ID: PMRREP34473| 190 Pages | 31 Jan 2026 | Format: PDF, Excel, PPT* | Energy & Utilities

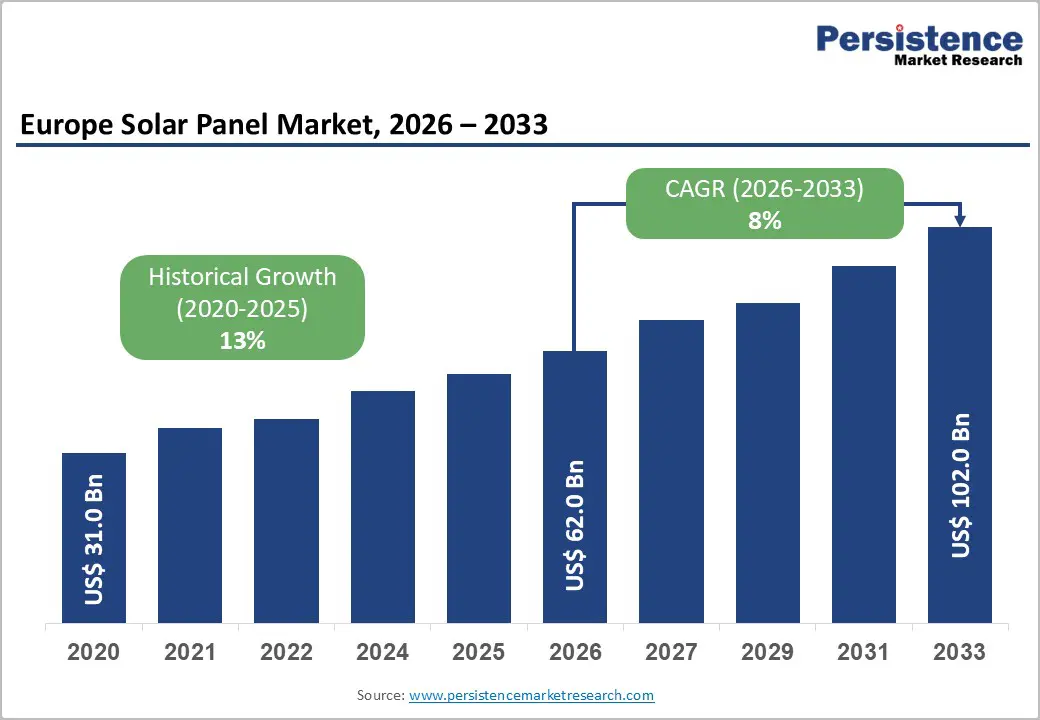

The Europe solar panel market size is likely to be valued at US$ 62.0 billion in 2026, and is projected to reach US$ 102.0 billion by 2033, growing at a CAGR of 8% during the forecast period 2026−2033.

This expansion is being driven by accelerating renewable energy adoption mandates across European Union member states, alongside continued declines in photovoltaic technology costs. Substantial government incentives are supporting clean energy infrastructure deployment, which is reinforcing investor confidence and enabling large-scale project execution across multiple national markets. Policy alignment under the European Green Deal is further strengthening demand, as long-term carbon neutrality targets for 2050 are catalyzing sustained capital allocation toward solar energy assets.

Technological innovation is also playing a critical role, as improvements in panel efficiency and integration with energy storage systems are enhancing reliability and return profiles. Adoption is therefore extending beyond utility-scale installations into residential and commercial segments, where distributed generation is supporting energy security and price stability. Market growth is likely to remain structurally supported by regulatory certainty, cross-border financing mechanisms, and continued performance optimization across the solar value chain.

| Key Insights | Details |

|---|---|

| Europe Solar Panel Market Size (2026E) | US$ 55.2 Bn |

| Market Value Forecast (2033F) | US$ 70.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8% |

| Historical Market Growth (CAGR 2020 to 2025) | 13% |

The European Union (EU) established the Renewable Energy Directive III (RED III) to require renewable sources to supply 42.5% of total energy consumption by 2030. EU policymakers position solar energy at the center of this ambitious goal. The REPowerEU initiative responds to urgent energy security needs. It directs substantial funding toward faster renewable energy deployment. Solar installations gain priority access to these resources. National governments implement supportive measures across member states. They offer feed-in tariffs and generous tax credits. Streamlined permitting processes now speed up project approvals. Developers complete timelines much more quickly than before. These combined actions stimulate demand throughout various customer segments.

