ID: PMRREP34542| 200 Pages | 8 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

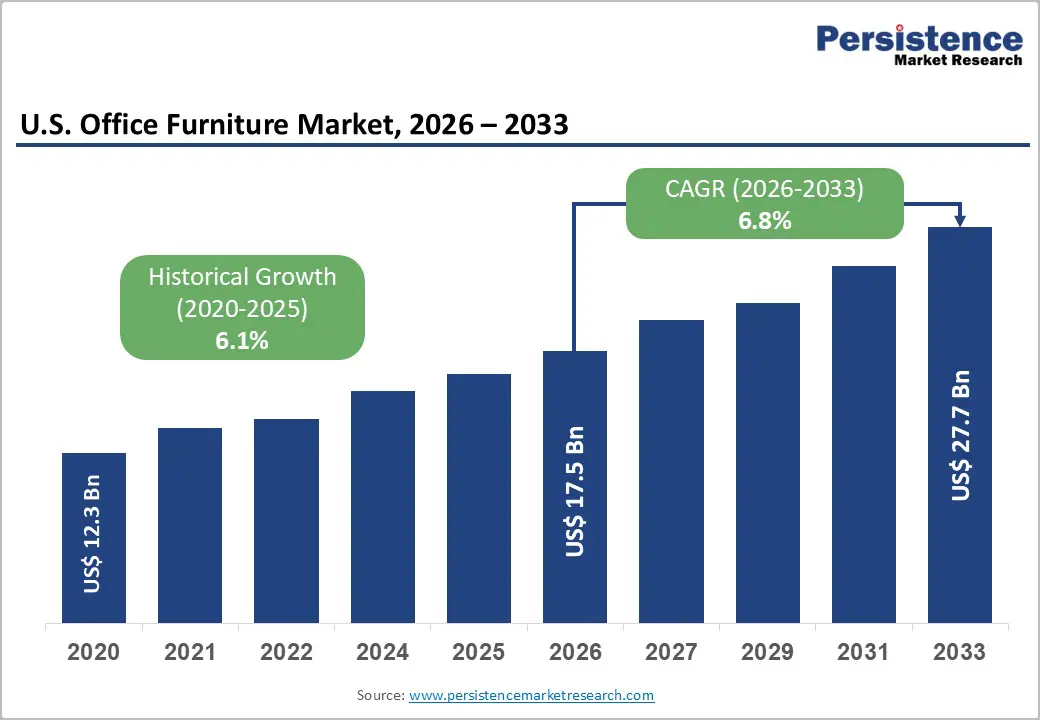

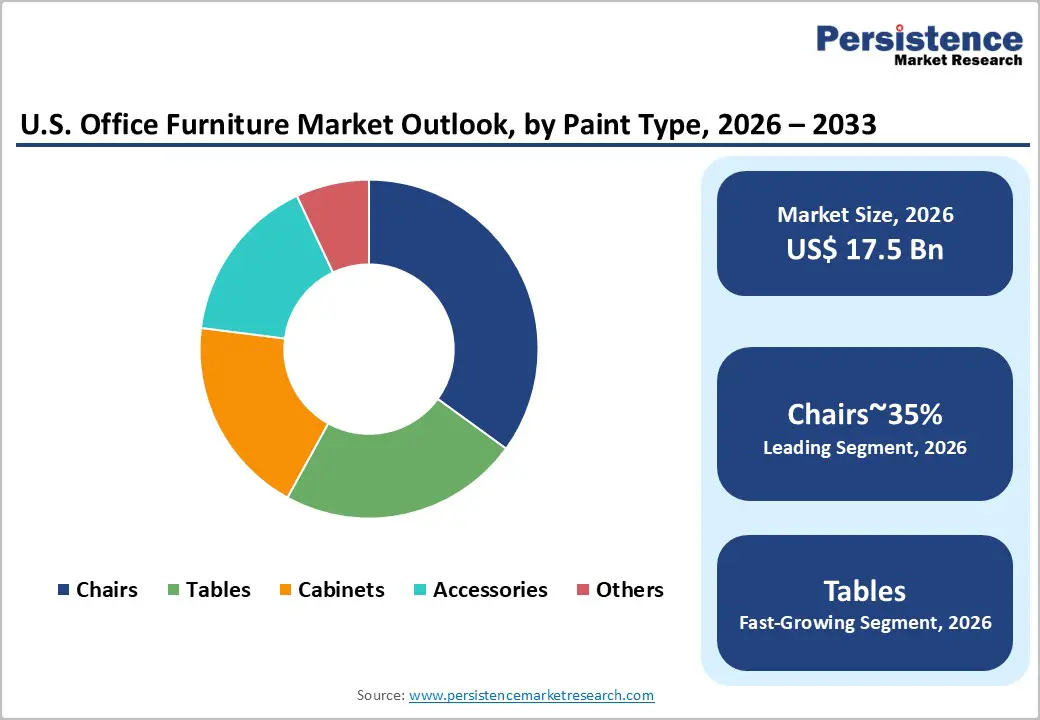

The US office furniture market size is likely to be valued at US$ 17.5 billion in 2026 and is expected to reach US$ 27.7 billion by 2033, growing at a CAGR of 6.8% during the forecast period from 2026 and 2033.

The market is witnessing a fundamental transformation driven by the permanent adoption of hybrid work models and the subsequent reimagining of physical office spaces.

| Key Insights | Details |

|---|---|

| US Office Furniture Market Size (2026E) | US$ 17.5 Billion |

| Market Value Forecast (2033F) | US$ 27.7 Billion |

| Projected Growth CAGR (2026 - 2033) | 6.8% |

| Historical Market Growth (2020 - 2025) | 6.1% |

The ongoing shift to hybrid work models remains a major growth driver for the US Office Furniture Market, compelling organizations to redesign traditional office layouts into flexible, collaborative environments. As employees split their time between home and the office, workplaces are evolving from task-oriented settings into hubs for interaction, collaboration, and team engagement. This transformation requires companies to replace outdated cubicles with modular lounge seating, acoustic pods, hot-desking systems, and adaptable meeting zones that support multiple work styles. To meet higher expectations for comfort, functionality, and employee experience, organizations are investing more per square foot, sustaining demand for modern, design-forward furniture solutions.

