ID: PMRREP3778| 189 Pages | 8 Sep 2025 | Format: PDF, Excel, PPT* | Packaging

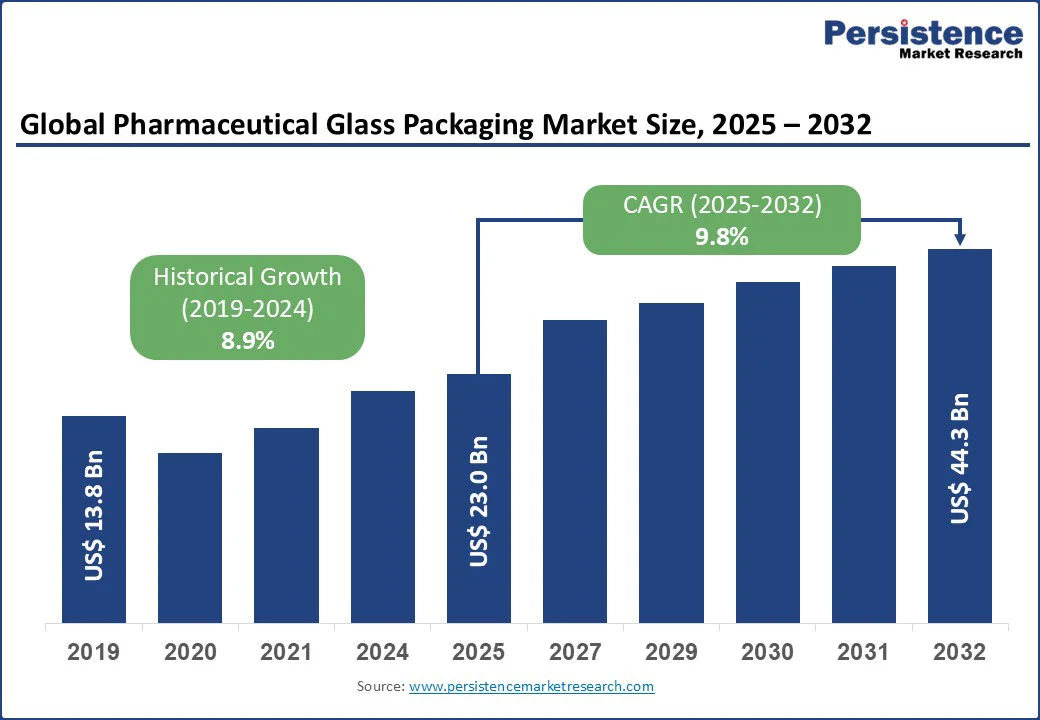

The pharmaceutical glass packaging market size is likely to be valued at US$ 23.0 Bn in 2025 and is estimated to reach US$ 44.3 Bn in 2032, growing at a CAGR of 9.8% during the forecast period 2025-2032. The pharmaceutical glass packaging market growth is driven by expansion of biologics, vaccines, and generic injectables. In addition, increasing demand for high-quality, sterile, and ready-to-use containers that ensure drug stability and patient safety is spurring growth.

Companies are responding with capacity expansions, strategic acquisitions, and product developments. Competition is intense with global leaders aiming to provide differentiated glass solutions that combine durability and regulatory compliance.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Pharmaceutical Glass Packaging Market Size (2025E) |

US$ 23.0 Bn |

|

Market Value Forecast (2032F) |

US$ 44.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.9% |

Increasing use of generic injectable drugs is fueling demand for pharmaceutical glass packaging as these drugs require high-quality containers for mass production and distribution. Injectable forms demand vials and prefilled syringes that can maintain sterility and stability. In India and China, where generic injectables form a key part of the pharmaceutical output, manufacturers are investing in pre-sterilized glass vials to improve production.

