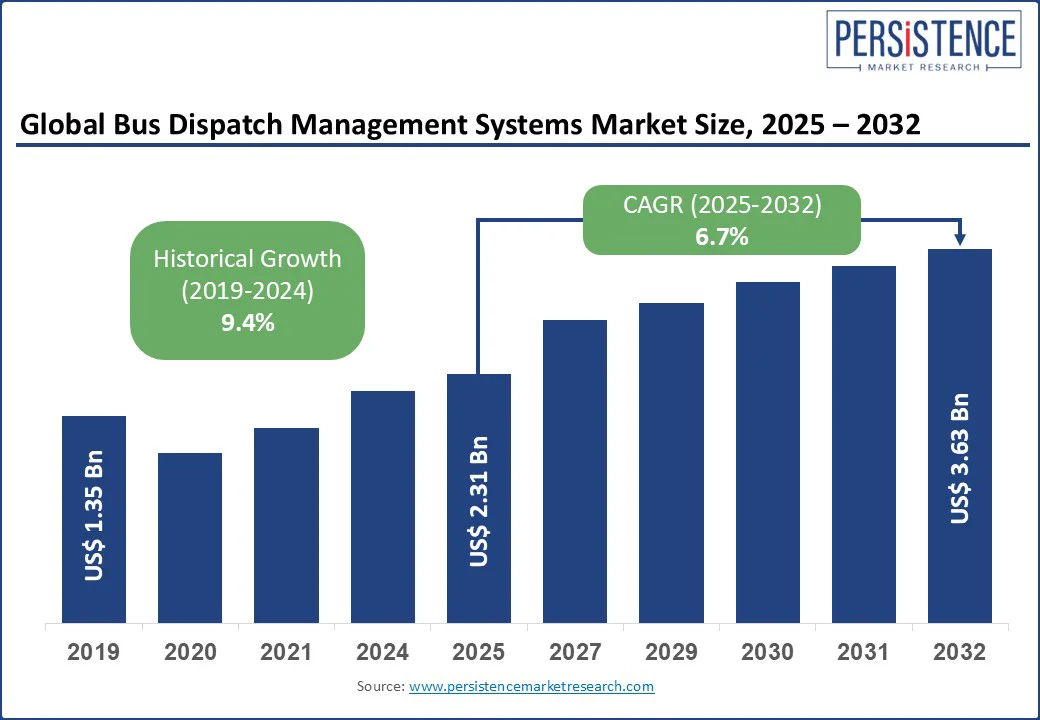

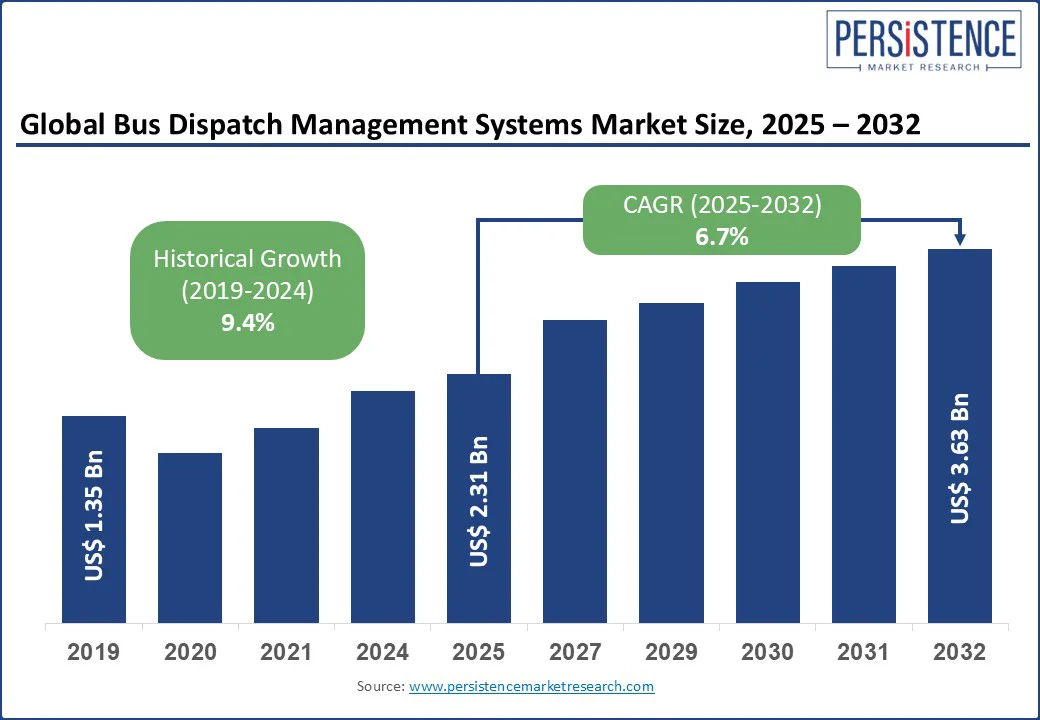

The global bus dispatch management systems market size is likely to be valued at US$ 2.31 Bn in 2025, and is estimated to reach US$ 3.63 Bn by 2032, growing at a CAGR of 6.7% during the forecast period 2025 - 2032. The bus dispatch management systems market growth is driven by a surging demand for reliable and transparent public transit services in large urban sprawls, accelerating urbanization in developing economies, and smart city initiatives.

