ID: PMRREP12340| 210 Pages | 20 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

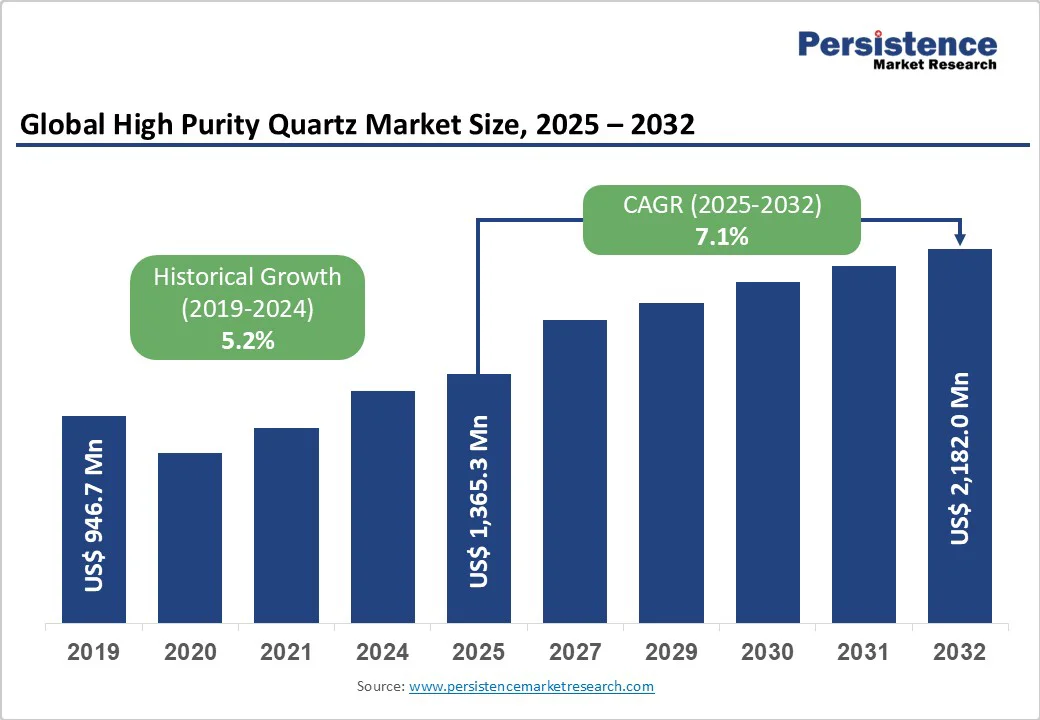

The global high purity quartz market size reached a value of US$1.4 Billion in 2025 and is anticipated to reach a value of US$2.2 Billion by 2032, growing at a CAGR of 7.1% between 2025 and 2032, driven by the increasing demand from the semiconductor and solar energy sectors.

| Key Insights | Details |

|---|---|

|

High Purity Quartz Market Size (2025) |

US$1.4 Bn |

|

Projected Market Value (2032F) |

US$2.2 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

7.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

5.2% |

The World Semiconductor Trade Statistics (WSTS) confirms continued double-digit growth. The global semiconductor market reached US$630 Billion in 2024, with 19% growth compared to 2023, and is projected to reach US$700 Billion in 2025, representing an 11.2% increase compared to 2024, with logic and memory segments driving demand for high-purity quartz crucibles and processing equipment.

Advanced node technologies requiring 300mm wafers and emerging AI chips necessitate ultra-pure materials, with HPQ consumption increasing proportionally to semiconductor complexity. The silicon wafer market is likely to be valued at over US$25 Billion in 2025 and is expected to grow at a 6% CAGR through 2032, directly correlating with HPQ demand for crucible manufacturing.