Generic injectables also augment demand because of their fast market turnover and large-scale distribution requirements. Companies demand glass packaging that can handle high-volume filling lines without compromising on quality. The rise of biosimilar injectables is another factor. As patents for biologics expire, generic versions are entering the market, requiring the same high-spec glass used for original biologics to ensure drug stability.

Weight variation in glass production is a key issue as it affects dimensional consistency, breakage resistance, and fill-finish reliability. Even minor differences in wall thickness or total weight can lead to weak points in vials or bottles. It increases the risk of cracks or fractures during sterilization, transport, or high-speed filling. This makes manufacturers cautious, especially for sensitive biologics and injectable drugs, where any compromise in container integrity can lead to contamination or dosage errors.

The problem is evident in high-volume production of generic injectables, where automated lines require uniform glass to avoid stoppages or rejects. Facilities producing large batches of vials or bottles tend to experience high line downtime when weight variations lead to misalignment with closures, stoppers, or filling machines. A few contract manufacturers in India and China, for example, have reported operational slowdowns due to inconsistent vial weights, prompting them to seek suppliers with strict quality controls.

The rising emphasis on product safety in healthcare is creating new opportunities for pharmaceutical glass packaging manufacturers. This is because premium glass materials reduce contamination risk and maintain drug stability. These features appeal to manufacturers who must comply with strict regulatory standards in the U.S., Europe, and parts of Asia. Efficacy concerns are also spurring demand for precision dosing and validated containment systems.

Ready-to-use (RTU) vials and prefilled syringes allow accurate and consistent drug delivery, which is important for GLP-1 therapies, oncology treatments, and vaccines. Patient convenience is another key driver. Modern glass packaging now supports features such as prefilled syringes, metered-dose bottles, and easy-to-open closures. These make administration convenient at home or in clinical settings.

