ID: PMRREP34971| 167 Pages | 3 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

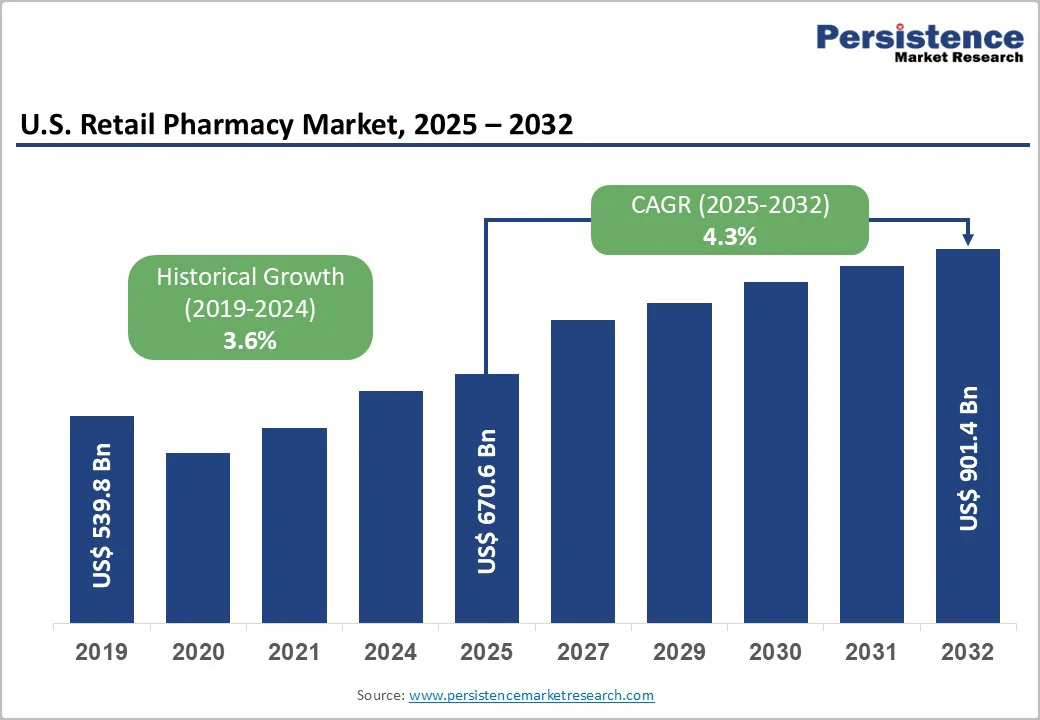

The U.S. retail pharmacy market size is estimated to reach US$ 670.6 billion in 2025 and is projected to reach US$ 901.4 billion, growing at a CAGR of 4.3% between 2025 and 2032. Pharmacies have evolved into integral hubs of the U.S. healthcare system, extending far beyond their traditional role of dispensing medications.

Their prominence surged during the COVID-19 pandemic, when they played a vital role in nationwide vaccination efforts. Today, pharmacies offer a wide spectrum of services, including immunizations, medication therapy management (MTM), and chronic disease management—all proven to improve outcomes and reduce hospital admissions.

| Key Insights | Details |

|---|---|

|

U.S. Retail Pharmacy Market Size (2025E) |

US$670.6 Billion |

|

Market Value Forecast (2032F) |

US$901.4 Billion |

|

Projected Growth (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

The rapid adoption of ePharmacies and doorstep delivery services is reshaping the U.S. retail pharmacy market. Growing internet literacy—around 96% of Americans use the internet-has fueled demand for convenient, affordable access to medicines, especially when products are unavailable in local stores.

In October 2024, Amazon introduced 24-hour drug delivery in select cities using e-bikes, drones, and electric vehicles, leveraging AI and machine learning to streamline prescription management. The company also announced plans to expand same-day prescription delivery to 20 additional cities in 2025, including Boston, Dallas, and San Diego, covering nearly half of the U.S. population.

