ID: PMRREP32520| 191 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

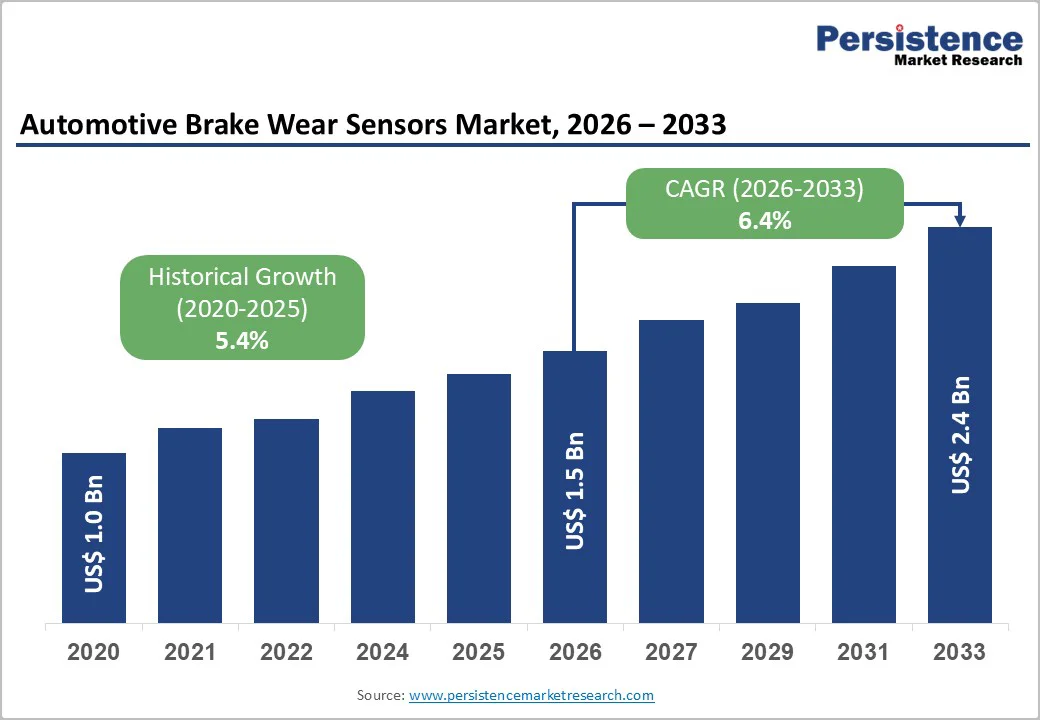

Automotive Brake Wear Sensors Market size was valued at US$ 1.5 billion in 2026 and is projected to reach US$ 2.4 billion by 2033, growing at a CAGR of 6.4% between 2026 and 2033. The market expansion is fundamentally driven by stringent regulatory mandates requiring advanced braking systems, the accelerating electrification of vehicle fleets across developed and emerging economies, and the integration of predictive maintenance technologies within commercial vehicle telematics platforms.

| Global Market Attributes | Key Insights |

|---|---|

| Automotive Brake Wear Sensors Market Size (2026E) | US$ 1.5 Bn |

| Market Value Forecast (2033F) | US$ 2.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.4% |

| Historical Market Growth (CAGR 2020 to 2024) | 5.4% |

Government agencies and international regulatory bodies have implemented increasingly stringent vehicle safety standards that mandate the integration of advanced braking technologies. The National Highway Traffic Safety Administration (NHTSA) in the United States adopted Federal Motor Vehicle Safety Standard (FMVSS) No. 127 in 2024, requiring all light vehicles to be equipped with automatic emergency braking (AEB) systems by September 1, 2029. In the European Union, Regulation (EU) 661/2009 mandates advanced emergency braking systems for commercial vehicles, while the Euro NCAP (European New Car Assessment Programme) assessment protocols increasingly reward vehicles equipped with sophisticated brake wear monitoring capabilities integrated with electronic stability control systems. The Euro 7 regulation, effective November 2026, introduces unprecedented brake particle emission limits of 7 mg/km for passenger cars, requiring manufacturers to develop advanced brake systems with integrated monitoring sensors to track wear patterns and optimize friction material performance.

