ID: PMRREP33540| 250 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

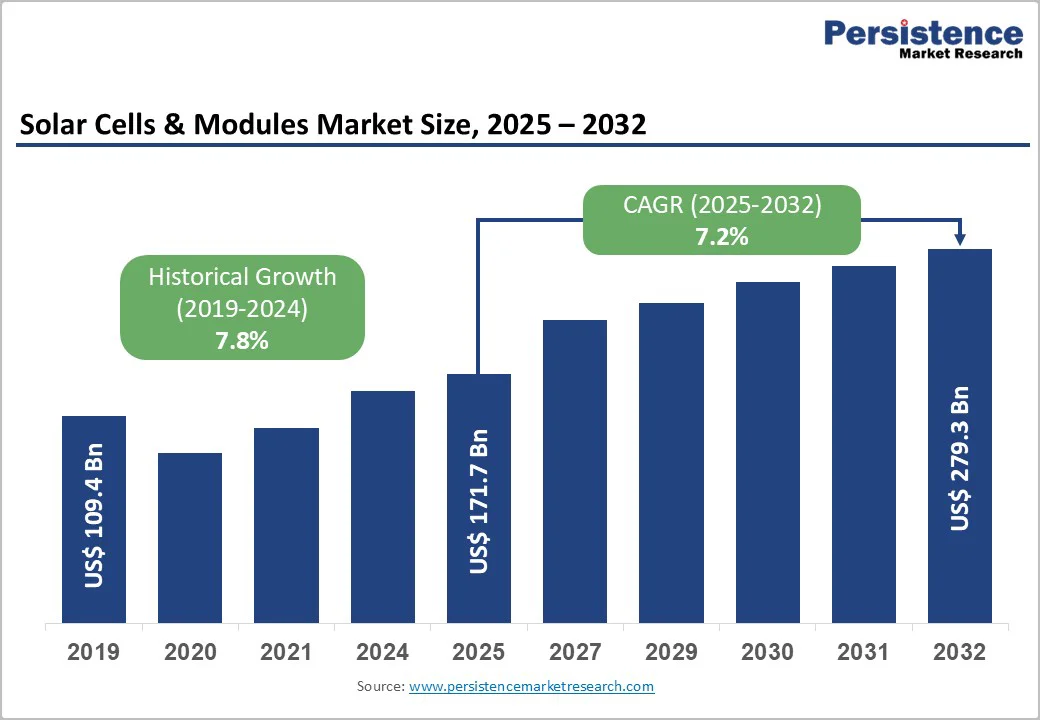

The global solar cells and modules market size is valued at US$ 171.7 billion in 2025 and projected to reach US$ 279.3 billion by 2032, growing at a CAGR of 7.2% between 2025 and 2032.

The market expansion is driven by unprecedented global photovoltaic installation records, with 602 gigawatts (GW) of solar capacity added in 2024, representing a 32% year-on-year increase according to REN21 Global Status Report, and electricity generation from solar reaching 475 terawatt-hours (TWh), representing a 30% increase.

Declining solar module manufacturing costs by approximately 5-8% in recent months and technological transitions toward high-efficiency N-type and bifacial solar cells are reshaping market dynamics.

| Key Insights | Details |

|---|---|

| Solar Cells & Modules Market Size (2025E) | US$ 171.7 billion |

| Market Value Forecast (2032F) | US$ 279.3 billion |

| Projected Growth CAGR (2025 - 2032) | 7.2% |

| Historical Market Growth (2019 - 2024) | 7.8% |

Global solar photovoltaic installations achieved unprecedented records in 2024, with cumulative installed capacity surpassing 2.25 terawatts (TW), nearly doubling from 1.18 TW in 2022, representing one of the fastest technology deployments in human history.

Annual additions reached a record 602 gigawatts, equivalent to all solar capacity installed globally by year-end 2019, with 382 gigawatts of utility-scale installations representing a 43% year-on-year increase, according to the International Renewable Energy Agency (IRENA) and REN21 Global Status Report.