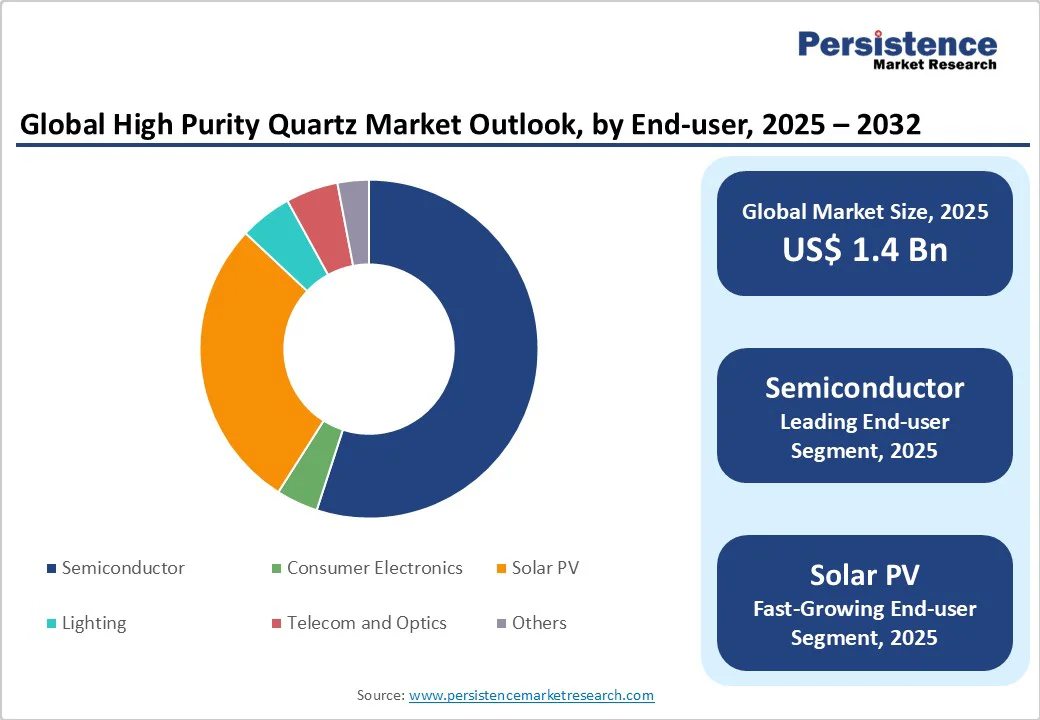

The solar photovoltaic sector is reliant on high-purity quartz for solar panel production and advanced renewable energy technologies. HPQ is crucial for improving the efficiency and longevity of photovoltaic cells.

The International Renewable Energy Agency (IRENA) reported 585 GW of renewable capacity additions in 2024, with solar accounting for most installations. China alone contributed 329 GW of new solar capacity in 2024, creating massive demand for quartz crucibles used in monocrystalline silicon production. Leading solar panel manufacturers emphasize HPQ's role in reducing impurities during silicon crystallization.

HPQ refinement procedures ensure that the material satisfies strict purity requirements for cutting-edge solar technologies, thereby reaffirming its vital role in facilitating the global transition to renewable energy.

The optical and laser technology sectors are boosting demand for high-purity quartz due to its high purity, superior performance, low impurity levels, thermal stability, and optical clarity. All these features make it crucial for producing optical fibers, lenses, and laser components.

The global optical fiber demand is expected to surpass 630 million kilometers in 2025, driven by 5G, data centers, and telecommunications advancements. Companies such as Heraeus Quartz and Quartz Corp. are innovating to meet the stringent requirements of the sector.

The demand for laser technology, estimated to be worth US$20 Billion in 2025, exhibits rapid growth owing to its applications in industrial processes, healthcare, and the military. Businesses such as Coherent Corp. and IPG Photonics are depending steadily on high-precision laser optics (HPQ) for accuracy and robustness. The development of LiDAR systems and driverless vehicles is expected to increase demand for HPQ.

The shortage of HPQ mines poses a significant challenge to industry growth. Only two main mines, such as Spruce Pine in the U.S. and Kyshtym in Russia, account for 95% of the world's HPQ production.

In 2024, Spruce Pine supplied over 70% of the global HPQ, due to its exceptional purity. The purity of quartz is crucial for important uses such as semiconductors and solar panels. The limited supply reduces market competition and makes it hard for small businesses to join the industry.

Production costs are escalated by stringent quality control requirements and the need for contamination-free processing environments, limiting scalability and profitability for smaller operations. HPQ production requires extensive multi-stage purification processes, including magnetic separation, flotation, acid leaching, and high-temperature treatments. The complex refinement procedures demand significant capital investment and specialized expertise, creating barriers for new market entrants.