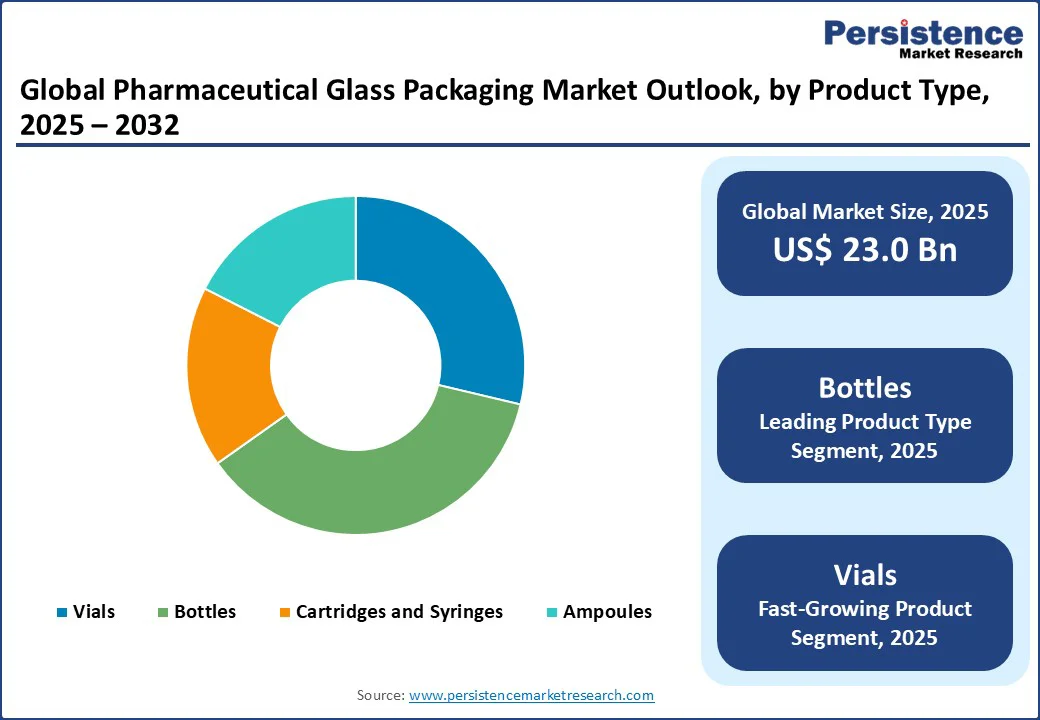

By product type, the market is divided into vials, bottles, cartridges and syringes, and ampoules. Among these, pharmaceutical glass bottles are speculated to account for nearly 36.5% of share in 2025 as they provide the most versatile containment solution for liquids, suspensions, and injectables. These can be produced in a wide range of sizes, from a few milliliters for potent drugs to hundreds of milliliters for oral liquids. It makes them suitable for hospitals, pharmacies, and home use. This versatility propels consistent demand across multiple drug categories.

Pharmaceutical glass vials are seeing considerable growth as they are the preferred format for injectables and high-value biologics, which are expanding steadily in global healthcare. Vials are compact, easy to store, and compatible with automated filling lines. These make them ideal for vaccines, monoclonal antibodies, and GLP-1 therapies. Recent launches of new biologics and personalized medicines have accelerated this trend, especially in the U.S. and Europe. Also, the expansion of cold-chain logistics and high-value drug distribution is augmenting demand.

Based on drug type, the market is trifurcated into generic, branded, and biologic. Out of these, generic will likely hold around 71.3% of share in 2025 as they require large-scale and cost-efficient production for oral liquids, injectables, and suspensions. Generics are produced in high volumes, making bottles and vials the default choice for standardized packaging. The shift toward biosimilar generics and injectable generics is also boosting glass demand. Cost and efficiency pressures further make generics a key driver for standardized glass packaging.

Biologics exhibit steady growth because these drugs are sensitive and require specialized as well as high-quality containers. Standard glass cannot always ensure chemical inertness or prevent interaction with the drug. Hence, manufacturers are turning to novel borosilicate glass or aluminosilicate vials that resist delamination and maintain product stability. Another factor is the rise of prefilled and ready-to-use (RTU) formats, which reduce contamination risk and speed up manufacturing for biologics.