Major markets contributed substantially, with China installing 329 gigawatts, the United States 50 gigawatts, and India adding 30.7 gigawatts, representing a 145% annual increase. This explosive growth reflects fundamental market transitions driven by solar achieving grid parity across virtually all global markets, with International Energy Agency (IEA) data indicating solar represents 72% of all new electricity generation capacity installed globally in 2024.

The combination of aggressive national renewable energy targets, economic competitiveness versus fossil fuels, declining manufacturing costs, and supportive government policies creates structural demand conditions supporting sustained market expansion throughout the forecast period.

The solar industry is experiencing a fundamental technology transition toward advanced cell architectures featuring superior efficiency, reduced degradation, and improved performance under diverse environmental conditions. N-type solar cells, utilizing phosphorus doping, achieve efficiency levels exceeding 25.7% compared to traditional P-type cells limited to approximately 23.6%, with further improvements expected as manufacturing scales and technology matures.

Advanced cell technologies, including Topcon (Tunnel Oxide Passivated Contact), Heterojunction (HJT), and perovskite-silicon tandem configurations, offer efficiency potential exceeding 28-33%, positioning next-generation technologies as replacement cycles accelerate.

N-type technology market share is projected to reach about one-third of the global market by 2032, according to the International Technology Roadmap for Photovoltaics (ITRPV), driven by manufacturing capacity investments and declining cost differentials relative to conventional P-type alternatives, creating substantial demand for advanced solar cells and modules across residential, commercial, and utility-scale applications.

The global solar photovoltaic supply chain exhibits unprecedented geographic concentration, with China controlling 85% of each supply chain segment, including 93% of polysilicon production, 97% of wafer manufacturing, 85% of solar cell production, and approximately 80% of module manufacturing capacity, according to Climate Energy and manufacturing trend analysis.

Manufacturing overcapacity in Asia, particularly China, has generated surplus production capacity, driving solar module prices to historic lows of approximately €0.12 per watt in August 2025 in Europe and US$0.10 per watt for bifacial modules, creating margin pressures and industry unprofitability affecting approximately two-thirds of manufacturers.

Declining domestic demand in China following subsidy expiration has freed low-cost modules for export, triggering aggressive pricing competition and market destabilization. Additionally, protectionist trade measures, supply chain fragmentation requirements, and emerging alternative manufacturing regions create competitive pressures and uncertainty affecting market dynamics.

Despite record installations in 2024, demand softening emerged in 2025, with residential solar installations declining in multiple markets is driven by installer over-capacity, consumer hesitation following rapid price movements, and changing interest rate environments affecting financing accessibility.

The residential solar market exhibited particular volatility, with U.S. residential installations declining from 30% annual growth rates to modest single-digit growth, reflecting residential installer bankruptcies, consolidation, and market oversupply.

Germany and other European nations have implemented policy reversals, delayed climate timelines, and reduced renewable energy support, creating uncertainty affecting investment decisions and project pipeline development. Manufacturing competency gaps in emerging economies limit adoption of advanced cell technologies, constraining regional manufacturing expansion and creating competitive disadvantages affecting global supply chain development.

Bifacial solar modules offer strong market opportunities as N-type bifacial technologies are projected to grow at double-digit CAGR through 2032, supported by superior energy yields and falling production costs. Their ability to generate 25-35% additional power through rear-side irradiation makes them highly attractive for utility-scale solar plants, particularly in regions with high albedo conditions such as the United States, China, and India.

These markets are increasingly adopting bifacial systems for both ground-mounted projects and advanced rooftop solar PV deployments. Commercial rooftop projects also benefit from higher power density and improved long-term output in limited surface-area environments. While residential adoption remains modest, declining module prices and rising awareness of bifacial performance advantages indicate strong future potential across all distributed generation segments.

India and the MENA region present significant manufacturing-led expansion opportunities for the solar cells and modules market. India is rapidly strengthening its position through aggressive national targets of 500 GW by 2030 and robust manufacturing growth that expanded module capacity to 74 GW by March 2025. Rising export volumes, reaching about 5.8 GW in 2024, highlight the country’s emergence as a competitive alternative to Chinese suppliers.

Major players such as Waaree Energies, backed by Tier 1 BNEF recognition and U.S. facility expansion, further reinforce India’s global footprint. Parallel growth in the MENA region is driven by tariff advantages, strategic trade access to Europe and Africa, and strong governmental support.