This shift reflects the larger digital transformation of healthcare, with recent studies highlighting that one-third of consumers prioritize convenience over credentials for non-emergent care. Research further indicates that 58% of Americans visit local pharmacies first for basic health needs, and 81% trust pharmacists or advanced practitioners for care advice.

Over the past two decades, consolidation, expanded retail pharmacy services, and digital entrants such as Amazon have reshaped market competition, influencing drug prices, accessibility, and the future structure of the U.S. pharmacy industry.

The growing prevalence of chronic illnesses such as diabetes, cancer, heart failure, and immunological disorders is significantly propelling the U.S. market. According to the Centers for Disease Control and Prevention (CDC 2024), about 129 million Americans live with at least one major chronic condition, creating sustained demand for long-term medication and pharmacy services.

This demand is further intensified by an aging population—nearly 58 million Americans are 65 or older, a number expected to reach 88.8 million by 2060. Older adults are disproportionately affected, with 93% having at least one chronic illness and 80% managing two or more. Overall, 27% of U.S. adults suffer from multiple chronic diseases, costing the healthcare system over USD 1 trillion annually (National Council on Aging, 2025).

In response, pharmacies are enhancing affordability and access through digital and in-store solutions. In October 2025, GoodRx launched its “RxSmartSaver” program across Kroger pharmacies nationwide, offering direct medication savings at the counter to improve patient experience and strengthen pharmacy economics. This convergence of chronic disease management, population aging, and innovative affordability models continues to reshape the growth trajectory of the U.S. retail pharmacy market.

The U.S. retail pharmacy sector faces mounting headwinds despite growing demand for prescription and direct care services. Increasing drug and vaccine volumes, frequent regulatory recalls due to manufacturing defects or safety concerns, and limited reimbursement frameworks continue to pressure margins and erode consumer trust. Patients also grapple with high out-of-pocket costs, while novel therapies complicate regulatory oversight and distribution systems.

The offline retail pharmacy channel has been shrinking amid intense consolidation and financial distress. Rite Aid filed for bankruptcy again in May 2025—just seven months after its previous restructuring—while Walgreens announced plans in late 2024 to close 1,200 stores over three years, including 500 in 2025. In contrast, CVS Pharmacy completed its acquisition of select Rite Aid assets in October 2025, taking over 63 stores and prescription files from 626 pharmacies across 15 states, serving over nine million new patients and hiring 3,500 former employees.

Meanwhile, Pharmacy Benefit Managers (PBMs) control 79% of the sector, inflating drug costs and reducing affordability. Though reforms such as the Pharmacy Benefit Manager Transparency Act aim to curb PBM dominance, sustained cost pressures, reduced prescription volumes, and declining foot traffic remain key restraints to U.S. retail pharmacy growth.

The U.S. retail pharmacy market is experiencing strong growth opportunities driven by rising consumer demand for convenience and digital access to healthcare. With 92% of Americans—over 307 million people—owning smartphones, online platforms have become integral to medication purchases. The COVID-19 pandemic further accelerated this shift toward mail-order and ePharmacy models. Around 15% of U.S. consumers now prefer online pharmacies for their affordability, accessibility, and reliability, particularly for chronic disease management.

Major retail chains are rapidly enhancing their digital and technological capabilities. In January 2024, Walgreens launched a mobile app offering advanced prescription management tools, while CVS employs centralized AI and robotics to support over 9,000 stores. Walgreens’ robotic hubs fill 60% of prescriptions for nearly 3,000 outlets, and Walmart’s automated facilities process up to 100,000 prescriptions daily, aiming to cover 90% of stores by 2026.

Automation and AI integration are improving operational efficiency, reducing medication errors, and enhancing patient satisfaction—boosting pharmacy service scores by 15–22% and pharmacist productivity by up to 33%. These innovations position digital and mail-order pharmacies as pivotal drivers of future growth and customer loyalty across the U.S. retail pharmacy ecosystem.

