ID: PMRREP21685| 157 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

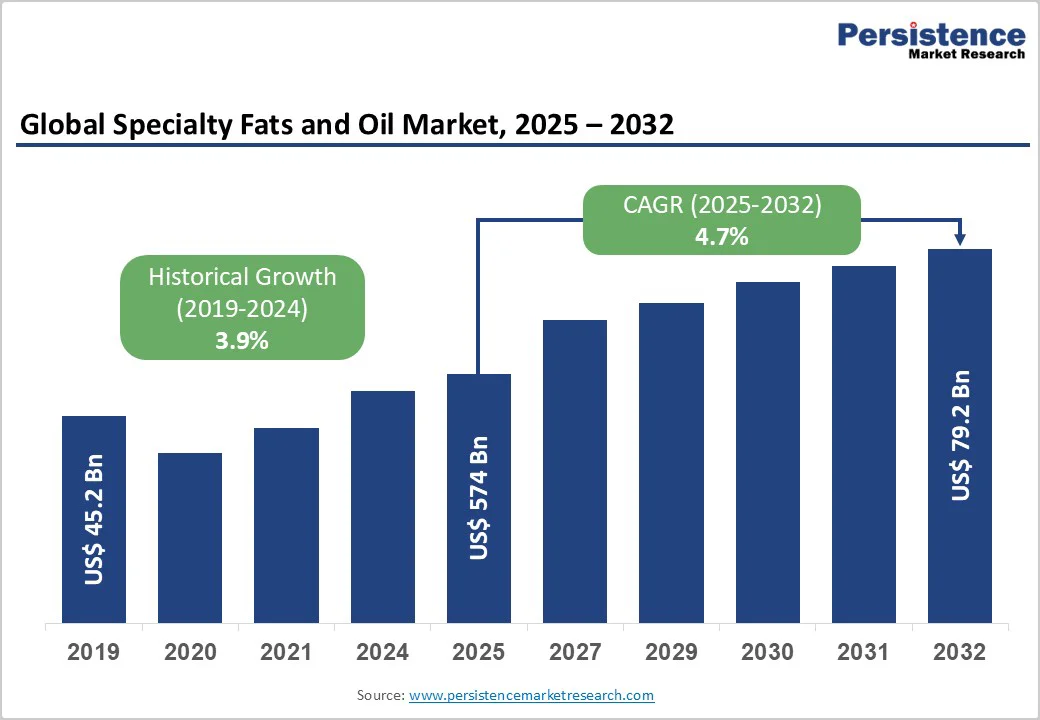

The global specialty fats and oils market size is likely to be valued at US$57.4 Billion in 2025 and is expected to reach US$79.2 Billion by 2032, growing at a CAGR of 4.7% during the forecast period from 2025 to 2032, driven by rising demand from the bakery, confectionery, dairy alternatives, and processed food industries. Customized fats and oils improve texture, taste, and stability while meeting clean-label and trans-fat-free standards. Rising demand for functional, plant-based ingredients and rapid food processing growth in Asia Pacific drive market expansion. Manufacturers emphasize sustainable sourcing, palm-free solutions, and tailored blends to meet diverse application needs.

| Key Insights | Details |

|---|---|

| Specialty Fats and Oils Market Size (2025E) | US$57.4 Bn |

| Market Value Forecast (2032F) | US$79.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.9% |

Trans-Fat Regulations and Health Reformulations

Stringent global regulations on trans fats have become a major catalyst, reshaping the specialty fats and oils market. Many countries, guided by WHO recommendations, have implemented partial or complete bans on industrially produced trans fatty acids due to their links with cardiovascular diseases. As a result, food manufacturers are investing heavily in reformulating their products using healthier fat alternatives, such as enzymatically interesterified oils, low-saturated blends, and naturally stable fats derived from shea, sunflower, and canola.

These advanced formulations not only eliminate harmful trans fats but also maintain desirable properties like texture, stability, and flavor. The ongoing shift toward heart-healthy, clean-label, and functional lipid solutions is fostering innovation and driving sustainable, science-based growth across global food applications.