Bus dispatch management systems are intelligent software platforms developed to streamline the scheduling, routing, monitoring, and coordination of bus fleets across a broad spectrum of use cases ranging from public transportation and school buses to charter and emergency services. These systems leverage GPS, cloud computing, and real-time data analytics to ensure movement predictability, optimize fuel consumption, elevate passenger safety, and improve operational efficiency of fleets.

Governments and transport agencies are prioritizing digitized fleet operations to reduce congestion and emissions while next-generation technologies such as AI-powered route optimization and mobile app-based dispatching are redefining the future of mass transit management.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Bus Dispatch Management Systems Market Size (2025E) |

US$ 2.31 Bn |

|

Market Value Forecast (2032F) |

US$ 3.63 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

9.4% |

A vital factor fueling the bus dispatch management systems market growth is the persistent shortage of qualified bus drivers, especially within public education and regional transit systems in North America. In response to a shrinking pool of qualified drivers, school districts, including Colorado Springs’ District 11 are adopting AI-powered platforms such as HopSkipDrive’s Strategic Routing to optimize bus operations and reduce route complexity. AI algorithms consolidate over 100 bus routes into just 55 by reallocating riders and suggesting alternatives, highlighting the rise of predictive route optimization and intelligent fleet dispatching.

Advanced systems equipped with cloud-based routing engines, IoT fleet telemetry, and demand forecasting tools are enabling operators to maximize fleet utilization, reduce fuel consumption, and prevent route overlap. These are now key success metrics in the evolution of intelligent transportation management. As workforce shortfalls intensify, particularly in education and last-mile urban networks, the integration of smart dispatch systems has now become an operational necessity, giving rise to new market opportunities anchored in AI, automation, and workforce optimization.

The widespread deployment of bus dispatch management systems is hindered by difficulties in integrating advanced digital solutions with outdated legacy transportation infrastructure. Several transit agencies, especially in developing economies and older municipal systems, still operate on fragmented IT systems, where dispatch decisions are tied to manual logs, paper-based schedules, or GPS data stored and retrieved in silos. Such legacy setups lack the wherewithal required to support real-time bus tracking, dynamic rerouting, or cloud-based dispatch algorithms, creating significant obstacles in modernizing operations.

For instance, transit systems in parts of Eastern Europe and South Asia have reported delays in implementing smart fleet software due to incompatible vehicle sensors, outdated hardware, or low digital literacy among dispatch personnel. This technological gap slows deployment timelines and inflates integration costs, with return on investment taking a hit and discouraging further investments. Even where digital tools are introduced, their full functionality often remains underutilized due to poor data visibility or unreliable network connectivity. As a result, legacy system bottlenecks continue to serve as a quiet but powerful barrier in the market.

A strategically lucrative opportunity awaiting players in the bus dispatch management systems market is the accelerating adoption of demand-responsive transit (DRT) models, particularly in suburban and semi-urban zones underserved by fixed-route systems. Unlike traditional transit systems, DRT dynamically adjusts routes and schedules based on real-time passenger demand. For DRT to function efficiently, it requires intelligent dispatching software capable of managing variable pick-up points, rider clustering, and predictive fleet allocation. This has created strong demand for software vendors deliver algorithm-driven dispatch solutions tailored to a wide array of microtransit operations.

Cities such as Arlington, Texas, and Milton Keynes in the U.K. have piloted DRT programs integrated with real-time dispatch solutions, substantially reducing wait times and improving last-mile connectivity. These systems rely on advanced features such as automated ride-matching, geofencing, and on-demand fleet deployment. In response to public and private operators increasingly pivoting toward low-cost, high-efficiency transit solutions, DRT-based deployments present a compelling and scalable opportunity for bus dispatch system providers to diversify their offerings and tap into emerging smart mobility ecosystems across ever-expanding urban sprawls.

In the current bus dispatch ecosystem, the cloud-based deployment model is slated to lead with a market share of around 57% in 2025, and it is also set to be the fastest-growing sub-segment, estimated to exhibit a 11% CAGR during the forecast period 2025-2032. This model is rapidly becoming the de facto industry standard, particularly among transit agencies aiming for digital scalability. Further underpinning its dominance is the rising demand for real-time dispatch insights, remote fleet monitoring, and data-driven route optimization, necessitating the flexibility and interoperability that cloud platforms offer.

