ID: PMRREP22561| 187 Pages | 29 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

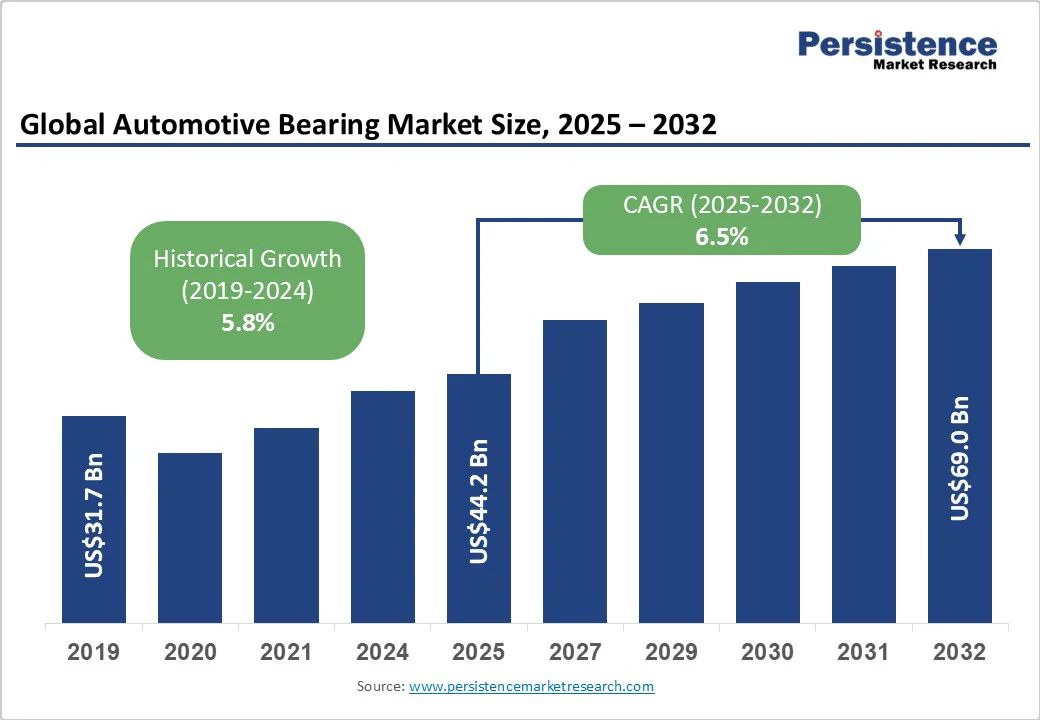

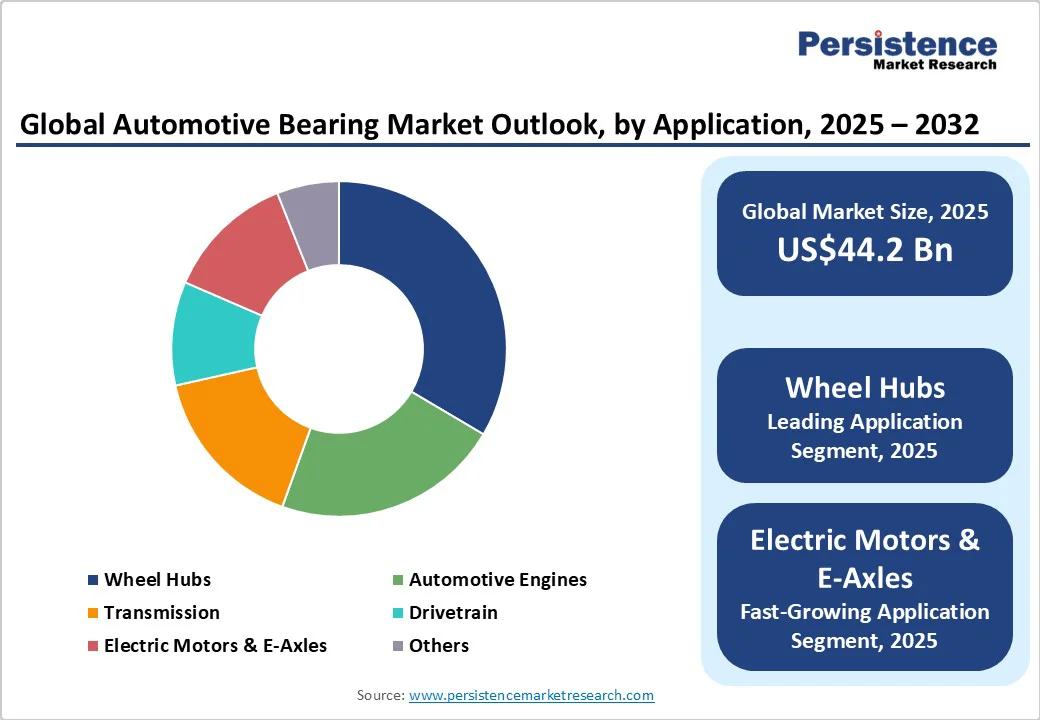

The global automotive bearing market size is likely to be valued at US$44.2 Bn in 2025. It is expected to reach US$69.0 Bn by 2032, growing at a CAGR of 6.5% during the forecast period 2025−2032, driven by increasing vehicle production in the Asia Pacific, rapid electrification of vehicles requiring specialized low-friction bearings, and rising demand for enhanced vehicle safety and performance.

| Key Insights | Details |

|---|---|

|

Automotive Bearing Market Size (2025E) |

US$44.2 Bn |

|

Market Value Forecast (2032F) |

US$69 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.8% |

The ongoing shift toward electric vehicles (EVs) is a key growth driver, with the EV segment valued at US$5.81 billion in 2025 and projected to reach US$12.82 billion by 2032, growing at a CAGR of 11.97%. EVs require specialized low-friction, lightweight, and