The promise of HPQ as a greener substitute for conventional energy-intensive purification procedures is drawing interest from mineral technology entrepreneurs. Growing environmental concerns about current techniques of quartz extraction and processing have prompted companies to investigate sustainable practices.

An increasing focus on low-carbon, energy-efficient extraction techniques is fueling demand for HPQ in sectors including semiconductors, solar power, and optical technology. By pushing environment-friendly quartz purification techniques, start-ups such as PureTech and Silicon Materials are drawing investors and government support.

The developments are consistent with the worldwide trend toward cleaner technology, providing a competitive advantage for organizations that value environmental responsibility. The demand for sustainable HPQ manufacturing is anticipated to receive a sizable investment from mining technology companies in 2024.

In 2025, grade III HPQ, a high-purity quartz with a SiO2 content of more than 99.99%, is anticipated to control 46.9% of the global market. This grade, which is comparable to IOTA 8, is desired in high-end applications such as sophisticated solar and semiconductor production processes and semiconductor-grade crucibles. The exceptional purity and thermal stability of Grade III HPQ ensure its indispensable role in these advanced industries, solidifying its market dominance.

Grade II HPQ, containing 99.95-99.99% SiO2, represents the fastest-growing segment due to its cost-effectiveness in intermediate applications. This grade serves optical fiber manufacturing, specialty glass production, and lower-tier semiconductor applications, benefiting from expanding telecommunications infrastructure and industrial automation.

A key component of the semiconductor industry, HPQ is estimated to hold a 56.4% of the market share in 2024. The usage of premium glass crucibles and the rising demand for semiconductor integrated circuits, especially in the IoT industry, are responsible for the rise in demand.

HPQ is an important part of semiconductors and is used in many industries, such as consumer electronics, telecommunications, and automotive. Its high purity and stability make it valuable. Its use is expected to grow with solar energy, especially in making photovoltaic cells, which will help lead producers.

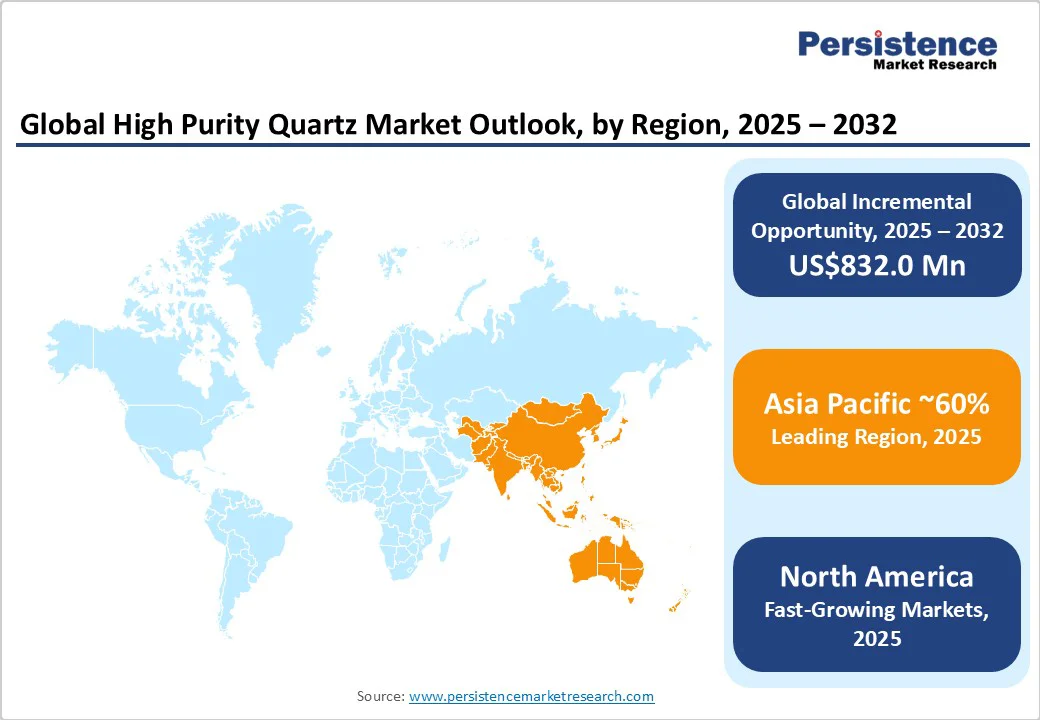

North America accounted for a significant share of the high purity quartz market. The U.S. high purity quartz market size is expected to cross US$270 Million by 2032, growing at a CAGR of 5.8% between 2025 and 2032.

