ID: PMRREP17053| 199 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

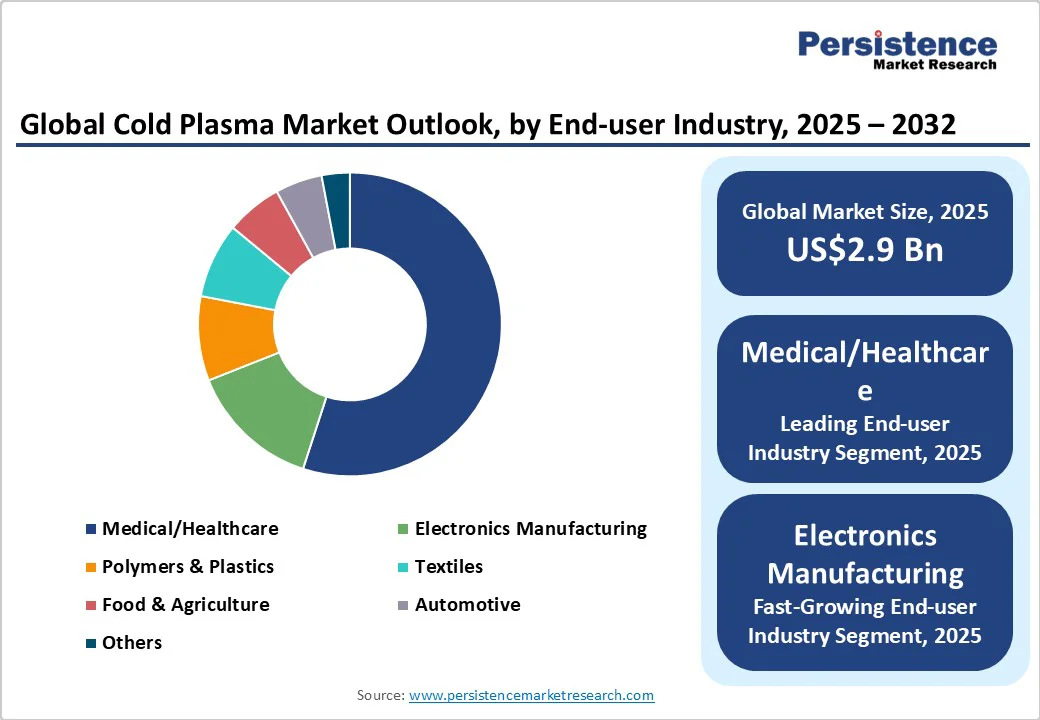

The global cold plasma market size is likely to be valued at US$2.9 Billion in 2025, and is estimated to reach US$8 Billion by 2032, growing at a CAGR of 15.8% during the forecast period 2025−2032, driven by the increasing adoption of plasma solutions in healthcare and industrial applications. Market growth is driven by advancements in plasma technology that enable innovative surface treatment and sterilization solutions, alongside increasing demand in wound healing and food safety applications. Regulatory approvals favoring non-thermal sterilization methods and escalating investments in research and development further reinforce this trajectory.

| Key Insights | Details |

|---|---|

|

Cold Plasma Market Size (2025E) |

US$2.9 Bn |

|

Market Value Forecast (2032F) |

US$ 8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

15.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

15% |

The healthcare sector is increasingly embracing cold plasma for its efficacy in wound healing, sterilization, and cancer therapy, driven by regulatory endorsements from entities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These agencies have approved several plasma-based devices for clinical use due to demonstrated efficacy and safety. For instance, the ability of cold plasma to accelerate chronic wound healing has resulted in its widening adoption in medical applications. This trend is fortified by growing aging populations requiring advanced therapeutic solutions and the rising prevalence of antibiotic-resistant infections demanding alternative sterilization approaches. Consequently, healthcare budgets are reallocated toward innovative treatment modalities such as plasma technology, fostering market expansion supported by new clinical protocols and funding from global health authorities.