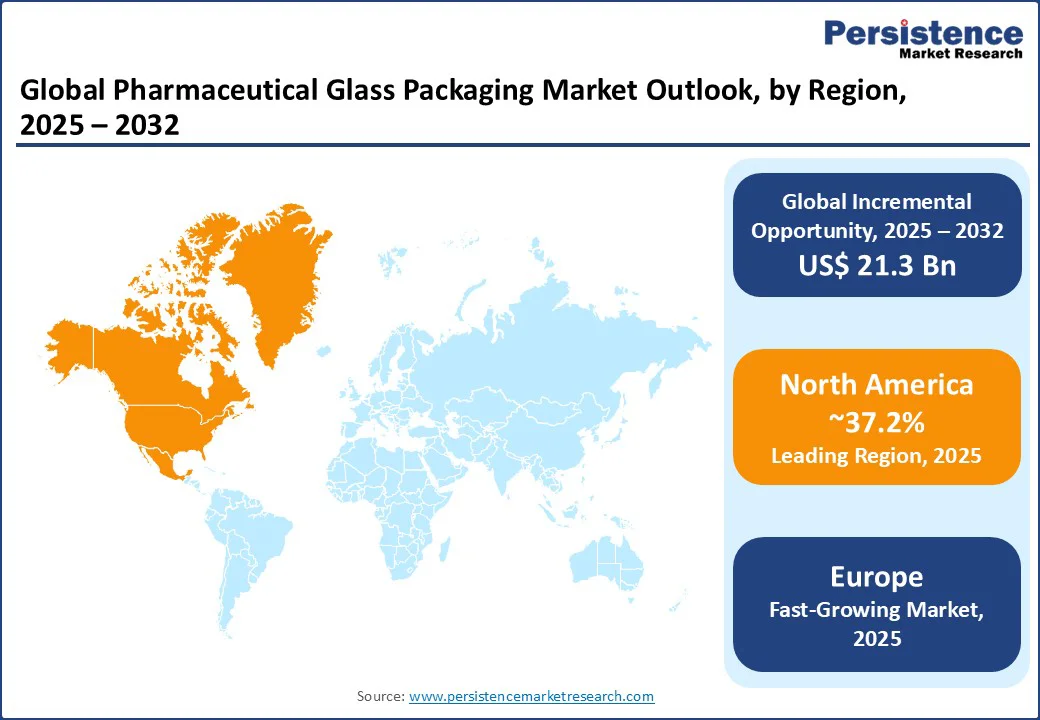

In 2025, North America is predicted to account for approximately 37.2% of share as pharmaceutical glass packaging is shifting toward local production because drug makers want to reduce supply chain risks. A key example is SCHOTT’s new facility in Wilson, North Carolina, announced in 2024. The plant will produce prefillable syringes and vials for vaccines, biologics, and GLP-1 drugs, ensuring U.S. pharma companies have a steady domestic supply.

Corning is also playing a major role in the U.S. pharmaceutical glass packaging market with its Valor and Viridian glass technologies. These are designed to reduce breakage and delamination in high-speed filling lines. These products are already being used by leading pharma companies, often in partnership with West Pharmaceutical Services. The focus is no longer just on glass, but on complete container-closure systems that can handle sensitive biologics.

In Europe, pharmaceutical glass packaging is influenced by strict quality and safety rules from the European Medicines Agency (EMA) along with the EU’s powerful sustainability agenda. Most companies now focus on producing high-quality borosilicate glass for injectables while also cutting carbon emissions through electric furnaces and high recycling rates. Since glass recycling levels in Europe are already among the highest worldwide, packaging firms are also investing in lightweight glass and eco-friendly production methods.

Mergers and acquisitions are changing the competitive map. Gerresheimer bought Bormioli Pharma in 2024 to expand its molded glass portfolio. But in 2025, it signaled plans to shift its focus more toward high-margin injectable packaging. At the same time, SGD Pharma recently acquired Alphial in Italy, adding more ampoule, vial, and ready-to-use production capacity in Europe. These strategies show how suppliers are consolidating to strengthen their positions in premium segments.

Drug makers in Asia Pacific are no longer satisfied with basic glass vials and are increasingly demanding ready-to-use formats that save time and reduce contamination risks. This change is most visible in India and China, where various contract manufacturers serve global pharma companies. Several companies are broadening their presence in Asia Pacific. Nipro upgraded its furnace in Meerut, India, to produce high-quality glass tubing for premium vials and syringes.

Schott has also invested in new production lines in China to supply local biotech firms. Corning is promoting its Valor glass across Asia Pacific to tackle problems such as delamination and breakage during high-speed filling. Sustainability is also starting to influence the regional market. With rising energy costs and strict local regulations, manufacturers are looking at efficient furnaces, lightweight glass, and high recycling use.

The pharmaceutical glass packaging market is dominated by a few vertically integrated specialists that control important steps from tubing to ready-to-use (RTU) formats. Leading players compete on fill-finish efficiency and quality attributes such as low particle load, chemical durability, and break-resistance. Mergers and acquisitions are also influencing the market. In India and Europe, companies are upgrading capacity to support biologics and GLP-1 therapies. These moves show how competition is shifting from commodity glass to high-spec containers designed for modern biologics.

The pharmaceutical glass packaging market is projected to reach US$ 23.0 Bn in 2025.

Rising demand for biologics and surging focus on drug safety are the key market drivers.

The pharmaceutical glass packaging market is poised to witness a CAGR of 9.8% from 2025 to 2032.

Shift toward RTU vials and investments in high-speed fill-finish systems are the key market opportunities.

Amcor plc, AptarGroup, Inc., and Becton, Dickinson, and Company are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Material

By Product Type

By Drug Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author