ID: PMRREP16420| 193 Pages | 10 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

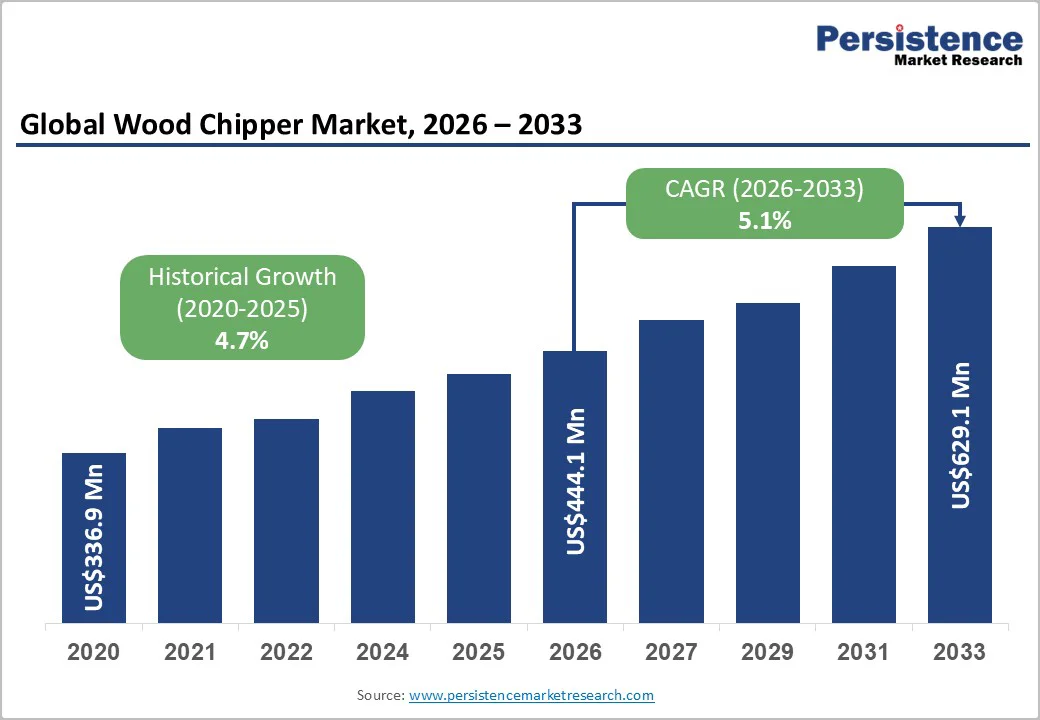

The global wood chipper market size is likely to be valued at US$444.1Mn in 2026 and is expected to reach US$629.1Mn by 2033, growing at a CAGR of 5.1% during the forecast period from 2026 and 2033, driven by the rising demand for wood chips in biomass energy, pulp and paper production, and forestry operations, supported by sustained expansion in landscaping and arboriculture services.

Additional growth is fueled by stricter regulations on green waste disposal, which encourage municipalities and contractors to adopt chippers for efficient on-site volume reduction. Increasing mechanization in commercial tree care and farm management is also boosting adoption, as operators seek to improve productivity and reduce manual handling of branches and residues.

| Key Insights | Details |

|---|---|

| Wood Chipper Market Size (2026E) | US$444.1Mn |

| Market Value Forecast (2033F) | US$629.1Mn |

| Projected Growth CAGR (2026 - 2033) | 5.1% |

| Historical Market Growth (2020 - 2025) | 4.7% |

The wood chipper market is increasingly driven by the rising demand for biomass energy and the global push toward renewable energy targets. Governments worldwide are emphasizing the use of sustainable energy sources, and biomass, particularly wood-based feedstock, has become a key component in power generation, district heating, and combined heat and power (CHP) systems.

Wood chippers play a critical role in this ecosystem by converting forestry residues, urban wood waste, and sawmill offcuts into uniform chips suitable for energy production.

Renewable energy policies, co-firing mandates, and incentives for clean energy utilization are encouraging the adoption of high-capacity, energy-efficient chippers capable of handling large volumes of feedstock. Drum and disc chippers, in particular, are preferred for industrial biomass applications due to their ability to produce consistent chip sizes that optimize combustion efficiency.

The expansion of biomass plantations and sustainable forest management practices is generating a steady supply of raw material.

The wood chipper market faces notable restraints from high capital costs and intensive operational requirements. Industrial-grade chippers, particularly large drum and disc models used in forestry, biomass, and pulp applications, require significant upfront investment.

