ID: PMRREP35952| 295 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

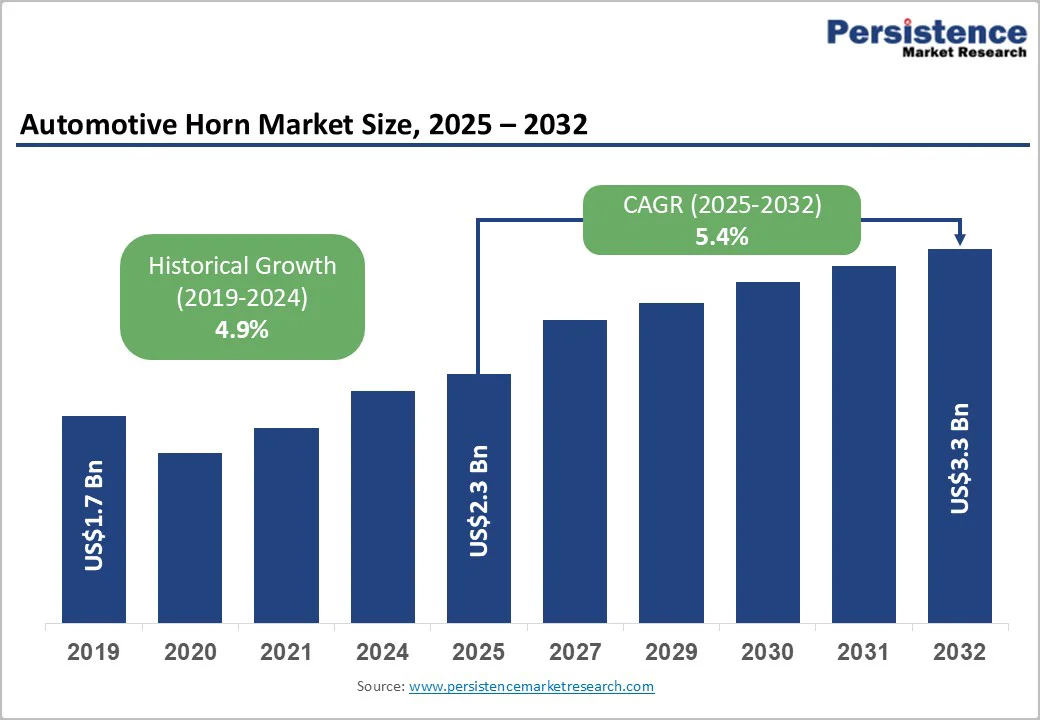

The global automotive horn market size is likely to be valued at US$2.3 billion in 2025 and is expected to reach US$3.3 billion by 2032, growing at a CAGR of 5.4% during the forecast period from 2025 to 2032, driven by expanding vehicle production in emerging economies, rising safety regulations mandating advanced audible warning systems, and technological advancements improving horn performance and energy efficiency. Technological advancements are playing a critical role, with manufacturers focusing on electric horns, energy-efficient designs, durable materials, and high-decibel outputs that comply with environmental and noise standards. The rising adoption of electric and hybrid vehicles is encouraging the use of compact, low-power electric horns that align with sustainability goals.

| Key Insights | Details |

|---|---|

| Automotive Horn Market Size (2025E) | US$2.3 Bn |

| Market Value Forecast (2032F) | US$3.3 Bn |

| Projected Growth CAGR (2025-2032) | 5.4% |

| Historical Market Growth (2019-2024) | 4.9% |

The automotive industry is witnessing a steady rise in vehicle production and ownership, driven by economic growth, urbanization, and the expanding middle-class population. Automakers are rapidly scaling up manufacturing capacities to meet the growing demand for personal and commercial mobility across both developed and emerging markets. This trend is strongly supported by government initiatives promoting industrial expansion, infrastructure development, and local vehicle manufacturing, which facilitates vehicle availability and affordability.