In 2025, Steelcase launched its modular workplace solution Be My Guest, specifically designed for hybrid work environments. The system features acoustic booths, connect booths, and configurable canopy and wall components that enable organizations to easily reconfigure spaces for focus or collaboration. This launch highlights how leading manufacturers are directly responding to hybrid work demands by enabling agile, people-centric office environments.

Employee wellness has become a strategic priority for companies, directly influencing furniture purchasing decisions across industries. Guidance from OSHA and the CDC continues to highlight the risks associated with prolonged sitting, driving organizations to adopt ergonomic, active-work furniture. Height-adjustable desks, sit-stand converters, and advanced ergonomic chairs are now widely integrated into wellness programs as tools to boost productivity and minimize health issues.

The human-centric design movement further strengthens this shift, positioning well-engineered furniture as essential for employee satisfaction and retention. Data from BIFMA shows that the ergonomic seating segment consistently outperforms the broader furniture market, largely due to corporate initiatives aimed at reducing musculoskeletal injuries and insurance costs. This focus on health-conscious work environments is expanding demand for premium adjustable furniture across corporate offices, hybrid setups, and employer-supported home offices.

Manufacturers face ongoing challenges due to fluctuating prices of key raw materials such as steel, aluminum, lumber, and petroleum-based foams. The producer price index for furniture manufacturing has become increasingly unstable due to global trade tensions, supply shortages, and unpredictable shipping costs. Leading companies like HNI Corporation and MillerKnoll have reported margin pressures triggered by steel tariffs, freight rate volatility, and rising input expenses.