The rapid expansion of electric vehicle manufacturing and deployment across global markets has fundamentally transformed braking system architecture and sensor requirements. In 2024, global electric vehicle sales reached 1.6 million units, representing 10% of total new light vehicle sales in the United States, while China achieved 11.3 million electric vehicle sales, cementing its position as the world's dominant electric vehicle market. Nordic countries demonstrate exceptional adoption rates, with Norway achieving 90% electric vehicle penetration among new car sales. Commercial fleet electrification trends further accelerate the market: 64% of fleet professionals currently operate electric vehicles, and 87% plan fleet electrification within five years, with 36% expecting to transition 20-50% of fleets to electric power by 2026. Electric vehicles employ regenerative braking systems that recover kinetic energy and require sophisticated brake wear sensors to monitor the interaction between regenerative and friction-based braking, enabling seamless transitions and optimizing energy recovery efficiency.

The integration of advanced electronic brake wear sensors into vehicle platforms requires substantial research and development investments, with manufacturers bearing significant costs for sensor calibration, software development, and testing across multiple vehicle architectures and regulatory domains. Original equipment manufacturers have prioritized direct factory integration of brake wear sensors as standard equipment in new vehicles, creating a bifurcated market where aftermarket adoption remains limited due to compatibility constraints and customer preference for manufacturer-installed solutions.

Additionally, the premature adoption of aftermarket sensors can conflict with vehicle diagnostic systems and compromise warranty coverage, further restricting market expansion in the service and replacement segments. These cost barriers and integration complexities disproportionately affect smaller automotive suppliers and independent service centers, limiting market accessibility and consolidating market share among tier-one suppliers with extensive engineering capabilities and capital resources.

The increasing penetration of regenerative braking technology in electric and hybrid vehicles fundamentally reduces the frequency of mechanical brake pad and rotor wear, thereby constraining demand for traditional brake wear sensors in these powertrains. Regenerative braking systems utilize the vehicle's electric motor in generator mode to decelerate vehicles and recharge batteries, minimizing reliance on friction-based braking in normal driving conditions.

Consequently, electric vehicle operators may experience brake wear intervals extending to 150,000 miles or more compared to 25,000-70,000 miles for conventional vehicles, reducing the replacement demand for brake components and associated wear sensors. While smart brake wear monitoring remains valuable for fleet maintenance planning, the extended service intervals and reduced maintenance frequency create pricing pressure and lower replacement demand in the aftermarket segment, compelling sensor manufacturers to transition business models from volume-based replacement sales toward performance monitoring and predictive analytics services.

The convergence of artificial intelligence, Internet of Things platforms, and telematics software has created unprecedented opportunities for brake wear sensors to function as critical components within predictive maintenance ecosystems for commercial vehicle fleets. Fleet operators increasingly deploy telematics systems to monitor real-time vehicle health metrics, optimize maintenance scheduling, and reduce unplanned downtime that generates substantial operational losses. 41% of retail and parcel delivery fleet operators have equipped 50-74% of their vehicle fleets with telematics solutions, and this penetration continues accelerating as logistics and transportation companies compete on delivery efficiency and cost optimization.

Advanced brake wear sensors integrated with cloud-based analytics platforms enable fleet managers to predict brake pad replacement needs with precision, schedule maintenance during planned downtime windows, and eliminate costly emergency repairs. The Automotive Brake System Market increasingly incorporates predictive analytics capabilities, with market leaders developing machine learning algorithms that analyze brake wear patterns, driving behavior metrics, and thermal signatures to forecast component failures before operational impact.

The Euro 7 regulation, adopted by the European Commission in 2024 and effective November 29, 2026, introduces comprehensive brake particle emission limits for the first time in automotive history, requiring manufacturers to develop advanced brake systems with integrated monitoring and control capabilities. The regulation mandates that brake systems undergo separate type-approval testing according to UN Global Technical Regulation No. 24, which establishes laboratory protocols for measuring particulate matter emissions from brake pad and rotor wear.