The cost of machinery, coupled with expenses for the installation, transportation, and setup, can be a barrier for small and medium-scale operators. Acquisition costs and operation require high energy, regular maintenance, and skilled labor for safe and efficient performance.

High operational intensity also limits the flexibility of deployment. Diesel-powered and high-capacity units demand continuous fueling, routine servicing, and careful monitoring to prevent downtime, which can increase total ownership costs.

Noise, vibration, and emissions control further add to operational complexity, particularly in urban or environmentally regulated areas. These factors make operators cautious in expanding or upgrading fleets, slowing market penetration in some regions.

The wood chipper market presents significant opportunities with the expansion of biomass power plants and district heating networks. As countries increase their focus on renewable energy and carbon reduction, biomass has emerged as a key fuel source for sustainable power generation and heating solutions. Wood chippers are essential in this supply chain, converting forestry residues, sawmill offcuts, and urban wood waste into uniform chips suitable for combustion.

The growth of biomass power plants, both large-scale and community-based, drives demand for high-capacity drum and disc chippers capable of handling diverse feedstock efficiently. District heating initiatives in urban and per-urban areas require a consistent supply of biomass chips to maintain reliable energy output.

This has encouraged investments in advanced, energy-efficient chipping equipment that maximizes throughput while minimizing downtime and operational costs.

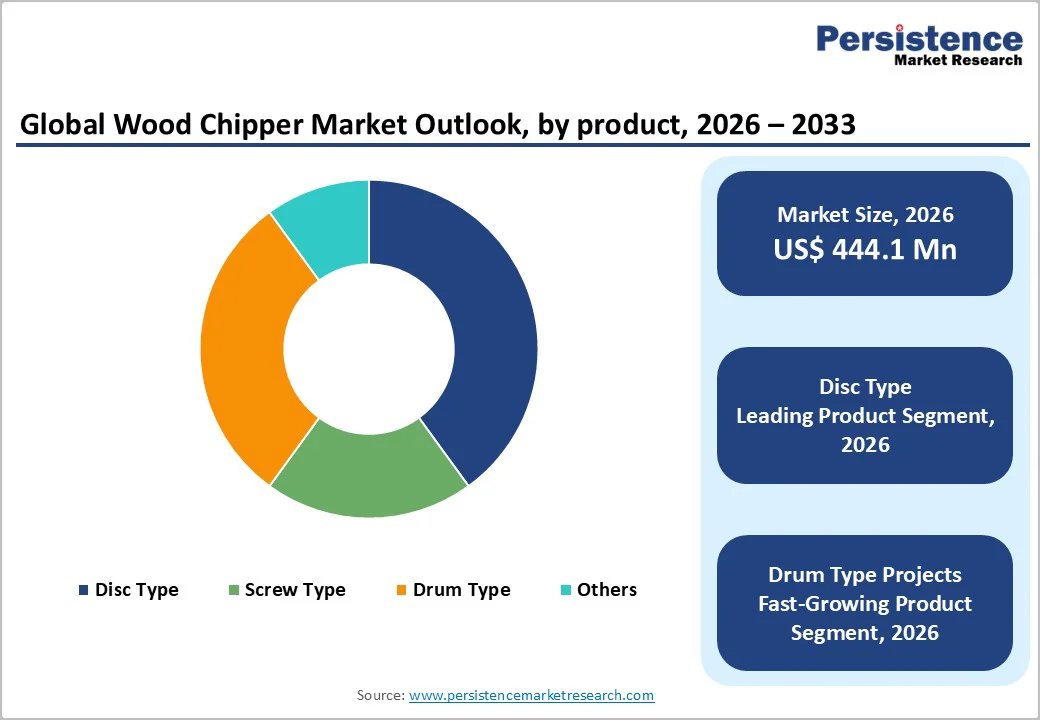

Disc-type wood chippers lead the global wood chipper market, capturing around 45% of total revenue share in 2026, widely used in pulp and paper mills, sawmills, and large forestry operations. Their popularity stems from their ability to produce uniform chips with high throughput, ensuring consistent feedstock for industrial processes.

Disc chippers are particularly favored in mill-integrated operations where process stability and chip quality are critical. For example, large pulp producers in North America and Scandinavia continue to deploy industrial disc chippers within mill complexes to maintain the consistent chip geometry required for chemical pulping. Their key role in wood processing makes them the preferred choice for large-scale, continuous operations.