These cost fluctuations make it difficult for manufacturers to maintain stable pricing for long-term agreements, often resulting in temporary surcharges that deter budget-sensitive SMEs. Additionally, heavy reliance on global supply chains exposes manufacturers to disruptions, forcing them to hold extra inventory to mitigate delays. This increases working-capital requirements, reduces operational flexibility, and ultimately impacts profitability, making raw material instability a significant restraint for the market.

The link between commercial real estate (CRE) activity and office furniture demand makes high interest rates a major constraint for the industry. Elevated borrowing costs have slowed new office construction and reduced the pace of property transactions and interior renovation projects. As developers and building owners face higher financial burdens, budgets for tenant improvements, including furniture, are often delayed or scaled back. Trends reflected in the AIA Architecture Billings Index indicate periods of weak commercial demand, signaling project postponements across key markets.

This environment forces furniture suppliers to compete aggressively for a smaller pool of active projects, often lowering prices to stay competitive. As a result, adoption of premium, design-rich furniture systems is delayed in cost-sensitive regions, putting pressure on manufacturers’ margins and slowing overall market growth during high-rate cycles.

A major opportunity for growth lies in the integration of IoT-enabled and data-driven smart furniture systems. As companies look to optimize space usage and improve employee experience, demand is rising for office furniture equipped with sensors that monitor occupancy, usage behavior, and environmental conditions. Leading brands like Steelcase and Herman Miller are developing connected desks, booths, and collaboration units that integrate with building management platforms to deliver real-time insights. These solutions help facility managers optimize layouts and reduce operating costs while offering employees app-based booking and personalized workspace features.

As 5G infrastructure strengthens, smart furniture adoption is expected to accelerate, creating opportunities for manufacturers to introduce subscription-based software services. This transition shifts furniture from a one-time asset purchase to a recurring-revenue model, unlocking long-term value and enhancing workplace performance through technology.

The rise of remote and hybrid work continues to boost demand for “resimercial” office furniture-products that combine commercial-grade durability with a home-friendly aesthetic. With millions of US employees working from home permanently or part-time, the home office is now a long-term lifestyle requirement rather than a temporary adjustment. This shift presents a strong opportunity for manufacturers to diversify into direct-to-consumer channels or partner with lifestyle retailers like West Elm and Crate & Barrel.

By adapting ergonomic features and performance standards typically found in corporate settings, brands can appeal to households seeking comfortable, professional setups. Corporate home-office stipends further add to this demand. This dual-channel opportunity effectively broadens the total addressable market, allowing furniture makers to serve both large enterprises and individual consumers, significantly expanding revenue potential.

Chairs remain the largest product category in the US office furniture market, representing around 35% of total market share. Their dominance stems from the essential need for seating across all types of work environments-including corporate headquarters, coworking spaces, small offices, and home offices. The continued demand for ergonomic task chairs, designed to lower employee health risks, plays a major role in driving sales.

Leading models such as the Herman Miller Aeron and Steelcase Leap have set industry benchmarks for performance and longevity, creating steady replacement cycles tied to warranties and evolving design standards. In addition to traditional task chairs, the growing adoption of lounge seating, stools, collaborative chairs, and soft seating for flexible workspaces further expands this category. As companies redesign workplaces for hybrid collaboration, seating continues to account for the highest share of product demand.

Wood remains a highly favored material in the office furniture market, accounting for approximately 42% of total value due to its premium look, warmth, and versatility. It is widely preferred for executive workspaces, formal meeting rooms, reception areas, and high-end collaborative spaces where aesthetics and brand image are important. The growing “resimercial” design trend further strengthens demand for wood and wood-veneer products by creating a home-inspired feel within modern offices.

While metal remains dominant for internal structural components, wood is essential for tabletops, cabinetry, storage solutions, and decorative elements. Innovations in engineered wood and sustainable forestry practices have enhanced durability, lowered cost, and improved environmental performance, making wooden furniture more accessible across budget categories. These advancements ensure wood remains a leading choice for both traditional office designs and contemporary, design-centric workplaces.