Passenger car brake systems must achieve particulate matter emissions below 7 mg/km, while battery electric vehicles benefit from reduced limits of 3 mg/km due to regenerative braking capabilities. To achieve compliance, manufacturers must optimize friction material compositions, develop advanced brake pad geometries, and integrate intelligent brake wear sensors that monitor real-time particle emission rates and adjust braking system performance to maintain compliance thresholds.

Electronic brake wear sensors represent the dominant product category within the Automotive Brake Wear Sensors Market, commanding approximately 65% market share and generating the highest growth trajectory among all sensor product variants. Electronic wear sensors utilize piezoelectric, capacitive, or resistance-based technology to detect brake pad thickness in real-time, transmitting signals to vehicle diagnostic systems that alert drivers when replacement is imminent and log wear data for fleet telematics platforms.

The superiority of electronic sensors derives from superior measurement accuracy, integration compatibility with modern vehicle electronics, and seamless connectivity with advanced driver-assistance systems that combine brake wear monitoring with autonomous braking functions.

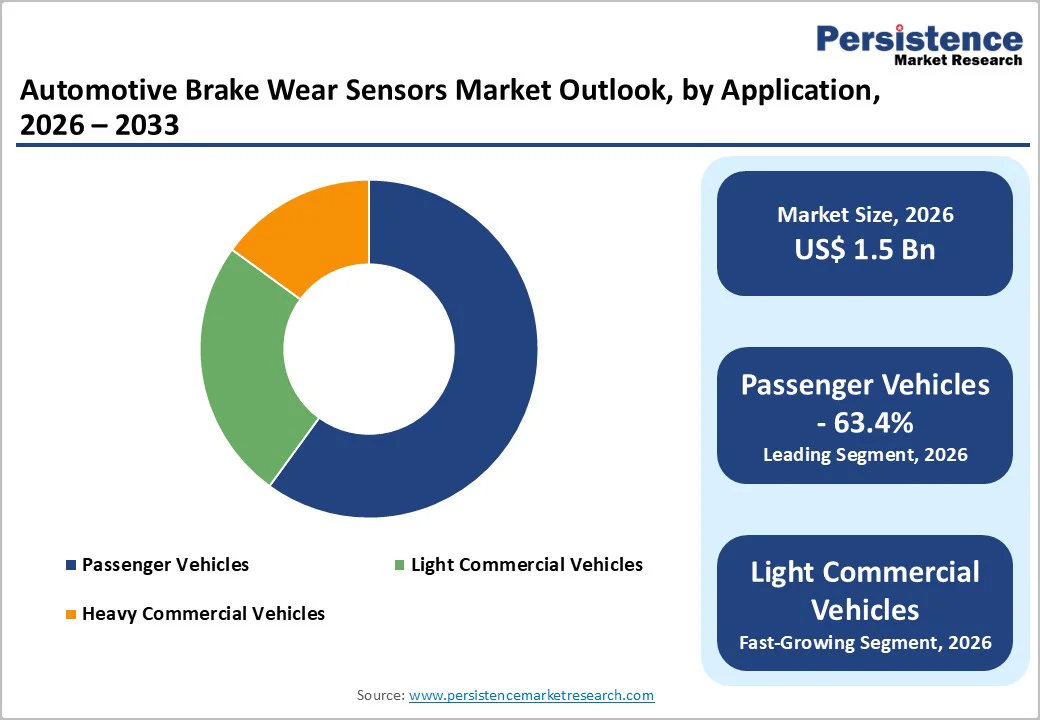

Passenger vehicles firmly establish themselves as the leading application segment, capturing approximately 72% of total Automotive Brake Wear Sensors Market revenue and demonstrating sustained growth momentum driven by regulatory mandates, increasing vehicle electrification, and consumer demand for advanced safety features. The dominance reflects the sheer production volume of passenger vehicles globally combined with stringent safety standards in developed markets that mandate electronic brake monitoring across vehicle platforms. North America, Europe, and Asia-Pacific passenger vehicle manufacturers have standardized brake wear sensor integration as a core safety feature, supported by NHTSA regulations in the United States, Euro NCAP assessment protocols in Europe, and growing consumer awareness of safety technology value propositions. Light commercial vehicles represent the fastest-growing application segment, expanding at a compound annual growth rate exceeding 7% as fleet operators embrace telematics integration and predictive maintenance practices.