Short Shelf Life of Certain Blends

Certain specialty fats and oils, particularly those with a high proportion of unsaturated fatty acids, face the critical challenge of limited shelf life due to oxidation and rancidity. These chemical reactions not only deteriorate flavor, aroma, and color but also compromise product functionality and nutritional value.

To maintain quality, manufacturers must invest in advanced stabilization methods such as antioxidant incorporation, nitrogen flushing, and controlled-temperature storage. Additionally, specialized packaging materials that limit oxygen and light exposure are required to extend shelf life. However, these added processes raise operational and logistics costs, especially in hot or humid regions where oxidation risk is higher. As a result, maintaining consistent product stability becomes both a technical and economic restraint for producers.

Cocoa Butter Equivalents (CBE) Expansion

The expansion of Cocoa Butter Equivalents (CBE) presents a major growth avenue in the specialty fats and oils market. With the rising cost and limited supply of cocoa butter, global confectionery and bakery manufacturers are turning to sustainable and cost-effective alternatives. CBEs derived from shea butter, palm mid-fractions, mango kernel, and illipe fats closely mimic the crystalline structure, melting behavior, and mouthfeel of natural cocoa butter.

These alternatives not only ensure product consistency but also enhance gloss, stability, and flavor release in chocolates and coatings. Moreover, CBEs align with clean-label and sustainability goals, offering ethical sourcing options and longer shelf life. As premium chocolate demand rises in emerging economies, CBE adoption is accelerating, creating high-margin opportunities for specialty fat producers.

Product Type Insights

The specialty oils segment leads the market primarily due to its broad application in both food and health-focused industries. Specialty oils such as canola, sunflower, olive, and high-oleic variants are increasingly used in nutraceuticals, dietary supplements, and functional foods owing to their rich nutritional profile and heart-healthy properties.

Rising consumer preference for plant-based, low-cholesterol, and omega-enriched oils has significantly boosted demand. Their role in enhancing flavor, improving stability, and providing essential fatty acids also makes them indispensable in cooking, infant nutrition, and processed foods. The growing awareness of preventive healthcare and the clean-label movement has further accelerated the adoption. In contrast, specialty fats are more application-specific, giving specialty oils a broader and faster-growing market base globally.

