ID: PMRREP33533| 190 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

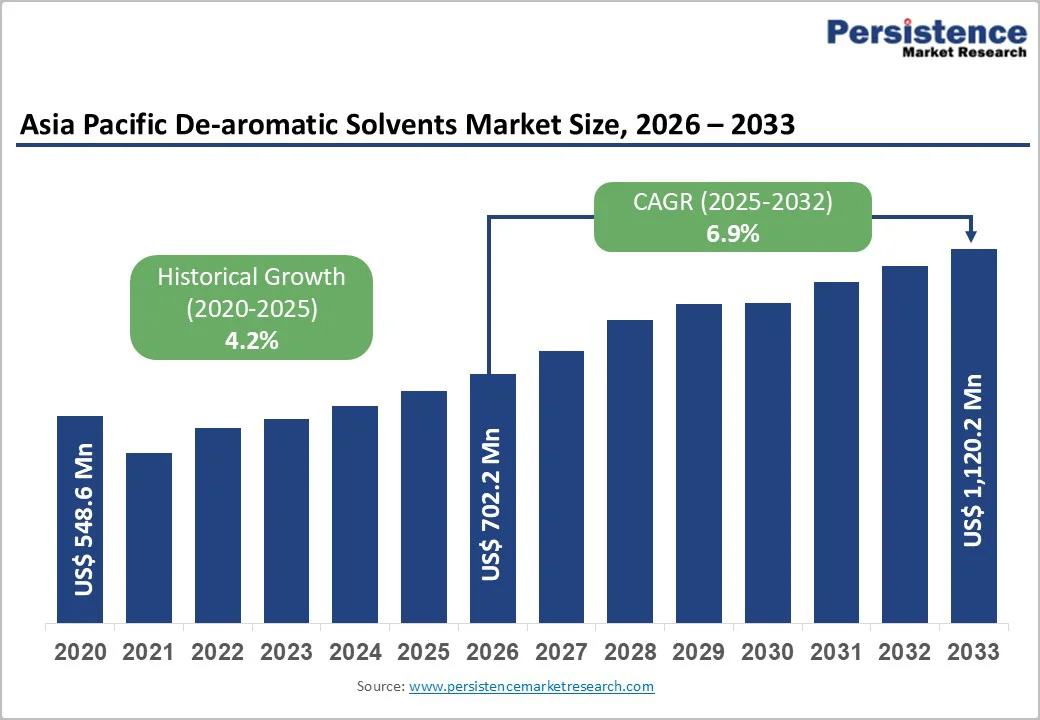

Asia Pacific de-aromatic solvents market size is likely to value at US$ 702.2 million in 2026 and is projected to reach US$ 1,120.2 million by 2033, growing at a CAGR of 6.9% between 2026 and 2033.

This growth is driven by rapid industrialization and urbanization across emerging Asia-Pacific economies, leading to higher consumption in paints, coatings, adhesives, and industrial cleaning applications.

Stricter environmental regulations and VOC emission standards are encouraging manufacturers to adopt low-aromatic, environmentally compliant solvents. Rising demand for high-performance and eco-friendly formulations in electronics, automotive, and construction sectors is further fueling market expansion throughout the region.

| Key Insights | Details |

|---|---|

| Asia Pacific De-aromatic Solvents Market Size (2026E) | US$ 702.2 Mn |

| Market Value Forecast (2033F) | US$ 1,120.2 Mn |

| Projected Growth CAGR (2026 - 2033) | 6.9% |

| Historical Market Growth (2020 - 2025) | 4.2% |

The rapidly expanding paints, coatings, and adhesives industry across the Asia-Pacific region is one of the strongest forces driving demand for de-aromatic solvents. Countries such as China, India, Indonesia, Vietnam, and Malaysia are witnessing exponential growth in construction, infrastructure development, and automotive production, three sectors that are heavy end-users of solvent-based coatings.