Industry leaders view these policy frameworks as transformative forces for the solar sector, as they create predictable investment environments that attract institutional capital. Developers are gaining confidence to scale projects across diverse applications such as residential rooftops and utility-scale farms. Utilities integrate solar generation more effectively into national grids. Businesses pursue self-consumption models to lower operational costs and meet sustainability targets. Policymakers coordinate these efforts at both the EU and national levels. They balance rapid deployment with grid stability requirements. Companies position themselves to capture growth from this policy momentum. They focus on compliant technologies and localized supply chains. Strategic partnerships emerge between manufacturers, installers, and financial institutions. These collaborations strengthen the entire value chain and ensure long-term market resilience.

European transmission and distribution networks are facing growing capacity constraints, which are increasingly limiting the pace of renewable energy integration. The European Network of Transmission System Operators for Electricity (ENTSO-E) is identifying substantial funding requirements for essential grid upgrades, as rising solar generation is introducing intermittency that existing infrastructure is not designed to manage at scale. Addressing variability is therefore requiring parallel investment in energy storage systems, smart grid technologies, and demand response mechanisms to stabilize energy flows. In several key markets, utility-scale solar projects are experiencing prolonged grid connection delays, which are disrupting construction timelines and constraining near-term deployment.

Investors are increasingly viewing grid modernization as a critical and attractive area for long-term capital allocation. Upgraded transmission and distribution assets are enabling utilities to integrate variable renewable generation more efficiently, while energy storage solutions are supporting load balancing and peak management. Advanced grid management software is improving operational visibility and coordination across networks, enhancing overall system resilience. Cross-border transmission investments are also unlocking renewable resources in high-generation regions by improving interconnection capacity. Greater standardization of interconnection protocols across EU member states is streamlining approvals and reducing technical uncertainty, strengthening grid flexibility, accelerating project execution, and supporting sustained renewable energy expansion across the region.

The Energy Performance of Buildings Directive (EPBD) is driving rising demand for building-integrated photovoltaics (BIPV) across Europe, as national governments are enforcing near-zero energy performance standards for new construction. Architects and developers are increasingly integrating solar technologies directly into building envelopes to meet regulatory thresholds efficiently. Photovoltaic façades are generating electricity while preserving architectural continuity, and solar roofing materials are combining weather protection with power generation. Glazing systems are also producing energy without reducing natural daylight, which is supporting adoption in dense urban environments. These integrated solutions are allowing developers to optimize limited space while ensuring compliance with tightening energy efficiency requirements.

BIPV is emerging as a premium growth segment within the broader solar value chain. Developers are commanding higher margins by delivering customized, design-led solutions that align energy performance with architectural intent. Manufacturers are differentiating offerings through aesthetic flexibility, including transparent solar cells for advanced window systems, semi-transparent modules that balance illumination and output, and color-matched panels that complement diverse building designs. Lightweight and flexible formats are simplifying retrofit applications, expanding the addressable market beyond new builds. Financing frameworks and incentive programs are increasingly favoring integrated solar solutions, while green building certification schemes are assigning higher value to BIPV deployments, reinforcing long-term demand from sustainability-focused real estate projects.

Monocrystalline is slated to maintain a dominant position in 2026 with an estimated 72% of the solar panel market revenue share. These panels are manufactured from high-purity silicon crystals, which is enabling superior energy conversion efficiency compared to alternative technologies. High performance is particularly valuable in residential and commercial installations where available roof space is limited and maximizing output per square meter is essential. Property owners are therefore prioritizing monocrystalline systems to extract the highest possible energy yield from constrained surfaces. Although upfront costs remain higher, buyers are accepting this premium due to proven durability and consistent performance over multi-decade lifespans. In developed markets, purchasing decisions are increasingly focusing on lifetime energy generation rather than minimizing initial capital expenditure, reinforcing sustained demand for monocrystalline panels.

Thin-film solar panels are expected to grow the fastest during the forecast period from 2026 to 2033, on the back of their lightweight construction and design flexibility. These attributes are making thin-film solutions suitable for applications requiring adaptable form factors, including BIPV, portable solar systems, and structurally sensitive installations. The segment encompasses multiple technologies, each serving distinct use cases. Amorphous silicon modules are delivering stable performance across wide temperature ranges, cadmium telluride panels are performing efficiently in large-scale deployments, and copper indium gallium selenide systems are offering consistent efficiency levels. While conversion efficiency remains lower than crystalline alternatives, developers are selecting thin-film technologies where versatility, environmental suitability, and integration requirements outweigh peak performance considerations.