Retail stores continue to play an important role in office furniture distribution, especially for the Small Office/Home Office (SOHO) market, holding roughly 28% share. Physical stores offer customers the benefit of testing comfort, material feel, and product durability before purchasing, particularly valuable for chairs and ergonomic setups. Big-box retailers such as Office Depot, Staples, and IKEA meet immediate needs for freelancers, small businesses, and home office users.

Despite the rise of online purchasing, the convenience of same-day buying, in-store product trials, and personalized support keeps retail outlets relevant. Additionally, many leading contract furniture manufacturers are launching branded experience centers and showrooms in major cities to connect directly with corporate buyers and designers. This strengthens the value of physical retail environments by supporting consultative selling and informed purchase decisions.

E-commerce platforms are the fastest-growing distribution channel, increasing rapidly to capture about 22% of the market. This expansion is driven by the digitization of B2B purchasing, the rise of small businesses, and the growing preference for online home-office setups. Platforms like Amazon Business, Wayfair Professional, and manufacturer-owned digital stores offer large product ranges, transparent pricing, fast delivery, and easy comparison tools.

Online configurators, AR-based room planners, and seamless shipping to residential addresses make e-commerce especially attractive for remote workers and startups. Direct-to-consumer strategies also allow manufacturers to bypass dealers for smaller orders, improving margins and enhancing reach. With hybrid work reshaping professional purchasing behavior, online channels are becoming essential for capturing diverse, fragmented, and fast-moving demand from both individuals and organizations.

Specialty furniture stores account for around 18% of market share and cater to a high-value segment focused on premium design, ergonomics, and customization. These stores often act as authorized dealers for leading brands such as Knoll, Haworth, and Teknion, offering curated collections and expert guidance that general retailers cannot match. They are particularly strong in markets where personalized service, design consultation, and long-term client relationships play a crucial role in purchasing decisions.

Specialty stores excel in providing value-added services, including ergonomic assessments, tailored space planning, and professional installation. Their emphasis on quality and bespoke solutions makes them a preferred choice for luxury home offices, boutique firms, and design-driven organizations. Despite competition from e-commerce and big-box stores, their specialized expertise and exclusive offerings sustain their relevance and demand.