North America demonstrates robust market expansion driven by comprehensive regulatory implementation, substantial original equipment manufacturer investment in safety technologies, and widespread fleet electrification initiatives. The National Highway Traffic Safety Administration (NHTSA) finalized Federal Motor Vehicle Safety Standard (FMVSS) No. 127 in May 2024, requiring all light vehicles manufactured after September 1, 2029 to incorporate automatic emergency braking systems with integrated brake wear monitoring, establishing a regulatory floor that mandates market-wide sensor adoption. General Motors, Ford Motor Company, and Hyundai-Kia have each announced comprehensive electrification strategies targeting annual electric vehicle sales exceeding 100,000 units, driving accelerated brake wear sensor integration across next-generation electric vehicle platforms.

Commercial fleet adoption of advanced telematics and predictive maintenance systems remains a critical growth vector in North America, with logistics and transportation companies leveraging brake wear sensor data to optimize maintenance planning and reduce operational downtime. Fleet operators report substantial cost savings from predictive maintenance practices, with brake wear sensors enabling precise replacement scheduling that prevents premature component failures while extending service intervals where feasible.

Europe represents the world's most stringent regulatory environment for brake wear sensors and advanced braking technologies, with the European Union implementing comprehensive legislative frameworks that mandate sensor integration and establish performance standards unmatched globally. The Euro 7 regulation, agreed in 2024 and effective November 2026 for new model type-approvals with universal application beginning November 2027, represents a watershed regulatory development by extending emissions control requirements beyond tailpipe sources to encompass non-exhaust particulate matter from brake wear.

European electric vehicle adoption demonstrates pronounced geographic heterogeneity, with Nordic countries achieving exceptional penetration Norway leads globally with 90% of new cars being fully electric while Southern Europe and Eastern Europe remain below 10% electric vehicle market share. Battery electric vehicles in Northern Europe require sophisticated regenerative braking integration with mechanical brake wear monitoring, creating complex sensor requirements that Continental and Bosch address through advanced brake-by-wire systems incorporating real-time wear sensing.