heat-resistant bearings such as ceramic and hybrid materials to enhance motor efficiency and longevity and reduce energy loss. This surge in EV adoption catalyzes the demand for advanced bearing technology, reshaping market dynamics and boosting revenue from e-powertrain components globally, particularly in the Asia Pacific and Europe, where EV manufacturing is accelerating at an unprecedented pace.

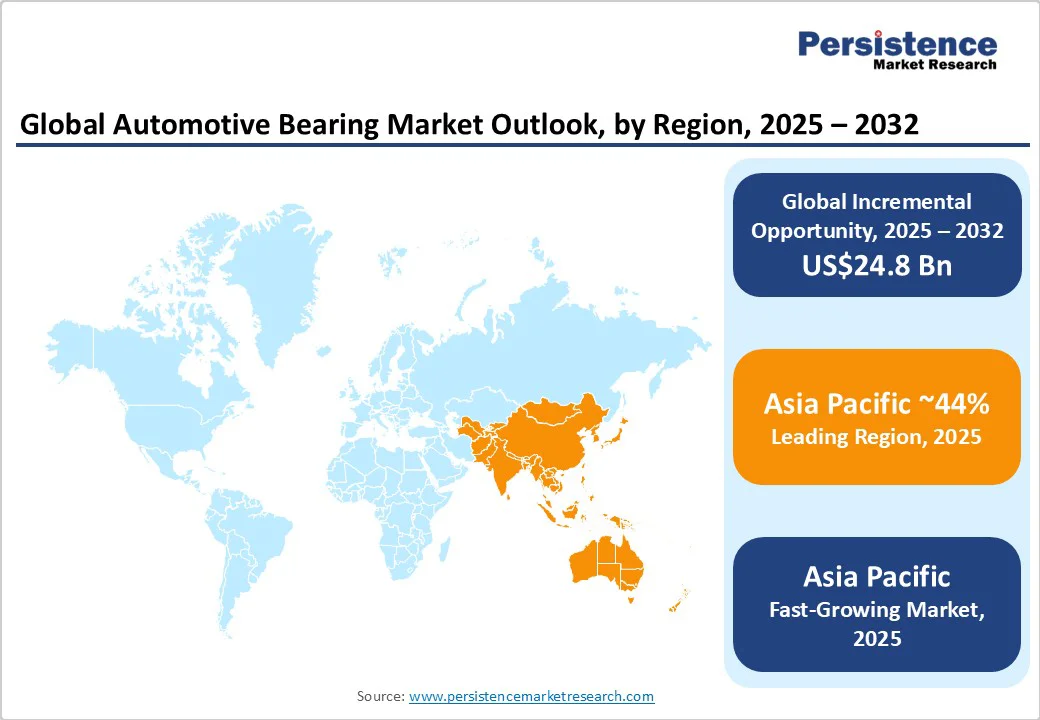

The Asia Pacific region leads, driven by significant growth in vehicle production in China, India, Japan, and South Korea. The automotive production expansion accounts for over 35% of the global vehicle output, thereby intensifying the demand for original equipment manufacturer (OEM) bearings and replacement parts in the aftermarket. This region’s expanding manufacturing infrastructure strategically positions it as the largest market, driving short-term demand growth and fostering continuous investments in manufacturing capacity and technology adoption tailored to both ICE vehicles and EVs.

