ID: PMRREP35647| 185 Pages | 23 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

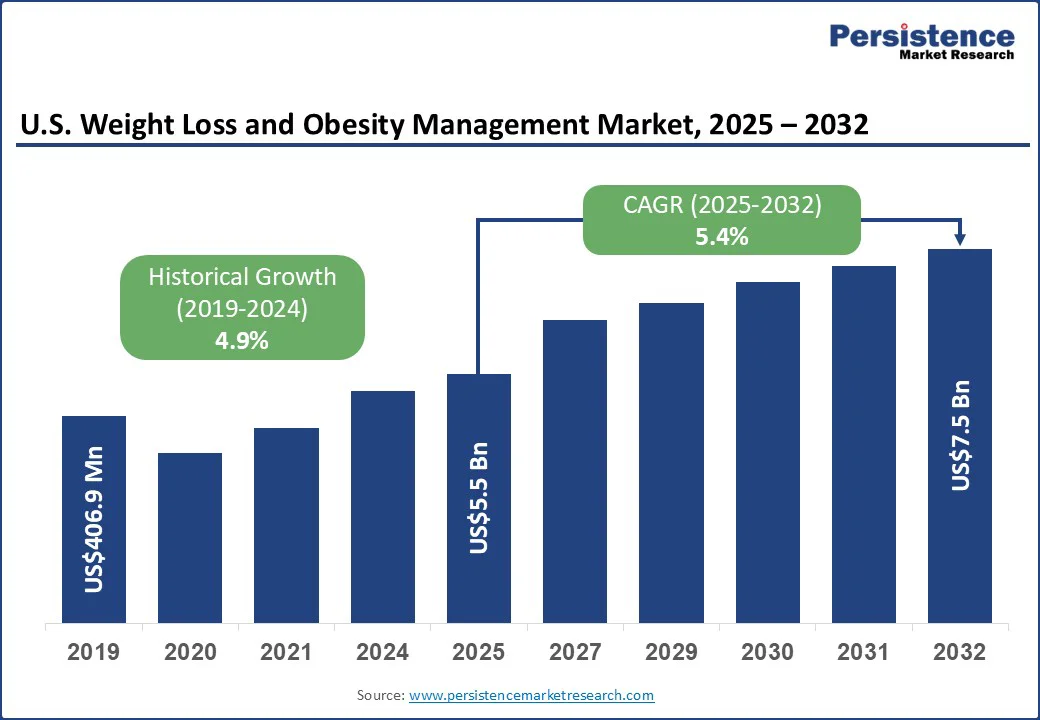

The U.S. weight loss and obesity management market size is likely to be valued at US$5.5 Bn in 2025 and is expected to reach US$7.5 Bn by 2032, growing at a CAGR of 5.4% during the forecast period from 2025 to 2032, driven by rising obesity prevalence, increasing health awareness, and a surge in demand for non-invasive and technologically advanced treatments.

Key Industry Highlights

| Key Insights | Details |

|---|---|

| U.S. Weight Loss and Obesity Management Market Size (2025E) | US$5.5 Bn |

| Market Value Forecast (2032F) | US$7.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.9% |

Obesity continues to be a major public health concern in the U.S., with over 42% of adults classified as obese. This high prevalence has created significant demand for effective weight management solutions, ranging from lifestyle modification programs and pharmacological treatments to surgical interventions.

The increasing incidence of obesity is closely linked to sedentary lifestyles, unhealthy dietary habits, and urbanization, which have amplified the need for structured weight-loss strategies. Healthcare providers are witnessing a growing number of patients seeking medical support for weight management, while payers and policymakers are recognizing the long-term economic burden associated with obesity-related comorbidities, such as diabetes, cardiovascular disease, and hypertension.

This trend is driving the expansion of specialized obesity clinics, the adoption of anti-obesity medications, and the acceptance of bariatric procedures across diverse age groups and demographics.

One of the primary restraints in the U.S. weight loss and obesity management market is the high cost of medications, particularly GLP-1 receptor agonists such as Wegovy and Ozempic, which can exceed US$1,000 per month. These prices place a significant financial burden on patients, especially those without comprehensive insurance coverage.

Even when insurance is available, access is often limited by strict criteria, such as requiring prior authorization, step therapy, or documentation of comorbid conditions such as type 2 diabetes.

Many insurers do not cover these medications for general weight loss, leaving a large population unable to afford treatment. This combination of high out-of-pocket costs and restrictive insurance policies discourages long-term adherence, reduces patient access, and slows market growth.

Consequently, despite proven efficacy, the adoption of these advanced therapies remains uneven across different demographic and socioeconomic groups, highlighting a critical barrier in obesity care.

Minimally invasive bariatric procedures are transforming the U.S. weight loss and obesity management landscape by offering safer, more efficient alternatives to traditional surgery.

Techniques such as laparoscopic sleeve gastrectomy, gastric bypass, and endoscopic interventions allow surgeons to perform complex weight-loss operations through small incisions or via the digestive tract, significantly reducing trauma to the patient. These procedures minimize post-operative pain, lower infection risks, and shorten hospital stays, enabling quicker recovery and faster return to daily activities.