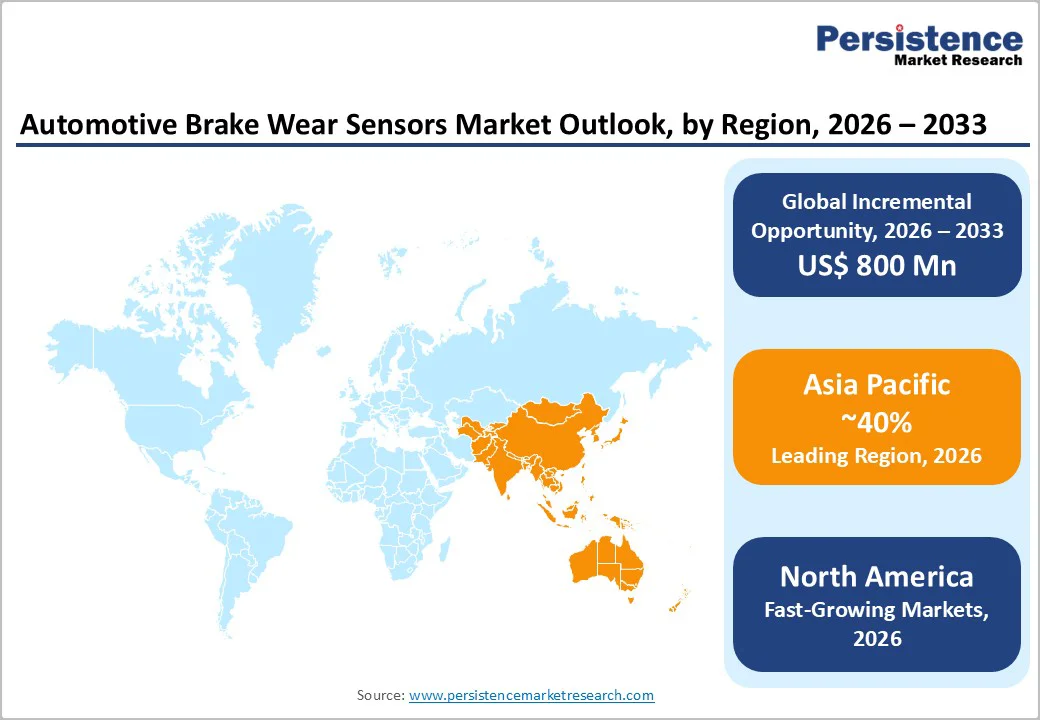

Asia-Pacific dominates the global Automotive Brake Wear Sensors Market with approximately 58% revenue share, driven by massive vehicle production volumes in China, India, and Japan combined with accelerating electrification and safety regulation adoption across the region. China maintains position as the world's largest automotive market, with vehicle sales reaching 26 million units in 2021 and projected to reach 35 million by 2026, while simultaneously achieving 11.3 million electric vehicle sales in 2024representing 43% of global electric vehicle sales and demonstrating unparalleled electrification momentum.

Chinese regulatory authorities have mandated that major automakers equip nearly all vehicles with advanced emergency braking systems, with over 12 major automakers achieving near-universal AEB compliance by December 2021. Continental AG commenced series production of its MK 120 ESC brake system with Chinese automaker Changan in May 2023, expanding capacity to serve regional markets through production facilities in Shanghai with planned expansion to Europe, Japan, and India, demonstrating international tier-one supplier commitment to Asia-Pacific market development.

The Automotive Brake Wear Sensors Market exhibits moderate consolidation characteristics, with market leadership concentrated among tier-one automotive suppliers possessing integrated brake system engineering capabilities, extensive original equipment manufacturer relationships, and substantial research and development resources.

Robert Bosch GmbH, headquartered in Germany, maintains a dominant competitive position as the inventor of electronic stability control and a leading developer of brake wear sensor technology, leveraging its comprehensive sensor portfolio and global manufacturing footprint to serve original equipment manufacturers across all vehicle categories and geographic regions. Continental AG maintains strong competitive standing through its brake system expertise, recent innovations including the MK 120 ESC and advanced MK C2 brake-by-wire system, and strategic partnerships with major automakers including Changan for series production expansion across Asia-Pacific markets.

The global Automotive Brake Wear Sensors Market is projected to reach US$ 2.4 billion by 2033, growing from US$ 1.5 billion in 2026 at a compound annual growth rate of 6.4%.

Market growth is fundamentally driven by stringent regulatory mandates including NHTSA FMVSS No. 127 and Euro 7 regulation requiring advanced braking system integration, accelerating electric vehicle adoption globally with 1.6 million EV sales in 2024 and 87% of fleet operators planning electrification within five years, and widespread telematics integration in commercial fleet management.

Electronic brake wear sensors represent the dominant product category, commanding approximately 65% of market value due to superior measurement accuracy, seamless integration with advanced driver-assistance systems, and alignment with original equipment manufacturer preferences for factory-integrated safety technology across all vehicle categories and geographic markets.

Asia-Pacific dominates the global market with approximately 38% revenue share, driven by massive vehicle production in China (26 million vehicles in 2021), exceptional electric vehicle adoption (11.3 million sales in 2024), and government safety regulations across China, India, and Japan mandating advanced braking system deployment.

Market leaders include Robert Bosch GmbH (Germany) as the dominant competitor with comprehensive brake system expertise, Continental AG (Germany) with advanced MK 120 ESC and MK C2 brake-by-wire systems, DENSO Corporation (Japan).

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2024 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

• Electronic Brake Wear Sensors

• Disc Brake Wear Sensors

• Passenger Vehicles

• Light Commercial Vehicles

• Heavy Commercial Vehicles

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author