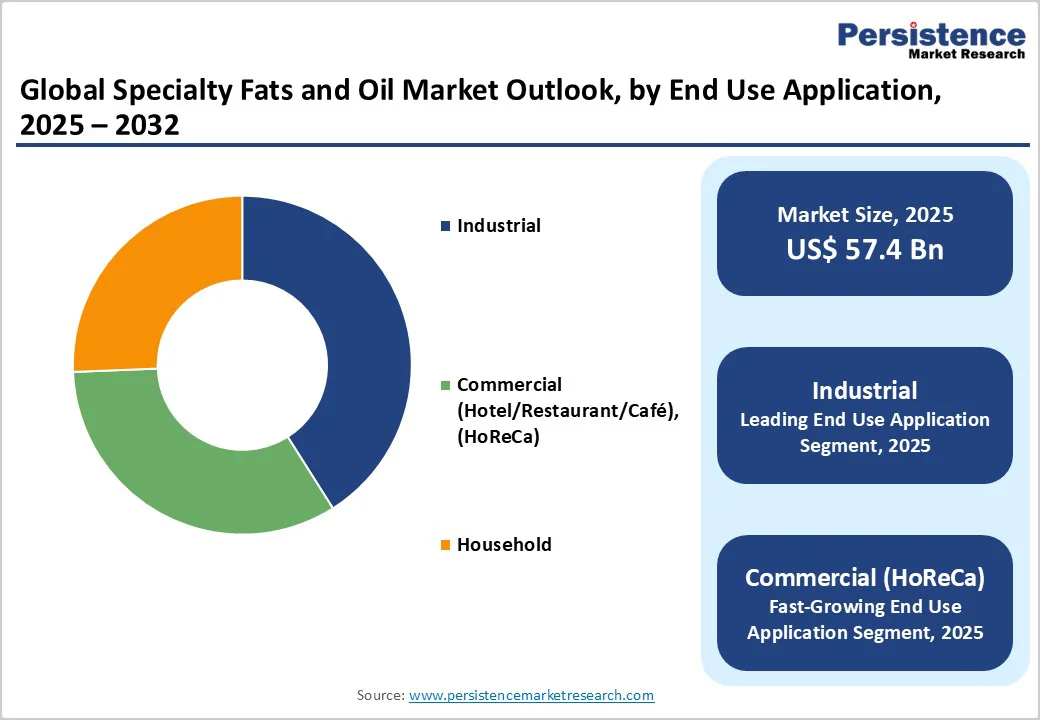

End-use Application Insights

The industrial segment dominates the market because specialty fats and oils are extensively used as key functional ingredients in large-scale food processing industries, including bakery, confectionery, dairy alternatives, snacks, and processed foods. These products require fats and oils with specific melting points, textures, and stability to achieve the desired taste and shelf life. Food manufacturers increasingly rely on customized formulations such as cocoa butter equivalents, specialty margarines, and frying oils to enhance product quality and production efficiency.

The growing demand for trans-fat-free and clean-label processed foods has encouraged industries to adopt advanced fat technologies. The industrial segment benefits from economies of scale, technological innovation, and high-volume demand, making it the largest contributor compared to HoReCa and household applications.

North America Specialty Fats and Oil Trends

North America, particularly the United States, leads the Specialty Fats and Oils market due to its highly developed food processing sector and strong consumer demand for premium, health-oriented products. The region’s growth is driven by rising use of specialty fats in bakery, confectionery, and dairy alternatives, along with a surge in clean-label, non-hydrogenated, and plant-based formulations. U.S. manufacturers emphasize innovation in palm-free, trans-fat-free, and functional fat blends to meet evolving health and sustainability standards. Moreover, increasing investments in R&D, advanced refining technologies, and the growing popularity of vegan and keto diets continue to reinforce North America’s leadership in this market.

Asia Pacific Specialty Fats and Oils Market Trends

The Asia Pacific region is emerging as the fastest-growing market for specialty fats and oils, driven by rapid urbanization, rising disposable incomes, and the expansion of the processed food sector. Countries, including India, China, Indonesia, and Malaysia, are witnessing surging demand for bakery, confectionery, and convenience foods requiring tailored fat formulations.

Local and multinational players are investing heavily in palm-based specialty fats, cocoa butter alternatives, and frying oils to cater to regional preferences. Growing awareness of health, coupled with a shift toward trans-fat-free and sustainable products, is reshaping consumption patterns. Additionally, strong palm oil production and strategic manufacturing hubs make the Asia-Pacific a key driver of global market growth.

The specialty fats and oils market features a competitive and innovation-driven landscape, characterized by technological advancements, product diversification, and sustainability-focused strategies. Manufacturers are emphasizing the development of trans-fat-free, palm-free, and functional fat blends to meet health-conscious and clean-label demands. Competition is intensifying as producers invest in advanced refining, enzymatic modification, and interesterification technologies to achieve superior product performance.

Key Industry Developments:

The specialty fats and oils market is projected to be valued at US$57.4 Billion in 2025.

The specialty fats and oils market is driven by several key factors that reflect changing consumer preferences and evolving food industry needs. Rising demand for processed, bakery, and confectionery products requiring customized fat compositions is a primary growth driver.

The global market is poised to witness a CAGR of 4.7% between 2025 and 2032.

The specialty fats and oils market offers several key opportunities driven by innovation, health awareness, and sustainability trends. Expanding demand for plant-based dairy and meat alternatives creates strong prospects for customized fat formulations that mimic animal textures.

The key players in the specialty fats and oils include Cargill Inc., Wilmar International Limited, Kiril Mischeff, and Riviana Foods Pty Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-use Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author