Increasing disposable incomes and easy financing options have made vehicle ownership more accessible, particularly in high-growth regions such as Asia Pacific, Latin America, and parts of Africa. The rise in electric and hybrid vehicle production further complements this momentum, as consumers shift toward sustainable, technologically advanced mobility solutions. Growth in commercial fleets, including logistics, e-commerce, and public vehicles, is also contributing to rising production volumes. The combined effect of these factors is creating consistent demand for critical automotive components such as horns, braking systems, and lighting solutions that ensure safety, regulatory compliance, and reliability across diverse vehicle segments.

Cost fluctuations in key materials such as steel, copper, aluminum, and plastics pose a significant challenge to the growth and profitability of the market. Prices of these materials are influenced by global supply-demand dynamics, trade regulations, and energy costs, directly affecting manufacturing expenses, profit margins, and pricing strategies for both OEMs and aftermarket suppliers. The increasing demand for high-performance electric and air horns with advanced acoustic features heightens dependence on specialized materials, amplifying exposure to price volatility. Manufacturers must balance quality and affordability to remain competitive in cost-sensitive emerging markets.

Volatility is further exacerbated by geopolitical tensions, fluctuating fuel prices, and supply chain disruptions. For example, surges in industrial demand or restrictions on metal exports can trigger sudden cost spikes, challenging manufacturers to maintain competitive pricing. The shift toward sustainable and eco-friendly materials adds additional cost pressures, as greener alternatives often carry higher procurement expenses. To mitigate these risks, companies are focusing on long-term supplier relationships, localized sourcing, and sound type optimization strategies. Investments in R&D for alternative materials and efficient production processes help maintain consistent horn performance while reducing reliance on volatile raw materials. Strategic stockpiling and forward contracts are also employed to stabilize supply costs across regions.

Emerging markets in Southeast Asia, Latin America, and Africa are experiencing rapid motorization, presenting significant growth prospects for the market. Economic development, rising disposable incomes, and expanding middle-class populations are fueling increased vehicle ownership, especially in urban and semi-urban areas. As mobility becomes integral to social and economic progress, consumers in these regions are investing more in personal and commercial vehicles, driving demand for essential automotive components such as horns.

The entry of foreign investments and the establishment of automotive assembly plants by global OEMs are further accelerating market penetration. The rising popularity of two-wheelers and compact passenger cars in these regions adds to overall volume demand. Additionally, the growing adoption of electric and hybrid vehicles in urban centers creates opportunities for energy-efficient electric horns, supporting the broader growth trajectory. With heightened road safety awareness, continued urbanization, and a rapidly expanding vehicle base, emerging markets are set to become key drivers of future growth in the automotive horn industry.

The electric horn segment leads the market, accounting for approximately 60% share of the total revenue. This dominance stems from their widespread use in passenger cars, two-wheelers, and electric vehicles due to their compact design, energy efficiency, and compliance with global noise and environmental standards. For example, Bosch’s EH1 electric horn is widely used in passenger cars for its reliability, low power consumption, and durability. Automakers increasingly favor electric horns for their low maintenance, reliability, and cost-effectiveness, making them a standard fitment across most vehicle categories.

The air horn segment is the fastest-growing category, primarily driven by rising demand from commercial vehicles, buses, and heavy-duty trucks that require louder and more durable sound systems for enhanced safety. An example is FIAMM’s High-Decibel Air Horn, commonly used in trucks and buses for long-distance alert signaling. Growth in global logistics, infrastructure, and construction activities has fueled production of large vehicles, accelerating the need for high-decibel air horns. Manufacturers are focusing on optimizing air pressure systems and corrosion-resistant materials to improve performance and lifespan.

The 100dB–120dB sound range leads the market, accounting for 60% share of total revenue due to its ideal balance between audibility and regulatory compliance. This sound range is widely preferred by automakers for passenger vehicles, as it ensures effective warning capability without exceeding permissible noise levels. Its versatility across different vehicle categories, especially compact and mid-sized cars, makes it the most commercially viable option for OEMs. Manufacturers design horns that deliver optimal performance while maintaining environmental and acoustic compliance. For example, Hella’s 100dB electric horn is commonly used in passenger cars for reliable performance and compliance with noise regulations. Manufacturers continue to design horns in this range to deliver consistent sound quality while maintaining environmental and acoustic standards.