As urbanization accelerates, governments in the Asia Pacific continue to invest massively in smart cities, housing projects, commercial real estate, and transportation networks. This surge directly increases the consumption of industrial coatings, architectural paints, protective coatings, and adhesives. De-aromatic solvents are preferred because they offer low odor, reduced toxicity, and higher environmental compliance compared to traditional high-aromatic solvents.

The automotive industry’s rapid vehicle manufacturing and refinishing activities in the Asia-Pacific region support the increased use of high-performance coatings and cleaning formulations. With rising regulatory emphasis on worker safety, cleaner formulations, and VOC-controlled solvents, manufacturers are shifting toward de-aromatic grades to meet both performance and environmental standards.

As the Asia Pacific becomes the global manufacturing hub for paints and coatings, the uptake of these solvents continues to strengthen, making this sector a critical demand driver for the market.

Asia Pacific is experiencing a significant regulatory shift toward eco-friendly, low-emission chemical products, which strongly boosts the adoption of de-aromatic solvents. Governments in China, India, South Korea, Japan, and ASEAN countries have been tightening norms regarding industrial emissions, workplace exposure limits, and the use of high-aromatic, hazardous solvent compositions.

De-aromatic solvents provide a safer, more compliant alternative due to their lower toxicity, controlled aromatic content (<1% or <5%), and reduced VOC emissions. Increasing awareness of worker safety, air quality, and environmental sustainability is pushing manufacturers in sectors such as pharmaceuticals, agrochemicals, metalworking fluids, inks, and industrial cleaning agents to reformulate their products using de-aromatized options.

Moreover, multinational companies expanding in Asia Pacific are bringing stricter internal environmental standards, further accelerating the transition. As industries shift to green chemistry, de-aromatic solvents are gaining importance for their ability to deliver high solvency while maintaining compliance with rapidly evolving national and international environmental frameworks.

This regulatory alignment not only encourages substitution of traditional aromatic solvents but also fosters long-term structural demand growth across multiple applications, positioning de-aromatic solvents as a preferred choice for sustainable industrial development.

Another significant restraint affecting the Asia Pacific De-Aromatic Solvents Market is the limited awareness and slow adoption of de-aromatized solvents among small and mid-sized manufacturers across the region.

Many industries in developing Asia Pacific countries, such as India, Vietnam, Indonesia, Bangladesh, and the Philippines, still rely heavily on traditional aromatic solvents like toluene, xylene, and mineral turpentine due to their low cost, easy availability, and long-established usage patterns.

These small and mid-scale companies often lack technical expertise, R&D capabilities, or financial resources to evaluate and transition to higher-priced, low-aromatic alternatives. As a result, the benefits of de-aromatic solvents, such as lower toxicity, reduced odor, and compliance with VOC standards, remain underutilized in many applications.

In several markets, regulatory enforcement is also inconsistent, reducing the urgency for manufacturers to shift toward safer formulations. The absence of strong local marketing efforts, limited distributor education, and lack of technical support from suppliers further slows down the replacement rate of aromatic solvents.

This low awareness and slow technology adoption curve create a barrier to penetration, especially in downstream sectors like adhesives, inks, agrochemicals, and general industrial cleaning.

The rising demand for eco-friendly, low-emission, and worker-safe industrial products across Asia Pacific presents a substantial opportunity for de-aromatic solvent manufacturers. As industries in China, India, South Korea, Japan, and Southeast Asia undergo sustainability-driven transformation, the need for low-VOC, low-odor, and low-toxicity solvents is expanding rapidly.

Sectors such as paints and coatings, adhesives, agrochemicals, metalworking fluids, and industrial cleaning agents are increasingly reformulating their product lines to comply with tightening environmental standards and customer expectations. This shift opens a pathway for high-purity de-aromatic solvents to replace traditional aromatic hydrocarbons.

Multinational companies operating in Asia Pacific bring stricter global environmental policies, pushing local suppliers to adopt safer alternatives. Government-led climate commitments, workplace safety initiatives, and green manufacturing incentives further accelerate this transition.

As sustainability becomes a competitive differentiator, the demand for de-aromatic solvents with improved biodegradability and reduced health risks is poised to grow significantly, creating a strong market expansion opportunity.