Drum-type chippers represent the fastest-growing product type, driven by the expansion of biomass power plants and large-scale fuel preparation facilities. These chippers can handle a diverse range of feedstock, from whole trees and branches to urban wood waste, while producing standardized chips that enhance combustion efficiency and boiler performance.

Increasing investments in high-capacity, energy-efficient drum chippers is supporting their adoption in district heating networks and bioenergy plants. For example, several European biomass energy facilities have recently upgraded to heavy-duty drum chippers to improve fuel uniformity and support renewable energy generation targets.

Diesel-engine wood chippers are projected to lead the market, accounting for over 55% share in 2026, due to their dominance in professional forestry, biomass harvesting, and large commercial landscaping. Diesel units are preferred for medium- and heavy-duty operations owing to their high torque, mobility, and the ability to operate in remote or off-grid locations.

These chippers are commonly towable or self-propelled, supporting intensive use in forestry supply chains, biomass fuel preparation, and large-scale tree-care services.

Electric-driven wood chippers remain the fastest growing fuel segment, driven by increasing urban emission regulations, noise restrictions, and corporate sustainability targets. Plug-in and battery-supported models are gaining popularity in municipalities, residential areas, and light commercial operations where lower noise levels, zero local emissions, and easy maintenance are key advantages.

Adoption is accelerating as governments and organizations promote clean energy solutions, while advancements in battery technology improve runtime and efficiency.

Paper and pulp stands as the leading end-user segment, accounting for 40% of the market share. This segment relies heavily on disc and drum chippers to convert logs, sawmill residues, and other wood waste into uniform, process-ready chips for industrial use. The steady demand for packaging, tissue, and other wood-derived products ensures consistent adoption of high-capacity chippers in large integrated mills.

For example, North American and Scandinavian pulp mills continue to employ centralized disc chippers to maintain uniform chip size for chemical pulping and paperboard production, ensuring quality and process efficiency. These facilities typically employ centralized, high-throughput chipping lines with redundancy to maintain reliability, minimize downtime, and ensure feedstock consistency.

Forestry and biomass are the fastest growing segment, driven by the expansion of biomass power plants, district heating systems, and dedicated biomass plantations are driving the demand for mobile and stationary drum chippers capable of handling diverse feedstock, from forest residues to urban wood waste.

Rising renewable energy targets and government incentives for sustainable energy utilization are encouraging investments in high-capacity, energy-efficient chippers. For example, European biomass energy projects are adopting heavy-duty drum chippers to process forestry residues and urban wood waste efficiently, supporting clean energy generation and operational reliability.