The manufacturing sector is increasingly adopting cold plasma for surface activation, coating, and treatment to enhance material properties and production efficiency. Advancements in atmospheric pressure plasma technology have eliminated the need for vacuum systems, broadening its industrial use. Growing industrial automation, demand for lightweight functional materials, and strict environmental regulations are accelerating adoption. Manufacturers are rapidly integrating plasma systems into production lines to boost product durability, sustainability, and performance without relying on chemical-based surface treatments.

High initial investments and ongoing maintenance costs remain major barriers to cold plasma adoption, particularly for small and medium enterprises (SMEs). These systems require specialized knowledge for installation and operation, increasing operational expenditure and limiting scalability. Economic assessments show that total ownership costs can exceed those of traditional sterilization and surface treatment methods by over 20%, limiting adoption in cost-sensitive sectors. Supply chain challenges for high-purity gases and specialized components also contribute to cost volatility and logistical complexity. These financial and operational hurdles dampen market growth and push manufacturers to prioritize cost-reduction strategies and modular system designs to improve affordability and accessibility.

As a relatively novel technology in both medical and industrial applications, cold plasma faces an evolving and fragmented regulatory landscape. Global inconsistencies in safety, efficacy, and environmental standards lead to approval delays, with commercialization timelines extended by up to 18 months in some jurisdictions. This uncertainty impacts return on investment and deters market entry, particularly for startups and emerging-market innovators. Compliance costs and documentation requirements are disproportionately burdensome for smaller players. Without harmonized standards, the risk of suboptimal implementations and liability concerns grows, underscoring the need for industry-wide collaboration to streamline regulatory frameworks and foster trust in plasma technologies.