These developments open substantial opportunities for technology suppliers, equipment manufacturers, and investors seeking entry into cost-competitive, fast-scaling global solar production hubs.

Crystalline silicon technology dominates the market with 94% share in 2025 due to decades of manufacturing maturity, proven reliability exceeding 25 years, and strong global supply chain integration. Among Crystalline silicon technology, Monocrystalline cells hold more than 60% share owing to higher efficiency and residential appeal, while polycrystalline cells account for the rest in cost-sensitive markets.

Although P-type PERC technology remains significant, its share is declining as N-type Topcon and heterojunction cells gain momentum, marking a major manufacturing shift. Thin-film technologies, including CdTe, CIGS, and amorphous silicon, collectively hold minor share, constrained by lower efficiencies, though perovskite thin-film innovations present future commercialization potential.

The residential segment leads with 50% share in 2025, supported by subsidies, net metering policies, and rising electricity tariffs that strengthen the case for rooftop solar adoption. Increasingly accessible financing mechanisms such as loans, leases, and PPAs help reduce upfront costs, with installation prices falling to US$ 2-3 per watt in developed markets and US$ 1.5-2 per watt in emerging regions.

Commercial applications hold the second-largest share, driven by corporate sustainability commitments and long-term cost-saving goals supported by large PPA-backed procurement. Miscellaneous applications, including telecom, off-grid systems, portable solar panels, BIPV, and floating solar, comprise the rest of the market and are growing rapidly, especially floating and integrated systems.

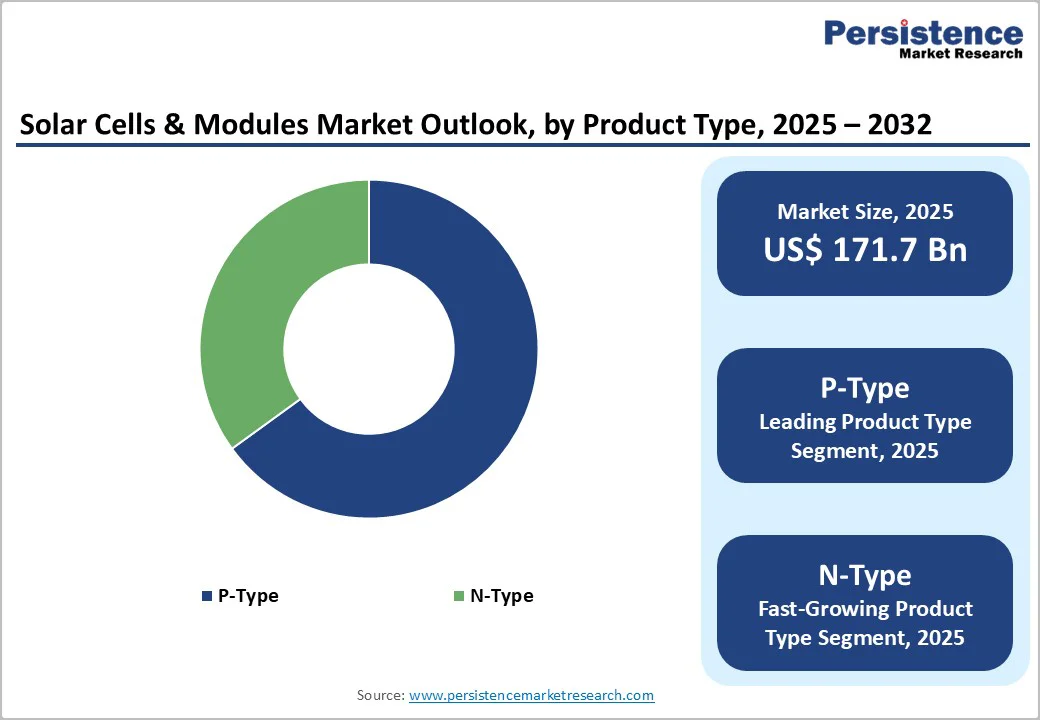

P-type solar cells dominate with 65% share in 2025 due to extensive manufacturing maturity, strong supply chain networks, and well-established PERC technology offering 22-23% efficiency at competitive cost. However, this segment is gradually declining as N-type technologies achieve faster adoption.