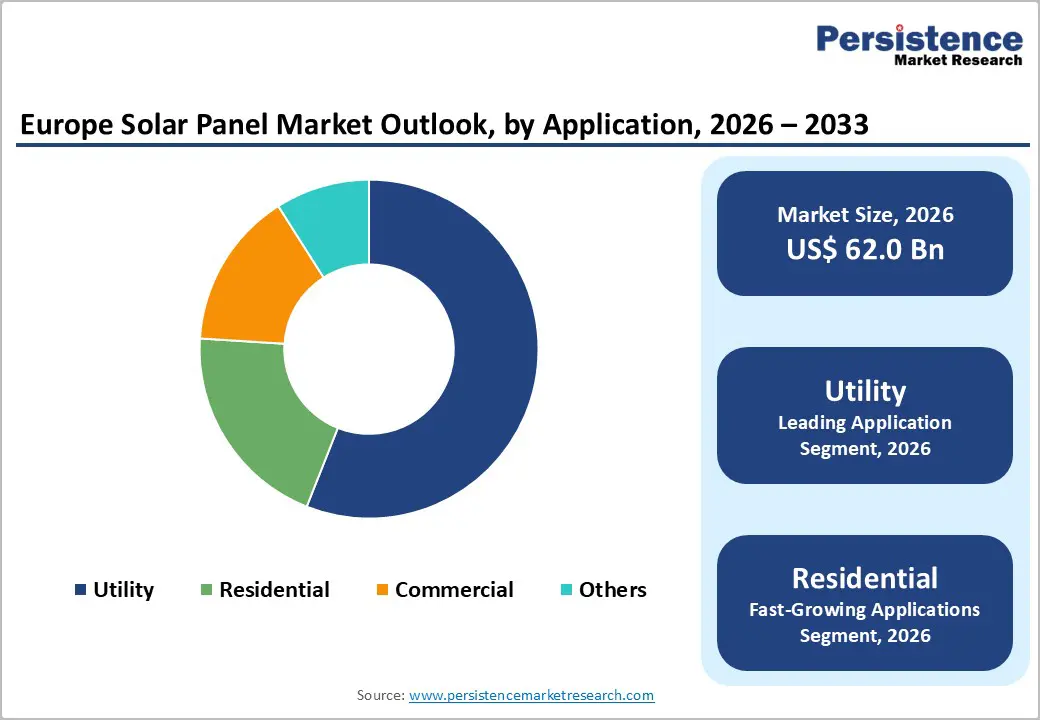

The utility segment is anticipated to hold the highest revenue share in the Europe solar panel market, projected to reach approximately 56% in 2026, powered by large-scale installations supplying electricity directly to national and regional grids. These projects are generating substantial power volumes, as developers are siting solar farms on available land to meet rising regional demand. Public authorities are actively supporting utility-scale developments to fulfill renewable energy mandates and diversify national energy portfolios. Expansion at this scale is enabling countries to reduce dependence on fossil fuels while strengthening long-term energy security. As clean energy demand is accelerating, capital inflows are increasingly favoring utility-scale projects, which industry participants are recognizing as foundational infrastructure for achieving comprehensive energy transition objectives.

The residential segment is slated to register the highest 2026-2033 CAGR, aided by rising consumer awareness of energy efficiency and sustainability. Homeowners are increasingly adopting solar installations to lower household electricity expenses through self-generated power and improved energy independence. Financial attractiveness is strengthening, as government support mechanisms are reducing adoption barriers. Tax credits are lowering upfront investment requirements, while net metering policies are compensating households for surplus electricity supplied to local grids. These incentives are making residential solar economically viable for average consumers, supporting steady adoption growth as long-term cost savings and reliability benefits become more widely understood.

The rooftop segment is forecasted to lead with an approximate 54% of the solar panel market share in 2026, driven by strong adoption across urban, residential, and small commercial applications. Rooftop installations are efficiently utilizing existing building surfaces, which is allowing property owners to avoid land acquisition costs entirely. Residential systems are integrating seamlessly into roof structures, while commercial buildings are converting unused rooftop areas into productive energy assets. Small industrial facilities are also adopting rooftop solutions, as these systems are eliminating land-use conflicts and simplifying project approvals. Advancements in mounting technologies are supporting wider deployment, as improved attachment systems are withstanding varied weather conditions and ensuring long-term structural integrity. Decentralized generation is therefore gaining momentum, with building occupants producing electricity for immediate consumption and exporting surplus power to local grids through established interconnection frameworks.