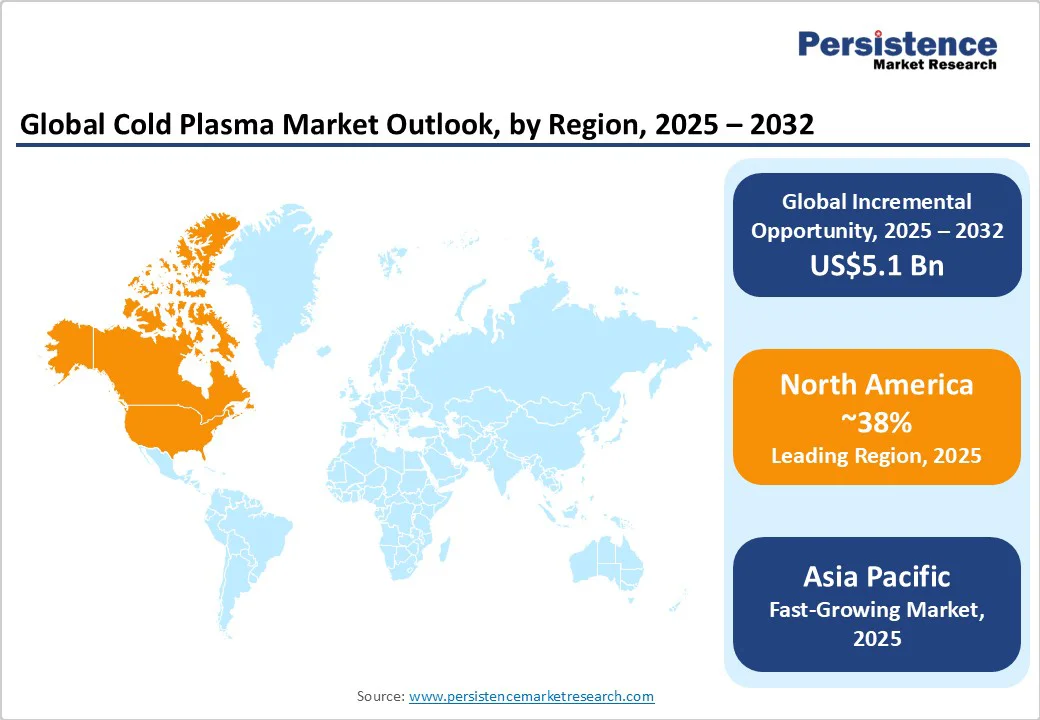

Rising healthcare expenditures and increasing industrial modernization in emerging economies such as Asia Pacific, Latin America, and the Middle East are creating high-growth opportunities for cold plasma market players. Growth in these regions is driven by expanding hospital infrastructure and the adoption of advanced technologies in manufacturing hubs. Government initiatives promoting healthcare innovation in countries, including India and Brazil, are accelerating clinical adoption, while textile and electronics manufacturers in ASEAN nations are using plasma treatments to enhance export competitiveness. Market forecasts suggest that emerging markets could account for over 30% of the market by 2032, emphasizing their strategic importance for both new entrants and established players seeking geographic diversification.

Another promising investment avenue is the integration of cold plasma with digital technologies such as the Internet of Things (IoT) and automation. This convergence enables real-time monitoring, precision control, and adaptive plasma treatments, enhancing efficiency and expanding use cases. Applications in sectors such as precision agriculture and smart manufacturing benefit from reduced waste, improved output, and shorter turnaround times. These advancements also lower labor costs and improve user experience. Companies that leverage convergent technology platforms to deliver tailored plasma solutions will be well-positioned to meet unmet market needs and gain a competitive advantage.

The atmospheric pressure segment is expected to dominate the cold plasma market with an estimated 75% share of global revenue in 2025. This dominant position is anchored by the operational benefits atmospheric cold plasma systems provide, including the removal of vacuum infrastructure requirements and the consequent reductions in capital expenditure and energy consumption. These advantages enhance scalability and applicability across a wide range of fields, particularly healthcare, where on-site treatment convenience is paramount. Furthermore, atmospheric plasma devices are increasingly benefiting from ongoing innovations that improve system stability, plasma uniformity, and energy efficiency, leading to expanded adoption in applications such as chronic wound therapy and food surface sterilization.

The low-pressure plasma segment, while representing a smaller portion, maintains strategic relevance, particularly in high-precision environments such as semiconductor fabrication and sensitive surface coating processes. Its controlled environment allows stringent treatment conditions necessary for wafer manufacturing and specialty materials processing. Growth in this sector is more moderate, tempered by higher equipment costs and infrastructure complexities inherent to vacuum systems. Despite this, its market holds steady due to the increasing demand for advanced manufacturing materials in electronics and aerospace sectors that require carefully regulated plasma treatment environments.

Wound healing is expected to remain the top application area, comprising around 40% of the revenue share in 2025. This leadership is the result of several factors, including robust clinical evidence validating its efficacy, multiple regulatory approvals facilitating faster medical device commercialization, and an expanding global base of chronic wound patients. The aging global population and the rising prevalence of diabetes and obesity are driving significant demand for advanced therapeutic options that cold plasma effectively meets. Hospitals and specialized clinics are integrating plasma-based therapies as part of comprehensive wound care programs, supported by insurance reimbursement frameworks, improving accessibility.

Surface sterilization and disinfection applications are rapidly scaling during the forecast period. The pandemic-driven emphasis on infection control protocols globally, including in food processing, pharmaceutical manufacturing, and general healthcare settings, has accelerated the deployment of chemical-free, residue-free sterilization technologies such as cold plasma. Environmental regulations limiting chemical disinfectants also create expanded opportunities for plasma sterilizers. With continuous improvements in device portability and automation, plasma-based sterilization solutions are increasingly adopted for large-scale and on-demand applications, reinforcing their market share gains.

Healthcare is the unequivocal leader with a 55% market share estimated for 2025, reflecting the broad adoption of plasma technologies in surgical procedures, dentistry, oncology, and infection control. Healthcare institutions are driving investments to incorporate cold plasma devices into treatment protocols due to their minimally invasive nature and demonstrated clinical efficacy. Policy frameworks in developed countries also incentivize adoption through innovation funding and proactive reimbursement policies, reinforcing healthcare’s dominance. The growth of this segment is supported by the ongoing development of application-specific plasma devices.