N-type Topcon cells deliver 23.5-24.5% efficiency, improved temperature performance, and enhanced bifacial output, while heterojunction cells exceed 24-25% efficiency with fewer processing steps, enabling cost and energy savings. With rising production investment and performance advantages, N-type technology is expected to reach parity with P-type by 2032, signaling a major shift in global manufacturing strategies and competitive dynamics.

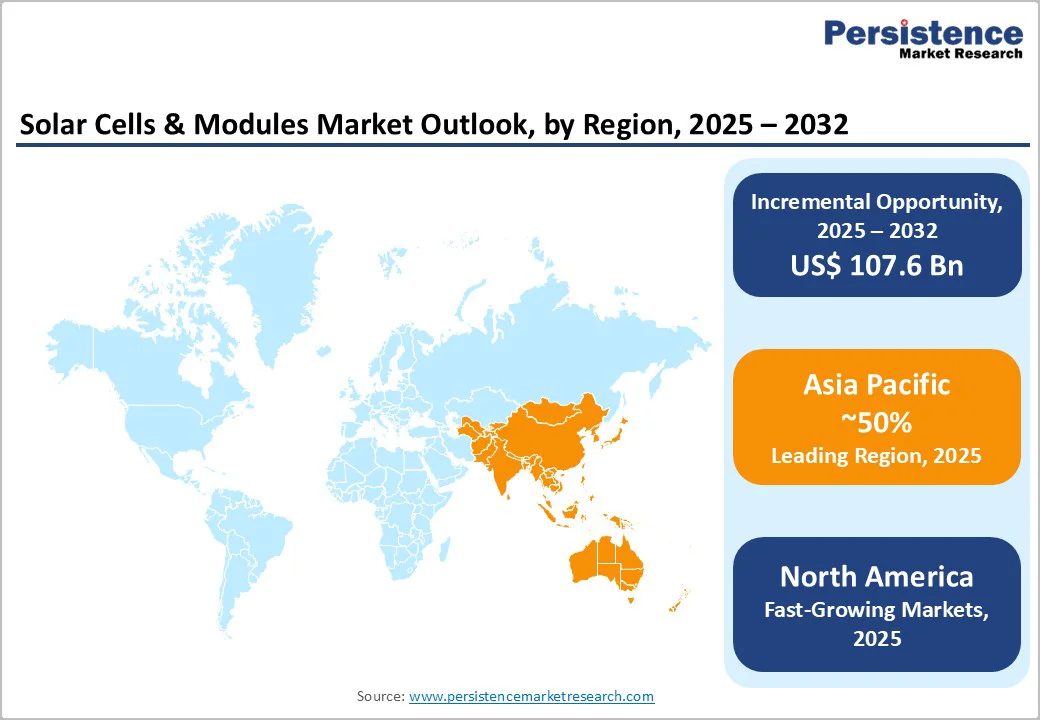

North America is emerging as one of the fastest-growing regions, projected to expand at a CAGR of 8% between 2025 and 2032, driven largely by the U.S. Solar PV Market, which benefits from the Inflation Reduction Act offering 30% Investment Tax Credits through 2032 alongside strong federal and state-level incentives.

The United States added 50 GW of new solar capacity in 2024, pushing cumulative installations to 224 GW and strengthening its position as the world’s second-largest solar market. Commercial deployment rose sharply, with 1.3 GW installed in Q1 2025-an increase of 108% year-over-year.

Domestic manufacturing momentum is accelerating, with 98 operational solar component facilities and 51 more under construction, although gaps remain between module and solar cell capacity. Supportive policies in California, Texas, and Florida further drive utility-scale and distributed adoption.

Residential solar remains robust, expected to grow at 9.5% CAGR, supported by rising electricity prices and strong customer satisfaction, with nearly 80% recommending solar to others.

Europe holds a strong position in the global solar landscape, accounting for about one third of global installation activity in 2025, driven by ambitious EU-wide climate policies under the Green Deal and Renewable Energy Directive requiring 42.5% renewable energy by 2030.