The ground-mounted segment is likely to emerging as the fastest-growing installation type during the forecast period from 2026 to 2033, supported by rising utility-scale and large commercial demand. Developers and energy companies are selecting ground-mounted configurations where ample land availability is enabling large project footprints and rapid capacity expansion. These installations are offering operational advantages, as maintenance teams can access equipment easily without roof-related constraints. Optimal orientation and layout are maximizing solar exposure, while fixed-tilt and tracking systems are significantly enhancing energy capture efficiency. Rural and suburban regions are providing suitable terrain for development, positioning ground-mounted solar as a preferred option for infrastructure-scale investments and comprehensive renewable energy portfolios.

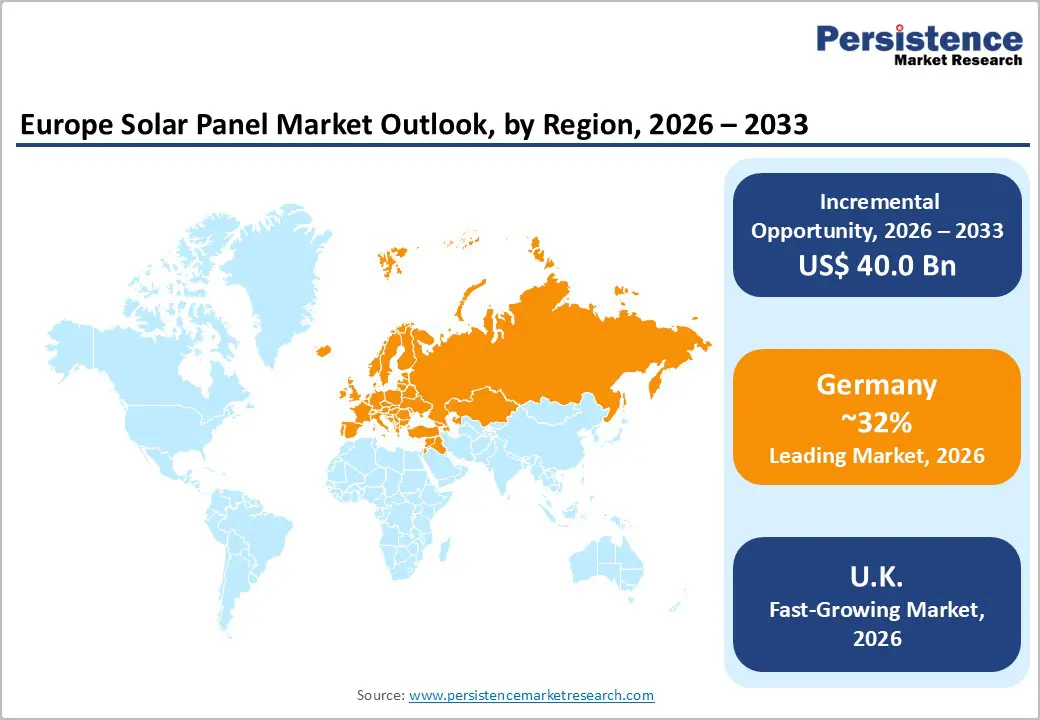

Germany is positioned to be the largest solar panel market in Europe, accounting for approximately 32% of regional capacity share in 2026. Strong government policy support is driving consistent year-on-year deployment, supported by a comprehensive mix of financial incentives across market segments. Residential customers are benefiting from tax exemptions on small-scale systems, while commercial operators are accessing favorable feed-in tariff structures for grid-connected installations. Utility-scale developers are leveraging premium-based remuneration mechanisms that are delivering predictable revenue streams across project lifecycles. In parallel, national renewable electricity targets are requiring sustained solar capacity additions, reinforcing long-term demand visibility. Domestic manufacturing initiatives are also attracting capital investment, as factory development programs are strengthening regional supply chains and reducing reliance on imports.

Germany is being recognized as a cornerstone market within Europe’s solar expansion strategy. Recent permitting reforms are accelerating approval timelines for ground-mounted projects, enabling faster commercialization and improved capital efficiency. Established domestic installers are demonstrating strong execution at scale, while international module suppliers are building dependable distribution networks to serve rising demand. Residential adoption is increasingly shifting toward solar-plus-storage systems, with battery attachments becoming standard for new installations. Corporate power purchase agreements are also gaining prominence, as large industrial consumers are securing long-term renewable contracts to stabilize energy costs and meet sustainability objectives. Developers are therefore aligning project design and offtake structures to serve corporate buyers effectively, reinforcing Germany’s leadership position in the regional solar market.