Electronics manufacturing is set to be the fastest-growing end-user segment over the forecast period, driven by the surging demand for plasma-enabled surface treatments that improve adhesion, conductivity, and reliability in semiconductor devices and printed circuit boards. The trend toward miniaturization and high-performance electronic components, alongside the growth of wearable and flexible electronics, amplifies the need for sophisticated plasma technologies. Regulatory pushes toward eco-friendly manufacturing processes further catalyze adoption, positioning electronics as a key growth vertical, surpassing textiles in velocity due to higher value-added process requirements and technological integration.

North America is anticipated to lead with an estimated 38% of the market share in 2025, predominantly fed by the U.S. The regional market benefits from a well-established innovation ecosystem, supported by federal investments in cutting-edge healthcare technologies and advanced manufacturing initiatives. The U.S. FDA’s clear and increasingly favorable regulatory framework enables the swift commercialization of cold plasma devices, especially in wound care and sterilization.

High healthcare spending and the urgency to address antibiotic-resistant infections propel clinical adoption. The region’s competitive landscape also includes both leading multinational companies and innovative startups pioneering atmospheric pressure plasma devices. North America remains a prime target for technology-driven market expansion, amplified by ongoing venture capital interest and government subsidies enhancing research capabilities.

Asia Pacific is the fastest-expanding regional market. China emerges as the dominant market force, attributable to its robust governmental support for healthcare infrastructure development, stringent environmental norms pushing advanced sterilization adoption, and aggressive manufacturing modernization programs. India, Japan, and ASEAN countries are also rife with attractive opportunities, on account of growing chronic disease burdens requiring innovative clinical treatments and export-oriented manufacturing sectors demanding enhanced product quality via plasma surface treatment.

Though regulatory frameworks remain a mix of diverse national standards, regional cooperation efforts to harmonize safety and efficacy benchmarks are underway, reducing market entry barriers. Investment inflows are robust, with multinational plasma companies enhancing local manufacturing capacities and establishing R&D centers to tailor solutions to regional needs. This fast-paced expansion positions Asia Pacific as a critical growth horizon for stakeholders aiming for long-term market leadership.

Europe is predicted to account for around 28% of the market share in 2025, with Germany, the U.K., France, and Spain emerging as pivotal contributors. The European Medicines Agency’s role in regulatory harmonization is critical, simplifying approval processes for plasma-based medical devices and fostering wider clinical acceptance. The mature industrial base of Europe, especially in automotive, electronics, and the food industry, is actively integrating plasma technologies for surface modification and sterilization purposes.

Strategic government initiatives focused on healthcare innovation and environmental sustainability further bolster market penetration. Investment flows directed at collaborative innovation projects track a growing inclination toward public-private partnerships, particularly for next-generation plasma applications. The regional market is expected to grow, guided by progressive regulatory policies and sustained industrial uptake.

The global cold plasma market structure demonstrates moderate concentration, with the top five players controlling an estimated 55% market share in 2025. Leading firms with substantial revenue streams include PlasmaSources Inc., Advanced Plasma Solutions LLC, and Nordic Plasma Technologies, exhibiting strong innovation pipelines and comprehensive product portfolios.

The market remains fragmented beyond this cluster, featuring numerous regional and niche providers specializing in device manufacturing and service integration. Competitive positioning revolves around technological innovation, strategic partnerships, and expanding geographic reach, enabling market leaders to maintain dominance while facing agile competition from emerging companies focusing on specific industrial verticals.

The cold plasma market is projected to reach US$2.9 Billion in 2025.

Advances in plasma technology enabling innovative surface treatment and sterilization solutions, along with growing demand in wound healing and food safety, are key growth drivers.

The cold plasma market is poised to witness a CAGR of 15.8% from 2025 to 2032.

Regulatory approvals favoring non-thermal sterilization methods, escalating investments in plasma technology R&D, and government incentives promoting healthcare innovation in emerging economies are key market opportunities.

PlasmaSources Inc., Advanced Plasma Solutions LLC, and Nordic Plasma Technologies are some of the key players in the cold plasma market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Pressure Type

By Application

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author