The reduced complication rates make bariatric surgery a viable option for a broader patient population, including those who may have been considered high-risk for conventional open surgery. Additionally, advancements in robotic-assisted laparoscopic systems are enhancing precision and outcomes.

As patient awareness grows and healthcare providers adopt these techniques, minimally invasive bariatric procedures are expanding access, improving safety, and increasing the overall adoption of surgical weight management solutions in the U.S. market.

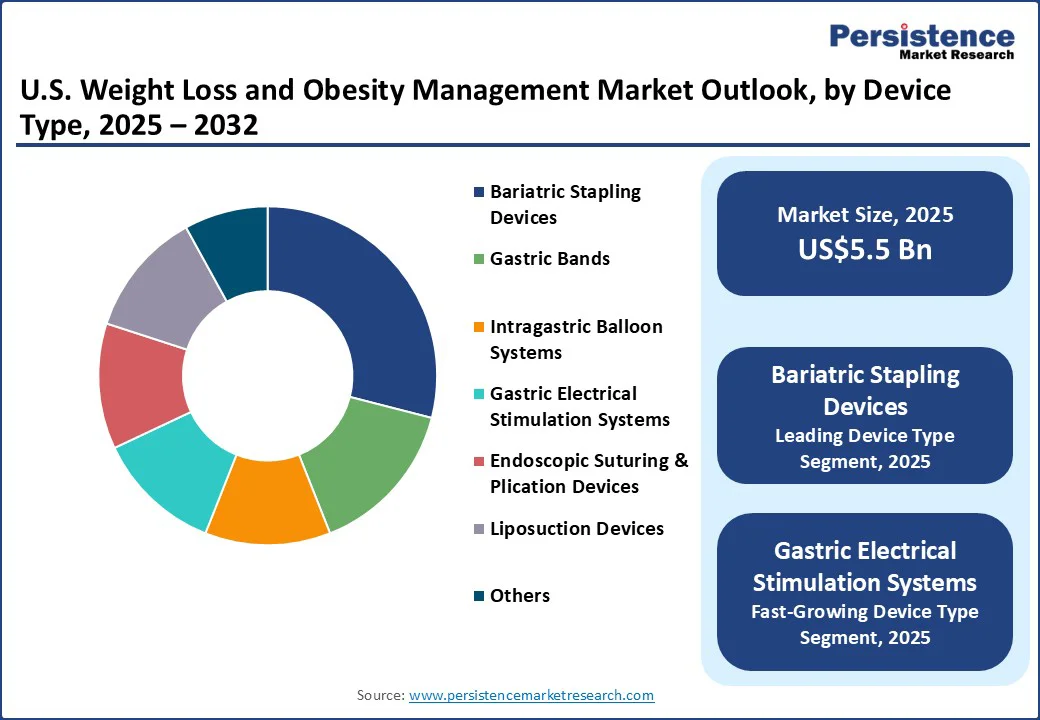

Bariatric stapling devices dominate the U.S. weight loss and obesity management market due to their central role in the most commonly performed surgical procedures, including sleeve gastrectomy and Roux-en-Y gastric bypass. These devices allow surgeons to perform precise tissue resection and anastomosis with minimal invasiveness, significantly reducing operative time, post-operative complications, and patient recovery periods.

Technological advancements, such as enhanced staple line integrity and automated stapling systems, have improved safety and surgical outcomes, increasing both surgeon and patient confidence. Moreover, the growing prevalence of obesity and rising demand for effective, long-term weight loss solutions have fueled the adoption of stapling devices.

Their compatibility with minimally invasive and robotic-assisted surgeries further strengthens their position, making bariatric stapling devices the preferred choice for healthcare providers and a key driver in the U.S. market.

Hospitals lead the U.S. weight loss and obesity management market as the primary end-use segment, as they offer advanced infrastructure, skilled bariatric surgeons, and comprehensive post-operative care. Most bariatric surgeries, such as sleeve gastrectomy and gastric bypass, are performed in hospitals due to the need for specialized equipment, anesthesia support, and intensive monitoring.

Hospitals also manage high-risk and complex obesity cases that require multidisciplinary teams, including dieticians, endocrinologists, and behavioral specialists. Their ability to integrate surgical, medical, and psychological support under one roof provides patients with holistic obesity management solutions. Moreover, hospitals often participate in clinical trials and adopt the latest technologies, making them the preferred centers for both patients and providers in the U.S. market.

The U.S. weight loss and obesity management market is highly competitive, characterized by innovation in drugs, devices, and digital platforms. Market players are focusing on developing advanced therapies, including novel injectables, oral medications, and minimally invasive surgical tools, to improve efficacy and safety. Non-invasive approaches such as endoscopic procedures, intragastric balloons, and gastric electrical stimulation are gaining momentum alongside lifestyle and digital behavior-modification programs.

The U.S. weight loss and obesity management market is projected to be valued at US$5.5 Bn in 2025.

Minimally invasive stapling, sleeve gastrectomy, and bypass procedures are increasingly preferred for sustainable weight reduction.

The U.S. weight loss and obesity management market is poised to witness a CAGR of 5.4% between 2025 and 2032.

There is a rising demand for less invasive, safer options, such as suturing and intragastric balloons.

Southeast is the leading zone in the U.S. weight loss and obesity management market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| U.S. Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Device Type

By End-user

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author