For instance, the Massachusetts Bay Transportation Authority (MBTA) transitioned several of its fleet management components to a cloud-based architecture to enhance operational transparency and enable predictive maintenance. The ability to scale software functions without high upfront IT infrastructure costs has heightened the appeal of cloud systems to smaller municipalities and smart mobility startups.

The on-premises segment is projected to be the fastest-growing due to the large installed base among traditional transit operators, particularly in regions with data localization mandates or limited internet connectivity. Municipal transportation bodies in many parts of the Middle East and Southeast Asia, still favor on-premise solutions owing to national security concerns and established in-house IT protocols. Even within these ecosystems, there is a gradual shift toward hybrid models that blend on-premise control with cloud-hosted analytics layers. On-premise models remain critical in politically sensitive or highly regulated transit environments where data governance trumps high-end technological solutions.

The public transportation management sub-segment is set to dominate the bus dispatch management systems market with a 50% share in 2025 on account of its indispensability in urban mobility planning and modernization of traditional mass transit systems. With traffic congestion in cities worldwide worsening incessantly, public bus systems are seeking digital transformation solutions to lower carbon emissions and boost commuter efficiency and comfort.

Integrated dispatch models enable real-time fleet tracking, predictive scheduling, and intermodal connectivity, which are capabilities vital to advancements such as Mobility-as-a-Service (MaaS). For example, Transport for London (TfL) and the Los Angeles Department of Transportation (LADOT) have both adopted advanced dispatch systems to coordinate hundreds of bus routes across their cities, leveraging APIs and cloud dashboards to align with metro, rail, and bike-share networks. Moreover, the rollout of electric bus fleets, which need dispatch systems to incorporate battery-level monitoring, charging schedules, and range optimization, plays a key role in driving market growth.

The school bus dispatch sub-segment is expected to display the fastest growth at a CAGR of nearly 10% through 2032, driven by increasing safety concerns among parents and the push for digitization across educational institutions. Schools and transport contractors are increasingly investing in AI-driven routing software and GPS-based real-time tracking to minimize route deviations, reduce idle time, and notify parents about arrival times or emergencies. Some countries are even providing legal backing to such efforts. In the U.S., for instance, the Student Transportation Safety Act has sped up the widespread adoption of smart bus monitoring systems, with platforms such as Zonar and Edulog becoming popular in districts across Texas and California.

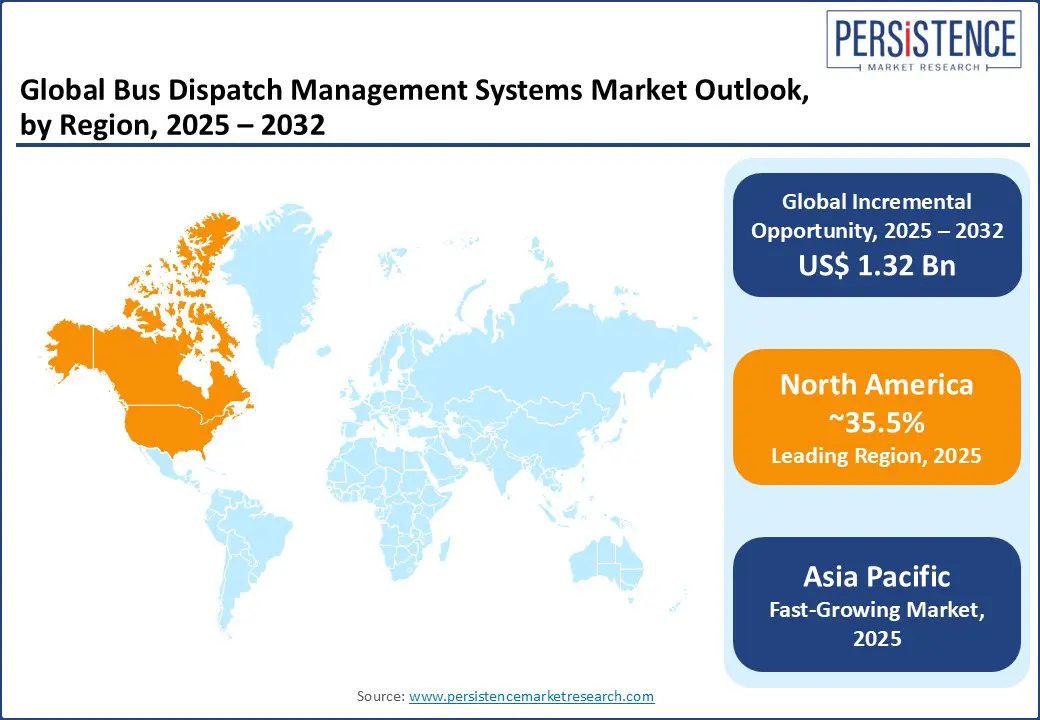

North America is forecast to command the largest market share of around 35.5% in 2025. Public transit agencies and school transport operators across the U.S. and Canada have been actively adopting cloud-based, AI-powered dispatch platforms, enabling real-time route optimization, telematics integration, and predictive maintenance. For instance, First Student launched its comprehensive HALO platform in 2025 to bring together recruiting, routing, dispatch, and maintenance, providing school districts with real-time fleet oversight and driver tracking.