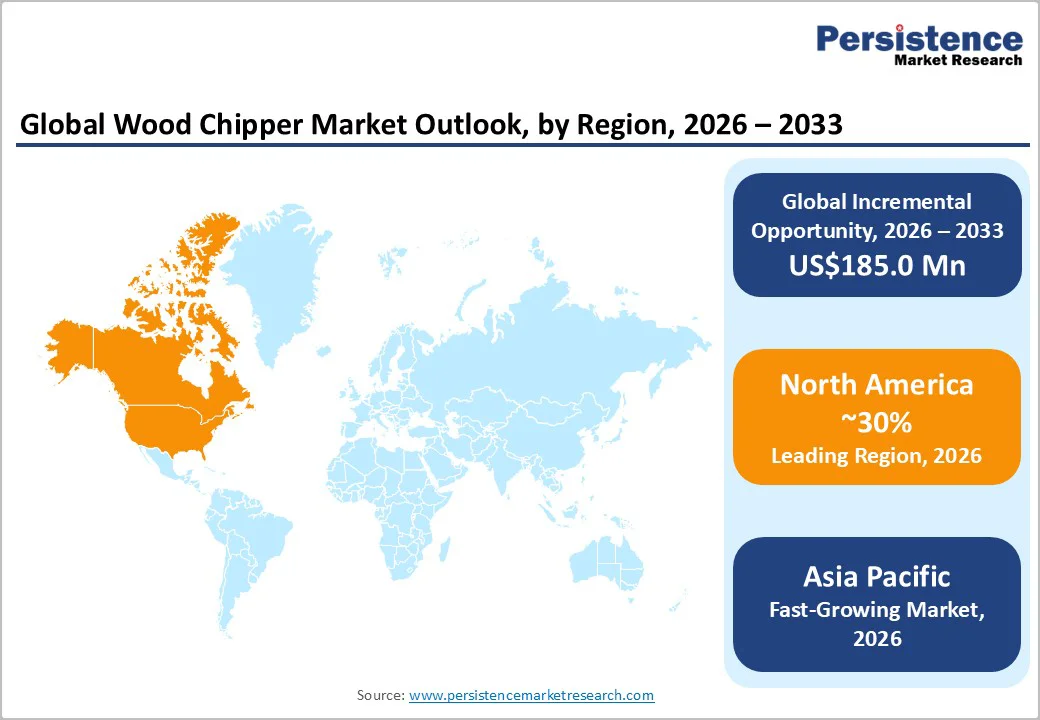

North America is anticipated to be the leading region in the wood chipper market, accounting for approximately 30% in 2026, driven primarily by the U.S. The market is supported by well-established forestry operations, a mature landscaping and tree-care industry, and the growing use of biomass for energy production.

Diesel-engine chippers dominate professional and industrial applications, favored for their high torque, mobility, and the ability to operate in remote or off-grid locations.

Electrification and smart technology are the emerging trends in urban and municipal applications, where electric and battery-supported chippers are being adopted to meet noise restrictions and sustainability goals.

The expansion of biomass power plants and district heating networks is increasing the demand for high-capacity drum chippers capable of handling diverse feedstock, from forestry residues to urban wood waste. Dealers and service providers continue to play a crucial role in purchase decisions, ensuring that operators have access to maintenance, parts, and technical support.

Europe remains a significant market for wood chippers, due to stringent environmental regulations, widespread adoption of sustainable forestry practices, and growing demand for biomass energy and district heating. The region is witnessing increased use of energy-efficient disc and drum chippers in pulp, paper, and sawmill operations, as well as in municipal and urban landscaping applications where low-noise and low-emission machines are required/preferred.

European markets such as Germany, France, and the Nordic countries are spearheading biomass-based energy initiatives, boosting demand for high-capacity drum chippers capable of processing forest residues, urban wood waste, and industrial offcuts. Electrification and smart technology adoption, including battery-supported and IoT-enabled machines, is rising to meet regulatory standards and improve operational efficiency.

Asia Pacific is likely to be the fastest-growing region in 2026, driven by rising urbanization, infrastructure development, and increasing forestry and biomass activity across China, India, Japan, and Southeast Asia. Rapid construction in these countries generates significant wood waste, driving demand for efficient chippers to manage residues and support circular economy goals.

Sustainability initiatives and government policies favoring renewable energy further boost adoption, particularly for biomass applications.

Biomass power generation and district heating projects are gaining traction in the region, fueling demand for high capacity drum chippers that can process a variety of feedstock from forest residues to industrial offcuts.

Compact electric and hybrid chippers are also beginning to penetrate urban and municipal markets, supported by environmental regulations, noise concerns, and innovations in telematics and digital safety systems. Rising mechanization in Asia Pacific forestry is boosting investments in modern chippers, with local manufacturing lowering costs and lead times.

The global wood chipper exhibits a moderately fragmented structure, driven by the presence of several established OEMs alongside regional and emerging manufacturers.

Market dynamics are influenced by growing demand for biomass energy, urban landscaping, and industrial applications, which encourage continuous product innovation and technological upgrades. Operators increasingly seek high-capacity, energy-efficient, and low-emission chippers, prompting manufacturers to focus on performance, safety, and sustainability features.

With key leaders including Vermeer, Bandit Industries, Morbark, Terex, Timberwolf, and GreenMech, the market sees intense rivalry around technological differentiation and geographic reach.

These players compete through innovations in electrification, hybrid models, automation, and IoT-enabled monitoring systems, as well as through dealer networks, maintenance services, and fleet financing options. Regional manufacturers leverage local production to serve biomass and small-to-medium forestry demand.

The wood chipper market is valued at US$444.1 million in 2026 and expected to reach US$629.1 million by 2033, reflecting robust growth.

Key drivers include the expansion of biomass energy and district heating, growth in forestry and landscaping activities, and increasing emphasis on sustainable management of wood residues and green waste.

Disc-type chippers currently lead by product type with 45% share, widely used in pulp, paper, and sawmill operations for their uniform chip quality and high throughput.

North America dominates the market with around 30% share, driven by the U.S. forestry and landscaping sectors, growing biomass demand, regulatory compliance, and investments in high-capacity, safe, and efficient equipment, with a moderately consolidated competitive landscape.

Drum and electric-driven chippers present a key opportunity, customized for biomass power, district heating, and urban green waste initiatives requiring standardized chips, low emissions, and high efficiency.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Fuel Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author