The rise of specialty and biologic medications is transforming the U.S. retail pharmacy landscape, creating significant growth opportunities. Biologics such as Humira, which precisely target disease pathways, are increasingly preferred for managing chronic and complex conditions. Advances in pharmacogenomics and personalized medicine now enable pharmacies to tailor treatments to individual genetic profiles, improving therapeutic outcomes and patient adherence.

Leading retail chains, including Walgreens and CVS Health, are partnering with genomics firms to integrate these innovations into routine care, optimizing medication efficacy for patients with long-term illnesses. The growing demand for high-touch, personalized services—such as patient counseling, education, and adherence programs—is further establishing retail pharmacies as key players in chronic disease management.

Digital integration is also enhancing personalization. Pharmacists can now deliver educational content, videos, and medication guidance through digital platforms, including text messages, emails, QR codes, and web links—offering patients greater flexibility and engagement than traditional paper leaflets. Together, these developments in personalized therapy and digital health tools are positioning U.S. retail pharmacies at the forefront of precision-driven, patient-centric care delivery.

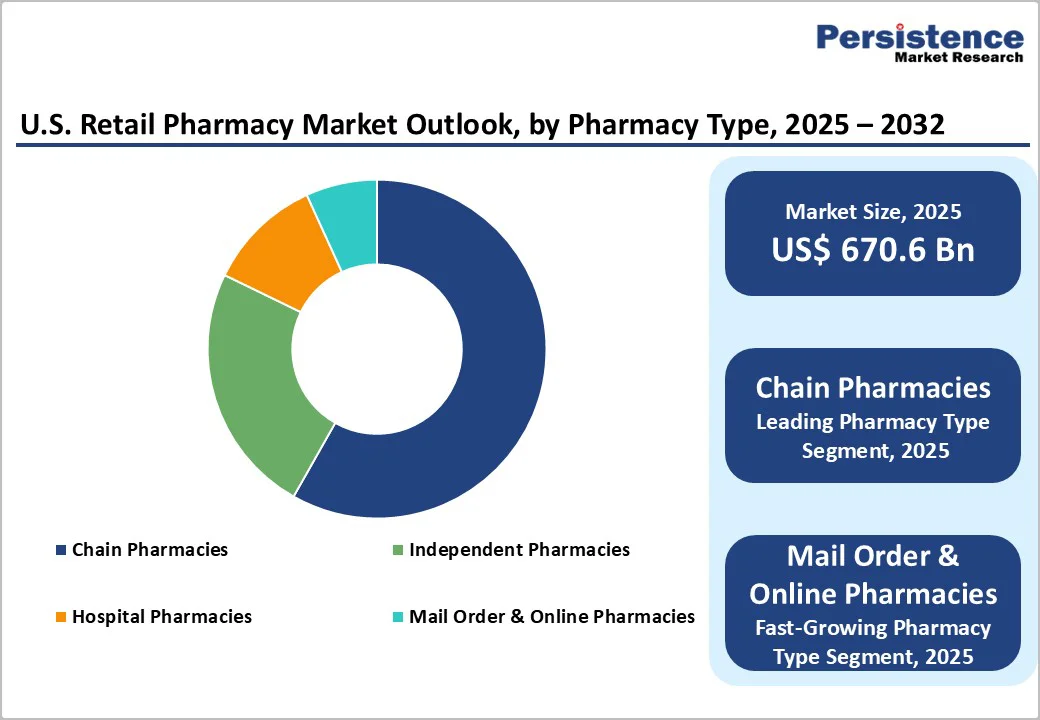

Chain pharmacies are projected to command a 58.2% revenue share of the U.S. retail pharmacy market by 2025, driven by widespread consolidation and expanding retail networks. Over the past three decades, vertical and horizontal mergers have transformed the industry, allowing large players such as CVS, Walgreens, and Walmart to dominate prescription sales.