Large Canadian cities such as Toronto and Vancouver are investing heavily in fuel-efficiency tracking and route scheduling for electric bus fleets, tying such measures to the country’s broader, long-term climate targets. In addition, federal infrastructure grants, such as the one awarded to Louisville’s TARC in early 2025, are also enabling the rollout of CAD/AVL systems with companion mobile apps (MyStop). Such funding programs have facilitated the integration of next-generation bus dispatch models with existing urban traffic management systems in the region.

Asia Pacific is anticipated to register the highest CAGR of around 11% through 2032 on the back of the thriving economic development in mega-cities such as Beijing, Shanghai, and Mumbai. This, coupled with government-backed smart city infrastructure projects, is augmenting the adoption of AI and IoT-enabled bus dispatch solutions in Asia Pacific. In China, where there has been a meteoric rise in the number of urban residents having full-fledged access to public transport over the past few decades, local players have effectively deployed advanced bus dispatch management systems that collect millions of data points daily to enhance route fidelity and fleet resource balancing.

India’s Smart Cities Mission also opens up promising prospects for the market, with cities upgrading bus networks with real-time tracking and dynamic routing to reduce congestion and improve service reliability. Pilot projects in major metros such as Bengaluru and Delhi demonstrating the capabilities of cloud-native dispatch platforms to support electric bus deployments and optimize charging cycles have proven to be considerably successful. The heightening need to scale low-cost, high-efficiency transit in densely populated areas, conjoined with growing public and private investments in sustainable mobility, has authoritatively made Asia Pacific the most lucrative regional market dispatch system vendors.

Europe is still a strategic regional market strongly supported by rigorous regulatory oversight and smart mobility ambitions. Countries such as Germany, France, and the U.K. are rolling out advanced bus dispatch platforms in alignment with comprehensive transit modernization strategies and environmental targets. Market players in the region have already deployed such systems with tangible success.

For instance, Siemens’ Vamos Next platform purportedly reduces route delays by nearly 23% in cities such as Berlin. The region is also a central hub for demand-responsive transit innovations, with platforms such as ioki and fflecsi deploying dynamic routing in peri-urban and rural zones across Germany and Wales. These platforms use AI-driven fleet optimization to serve low-density catchment areas cost-effectively.

The global bus dispatch management systems market is deeply influenced by an exciting synergy of veterans and agile innovators. Working at the forefront are major players such as Samsara Networks, Verizon Connect, GIRO Inc., and INIT GmbH, which collectively command nearly a fourth of the market. These companies are smartly utilizing their well-established AI-powered fleet management, real-time GPS tracking, and predictive analytics capabilities to build robust dispatch platforms. For example, Samsara’s cloud-native solution combines telematics with route optimization and maintenance alerts, in a bid to meet transit agencies' need for end-to-end visibility and operational efficiency.Similarly, Optibus and GIRO specialize in integrating cloud features into municipal and school transport networks, focusing on customizable route-planning and compliance with local safety mandates.

Emerging firms such as BusHive, Cubic Transportation Systems, and TripSpark Technologies are making notable headway in carving out niches in areas such as school bus routing, DRT, and paratransit services. The differentiating determinant for these players are tailored functionalities such as RFID-based student tracking, on-demand ride-matching, and mobile app integrations, solving unique issues that may not be fully served by mainstream platforms.

The global cereal ingredients market is expected to reach US$ 112.1 billion by 2032, with a 4.1% CAGR from 2025.

Wheat-based cereal ingredients, with a 36.73% share in 2024, lead due to versatility in breakfast cereal production.

Demand for healthy cereal ingredients, animal feed cereals, and biofuel cereal production fuels growth.

North America, led by the U.S. cereal ingredients market, holds a 36.63% share due to breakfast cereal culture.

Fluctuating cereal grain prices, health concerns with processed cereal products, and competition from alternative breakfast options are challenges.

Oats are the fastest-growing cereal ingredient, favored for their cholesterol-lowering benefits and high fiber content, making them popular in healthy breakfast cereals.

Innovation in fortified cereal products and expansion into the Asia Pacific cereal markets offer significant potential.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Deployment

By End-user

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author