In November 2023, the semiconductor sector in North America experienced significant growth, such as the opening of new fabs in the U.S., driven by the increased adoption of HPQ in the semiconductor and solar industries. Owing to this growth, the HPQ market in the U.S. is estimated to flourish in the forthcoming years.

The U.S. CHIPS and Science Act has allocated over US$52 Billion for domestic semiconductor manufacturing, significantly boosting HPQ demand for wafer processing equipment and crucibles. Canada is emerging as a promising HPQ source with exploration activities in Quebec, Ontario, and British Columbia, supported by government policies promoting clean technology supply chain security.

Increased demand for High-performance photovoltaics in photovoltaic cell manufacture, supported by government assistance, has resulted from the U.S.'s solar capacity development, which is expected to top 35 GW in 2023.

Germany leads the regional market with substantial semiconductor and photovoltaic manufacturing capabilities, supported by companies such as Heraeus Covantics and Momentive Technologies investing in advanced quartz processing technologies. The German quartz glass market is likely to surpass US$50 Million in 2025 and is projected to grow at a steady CAGR through 2032. European renewable energy initiatives are driving solar PV manufacturing expansion, particularly in Spain and France, increasing demand for HPQ in silicon ingot production.

The EU Chips Act aims to double Europe's global semiconductor market share by 2030, necessitating increased HPQ consumption for fab equipment and processing materials. Environmental regulations favor high-purity materials in manufacturing processes, with European companies leading in synthetic quartz production and sustainable processing technologies.

Asia Pacific is expected to dominate the market in 2024, with a 63% market share. Growing solar PV installations and the extensive usage of HPQ in the industrial and semiconductor industries in nations such as China, India, and Japan are driving the regional market growth.

China's solar power capacity exceeds 500 GW, requiring substantial HPQ consumption for polysilicon and wafer production, while the country added 329 GW of new solar capacity in 2024 alone. India's "Make in India" initiative has attracted US$10 Billion in semiconductor manufacturing investments in 2023, boosting regional HPQ demand.

Japan's advanced electronics sector and South Korea's memory chip manufacturing contribute significantly to regional consumption, with Taiwan's TSMC and Samsung driving demand for ultra-pure quartz components.

The region's integrated supply chains from silicon production to end-device manufacturing create concentrated HPQ demand, while government initiatives supporting semiconductor and renewable energy development ensure sustained market growth.

The global high purity quartz (HPQ) market is dominated by Sibelco, primarily through its Spruce Pine operations in North Carolina, and The Quartz Corp., which operates in both Norway and North Carolina. These two companies account for over 75% of the global HPQ supply. Leading industry players are actively expanding their production capacities to strengthen their competitive position worldwide.

Through strategic partnerships with end-users in the semiconductor and solar energy sectors, companies are gaining demand visibility and co-developing customized products tailored to specific applications. These long-term collaborations aim to ensure consistent demand, contributing to greater market stability and long-term success.

In Europe and North America, high-tech innovations from companies such as Heraeus, Quartzware, and Momentive Quartz have fueled regional growth and solidified market presence. As a critical material for both advanced electronics and renewable energy technologies, the HPQ market continues to offer significant opportunities driven by the global transition toward sustainable energy and next-generation technology solutions.

The high purity quartz market size is projected to reach US$1.4 Billion in 2025.

The key driver of the solar photovoltaic (PV) market, and the resulting demand for high-purity quartz (HPQ), is the global shift toward renewable energy and decarbonization.

The high purity quartz market is poised to witness a CAGR of 7.1% from 2025 to 2032.

The key opportunity lies in developing and scaling sustainable, low-carbon, high-purity quartz (HPQ) production methods to meet rising demand from clean technology sectors and attract investments and regulatory support.

Key players in the high purity quartz market are Covia Holdings Corporation, The Quartz Corp, Russian Quartz LLC, and Jiangsu Pacific Quartz Co., Ltd.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Grade

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author