Emerging technologies such as sensor-embedded bearings are revolutionizing the automotive industry by enabling real-time vehicle diagnostics and predictive maintenance. Such innovations facilitate improved operational efficiency and reduced downtime, critical for connected and autonomous vehicles. The adoption of these advanced bearings is predicted to increase steadily across the mature markets of North America and Europe, creating lucrative aftermarket opportunities. This technological convergence aligns with Industry 4.0 trends and digital transformation, enabling OEMs and suppliers to deliver value-added services while addressing the demand for quieter, more durable bearing solutions.

The adoption of advanced bearing technologies, including ceramic and hybrid bearings, is hampered by high production costs and material expenses. These cost barriers restrict widespread deployment, especially in cost-sensitive emerging markets, where approximately 40-50% price differentials compared to traditional steel bearings exist. This challenge limits the penetration rate of premium bearings, creating a structural restraint that slows the transition to high-performance materials despite clear operational advantages.

The market expansion faces challenges in the raw material supply chain, including volatility in steel and rare-earth material prices, which can increase lead times and production costs by 10-15%. Geopolitical tensions and logistics disruptions, especially in the post-pandemic period, exacerbate these issues, risking operational delays and higher inventories that affect automotive manufacturers globally. These uncertainties are critical as just-in-time production dominates the automotive sector, and any disruption leads to measurable production efficiency losses and increased risk exposure for OEMs and suppliers.

Emerging automotive markets, such as India, offer substantial business opportunities, with the Indian automotive bearing market valued at approximately US$503.3 million in 2024 and forecasted to reach US$725.5 million by 2033. Increasing domestic vehicle production, policy-backed incentives for EV production and purchase, and local manufacturing investments present an untapped potential for OEMs and aftermarket players to expand their footprint and tailor products to regional specifications, while capitalizing on government incentives that promote EV adoption.

The transition toward EVs promises vast opportunities, with the EV bearings market set to nearly double between 2025 and 2032, from US$5.81 Bn to US$12.82 Bn. The demand for specialized bearings for e-motors, e-axles, and dedicated transmissions presents actionable avenues for innovation and product differentiation, focusing on lightweight, heat-resistant, and low-friction characteristics. Investments in R&D for advanced materials and sensor technology can position companies to lead this high-growth segment.

The rise of sensor-integrated automotive bearings supports proactive vehicle maintenance, enabling aftermarket growth via extended vehicle life and reduced downtime. Stakeholders in North America and Europe have always been early adopters, while those in the Asia Pacific are also increasingly embracing these technologies. This development enables companies to offer value-added services and tap into a growing predictive maintenance market, estimated to impact millions of vehicles globally, resulting in significant revenue growth potential beyond traditional product sales.

The rolling-element bearings segment currently leads the market, commanding a dominant share of approximately 54.0% in 2025. Its leadership stems from the versatile application of these bearings across wheel hubs, transmissions, and e-axles, balancing cost-efficiency and performance. Deep-groove ball bearings, cylindrical, and tapered rollers cater to the demands of both ICE vehicles and electric vehicles, especially excelling in high-speed operations and durability. Steel remains the primary material, representing 76.8% of shipments in 2024, benefiting from mature manufacturing and cost advantages.

The fastest growing segment within product types is ceramic & hybrid bearings, growing at a CAGR of 6.3%. This rise is attributed to their electrical insulation properties and high-temperature resistance, making them ideal for EV motors and powertrains. The shift toward electrification is accelerating adoption as OEMs seek enhanced efficiency and lightweight solutions for new vehicle platforms, especially in Asia Pacific and Europe.

In the application category, wheel hubs currently dominate with an estimated 26.5% share in 2025, driven by their crucial role in ensuring smooth vehicle motion, supporting radial and axial loads, and contributing to safety and steering performance. These bearings account for a significant portion of demand due to their universal usage across passenger cars, commercial vehicles, and off-highway equipment. Their durability requirements also make them a focus for OEMs prioritizing vehicle longevity and maintenance.

The fastest growing application segment is electric motors & e-axles, propelled by the surge in electric vehicle manufacturing. This segment is projected to post a CAGR of around 12.0%, reflecting an increased demand for specialized low-friction, high-speed bearings that withstand thermal stresses and enhance e-powertrain efficiency. Technological advancements such as sensor integration are also expected to augment the segment growth by enabling predictive maintenance and real-time vehicle performance monitoring.