The rapid industrialization of emerging Asia Pacific economies, including India, Vietnam, Indonesia, Malaysia, and the Philippines, offers a promising growth avenue for de-aromatic solvent suppliers. These countries are witnessing major investments in manufacturing, construction, automotive production, electronics assembly, and agrochemicals, all key application areas for de-aromatized solvents.

Rising infrastructure development and urbanization increase the consumption of paints, coatings, and adhesives, while booming agriculture sectors drive demand for high-quality crop protection formulations that require stable, low-toxicity solvents.

The growth of small and mid-sized manufacturing clusters across Asia Pacific also expands the customer base for industrial cleaning agents, printing inks, and metalworking fluids. As these economies mature, they gradually adopt cleaner production standards and modern manufacturing practices, boosting the appeal of de-aromatic solvents.

With foreign direct investment flowing into these countries and industries shifting production bases to the Asia-Pacific for cost efficiency, solvent manufacturers have a compelling opportunity to strengthen distribution networks, introduce tailored formulation grades, and capture significant market share in fast-growing downstream sectors.

The de-aromatic solvents market segments into three distinct flash point categories, with medium flash point solvents commanding the dominant market share of approximately 45% in the Asia Pacific region.

Medium flash point de-aromatic solvents, typically ranging from 50°C to 100°C, offer optimal balance between solvency performance, safety handling characteristics, and evaporation rates essential for paints, coatings, adhesives, and sealant formulations. This segment's leadership is justified by its versatility across diverse industrial applications and widespread adoption in automotive coatings, architectural paints, and general-purpose industrial cleaning solutions.

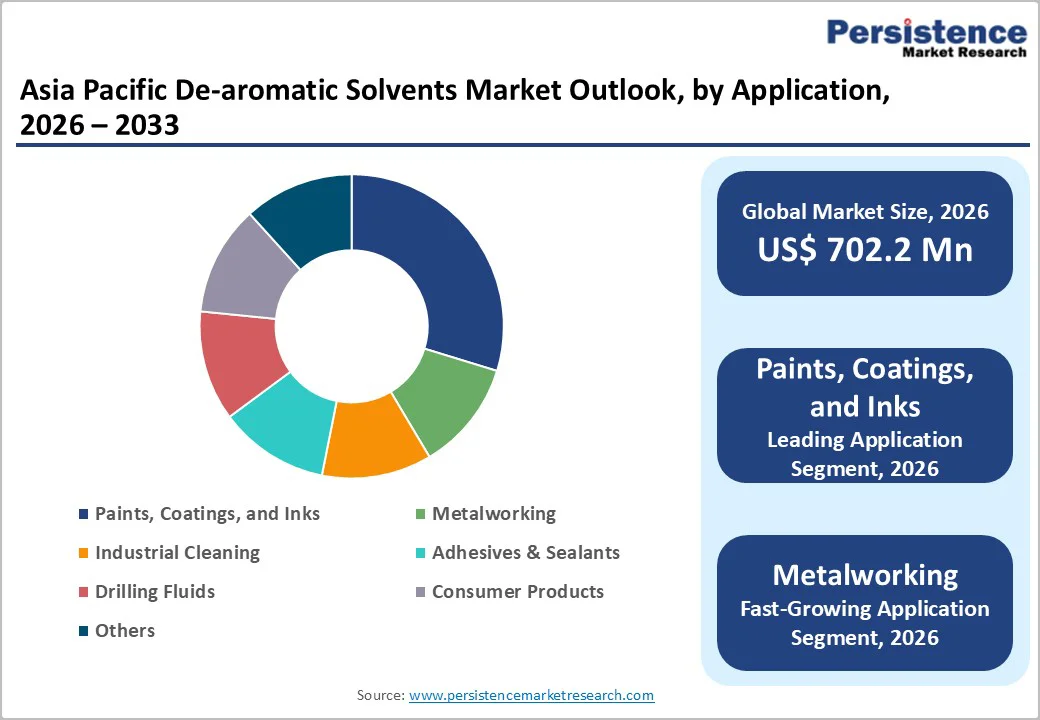

Type 2 de-aromatic solvents dominate the Asia Pacific market, capturing approximately 50% of the total market share, due to their balanced performance, cost-effectiveness, and widespread applicability across multiple industrial sectors.