The United Kingdom is forecasted to emerge as the fastest-growing national market for solar panels in Europe through 2033, supported by strong demand from corporate PPAs. Businesses are increasingly securing long-term renewable energy contracts to manage exposure to volatile wholesale electricity prices, which is revitalizing large-scale project development. Residential adoption is also accelerating, as households are benefiting from the Smart Export Guarantee (SEG) scheme that compensates surplus electricity exported to local grids. For utility-scale projects, developers are utilizing Contracts for Difference (CfD) mechanisms that are providing revenue certainty through predefined strike prices. At the same time, subsidy-free models are becoming dominant for larger installations, with merchant revenue strategies gaining traction as corporate offtake commitments extend in duration. Government authorities are reinforcing momentum by prioritizing renewable infrastructure through streamlined permitting frameworks.

Solar industry stakeholders are positioning the U.K. for accelerated capacity expansion under evolving regulatory conditions. Recent reforms are classifying major solar developments as nationally significant infrastructure, enabling faster approvals through Development Consent Orders. Planning policies are increasingly favoring renewable projects on suitable non-agricultural land, while limiting the ability of local authorities to block commercially viable installations. Established domestic developers are demonstrating strong execution across residential, commercial, and utility-scale segments, while international investors are deploying significant capital to capture growth opportunities. Project bankability is further improving through battery storage co-location, which is enhancing grid integration and revenue flexibility. In parallel, residential installations are increasingly combining solar generation with heat pump systems, reinforcing the role of distributed solar in the U.K.’s broader energy transition.

France is maintaining a strong position within the European solar panel market, supported by regulatory frameworks that are actively mandating solar installations on new commercial buildings. Demand is being reinforced by large rooftop areas on warehouses and expansive parking facilities, which are providing scalable surfaces for photovoltaic deployment. Utility-scale growth is being managed through competitive auction mechanisms that are allocating capacity efficiently, while regional programs are designating priority development zones to streamline project planning. Local authorities are expediting permitting for approved locations, and grid operators are guaranteeing connection capacity in strategic areas, collectively accelerating solar adoption across commercial, industrial, and utility-scale applications.

Developers are targeting France for its balanced growth profile and regulatory clarity. Policies protecting high-value agricultural land are limiting conventional ground-mounted installations, which is redirecting investment toward brownfield sites, degraded land, and engineered solutions such as parking lot canopies. Domestic developers are demonstrating strong regional execution capabilities, while international players are establishing complementary market positions through partnerships and acquisitions. Agrivoltaic systems are gaining traction by integrating agricultural activity with power generation, aligning land-use efficiency with sustainability goals. Government investment programs are prioritizing energy transition initiatives, including targeted funding for solar manufacturing. Market participants that are effectively navigating France’s regulatory structure are likely to secure transferable advantages across broader European solar markets.

The Europe solar panel market is exhibiting a moderately concentrated structure, headlined by LONGi Solar, Canadian Solar, Meyer Burger, TotalEnergies, and Enel Green Power, which rule approximately 55% to 60% of the market revenues. This concentration is reflecting the advantages of scale, capital intensity, and established supply chains required to compete effectively in the region. Leading companies are continuously advancing solar technologies through sustained research efforts, while simultaneously expanding manufacturing capacity to meet rising demand across residential, commercial, and utility-scale segments. Product portfolios are also being diversified with differentiated solutions that address efficiency, durability, and system integration requirements, reinforcing competitive positioning across multiple applications.

Competitive intensity is driving executives to pursue cost leadership through manufacturing optimization and supply chain efficiency, while technological innovation is creating differentiation through higher conversion efficiency and improved performance metrics. Market expansion strategies are increasingly targeting underserved geographies within Europe, where grid upgrades and policy support are unlocking new deployment opportunities. Strategic partnerships are being formed to combine complementary strengths across project development, financing, and technology deployment. In parallel, mergers and acquisitions are consolidating market share and enabling faster entry into established customer networks. These approaches are collectively strengthening competitive resilience and supporting systematic expansion of both regional influence and global market presence.

The Europe solar panel market is projected to reach US$ 62.0 billion in 2026.

The market is driven by EU regulatory mandates, declining technology costs, and rising energy prices fuel accelerated deployment across residential, commercial, and utility-scale segments.

The is poised to witness a CAGR of 8% from 2026 to 2033.

Commercial & industrial self-consumption, agrivoltaic dual-use systems, and battery storage integration represent the highest-growth value creation areas.

LONGi Solar, Canadian Solar, Meyer Burger, TotalEnergies, and Enel Green Power are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Application

By Installation Type

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author