The above 120dB category is the fastest-growing segment, driven by widespread use in commercial vehicles, heavy-duty trucks, and buses that require powerful, long-range sound output for road safety. Expansion in industrial transport, construction, and logistics has further fueled demand for high-decibel air horns, such as FIAMM’s truck horns, designed for large vehicles. In contrast, horns below 100dB continue to maintain steady demand in two-wheelers and compact vehicles, where lower sound levels are adequate.

The passenger vehicle segment is leading, accounting for 70% of the market share in 2025. This dominance is driven by rapid urbanization, rising disposable incomes, and expanding middle-class populations, particularly in emerging economies such as China, India, and Brazil. Automakers are increasing production capacity to meet the surging demand for affordable and fuel-efficient cars, while government initiatives supporting local manufacturing and infrastructure growth further reinforce this trend. For example, vehicles such as the Toyota Corolla, Honda City, and Hyundai i20 widely incorporate electric horns due to their energy efficiency, compact design, and compliance with safety and noise regulations.

The commercial vehicle segment represents the fastest-growing category in global vehicle production, supported by expanding logistics, construction, and public transportation sectors. The rise of e-commerce, infrastructure projects, and goods movement across regional markets is driving the production of trucks, buses, and utility vehicles. Manufacturers are focused on durable, high-performance systems to meet the safety needs of heavy-duty vehicles. Examples include Tata LPT trucks, Volvo Buses, and Ashok Leyland commercial vehicles, which commonly use high-decibel air horns designed to withstand heavy usage and harsh conditions, ensuring reliability and safety in demanding operational environments.

North America automotive horn market is witnessing steady growth, driven by stringent vehicle safety regulations, rising vehicle production, and growing consumer demand for advanced safety and comfort features. The U.S. dominates the regional market, supported by a strong automotive manufacturing base and regulatory standards that mandate effective warning systems in all vehicles.

Technological advancements are shaping product innovation, with the integration of electronic and electromagnetic horns becoming more prevalent in passenger and commercial vehicles. The rising adoption of electric vehicles (EVs) is also influencing product development, as manufacturers design compact, low-noise, and energy-efficient horns suitable for EV platforms.

The Europe automotive horn market is characterized by strong regulatory enforcement, technological innovation, and growing emphasis on safety and environmental sustainability. Countries such as Germany, France, Italy, and the U.K. lead the regional market, supported by robust automotive manufacturing bases and stringent EU regulations mandating reliable warning systems in all vehicles.

Europe is further influencing product design, prompting the development of compact, energy-efficient, and low-noise horns suitable for quieter EV drivetrains. Consumers are also showing increased preference for premium and dual-tone horn systems, particularly in luxury and passenger vehicles. Manufacturers are investing in advanced materials, smart sound control technologies, and collaborations with OEMs to enhance product reliability and compliance.