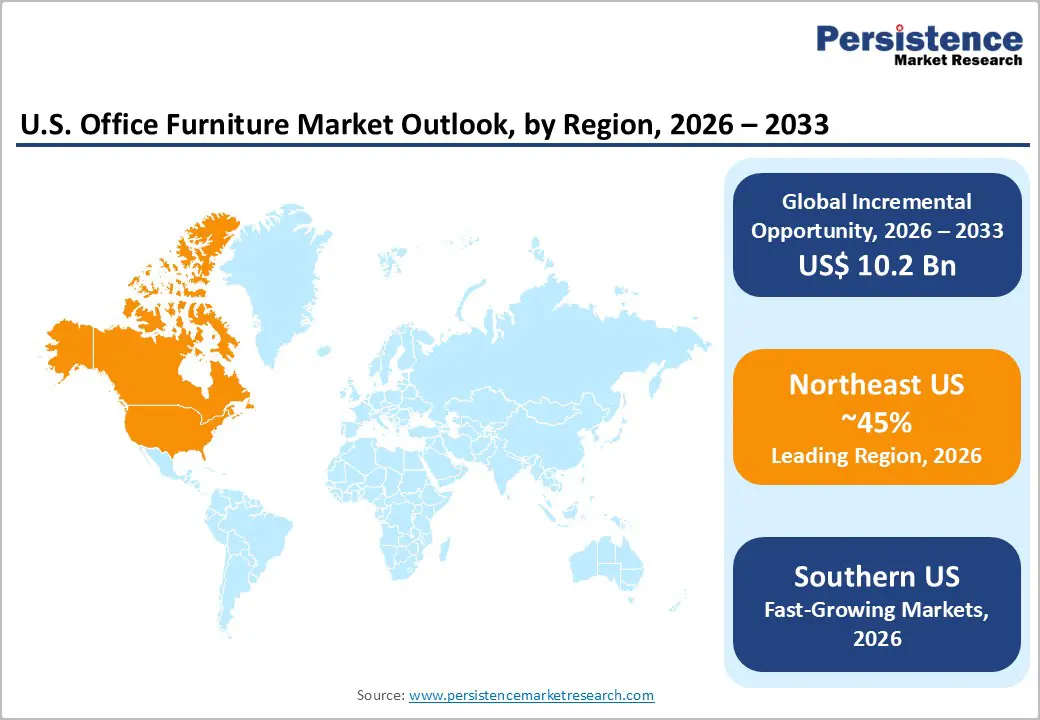

The Northeast remains one of the strongest regions for the US Office Furniture Market, supported by its concentration of corporate headquarters, financial institutions, legal firms, and design studios in cities such as New York, Boston, and Philadelphia. The region shows a high preference for premium, design-centric furniture that aligns with corporate branding and helps attract top talent. With many Wall Street and consulting firms enforcing structured return-to-office policies, demand for upgraded work environments has grown significantly.

Strict sustainability regulations in the region also push companies to procure BIFMA LEVEL-certified, environmentally compliant products. The Northeast is consistently among the earliest adopters of innovative solutions such as acoustic pods, architectural partitions, and high-end collaboration furniture. These factors maintain the region’s position as a mature but high-value growth market for manufacturers.

The Southern region is emerging as the fastest-growing market for office furniture, driven by strong population growth, rising commercial development, and business migration to states like Texas, Florida, and Georgia. Favorable tax environments and lower operating costs have attracted numerous corporate relocations from coastal cities, resulting in a notable increase in new office space construction.

This development has generated substantial demand for furniture across a wide range of sectors, including technology, logistics, customer support centers, and expanding corporate campuses in cities like Austin and Atlanta. The South also benefits from rising demand for educational and healthcare furniture due to rapid regional expansion. With a balanced need for cost-effective solutions and premium corporate fit-outs, the region presents significant opportunities for manufacturers seeking diversified revenue streams and long-term growth.

The Western US, led by California and Washington, continues to serve as a hub for innovation within the office furniture sector. Dominated by technology companies and creative industries, the region is a leader in adopting agile, flexible, and collaborative workspace designs. Furniture that supports fast-paced team workflows-such as mobile tables, modular seating, and reconfigurable collaborative systems-is in high demand.

Despite recent adjustments in the tech industry, the region’s strong innovation culture maintains consistent investment in forward-thinking workplace solutions. Western states also place strong emphasis on sustainability, often exceeding national standards, with many RFPs requiring net-zero manufacturing practices and circular lifecycle programs. Additionally, the strong presence of startups and remote professionals fuels demand for modern home office setups. Brands like Herman Miller and Steelcase maintain significant West Coast distribution networks to serve this design-driven market.

The U.S. Office Furniture Market has historically been an oligopoly dominated by a few massive "contract" manufacturers, and recent events have dramatically consolidated this structure. The market is now highly concentrated, following the aggressive M&A activity of top players aiming to achieve scale and diversify their portfolios across price points and verticals. Strategies have shifted from pure manufacturing to holistic "workplace solutions," where companies offer design, technology, and asset management services. Key differentiators now include the ability to offer a "kit of parts" for hybrid work, robust digital tools for dealers, and proven sustainability credentials. The entry of HNI Corporation into the mega-cap tier has fundamentally altered the competitive balance, forcing remaining independents to seek niche specializations or mergers to survive.

The U.S. office furniture market is projected to reach US$ 27.7 Billion by 2033, expanding from US$ 17.5 Billion in 2026.

The shift to hybrid work models and the redesign of offices into collaborative, ergonomic-focused "destination" spaces are the primary growth drivers.

Chairs are the leading segment, driven by the universal need for ergonomic seating in both corporate and home office environments.

The Southern US is the fastest-growing region, fueled by favorable business climates and significant corporate migration.

Developing Smart Furniture with integrated IoT technology for space management and data analytics offers immense future potential.

Major players include HNI Corporation, MillerKnoll, and Haworth.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Distribution Channel

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author