These solvents are characterized by moderate aromatic content (typically less than 5%), which provides strong solvency power while maintaining low toxicity and reduced odor compared to traditional aromatic hydrocarbons. This combination makes them highly suitable for applications where both performance and safety are critical.

The paints, coatings, and adhesives sector is a major consumer of Type 2 solvents, particularly in countries such as China, India, South Korea, and Southeast Asia, where construction, automotive, and industrial manufacturing are rapidly expanding.

These solvents provide efficient dissolving capabilities for resins, polymers, and specialty coatings while adhering to low-VOC regulations, making them a preferred choice for both environmentally conscious and cost-sensitive manufacturers.

The paints, coatings, and inks segment holds the leading position in the Asia Pacific de-aromatic solvents market, accounting for approximately 40% of the total market share. The rapid growth of architectural coatings, industrial protective coatings, and automotive refinishing applications across the region fuels this dominance.

De-aromatic solvents play a critical role as carriers for resins and pigments, facilitating uniform pigment dispersion, enhancing coating stability, and ensuring consistent film formation. Their low aromatic content and reduced odor make them particularly suitable for applications that require compliance with stringent VOC and environmental regulations while maintaining the performance standards demanded by industrial and decorative coatings.

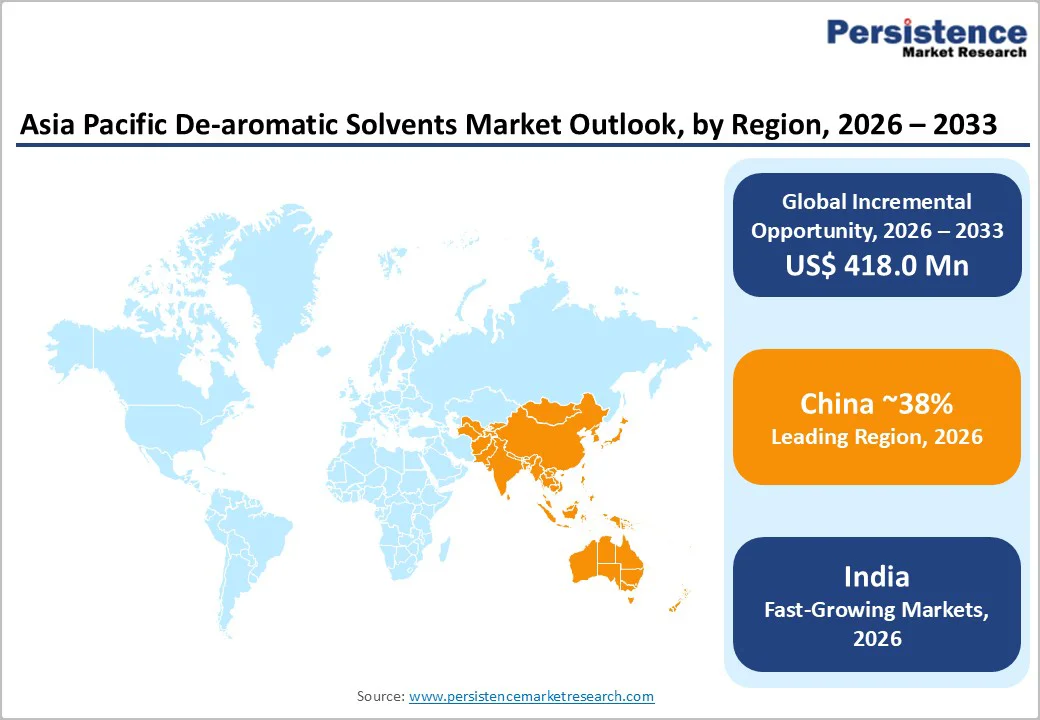

China is the largest market for de-aromatic solvents in the Asia Pacific, accounting for approximately 38% of the total regional market share. The country’s dominance is primarily driven by its massive industrial and manufacturing base, rapid urbanization, and robust construction and automotive sectors. The paints, coatings, and inks segment, along with industrial cleaning, metalworking fluids, and adhesives, consumes a significant portion of the region’s de-aromatic solvents.