Among vehicle types, passenger cars lead the market, holding around 64.0% revenue share, owing to a consistently high global demand for personal mobility and urbanization trends, especially in Asia Pacific. This segment growth is additionally supported by rising disposable incomes and vehicle production expansion, contributing over 50% of the automotive bearing demand in 2024. Passenger cars remain the core segment for OEMs and aftermarket suppliers, emphasizing quality, safety, and performance.

The fastest growing vehicle type is the EV segment, boosting the demand for bearings optimized for electric powertrains, including ceramic and sensor-embedded bearings, which improve motor efficiency and reduce noise. Government policies promoting sustainable mobility and incentives for EV adoption in several countries underpin this rapid expansion, making it a prime focus area for innovation and strategic investments in the automotive bearing market.

Asia Pacific is likely to dominate with approximately 44.0% of the market share in 2025. The region is also projected to showcase the highest CAGR of about 6.6% during 2025-2032. Key markets include China, India, Japan, and ASEAN countries, with China leading large-scale vehicle manufacturing, including both ICE and EVs. The region benefits from expansive manufacturing infrastructures, cost advantages, and government incentives promoting localization and electrification, such as India’s Make-in-India policy aimed at reducing import reliance from 40% to 25%.

Surging new vehicle production with robust double-digit expansion in passenger and commercial vehicles, rising EV adoption, and strengthening supplier ecosystems are important growth drivers. Regulatory frameworks favor environmental sustainability and industrial upgrading, while investment flows focus on capacity expansion, R&D centers, and regional supply chain robustness. Competitive intensity is high, with Japanese and Chinese players leading innovations in hybrid bearing technologies and advanced manufacturing processes.

North America is set to account for around 28.0% of the market share owing to the strong vehicle manufacturing base in the U.S.. The regional market size is poised to grow steadily, supported by a rising demand for high-performance bearings in light trucks, SUVs, and electric vehicles. The U.S. leads innovation with investments such as Schaeffler’s US$230 Mn e-axle plant in Ohio, underscoring the focus of companies on advanced electric powertrain components.

Rugged regulatory frameworks around emissions and safety standards will fuel the adoption of sensor-integrated and hybrid bearings. Investment trends highlight local facility expansions and technology partnerships, targeting supply chain resilience and lean manufacturing. Major players in the region include Timken and Schaeffler, competing on innovation and regional compliance.

Europe remains a critical market for automotive bearings, with Germany, the U.K., France, and Spain as key contributors. Germany leads in R&D spending, fueling innovations in hybrid-ceramic and sensor-embedded bearings, aligned with ambitious EU Green Deal mandates targeting decarbonization and sustainable mobility. Rigorous regulatory harmonization across the EU ensures streamlined compliance, raising cost pressures on manufacturers.

Regional e-axle production hubs and supply chain realignments support market growth in this region. The market rewards advanced material development and circular economy initiatives. Competitive dynamics reveal consolidation trends with regional leaders such as SKF actively optimizing cost structures and launching sustainability programs. Opportunities lie in premium electric and autonomous vehicle segments expanding across the continent.

The global automotive bearing market landscape is moderately consolidated, with leading players such as NSK Ltd., NTN Corporation, The Timken Company, JTEKT Corporation, and Nachi Fujikoshi commanding an estimated combined market share exceeding 60.0%. These companies leverage strong regional footprints, extensive R&D, and diversified product portfolios.

The market also features several specialized regional and tier-2 suppliers, creating moderate fragmentation at the sub-segment level. Competitive positioning emphasizes innovation in material science, sensor technologies, and geographic expansion, balancing cost leadership and premium product differentiation.

Market leaders are pursuing innovation-driven differentiation and strategic geographic expansions. Key themes include cost optimization, product diversification toward EV bearings, and leveraging partnerships for smart, sensor-embedded solutions. Emerging models focus on circular economy initiatives and aftermarket services linked to predictive maintenance.

The automotive bearing market is projected to reach US$44.2 Bn in 2025.

The soaring production of EVs and the massive automotive manufacturing ecosystem of Asia Pacific are driving the market.

The automotive bearing market is poised to witness a CAGR of 6.5% from 2025 to 2032.

Technological advancements in smart bearings and the enhancement of aftermarket services through predictive maintenance are key market opportunities.

NSK Ltd., NTN Corporation, and The Timken Company are some of the key players in the automotive bearing market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Bearing Type

By Application

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author