The region installed 71.4 GW in 2024, led by Germany’s 17.4 GW growth as the country targets 215 GW of cumulative capacity by 2030 and expands distributed generation through supportive feed-in tariffs. Spain, Italy, and France continue to remain major contributors to regional installations.

However, Europe faces a strategic challenge, with domestic manufacturing meeting less than 5% of its solar demand, resulting in heavy reliance on imports from China and other Asian countries. In response, Germany introduced a 2024 solar industrial strategy aimed at reviving large-scale module manufacturing and strengthening supply chain resilience.

European manufacturers increasingly compete on sustainability, offering low-carbon modules and circular economy innovations that appeal to premium market segments prioritizing environmental performance.

Asia-Pacific remains the undisputed global leader, representing 50% of the solar photovoltaic market in 2025, driven by China’s overwhelming manufacturing strength and rapid deployment across major economies. China installed 329 GW in 2024, with 60% of global additions, bringing cumulative capacity to around 1.1 TW, nearly half of global installed solar.

India is rapidly rising as a dominant force, adding 30.7 GW in 2024 and scaling module manufacturing capacity from 38 GW in 2024 to 74 GW by March 2025, with targets exceeding 110 GW by late 2025 supported by the Production Linked Incentive scheme. India’s module exports surged to 5.8 GW in 2024, with 97% shipped to the U.S., strengthening its position as a competitive alternative to Chinese suppliers.

Pakistan recorded exceptional growth, adding 17 GW in 2024, while Japan continues advancing solar adoption through disaster-resilient infrastructure and smart city initiatives. Ongoing expansion by manufacturers such as Waaree Energies highlights the region’s continuous capacity growth, while oversupply from China drives aggressive global pricing.

The global solar cells and modules market exhibits moderate consolidation, with the top 10 manufacturers accounting for more than 50% of module production capacity, while solar cell production remains highly concentrated with leading manufacturers dominating supply.

The competitive landscape reflects ongoing consolidation, with major players such as LONGi Solar, Trina Solar, JA Solar, JinkoSolar, Hanwha Q Cells, Canadian Solar, and Waaree Energies operating integrated facilities spanning polysilicon, ingots, wafers, cells, and modules.

Manufacturing excellence and vertical integration serve as key competitive differentiators, with companies controlling upstream processes achieving cost advantages of 10-15% over module-only manufacturers. A growing differentiator is the integration of building integrated photovoltaic (PV) Solar solutions within their offerings, supported by engineering expertise, efficient supply chains, and technical support for end-to-end deployment.

Manufacturers are also strengthening sustainability credentials through carbon-neutral operations, circular economy initiatives, recycling programs, and transparent supply chain practices, enabling premium positioning among environmentally conscious consumers.

The global solar cells and modules market is valued at US$ 171.7 billion in 2025 and is expected to reach US$ 279.3 billion by 2032, growing at a CAGR of 7.2% supported by rising global installations, cumulative capacity expansion, and continued module cost reductions.

Market growth is driven by record global photovoltaic installations, declining manufacturing costs, rapid transition to N-type and bifacial technologies, strong government incentives across major regions, and large-scale national targets such as India’s 500-gigawatt solar roadmap.

P-type solar cells lead the market with 65% share in 2025, while N-type cells are the fastest-growing category due to efficiency above 25.7%, lower degradation, and strong adoption in bifacial systems.

Asia-Pacific dominates the market with 50% share in 2025, supported by China’s supply chain leadership, India’s expanding capacity, and strong installation growth across China, India, and Southeast Asia.

Key opportunities include accelerating adoption of N-type bifacial modules, expanding manufacturing investments in India and the MENA region, rising regional capacity additions, and advancement of perovskite-silicon tandem technologies with efficiency potential beyond 33%.

Leading players include Waaree Energies, Canadian Solar, LONGi Solar, Trina Solar, JA Solar, JinkoSolar, BYD, and Hanwha Q Cells, all of which maintain strong technological capabilities and large-scale manufacturing footprints.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Million/Billion, Volume: Gigawatts (GW) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Application

By Product Type

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author