Stringent environmental regulations and VOC emission standards implemented by the Chinese government are encouraging manufacturers to shift from conventional aromatic solvents to low-aromatic and de-aromatic alternatives, further solidifying China’s leadership in the market.

The presence of a strong supplier network and localized production facilities also ensures steady availability and competitive pricing of de-aromatic solvents, reinforcing the country’s position as the regional market leader.

India is emerging as the fastest-growing de-aromatic solvents market in Asia Pacific, with a projected CAGR of approximately 8% during 2025 - 2030. This rapid growth is fueled by the country’s expanding construction, automotive, and industrial manufacturing sectors, alongside increasing adoption of environmentally compliant and low-VOC formulations.

The rising demand for architectural coatings, industrial paints, and automotive refinishing products in Tier-1 and Tier-2 cities is creating a strong consumption base for de-aromatic solvents.

India’s growing pharmaceutical, agrochemical, and printing industries are gradually adopting de-aromatic solvents due to safety, performance, and regulatory considerations. With ongoing urbanization, government-led infrastructure projects, and foreign direct investment in industrial sectors, India is poised to witness sustained growth, offering significant opportunities for manufacturers looking to expand in high-potential Asia Pacific markets.

Asia Pacific de-aromatic solvents market exhibits a moderately consolidated competitive structure, primarily dominated by integrated multinational petroleum refiners and specialized chemical manufacturers.

Major players leverage their vertically integrated operations, advanced refining technologies, and established distribution networks to maintain a strong foothold in the region. These companies focus on producing high-purity, low-aromatic solvents that comply with increasingly stringent VOC regulations and environmental standards across the Asia Pacific markets.

Competition is also driven by product differentiation, with manufacturers offering a range of de-aromatic grades tailored for paints, coatings, inks, adhesives, industrial cleaning, and metalworking applications. Strategic initiatives such as cAsia Pacificity expansions, partnerships, technological collaborations, and regional manufacturing hubs further strengthen their market presence.

The entry of regional chemical companies and niche solvent manufacturers intensifies competition, particularly in emerging markets such as India, Vietnam, and Indonesia, where demand growth is accelerating. Overall, the combination of multinational dominance, regional expansions, and product innovation shapes a moderately consolidated but competitive landscape in the Asia Pacific de-aromatic solvents market.

Asia Pacific De-aromatic Solvents Market is valued at US$ 702.2 Mn in 2026 and is projected to reach US 1,120.2 Mn by 2032, growing at a CAGR of 6.9% from 2026 to 2032.

Growing need for low-VOC, low-toxicity, and environmentally compliant solvents across paints, coatings, adhesives, and industrial cleaning applications coupled with stricter regulations on worker safety and emissions, are accelerating their adoption.

Type 2 de-aromatic solvents dominate the Asia Pacific market, accounting for approximately 50% of the total market share, due to their balanced solvency performance, low aromatic content, and cost-effectiveness, making them widely preferred across paints, coatings, inks, adhesives, and industrial cleaning applications.

China leads the Asia Pacific de-aromatic solvents market, holding approximately 35-38% of the regional market share, driven by its massive industrial base, high demand from paints, coatings, and adhesives, and stringent environmental regulations encouraging the adoption of low-aromatic, low-VOC solvents.

India represents the most significant emerging market opportunity in the Asia Pacific de-aromatic solvents sector, with a projected CAGR of 8.0% over 2025-2030. Rapid industrialization, urbanization, and infrastructure development.

ExxonMobil Corporation, Shell Plc, Idemitsu Kosan Co., Ltd., Raj Petro Specialities P. Ltd., Arham Petrochem Private Limited, Avant Petrochem Private Limited are some key players in the Asia Pacific De-aromatic Solvents Market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Flash Point

By Boiling Point

By Application

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author