Of approximately 60,000 U.S. retail pharmacies, two-thirds now comprise chains, supermarkets, and mass retailers, reflecting their growing dominance in prescription sales. Meanwhile, mail-order and online pharmacies continue to emerge as strong competitors, reshaping consumer preferences and expanding access beyond traditional brick-and-mortar outlets.

Prescription drugs (Rx) are projected to account for 54.7% of the U.S. retail pharmacy market by 2025, driven by the growing prevalence of chronic diseases and an aging population. With 38.4 million Americans living with diabetes (CDC, 2024), demand for long-term medication management continues to surge in the forthcoming years.

Pharmacies are expanding patient-focused services, improving medication adherence, and positioning themselves as integrated healthcare hubs. By ensuring better access to essential treatments, this trend not only strengthens prescription revenues but also enhances overall healthcare outcomes, making Rx drugs the key growth driver in the U.S. retail pharmacy landscape.

Generic drugs are projected to capture a dominant 67.2% share of the U.S. retail pharmacy market by 2025, driven by affordability, accessibility, and increasing FDA approvals. Generics now account for about 90% of all prescriptions dispensed, offering substantial cost savings—over US$400 billion in 2022 alone.

Pharmacies benefit from higher margins on low-cost generics, averaging 42.7% compared to 3.5% for branded drugs. As more blockbuster drugs lose patent protection, generics and biosimilars continue to expand their footprint, reinforcing their role as the primary revenue and volume drivers in the U.S. pharmacy market.

The U.S. retail pharmacy market, projected to grow at a CAGR of 4.3% over the forecast period, remains a cornerstone of the healthcare ecosystem—providing essential medications, preventive services, and patient care. Dominated by retail giants such as CVS and Walgreens alongside independent and mail-order pharmacies, the industry continues to evolve with expanding digital adoption and pandemic-driven behavioral shifts.

Rising chronic disease prevalence has fueled demand for both prescription and over-the-counter drugs—over 131 million Americans used prescription medications in 2023. Pharmacies have also diversified their services, administering more than 50 million flu shots during the 2022–2023 season and deploying AI-driven prescription systems to improve efficiency and patient engagement.

Regional variations further shape growth opportunities. The Northeast leads in pharmacy spending and specialty care integration, while rural Midwest regions rely heavily on independent and mail-order pharmacies—over half of which are locally owned. In the South, population aging and chronic illnesses are driving drug demand, though “pharmacy deserts” persist in underserved communities.

According to CVS Health’s 2025 Rx Report, 77% of adults trust their local pharmacists, 80% prefer in-person care, and 65% of professionals seek greater technology integration—underscoring strong opportunities for hybrid, tech-enabled, and patient-centric retail pharmacy models.

A few large corporations, such as CVS Health Corporation, Walgreens Boots Alliance, Inc., and Cigna, control most of the pharmaceutical industry in the U.S. These firms are extending their businesses by opening both physical pharmacies and online pharmacy platforms. Some of the organizations are enhancing medication accessibility and improving drug distribution efficiency through technological innovations.

These include telehealth services, digital prescription management, and innovative inventory management systems. Healthcare organizations are also forming strategic partnerships with other providers and technology firms to extend their product offerings and improve service delivery. These strategies are enhancing innovation and helping companies to respond more effectively to consumer needs, ultimately aiming to improve healthcare outcomes nationwide.

The global market is projected to be valued at US$ 670.6 Billion in 2025.

Rising chronic disease prevalence, aging population, and expansion of clinical and digital pharmacy services are key growth drivers.

The global market is poised to witness a CAGR of 4.3% between 2025 and 2032.

Telepharmacy, personalized medicine, home delivery, and integration of AI-driven health management solutions present major growth opportunities.

Major players in the global are CVS Health, Walgreens Boots Alliance, Inc., Cigna Healthcare, UnitedHealth Group, Walmart, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage (Zones) |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Pharmacy Type

By Prescription Type

By Product

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author