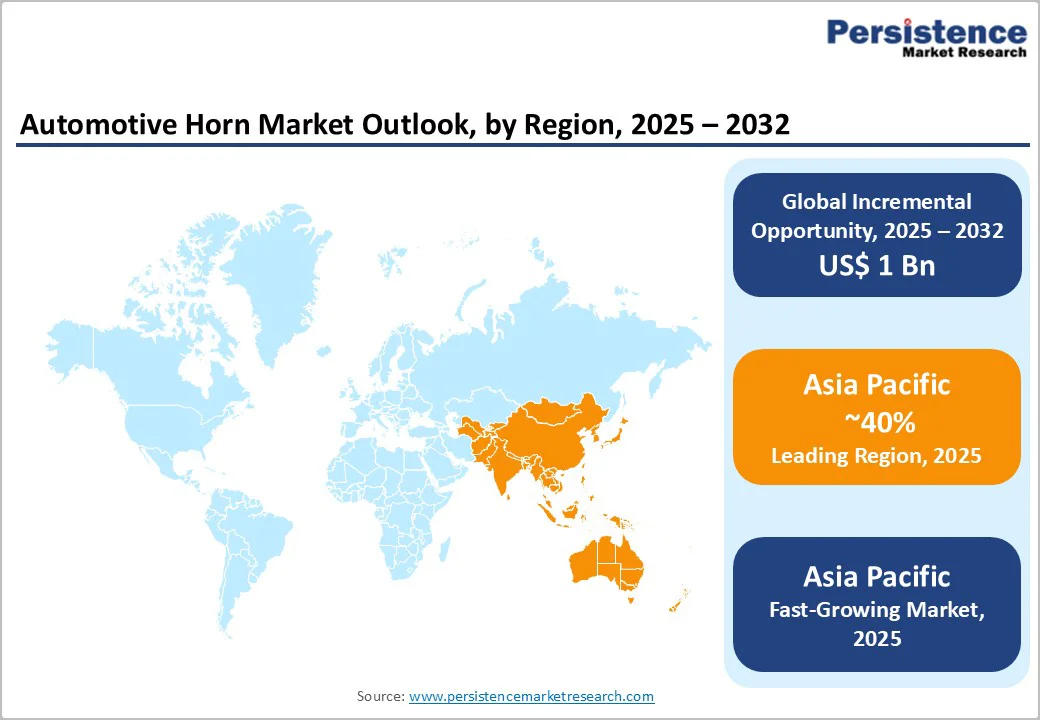

Asia Pacific is the leading region, capturing over 40% of the market share in 2025, driven by large-scale vehicle production, rapid urbanization, and rising vehicle ownership in emerging economies such as China, India, Japan, and ASEAN countries. The region’s strong manufacturing base, cost-effective labor, and government initiatives supporting domestic automotive production further reinforce its market dominance.

Technological advancements and alignment with international safety and noise regulations are shaping the continued and fastest growth. China leads in vehicle production and exports, while India experiences rapid expansion due to infrastructure development and increasing two-wheeler and commercial vehicle sales. Both local and global manufacturers are investing in innovation to produce durable, energy-efficient, and environmentally compliant horns suitable for a wide range of vehicle types.

The global automotive horn market exhibits a moderately consolidated structure, driven by a mix of established OEM suppliers and regional manufacturers competing for share in both original equipment and aftermarket segments. Market leadership tends to be concentrated among well?capitalized players with broad portfolios spanning electric, electromagnetic, and air horn technologies and extensive distribution networks that serve passenger and commercial vehicle manufacturers worldwide. Innovation in acoustic performance, energy efficiency, and compliance with evolving safety and regulatory standards remains a key differentiator among competitors.

With key leaders including FIAMM Componenti Accessori S.p.A., HELLA GmbH & Co. KGaA, Uno Minda Group, Robert Bosch GmbH, Denso Corporation, and regional players such as Seger Horns and Mitsuba Corporation, the market reflects both global scale and localized strengths tailored to specific regions and customer needs. These players compete through strategic investments in research and development, advanced horn technologies including smart and energy?efficient systems, and expanded geographic footprints.

The global automotive horn market is valued at US$2.3 billion in 2025 and expected to reach US$3.3 billion by 2032, reflecting robust growth.

Rising vehicle production and ownership, stringent road safety regulations, growing commercial vehicle fleets, increasing urbanization, and advancements in electric and hybrid vehicle technologies are the key drivers.

The automotive manufacturing segment leads the industry category of the automotive horn market, driven by high vehicle production volumes, safety compliance requirements, and continuous integration of advanced horn systems by OEMs.

The Asia Pacific region dominates the automotive horn market, holding over 40% of the global share, driven by massive vehicle production in countries such as China, India, and Japan, along with rapid urbanization and growing automotive demand.

Development of smart, eco-friendly, and electronic horn systems that comply with noise and environmental regulations while catering to the growing demand for advanced electric and hybrid vehicles.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author